Downing Renewables & Infrastructure Trust to Raise Around GBP50 Million

07 June 2022 - 6:07PM

Dow Jones News

By Anthony O. Goriainoff

Downing Renewables & Infrastructure Trust PLC said Tuesday

that it plans to raise around 50 million pounds ($62.7 million) via

a discounted share-placing, an open offer and a subscription.

The U.K.-based trust, known as DORE, said it will use the

proceeds to repay outstanding monies on a loan and purchase

assets.

The trust, which holds a portfolio of renewable-energy

generating assets, said it will issue up to 45.7 million new

ordinary shares at 111 pence a share, a 1.3% discount to Monday's

closing price of 112.50 pence.

DORE said outstanding monies drawn under its revolving credit

facility currently amounted to GBP17.3 million. It added that its

investment opportunities pipeline included near-term hydropower,

wind and solar assets in the U.K., Sweden and Finland.

The trust said its investment manager was in bilateral and/or

exclusive discussions regarding near-term pipeline assets with a

total equity value of more than GBP200 million.

"Raising capital to acquire additional assets has the potential

to further grow [net asset value], increase the diversity of DORE's

portfolio, and continue to provide stable returns to shareholders,"

the company said.

Shares at 0720 GMT were flat at 112.50 pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

June 07, 2022 03:52 ET (07:52 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

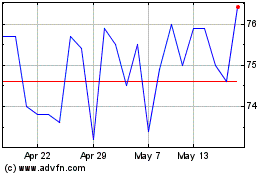

Downing Renewables & Inf... (LSE:DORE)

Historical Stock Chart

From Apr 2024 to May 2024

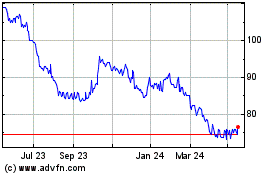

Downing Renewables & Inf... (LSE:DORE)

Historical Stock Chart

From May 2023 to May 2024