TIDMBLU

RNS Number : 4403R

Blue Star Capital plc

30 June 2020

30 June 2020

Blue Star Capital plc

("Blue Star" or "the Company")

Half-yearly Results for the six months ended 31 March 2020

Chairman's Statement

I am pleased to report Blue Star's half-yearly results for the

period ended 31 March 2020.

Financials

Blue Star reported a loss for the period of GBP189,460 compared

with a loss of GBP494,543 for the six months ended 31 March 2019.

The results for the period ending 31 March 2019 included a

substantial loss relating to non-cash adjustments to the carrying

value of investments. The ongoing running costs of the business

have been maintained at a similar level to last year.

Net assets increased to GBP5,969,917 compared to GBP5,209,377 at

the Company's last financial year end of 30 September 2019 and

reflected the fund raise of GBP900,00 (before expenses) undertaken

in November 2019. This equates to a net asset value per share of

approximately 0.19 pence.

Blue Star's cash position at 31 March 2020 was GBP7,379 compared

to a balance of GBP120,828 at 30 September 2019. The Company's

working capital position is dependent on new funds being made

available to it and post the period end the Company successfully

raised GBP500,000 before expenses on 9 June 2020.

Portfolio Review

I would like to provide the following information on our

portfolio companies, inclusive of updates for the six-month period

ended 31 March 2020 and any subsequent developments of note.

SatoshiPay

Company Description

SatoshiPay provides an innovative two-way digital payments

platform with applications across a number of segments within the

global payment industry. The SatoshiPay platform is powered by the

Stellar network, which is a leading global blockchain network and

payment technology. SatoshiPay is targeting three segments within

the global payments industry, each of which represents a

substantial market opportunity:

The SatoshiPay platform has unique advantages in each of the

three markets:

-- Micro-payments represent a growing market segment. These are

transactions that can be as low as a few cents and are often

uneconomical using conventional payment technologies. Applications

include online publishing (pay per view), gaming and consumer

reward programmes. The SatoshiPay platform offers instant

end-to-end payments at a level of commission that makes payments

viable for merchants and customers. SatoshiPay has commercial

partnerships in place with online publishers such as Axel Springer

and Börsenmedien.

-- Digital wallets are a mechanism allowing consumers to make

payments using their mobile or desktop device. The Solar wallet

from SatoshiPay, powered by the Stellar Network, has more than 25k

instalments in 40 countries. It is recommended by the Stellar

Development Foundation, which coordinates the Stellar network.

-- B2B cross-border payments are the most recent market for

SatoshiPay. In November 2019, the company announced the new

SatoshiPay B2B service, using the same technical platform as the

existing products. This is the largest segment in the global

payments market and represents an exciting growth opportunity for

SatoshiPay.

Recent developments at SatoshiPay

On 28 May 2020, the Stellar Development Foundation ("SDF")

announced that it had made a strategic investment of $550,000 by

way of convertible loan notes into SatoshiPay. This investment will

be used to support the development of SatoshiPay's B2B solution for

commercial, cross-border payments and its digital wallets.

SatoshiPay was one of the first businesses to use Stellar

commercially and has, to date, processed EUR650,000 in payments

from over 200,000 accounts.

SDF is a key partner of SatoshiPay providing maintenance and

partner support for the Stellar decentralised ledger network. This

investment will enhance the already strong relationship that exists

between the two organisations. The convertible loan notes are

expected to convert at the time of SatoshiPay's next round of

funding.

SatoshiPay is currently testing its B2B payments solution and

expects to have a public beta product launch live sometime in the

fourth quarter of 2020. SatoshiPay advises that the reaction to the

product continues to be very positive with a number of potential

clients already signed for when the product goes live.

Blue Star's holding in SatoshiPay

The Company's shareholding in SatoshiPay was acquired for

GBP1,876,788 and represents 27.9 per cent, of SatoshiPay as at 30

March 2020. This investment has a carrying value of

GBP4,745,787.

