TIDMCTEC

RNS Number : 9073F

ConvaTec Group PLC

10 November 2022

10 November 2022

Convatec Group Plc

Trading update for the ten months ended 31 October 2022

Good sales growth sustained Organic growth guidance increased

for 2022

Convatec Group Plc ("Convatec" or the "Group"), a global medical

products and technologies company, today announces a trading update

for the ten months ended 31 October 2022. Group revenue increased

by 2.4% on a reported basis (H1: 3.6%) impacted by foreign exchange

movements. On a constant currency basis revenue was up 7.8% (H1:

8.0%) and was up 6.3% on an organic basis(1) (H1: 6.4%). Following

sustained good sales growth, guidance for 2022 organic revenue

growth has been increased to 5.4% to 5.8% (previously 4.0% to

5.5%.)

In Advanced Wound Care, organic revenue growth was high

single-digit for the first 10 months, broadly in line with the

first half year. In North America the limited position in foam

continued to impact performance ahead of the launch of ConvaFoam in

Q4. The strong performance in Global Emerging Markets and good

performance in Europe continued.

In Ostomy Care, organic revenue growth was low single-digit for

the first 10 months, as expected and consistent with the first half

year. Good growth in Convatec products was achieved, particularly

in the Global Emerging Markets. The growth in Europe and North

America continued to be impacted by planned rationalization,

leading to improvements in mix and consequently margin.

In Continence and Critical Care, organic revenue growth for the

first 10 months was mid single-digit, in line with the first half

year. The growth in Continence Care improved in the second half

with better supply chain management. The organic growth in the

critical care component (which is only the Flexi-seal(TM) portfolio

following the exit of hospital care), declined in the second half.

This was as expected, given it is against strong COVID-19 driven

comparatives.

In Infusion Care, organic revenue growth was double-digit for

the first 10 months, slightly lower than in the first half year.

Underlying demand for our infusion sets remains strong and we

continue to expect at least high single-digit growth for the full

year. Growth in the remainder of the year will be lower reflecting

the order phasing and strong demand seen year to date.

Strategic progress over the last 4 months

The exit from Hospital Care and related industrial sales is

proceeding as planned. As previously indicated, we closed our

Belarus plant on 31 May 2022 and the related production at other

sites will cease by the end of this year.

The integration of Triad Life Sciences and our entry into the

attractive wound biologics segment(2) is progressing well. It is

still early days but we are pleased with the performance. Following

the new reimbursement code for the InnovaMatrix FS product and the

recent regulatory clearance of the InnovaMatrix powder product, we

have now paid both of the two $25 million transaction

milestones.

In the spring we started launching Gentle Cath(TM) Air Male in

France and the UK to enter the large and rapidly growing compact

segment in Europe; with performance in line with expectations.

Furthermore, we are on track to start launching ConvaFoam in the

USA this quarter.

We continue to strengthen Convatec's position by effectively

executing our FIBSE strategy and will update the market further at

the Capital Markets Event on 17(th) November.

1 Organic growth is calculated by applying the applicable prior

period average exchange rates to the Group's actual performance in

the respective period and excluding acquired and

disposed/discontinued businesses.

2 SmartTRAK Wound Biologics segment includes skin substitutes,

active collagen dressings and topical drug delivery

Full year guidance updated

Given the sustained good sales growth so far this year, we now

expect organic revenue growth for 2022 to be between 5.4% and 5.8%

(previously 4-5.5%.)

Inflation in raw materials and freight has moderated in recent

months, but inflation in utilities and labour has increased.

Overall, we continue to expect COGS inflation of 8-9% for the year

and we continue to expect to deliver constant currency adjusted

operating profit margin of at least 18%.

Foreign exchange rate movements have been volatile in recent

months. The FX impact on 2022 is currently estimated to be a 6%

headwind on revenue growth with a 90bps tailwind to the EBIT

margin. These estimates are based on actual rates to 31 October and

spot rates for the remainder of the year. On this basis, we expect

to publish an adjusted operating profit margin of over 19%.

***

Contacts

Analysts & Kate Postans, Vice President +44 (0) 7826

Investors of Investor 447807

Relations & Corporate Communications ir@convatec.com

Buchanan: Charles Ryland / +44 (0)207 466

Media Chris Lane 5000

Details about our Capital Markets Event - 17(th) November

2022

Convatec will be hosting a Capital Markets Event for sell-side

analysts and institutional holders on Thursday, 17 November 2022 at

2:00pm. The event will be held at The Auditorium - UBS, 5

Broadgate, London, EC2M 2QS

Presentations from CEO Karim Bitar, CFO Jonny Mason and other

members of Convatec's Executive Leadership Team

(CELT) will provide insight into:

-- FISBE strategy

-- Markets and future growth opportunities

-- Plans on how the company will deliver its medium-term

targets

Places are limited so if you would like to attend in-person

please contact IR@convatec.com. The event will also be webcast

live.

About Convatec

Pioneering trusted medical solutions to improve the lives we

touch: Convatec is a FTSE 100 global medical products and

technologies company, focused on solutions for the management of

chronic conditions, with leading positions in advanced wound care,

ostomy care, continence and critical care, and infusion care. Group

revenues in 2021 were over $2 billion. With around 10,000

colleagues, we provide our products and services in over 100

countries, united by a promise to be forever caring. Our products

provide a range of benefits, from infection prevention and

protection of at-risk skin, to improved patient outcomes and

reduced care costs. To learn more about Convatec, please visit

http://www.convatecgroup.com

Forward Looking Statements

This document includes certain forward-looking statements with

respect to the operations, performance and financial condition of

the Group. Forward-looking statements are generally identified by

the use of terms such as "believes", "estimates", "aims",

"anticipates", "expects", "intends", "plans", "predicts", "may",

"will", "could", "targets", continues", or their negatives or other

similar expressions. These forward-looking statements include all

matters that are not historical facts.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

the Company, are inherently subject to significant business,

economic and competitive uncertainties and contingencies that are

difficult to predict and many of which are outside the Group's

control. As such, no assurance can be given that such future

results, including guidance provided by the Group, will be

achieved. Forward-looking statements are not guarantees of future

performance and such uncertainties and contingencies, including the

factors set out in the "Principal Risks" section of the Strategic

Report in our Annual Report and Accounts, could cause the actual

results of operations, financial condition and liquidity, and the

development of the industry in which the Group operates, to differ

materially from the position expressed or implied in the

forward-looking statements set out in this document. Past

performance of the Group cannot be relied on as a guide to future

performance.

Forward-looking statements are based only on knowledge and

information available to the Group at the date of preparation of

this document and speak only as at the date of this document. The

Group and its directors, officers, employees, agents, affiliates

and advisers expressly disclaim any obligations to update any

forward-looking statements (except to the extent required by

applicable law or regulation).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGBDBGGGDGDC

(END) Dow Jones Newswires

November 10, 2022 02:00 ET (07:00 GMT)

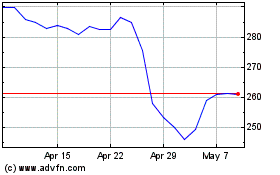

Convatec (LSE:CTEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Convatec (LSE:CTEC)

Historical Stock Chart

From Apr 2023 to Apr 2024