Bluebird Merchant Ventures Limited Successful Placing of 19,400,000 Shares (0950T)

18 March 2019 - 6:00PM

UK Regulatory

TIDMBMV

RNS Number : 0950T

Bluebird Merchant Ventures Limited

18 March 2019

18 March 2019

Bluebird Merchant Ventures Ltd

(the "Company" or "Bluebird")

Successful Placing of 19,400,000 Shares at 2.25p to Advance

South Korean Gold Projects

Bluebird Merchant Ventures (EPIC: BMV), the Asian focused

resource development group, is pleased to announce that it has

successfully placed all of the available headroom of 19,400,000

shares for a total of GBP 436,500. This enables the South Korean

gold projects to advance and finalise the next phase of the project

which is the pre-construction stage.

Highlights:

-- Successful placement of 19,400,000 shares with management participation

-- Projects advance to the pre-production phase

-- Land-owner agreement received at Kochang and Gubong

SVS Securities placed 11,111,111 shares amounting to GBP 250,000

and Directors, Colin Patterson, Charles Barclay and Aidan Bishop

contributed GBP 186,500 resulting in the issuance of a further

8,288,888 shares. SVS Securities have also been appointed as a

Joint Broker to the Company, which is expected to enable the

Company to reach a wider base of potential shareholders.

The funding will be used to advance the pre-construction phase

of the South Korean gold projects and to complete the more detailed

design work required for the construction phase. Bluebird is

targeting first gold pour in the fourth quarter of 2019. Once gold

production commences, it is planned to increase production to

100,000 oz of gold per year over a five year period.

An agreement has also been reached with the local landowner at

Kochang for use of the land outside the main adit entrance. This

agreement is regarded as a strong indication of local approval for

the reopening of the mine and augments the application for the

'permit to develop the Kochang mine. The Company has the approval

from the Mines Safety Department to carry out refurbishment works

in the adit which is expected to commence in April, prior to the

commencement of the definition drilling underground thereafter. A

similar agreement is already in place at the Gubong mine, which

also demonstrates support for reopening the mine.

The Company is optimistic that the grant from the South Korean

government for the underground drilling campaign will be

successfully given during this month. In addition, as previously

announced, the Company is expecting to receive feedback from its

application for the 'permit to develop' the Gubong mine around 23

March 2019. The Company announced on 12 March 2019 the application

for the 'permit to develop' the Kochang mine has been made and will

be in the public domain for forty days after which the Company

expects to receive a response. Once the applications are successful

it will enable the mines to enter the production phase.

The Company expects to update the market in due course as

further progress is made in South Korea.

Colin Patterson, CEO, commented:

"The Placing enables the company to progress and advance towards

the goal of reopening the Gubong and Kochang mines. The level of

local and government support for the reopening of the mines is very

encouraging. Moving to the next phase of the project is key for

Bluebird as we advance towards production and achieving first gold

pour. It is really exciting that Bluebird it as the heart of

bringing back gold production to South Korea which is proving to be

one of the most welcoming mining jurisdictions that I have ever

worked in."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR")

Enquiries:

Bluebird Merchant Ventures Ltd +44 (0) 7797 859986

Jonathan Morley-Kirk, Non-Executive

Chairman

SP Angel Corporate Finance LLP

Ewan Leggat

Smaller Company Capital Ltd + 44 (0) 20 3470 0470

Rupert Williams/Jeremy Woodgate +44 (0) 20 3651 2910

Blytheweigh +44 (0) 20 7138 3204

Tim Blythe / Camilla Horsfall

/ Julia Tilley

www.bluebirdmv.com

@BluebirdIR

Notes to Editors

The Gubong mine was once the second largest producing gold mine

in South Korea until its closure in 1971 when gold prices were

US$40 per ounce. The mine consists of nine shallow dipping stacked

veins. Although production was mainly from vein number six, five

other veins were mined from 1928 until its closure. Over 17,000

metres of drilling was carried out over the years and there are

over 120 kilometres of existing underground development.

The Kochang mine is a gold-silver mine that operated between

1928 and 1975 and produced over five million ounces of silver at

over 1000 g/t and 110,000 ounces of gold at 19.6 g/t. This gold

production was mainly derived from the three main veins at the

North East end of the "Gold Mine" part of Kochang, with the

majority of the silver production from the "Silver Mine" some 2.5

kilometres to the south west. The mine closed in 1975 when the gold

price was USD 140 per ounce. Today the mine consists of three

steeply dipping veins. BMV has opened up three kilometres of

original development, taken over 400 samples and has confirmed

process viability by carrying out initial metallurgical test

work.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEMMGMFLNVGLZM

(END) Dow Jones Newswires

March 18, 2019 03:00 ET (07:00 GMT)

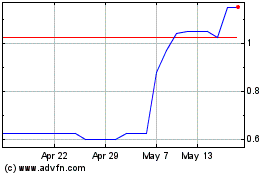

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From Apr 2024 to May 2024

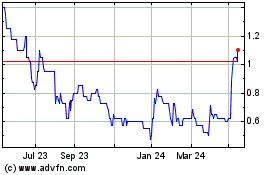

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From May 2023 to May 2024