Esports portfolio

The global esports market is a rapidly growing economy. More

than 200 million viewers regularly stream competitive gaming

tournaments and related content, with a broader fan-base of up to

900 million occasional viewers. In terms of revenues, the industry

exceeded US$1bn for the first time in 2019 and is forecast to reach

over US$1.8bn in 2021.

The growing professionalisation of the esport industry has been

attracting increasing investment capital into the space and Blue

Star has made investments in a portfolio of early-stage businesses

with potential to enter the top tier. In October 2019 Blue Star

announced a GBP900k investment in the esports market, comprising

six e-sport companies, each valued around GBP150k. I will discuss

each of these companies below.

Dynasty Esports PTE is a Singapore-based business addressing the

Malaysian market. Malaysia is already a rapidly growing market for

e-sport, and we believe that this will be accelerated by a

programme of government investment that is already underway, aimed

at making Malaysia a regional hub in the e-sport industry. In this

regard, we are delighted at the recent announcement from Dynasty

that it has signed a five year exclusive partnership agreement with

Malaysia eSports Federation ("MESF",) via its Kuala Lumpur based

subsidiary Dynasty eSports (M) Sdn Bhd, to provide its esports

Portal Management ("EPM") platform to enable effective management

and control of the esports ecosystem within Malaysia.

Dynasty's EPM platform will be fully white-labelled, customised

and branded for MESF and will bring together the main elements of

the esports ecosystem being the players, the organisations and the

tournaments, under one single integrated digital platform with the

intention of providing a shared national and global view of the

esports industry.

Under the Terms of the partnership agreement, MESF will actively

endorse, promote and drive all esports related traffic in Malaysia

to the EPM platform. MESF will also regulate and ensure that all

domestic esports events, leagues or tournaments in Malaysia will be

exclusively hosted on the MESF platform as the single destination

site for esports. Tournaments and leagues attempting to operate

outside of the MESF Platform will not be licensed or authorised by

MESF which is expected to have the effect of any such event being

blocked.

Dynasty will generate income throughout the term of the

partnership via a matrix of revenue streams Including management

fees, advertising, sponsorship, exclusive eSports broadcast rights

(both nationally and internationally), and other revenue share

arrangements with MESF.

Blue Star's shareholding in Dynasty is 13.7%.

Guild Esports plc ("Guild") is a London-based esports team

operator. On 25 June 2020, Guild announced its global launch and

association with David Beckham, an investor in Guild. Guild is

developing a talent pipeline in the UK, based on the traditional

academy model, with the intention that the most able players are

coached and nurtured by industry leaders in order to attain the

skillset required to compete professionally. A roster of scouts

will continually find and sign the best young talent.

Guild has established a management team of esports veterans with

experience as professional players, coaches and esports media.

Guild Executive Chairman, Carleton Curtis, is well-known in the

industry and architect of the Overwatch League and Call Of Duty

Leagues. Prior to joining Guild, he held senior esports roles at

Activision Blizzard and Red Bull. His expertise complements David

Beckham's position in the world of mainstream sports to create a

unique esports proposition.

Guild intends to develop into various esports disciplines over

the course of the 2020/2021 season with its first team making its

debut in autumn 2020 expecting to compete in the most popular

titles including Rocket League, EA Sports FIFA, and Fortnite. The

Company's ambition is to build a culture of excellence around its

brand and digital presence.

At the same time and connected to the launch, the Company

announced that it was making a further investment of GBP480,000

into the Guild in order to retain its shareholding at 11.7 per

cent. The investment has been made at a price of 6p per share,

which compares to the Company's initial investment at 1p per

share.

Googly is an esports tournament operator based in India. This is

a large and fast-growing esports market, with prize money more than

doubling each year in 2017, 2018 and 2019 (data from AFK Gaming).

Googly is actively engaged in conversations regarding the

development of its business and I am hopeful we will have news

later this year. Blue Star's shareholding in Googly is just over

11%.

