TIDMECR

ECR MINERALS plc

("ECR Minerals", "ECR" or the "Company")

SALE OF EXPLORATION LICENCES

ECR Minerals plc (LON: ECR), the gold exploration and

development company focussed on Australia, is pleased to announce

the sale by ECR's wholly owned Australian subsidiary Mercator Gold

Australia Pty Ltd ("MGA") of the licences comprising the Avoca,

Moormbool and Timor gold exploration projects (the "Licences") in

Victoria, Australia to Fosterville South Exploration Ltd

("Fosterville South") for total potential cash consideration of up

to A$2.5 million.

Fosterville South, which recently listed on the TSX Venture

Exchange with the code FSX, has agreed to acquire MGA's 100%

ownership of the Licences by way of Currawong Resources Pty Ltd, a

wholly owned subsidiary of Fosterville South, for the following

consideration:

1. A$500,000 in cash to be paid to MGA immediately;

2. A further payment of A$1 for every ounce of gold or gold

equivalent of measured resource, indicated resource or inferred

resource estimated within the area of one or more of the Licences

in any combination or aggregation of the foregoing, up to a maximum

of A$1,000,000 in aggregate;

3. A further payment of A$1 for every ounce of gold or gold

equivalent produced from within the area of one or more of the

Licences, up to a maximum of A$1,000,000 in aggregate.

Craig Brown, Chief Executive Officer of ECR, commented: "We are

delighted to sell these non-core but high-potential licences to

Fosterville South, while maintaining exposure to upside from the

Licences as a result of future resource estimation or

production.

We believe Fosterville South is well placed to advance the

Licences with its strong local exploration team and backing from

North American high-net worth and institutional investors, while

ECR will continue to concentrate its resources on our core projects

in Victoria, Bailieston and Creswick.

The initial cash to be received from this disposal, in addition

to the recently announced placing for GBP500,000, puts ECR in a

robust working capital position which we can apply toward

development of our core projects.

It is worth noting that other external parties are currently

reviewing data on our Bailieston and Creswick gold projects with a

view to potential commercial transactions, including joint venture

opportunities, although there can be no guarantee that any

transaction will occur. In addition, whilst ECR remains open to

transactions on these licence areas, the ECR board believe both to

hold considerable potential and inherent value for the

Company."

Further Information

The Licences comprise exploration licences EL5387 (Avoca

project), EL006280 and EL006913 (Moormbool project), and EL006278

(Timor project) in Victoria, Australia.

The book value of the Licences as derived from ECR's unaudited

management accounts for the period ended 30 March 2020 was

approximately A$282,000, which is the equivalent of approximately

GBP144,000, based on GBP1 = A$1.9626*. No turnover, profits or

losses are attributable to the Licences.

The maximum potential cash consideration receivable by MGA in

respect of the sale of the Licences is A$2.5 million, which is the

equivalent of approximately GBP1.275 million, based on GBP1 =

A$1.9626*

The Company intends that the consideration to be received

immediately, and any future consideration received, will be applied

by ECR to augment its ongoing working capital position as well as

towards its exploration and development activities.

MARKET ABUSE REGULATIONS (EU) No. 596/2014

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the

publication of this announcement via Regulatory Information Service

(RIS), this inside information is now considered to be in the

public domain.

*Exchange rate derived from closing price on Bloomberg at 17

April 2020.

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0)20 7929 1010

David Tang, Non-Executive Chairman

Craig Brown, Director & CEO

Email:

info@ecrminerals.com

Website: www.ecrminerals.com

WH Ireland Ltd Tel: +44 (0)161 832 2174

Nominated Adviser

Katy Mitchell/James Sinclair-Ford

SI Capital Ltd Tel: +44 (0)1483 413500

Broker

Nick Emerson

ABOUT ECR MINERALS PLC

ECR is a mineral exploration and development company. ECR's

wholly owned Australian subsidiary Mercator Gold Australia Pty Ltd

has 100% ownership of the Bailieston and Creswick gold projects in

central Victoria, Australia and the Windidda project in the Yilgarn

region, Western Australia.

ECR has earned a 25% interest in the Danglay epithermal gold

project, an advanced exploration project located in a prolific gold

and copper mining district in the north of the Philippines. An

NI43-101 technical report was completed in respect of the Danglay

project in December 2015 and is available for download from ECR's

website.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200420005348/en/

CONTACT:

ECR Minerals plc

SOURCE: ECR Minerals plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

April 20, 2020 05:12 ET (09:12 GMT)

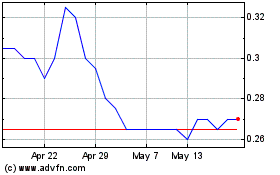

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Apr 2024 to May 2024

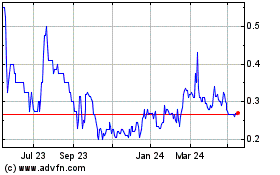

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From May 2023 to May 2024