TIDMDKL

RNS Number : 7872L

Dekeloil Public Limited

31 December 2018

The following replaces the announcement released at 07:00 on 21

December 2018 under RNS number 1959L in which the third paragraph

of the announcement incorrectly stated the number of new ordinary

shares to be issued as consideration as being 52,456,660 when it

should have stated 52,612,613. This change has been underlined, all

other details remain unchanged and the full amended announcement is

set out below.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

DekelOil Public Limited ("DekelOil" or the "Company")

Acquisition of 43.8% Interest in Cashew Processing Project,

Issue of Equity and

Director / PDMR Shareholding

Highlights:

-- Revised option agreement permitting the acquisition of

initial 43.8% stake in Tiebissou cashew processing project in Cote

d'Ivoire (the "Project") at an implied current valuation of EUR6

million (the "Option"), in line with DekelOil's strategy to build a

multi-project, multi-commodity West African focused agriculture

company

-- Acquisition settled by the issue of new ordinary shares in

DekelOil at 4.5p per share, a 46.3% premium to the closing price of

3.075 pence per DekelOil share on 20 December 2018, being the last

practicable date prior to publication of this announcement

-- DekelOil retains an option to acquire a further 20.5%

interest on the same terms as the original option agreement

announced on 26 June 2018 ("Original Option")

-- Tiebissou cashew processing project is on course to become

DekelOil's second operational project by early 2020, alongside its

palm oil project at Ayenouan, Cote d'Ivoire

DekelOil Public Limited, the West African focused agricultural

company, is pleased to announce that it has entered into a new,

revised option agreement (the "Option") pursuant to which it will

acquire an initial 43.8% interest in the share capital of Pearlside

Holdings Ltd ('Pearlside') from Trustland Management Limited (the

'Acquisition'). Pearlside's wholly owned subsidiary Capro CI SA

('Capro') is currently developing a large-scale 10,000tpa

(expandable to 30,000 tpa) raw cashew nut ('RCN') processing

project at Tiebissou in Côte d'Ivoire which is now expected to

commence production in late 2019/early 2020.

The Acquisition is at a significantly reduced valuation to the

terms of the Original Option to acquire up to 58.5% of the issued

share capital of Pearlside, announced on 26 June 2018 reflecting

the fact that the project is not yet operational. The new Option

also permits the acquisition of up to a total of 64.3%, not 58.5%

as set out in the Original Option agreement, of the issued share

capital of Pearlside.

The Acquisition is to be settled by the issue of 52,612,613 new

ordinary shares of EUR0.0003367 each ('Ordinary Shares') in

DekelOil at a price of 4.5p per share, a 46.3% premium to the

closing price of 3.075 pence per DekelOil share on 20 December

2018, being the last practicable date prior to entering into the

Acquisition agreement ('Consideration Shares'). This implies a

current valuation of EUR6 million for the entire issued share

capital of Pearlside and represents a significant discount to the

minimum EUR18 million valuation assigned to Pearlside under the

terms of the Original Option agreement announced in June 2018. An

independent report prepared by PKF Littlejohn LLP opined that the

current valuation assigned to Pearlside "appears reasonable and on

an arm's length basis."

The Option (similar to the Original Option) permits the exercise

of options granted pursuant to it for a limited period following

the publication of Pearlside's audited annual accounts for the year

ending 31 December 2020.

DekelOil has elected to bring forward the Acquisition following

the significant progress made at Tiebissou since the Original

Option was signed. As a result, the Directors believe the

development phase of the Tiebissou Project has been materially

de-risked. Progress includes the appointment of a senior management

team at Capro comprising executives who played a key role in the

successful construction and commissioning of DekelOil's palm oil

project in Ayenouan; confirmation of a 13 year tax exemption for

the Project; and the execution of key contracts relating to the

cashew processing plant and infrastructure works and the final

financing package for the plant.

DekelOil Executive Director Lincoln Moore said, "The early

acquisition of a 43.8% interest in Tiebissou is a significant event

for DekelOil and one which we believe will generate long term value

for shareholders. This is a reflection of both the substantially

lower valuation we have secured compared to the Original Option

agreement, but also the significant premium at which the new

Consideration Shares in DekelOil have been issued. The share price

premium is an endorsement of our vision to build a multi-project,

multi-commodity agriculture company, the strategy we have in place

to achieve this and our management team which, as it successfully

demonstrated at our palm oil project in Ayenouan, has the

credentials to deliver.