The Drops is an esport team operator, based in Canada, which

will field teams in Rocket League, Fortnite, FIFA, and

CounterStrike Global Offensive. In February 2020 The Drops

announced that it had exchanged letters of intent for its entire

share capital to be acquired by Fibersources Corporation, an entity

listed on the TSX Venture Exchange, in an all-share deal, allowing

The Drops to achieve market listed status. Furthermore, The Drops

announced that it intended to cancel some founder shares, which

would increase Blue Star's holding from 13.6% to 18.6%. We are

awaiting further news on this transaction which has been impacted

by recent events connected to Covid 19.

Diemens Esports , formerly The Cubs, operates in the Australian

market. In February 2020 Diemens announced its intention to merge

with Critical Hit Entertainment PTY Ltd (CHE) and should the

transaction proceed, Blue Star's stake in the combined entity will

be 6.6%. The board of Blue Star is still awaiting news regarding

the proposed transaction.

The Dibs is an esports team operator based in Los Angeles that

will field an all-female teams in major e-sport tournaments. This

business is at an early stage, with the potential to grow strongly.

Blue Star holds a US$185k convertible loan note, which will

represent a 13.7% holding in The Dibs Esport Corp upon

conversion.

Sthaler Limited ("Sthaler")

Company Description

In June 2015 the Company invested GBP50,000 in Sthaler Limited,

an early stage identity and payments technology business which

enables a consumer to identify themselves and pay using just their

finger at retail points of sale.

Sthaler was founded in 2012 when it was introduced as a

biometric identity authentication and payment platform into the UK

live entertainment industry with British Telecom and

Bancorp/Elavon. The system, named Fingopay, uses a biometric called

VeinID which instantly recognises an individual through the unique

pattern of veins inside each finger. In same year, the Company also

entered into a long-term partnership with Hitachi for exclusive use

of Fingopay across many areas of the globe.

During the period of 2016-2019 the Company conducted several

successful authentication security trials with Hitachi, Visa,

Mastercard, Worldpay and Ernst and Young. In 2019 Fingopay was

deployed in Denmark with Nets and Dankort, the Danish national

debit card scheme. In 2020, Fingopay was piloted successfully by

the UK's Open Banking Authority with the Financial Conduct

Authority to introduce a new fraud free bank-to-bank account

payment scheme.

The largest market the company is currently targeting is Egypt,

with a population of 100 million. Fingopay is now being piloted in

Egypt by the banking industry to authenticate payment transactions

and by the Ministry of Supply to authenticate government food

subsidies. The Egyptian approach came from global television

coverage of Fingopay including CNBC, BBC, Al Jazeera and Fox, to

name just a few. In addition, Fingopay has won the following awards

this year: -- The Fintech Power 50 - Most influential, innovative

and powerful figures in the Global Fintech industry 2020 -- Card

& Payment Industry Awards - Industry Innovation of the Year

2020 -- Fast Company - Top 50 World's most Innovative Companies

2020.

Blue Star's Shareholding in Sthaler

The Company's shareholding in Sthaler is valued on the basis of

the last fundraise at approximately GBP350,000.

Outlook

The recent esports announcements relating to the Guild and

Dynasty have helped to illustrate the potential upside from our

esports investment portfolio and the Board remains highly confident

that this new area of investment offers the potential for a

significant improvement in net asset value. Our long-term

shareholdings in payment companies SatoshiPay and Sthaler continue

to progress and while taking time to mature provide another

exciting area of investment. Overall, we are pleased with progress

over the period and look to the future with confidence.

