BigDish PLC Strategy and Operational Update (7557B)

12 October 2020 - 5:00PM

UK Regulatory

TIDMDISH

RNS Number : 7557B

BigDish PLC

12 October 2020

BigDish Plc

( " BigDish " or the " Company")

Strategy and Operational Update

BigDish Plc (LON: DISH), a technology and software solutions

company currently specialising in the food technology space, is

pleased to announce a Strategy and Operational Update.

Highlights:

-- Developing a Venture Builder model to gain sweat equity

stakes in a portfolio of assets with no cash outlay

-- Funding runway potentially further extended beyond Q2

2021

-- Upcoming enhancements to the management team

-- BigDish business to be funded privately and in a non-dilutive

manner

The Company has been approached on various occasions with

regards to utilising the BigDish technology platform for use in

other sectors. The current BigDish technology platform enables

bookings, dynamic pricing, search and discovery, payments, delivery

and pick up as well as analytics. The technology team is able to

modify the code to make the technology applicable to other sectors.

Therefore, the Company has decided to commercialise the

opportunity, especially given that opportunities have multiplied in

technology and online applications, due to the pandemic.

Over the next few weeks the Company will sign agreements with

several significant startup and early stage technology companies

whereby BigDish will provide the technology in return for equity

stakes. There will be no cash contribution required from BigDish to

support these businesses. This presents an exciting opportunity for

BigDish to both diversify and own meaningful equity stakes in

exciting ventures with no capital outlay. The company believes that

this approach, where it will effectively be paid to develop tech

businesses and then own equity at a ground floor valuation, could

very well set the Company on a path to sustainability. The strategy

is that once BigDish has gained its respective equity stake that it

would also be paid to maintain and develop further technology

updates for the various businesses. This presents an opportunity

for the Company to grow a portfolio of assets at the cutting edge

of the tech sector with minimal long term cash burn.

As part of this strategy the Company is making plans to bring in

new experienced technology focused management to lead this

initiative. The Company is also having talks with several potential

Non-Executive Directors to add further substance to the Board.

Aidan Bishop will step down from the Board when a replacement

has been identified. With his time freed up off the board, and as

the largest shareholder, he will continue to work with the Company

to progress the various opportunities that are being presented. In

addition, he will originate new technology opportunities to create

value for shareholders from the new technology development

platform, a concept which has only been accelerated in terms of

merit since the arrival of COVID-19, and the need for technology to

address the fresh issues which it has delivered.

Looking ahead, BigDish is expected to grow into what is termed a

Venture Builder and through this diversification, own stakes in

companies across the technology spectrum. It is envisioned that the

new, larger company, having fully developed will be able to

increase the value of the assets at a significant premium to the

present market implied valuation.

A Venture Builder model benefits from a leaner management team

and has a low cost base with its core focus on technology

development where the various businesses are privately funded. The

Company recently announced having secured short term funding to

provide sufficient runway to the end of the second quarter of 2021.

A leaner model may, in all likelihood, extend that runway

substantially beyond the second quarter of 2021, especially as by

this time it is anticipated that Venture Builder will be

contributing to the bottom line. The recent conditional funding of

USD 5 million that was previously announced will be for the

progression of the BigDish platform once conditions precedent are

met. This will ensure that the ongoing development of the BigDish

business will effectively be privately funded. The Company will

also consider a change of name as the Venture Builder model

progresses.

Enquiries:

Zak Mir, Digital Communications Officer, BigDish +44 (0) 7867 527659 zak@bigdish.com

Jonathan Morley-Kirk, Non-Executive Chairman jmk@bigdish.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKKBBBPBDKNKD

(END) Dow Jones Newswires

October 12, 2020 02:00 ET (06:00 GMT)

Amala Foods (LSE:DISH)

Historical Stock Chart

From Mar 2024 to May 2024

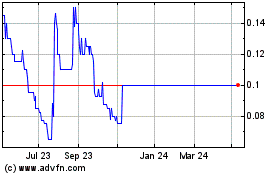

Amala Foods (LSE:DISH)

Historical Stock Chart

From May 2023 to May 2024