"Due to the progress made at Tiebissou since we announced the

Original Option in June 2018, we are pleased to have agreed this

earlier partial exercise. We are also delighted to have secured the

option to acquire a further 20.5% interest, in addition to this

early acquisition of a 43.8% interest in Tiebissou, representing an

aggregate interest of up to 64.3% in the Project, as opposed to an

interest of up to 58.5% under the Original Option agreement. We are

confident that the EUR6 million valuation assigned to the Project

today represents value for shareholders and I look forward to

providing further updates on our progress, as we focus on bringing

our second project into production in late 2019."

Related Party Transaction

Youval Rasin, CEO and 16.1% shareholder of DekelOil, Yehoshua

Shai Kol, Deputy CEO and CFO and 3.6% shareholder of DekelOil, and

Lincoln Moore, Executive Director and 0.5% shareholder of DekelOil,

have recently joined the board of Pearlside. Trustland has

nominated that each of Youval Rasin, Yehoshua Shai Kol and Lincoln

Moore be issued the following Consideration Shares:

Date of this announcement Immediately following

the Acquisition

Director Number of Percentage Number of Number Percentage

Ordinary of ordinary Consideration of Ordinary of the enlarged

Shares share capital Shares Shares issued share

capital

----------- --------------- --------------- ------------- -----------------

Youval

Rasin 48,298,538 16.1% 16,576,577 64,875,115 18.4%

----------- --------------- --------------- ------------- -----------------

Shai Kol 10,725,884 3.6% 16,576,577 27,302,461 7.8%

----------- --------------- --------------- ------------- -----------------

Lincoln

Moore 1,387,201 0.5% 3,003,003 4,390,204 1.2%

----------- --------------- --------------- ------------- -----------------

Accordingly, the Acquisition constitutes a related party

transaction under Rule 13 of the AIM Rules for Companies. Andrew

Tillery and Bernard Francois, Non-Executive Chairman and

Non-Executive Director respectively at DekelOil, and who are

considered independent directors for the purposes of the

Acquisition, and having consulted with the Company's nominated

adviser, consider the terms of the Option to be fair and reasonable

insofar as DekelOil's shareholders are concerned. In forming this

opinion, Mr Tillery and Mr Francois have taken into account the

conclusions of an independent valuation report prepared by PKF

Littlejohn LLP on Pearlside, and on the value that a recent

independent investment was made in Pearlside by an unrelated

investor.

Issue of Equity and Total Voting Rights

The Company is issuing 189,441 Ordinary Shares to certain

advisers in settlement of fees for services provided and 52,612,613

Ordinary Shares in settlement of the Acquisition. Therefore,

application has been made to the London Stock Exchange for the

admission of a total of 52,802,054 Ordinary Shares ("Admission").

It is expected that Admission will become effective on 7 January

2019. The new Ordinary Shares will rank pari passu with the

existing Ordinary Shares in issue. Following Admission, the

Company's total issued share capital will comprise 352,273,423

Ordinary Shares. This number may be used by shareholders in

DekelOil as the denominator for calculation by which they determine

if they are required to notify their interest in, or a change in

their interest in, the share capital of DekelOil under the FCA's

Disclosure Guidance and Transparency Rules.

**S **

For further information please visit the Company's website or

contact:

DekelOil Public Limited

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Cantor Fitzgerald Europe (Nomad and

Joint Broker)

David Foreman

Richard Salmond +44 (0) 207 894 7000

VSA Capital (Joint Broker)

Andrew Monk (Corporate Broking)

Andrew Raca (Corporate Finance) +44 (0) 203 005 5000

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

St Brides Partners Ltd (Investor Relations)