Derek Lew

Non-Executive Chairman

30 June 2020

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Blue Star Capital plc

Tony Fabrizi, Chief Executive +44 777 178 2434

Cairn Financial Advisers LLP

Nomad & Broker

Jo Turner/Liam Murray +44 20 7213 0880

Statement of Comprehensive Income

for the six months ended 31 March 2020

Unaudited Audited

Year ended

Six months ended 31 March 30 September

-------------

2020 2019 2019

Note GBP GBP GBP

Revenue - - -

Loss arising from investments

held at fair value through

profit or loss: - (288,496) (399,748)

Other fair value losses (8,414) (36,757) -

(325,253) (399,748)

Administrative expenses (181,094) (169,320) (287,662)

------------- ------------ -------------

Operating loss (189,508) (494,573) (687,410)

Finance income 48 30 2,446

Loss before and after

taxation and total comprehensive

income for the period (189,460) (494,543) (684,964)

------------- ------------ -------------

Loss per ordinary share:

Basic (loss)/earnings

per share 3 (0.01p) (0.03p) (0.03p)

Diluted (loss)/earnings

per share 3 (0.01p) (0.03p) (0.03p)

------------- ------------ -------------

The loss for the period was derived from continuing operations

and is attributable to equity shareholders.

Statement of Financial Position

as at 31 March 2020

Unaudited Audited

Six months ended 31 March Year ended 30 September

--------------------------- -----------------------

2020 2019 2019

Note GBP GBP GBP

Non-current assets

Investments 5,820,215 5,173,757 5,101,587

5,820,215 5,173,757 5,101,587

------------- ------------ -----------------------

Current assets

Trade and other receivables 166,103 8,329 10,275

Cash and cash equivalents 7,379 63,605 120,828

173,482 71,934 131,103

------------- ------------ -----------------------

Total assets 5,993,697 5,245,691 5,232,690

------------- ------------ -----------------------

Current liabilities

Trade and other payables 23,780 95,893 23,313

Total current liabilities 23,780 95,893 23,313

------------- ------------ -----------------------

Net assets 5,969,917 5,149,798 5,209,377

------------- ------------ -----------------------

Shareholders' equity

Share capital 4 3,092,584 1,892,584 2,142,584

Share premium account 4 8,852,724 8,852,724 8,852,724

Other reserves 64,190 64,190 64,190

Retained earnings (6,039,581) (5,659,700) (5,850,121)

5,969,917 5,149,798 5,209,377

------------- ------------ -----------------------

Statement of changes in equity

as at 31 March 2020

Other reserves Retained

Share capital Share premium earnings Total

-------------- -------------- -------------- ------------------ ---------

GBP GBP GBP GBP GBP

Six months ended

31 March 2020

At 1 October 2019 2,142,584 8,852,724 64,190 (5,850,121) 5,209,377

Loss for the period

and total comprehensive

income - - - (189,460) (189,460)

Shares issued in

period 950,000 - - - 950,000

At 31 March 2020 3,092,584 8,852,724 64,190 (6,039,581) 5,969,917

============== ============== ============== ================== =========

Six months ended

31 March 2019

At 1 October 2018 1,881,473 8,679,075 64,190 (5,165,157) 5,459,581

Loss for the period

and total comprehensive

income - - - (494,543) (494,543)

Shares issued in

period 11,111 188,889 - - 200,000

Share issue costs - (15,240) - - (15,240)

At 31 March 2019 1,892,584 8,852,724 64,190 (5,659,700) 5,149,798

============== ============== ============== ================== =========

Year ended 30 September

2019

At 1 October 2018 1,881,473 8,679,075 64,190 (5,165,157) 5,459,581

Loss for the year

and total comprehensive

income - - - (684,964) (684,964)

Shares issued in

year 261,111 188,889 - - 450,000

Share issue costs - (15,240) - - (15,240)

At 30 September

2019 2,142,584 8,852,724 64,190 (5,850,121) 5,209,377

============== ============== ============== ================== =========

Statement of cash flows

for the six months ended 31 March 2020

Unaudited Audited

Year ended

Six months ended 31 March 30 September

--------------------------- -------------

2020 2019 2019

GBP GBP GBP

Operating activities

Loss for the period (189,460) (494,543) (684,964)

Adjustments for:

Finance income (48) (30) (2,446)