Frank Buhagiar

Cosima Akerman +44 (0) 207 236 1177

Further Information on the Project

Pearlside is a privately-owned investment holding company, which

wholly owns Capro, a cashew business in Côte d'Ivoire. Capro is

constructing a 10,000 tpa (expandable to 30,000 tpa) plant at

Tiebissou in Côte d'Ivoire to take advantage of a significant

shortfall in processing capacity in the country. Tiebissou is

located in a cashew producing region and within three hours of the

port at Abidjan. Capro has secured 6ha of land at Tiebissou on

which the processing plant will be built, plus an additional 3ha

for expansion and 1ha for a warehouse. Once operational, the

processing plant at Tiebissou will aim to process up to 10,000 and

15,000 tonnes per annum of RCNs in 2020 and 2021 respectively,

gradually increasing to 30,000 tonnes per annum by 2024. Processing

of RCNs at the plant is scheduled to begin early 2020.

Appendix

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Youval Rasin

-------------------------------------- -------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Chief Executive Officer

-------------------------------------- -------------------------------

b) Initial notification/amendment: Initial notification

-------------------------------------- -------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

-----------------------------------------------------------------------

a) Name: DekelOil Public Limited

-------------------------------------- -------------------------------

b) LEI: 213800TZMTERFY8P7D14

-------------------------------------- -------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary shares of

instrument, type of instrument: EUR0.0003367 each

Identification code: CY0106502111

-------------------------------------- -------------------------------

b) Nature of the transaction: Consideration shares

issued

-------------------------------------- -------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

4.5

pence 16,576,577

-----------

-------------------------------------- -------------------------------

d) Aggregated information: Single transaction

as in 4 c) above

Aggregated volume: Prices(s) Volume(s)

4.5 pence 16,576,577

Price: -----------

-------------------------------------- -------------------------------

e) Date of transaction: 20 December 2018

-------------------------------------- -------------------------------

f) Place of transaction Outside a trading

venue

-------------------------------------- -------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Shai Kol

-------------------------------------- -------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Deputy CEO

-------------------------------------- -------------------------------

b) Initial notification/amendment: Initial notification

-------------------------------------- -------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

-----------------------------------------------------------------------

a) Name: DekelOil Public Limited

-------------------------------------- -------------------------------

b) LEI: 213800TZMTERFY8P7D14

-------------------------------------- -------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary shares of

instrument, type of instrument: EUR0.0003367 each

Identification code: CY0106502111

-------------------------------------- -------------------------------

b) Nature of the transaction: Consideration shares

issued

-------------------------------------- -------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

4.5

pence 16,576,577

-----------

-------------------------------------- -------------------------------

d) Aggregated information: Single transaction

as in 4 c) above

Aggregated volume: Prices(s) Volume(s)

4.5 pence 16,576,577

Price: -----------

-------------------------------------- -------------------------------

e) Date of transaction: 20 December 2018

-------------------------------------- -------------------------------

f) Place of transaction Outside a trading venue

-------------------------------------- -------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Lincoln Moore

--------------------------------------- ------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Executive Director

--------------------------------------- ------------------------------

b) Initial notification/amendment: Initial notification

--------------------------------------- ------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

-----------------------------------------------------------------------

a) Name: DekelOil Public Limited

--------------------------------------- ------------------------------

b) LEI: 213800TZMTERFY8P7D14

--------------------------------------- ------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary shares of

instrument, type of instrument: EUR0.0003367 each

Identification code: CY0106502111

--------------------------------------- ------------------------------

b) Nature of the transaction: Consideration shares

issued

--------------------------------------- ------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

4.5

pence 3,003,003

----------

--------------------------------------- ------------------------------

d) Aggregated information: Single transaction

as in 4 c) above

Aggregated volume: Prices(s) Volume(s)

4.5 pence 3,003,003

Price: ----------

--------------------------------------- ------------------------------

e) Date of transaction: 20 December 2018

--------------------------------------- ------------------------------

f) Place of transaction Outside a trading venue

--------------------------------------- ------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFKDDBFBDKFBN

(END) Dow Jones Newswires

December 31, 2018 03:37 ET (08:37 GMT)

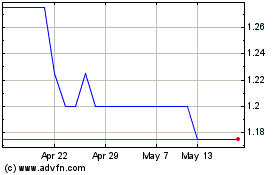

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Apr 2024 to May 2024

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From May 2023 to May 2024