Fair value loss 8,414 325,253 391,748

Working capital adjustments

(Increase)decrease in trade

and other receivables (155,828) 57,750 265,871

Increase/(decrease) in trade

and other payables 467 (41,031) (113,612)

------------- ------------ -------------

Net cash used in operating

activities (336,455) (152,601) (143,343)

------------- ------------ -------------

Investing activities

Increase in investments (727,042) - (204,451)

Interest received 48 30 2,446

------------- ------------ -------------

Net cash generated (used

in)/from investing activities (726,994) 30 (202,005)

------------- ------------ -------------

Financing activities

Proceeds from issue of equity

shares 950,000 200,000 450,000

Share issue costs - (15,240) (15,240)

------------- ------------ -------------

Net cash generated by financing

activities 950,000 184,760 434,760

------------- ------------ -------------

Net (decrease)/ increase

in cash and cash equivalents (113,449) 32,189 89,412

Cash and cash equivalents

at beginning of the period 120,828 31,416 31,416

------------- ------------ -------------

Cash and cash equivalents

at end of the period 7,379 63,605 120,828

------------- ------------ -------------

Notes to the Interim Financial Statements

for the six months ended 31 March 2020

1. Basis of preparation

The principal accounting policies used for preparing the Interim

Accounts are those the Company expects to apply in its financial

statements for the year ending 30 September 2020 and are unchanged

from those disclosed in the Company's Report and Financial

Statements for the year ending 30 September 2019.

The financial information for the six months ended 31 March 2020

and for the six months ended 31 March 2019 have neither been

audited nor reviewed by the Company's auditors.

2. Critical accounting estimates and judgements

The Company makes certain estimates and assumptions regarding

the future. Estimates and judgements are continually evaluated

based on historical experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances. In the future, actual experience may

differ from these estimates and assumptions. The estimates and

assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial year are discussed below:

Fair value of financial instruments:

The Company holds investments that have been designated at fair

value through profit or loss on initial recognition. The Company

determines the fair value of these financial instruments that are

not quoted, using valuation techniques such as the price of the

most recent transaction and discounted cash flow analysis. It is

important to recognise that the derived fair value estimates cannot

always be substantiated by comparison with independent markets and,

in many cases, may not be capable of being realised

immediately.

In certain circumstances, where fair value cannot be readily

established, the Company is required to make judgements over

carrying value impairment and evaluate the size of any impairment

required.

3. Loss per ordinary share

The calculation of a basic loss per share is based on the loss

for the period attributable to equity holders of the Company and on

the weighted average number of shares in issue during the

period.

4. Share capital

On 18 October 2019, the Company announced that it was raising

GBP450,000 from a placing and that it was holding an Extraordinary

General meeting on 6(th) November to approve a second placing to

raise a further GBP450,000 at a price of 0.10p per share. The funds

raised were invested into a portfolio of six Esports companies.

On 17 February 2020, the Company allotted 50,000,000 new

ordinary shares of 0.1p each pursuant to an exercise of

warrants.

On 17 April 2020, the Company raised GBP100,000 at a price of

0.10p per share by issuing 100 million shares. The company invested

approximately GBP57,000 into Leaf Mobile Inc which subsequently

listed on the TSX Venture Exchange.

On 4 May, 2020, the Company raised GBP35,000 at a price of 0.12p

per share and invested GBP16,000 in the Guild to maintain its

shareholding at 11.7%.

On 9 June 2020, the Company raised 500,000 through the issue of

416,666.666 new ordinary shares at a price of 0.12p. The places

were also granted warrants to subscribe on a one for one basis at a

price of 0.175p and had a one year life, terminating on 8 June

2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEUFWUESSEFM

(END) Dow Jones Newswires

June 30, 2020 02:00 ET (06:00 GMT)

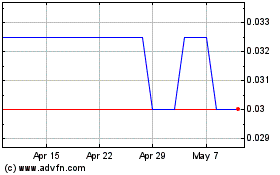

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Nov 2023 to Nov 2024