ECR MINERALS PLC: Equity Placing to Raise GBP900,000

12 December 2022 - 10:08PM

UK Regulatory

TIDMECR

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR"), AND IS DISCLOSED IN ACCORDANCE WITH

THE COMPANY'S OBLIGATIONS UNDER ARTICLE 17 OF MAR. IN ADDITION,

MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN RESPECT OF THE

MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION AS

PERMITTED BY MAR. THAT INSIDE INFORMATION IS SET OUT IN THIS

ANNOUNCEMENT AND HAS BEEN DISCLOSED AS SOON AS POSSIBLE IN

ACCORDANCE WITH PARAGRAPH 7 OF ARTICLE 17 OF MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THE INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION IN

RELATION TO THE COMPANY AND ITS SECURITIES

ECR MINERALS plc

("ECR Minerals", "ECR" or the "Company")

Equity Placing to Raise GBP900,000

ECR Minerals plc (LON: ECR), the exploration and development

company focused on gold in Australia, is pleased to announce that

the Company has today raised GBP900,000 by way of a placing and

direct subscription.

SI Capital Limited has today placed on behalf of the Company

66,666,653 new ordinary shares in the Company ("Placing Shares") at

a price of 0.9 pence per share to raise gross proceeds of

c.GBP600,000 (the "Placing"), subject only to Admission; and the

Company has also raised a further cGBP300,000 by way of the issue

of 33,333,333 new ordinary shares ("Subscription Shares") at a

price of 0.9p per share, subject only to receipt of the funds and

Admission.

Both the Placing Shares and the Subscription Shares were also

accompanied by the issue of one warrant to subscribe for one

ordinary share in the Company for each new share issued (the "New

Warrants"). When issued, the New Warrants will be exercisable at

any time, for a period of 2 years from the date of admission of the

Placing Shares and the Subscription Shares (as applicable) at an

exercise price of 1.5p each.

The monies raised in this fundraise will be used by the Company

as follows:

Victoria assets:

-- Progress work on the Blue Moon project and other Bailieston assets.

-- Progress work on the Creswick project following the results of the

re-assay of diamond drill core announced recently.

-- Commence initial studies at the Tambo project.

North Queensland assets:

-- Progress work on the Lolworth Project, where an extensive sampling

campaign has recently been completed.

-- Progress work at the Hurricane Project following the recent announcement

of a conditional option to acquire 100% of Placer Gold, owner of the

Hurricane Project located west of Cairns in the Hodgkinson Province, NE

Queensland.

And for general working capital

Application will be made for the Placing Shares and the

Subscription Shares to be admitted to trading on AIM ("Admission")

and it is expected that Admission will become effective on or

around 19 December 2022. The Placing Shares and the Subscription

Shares will rank pari passu with the existing ordinary shares. Upon

Admission, ECR's issued ordinary share capital will comprise

1,167,737,145 ordinary shares of 0.001p. This number will represent

the total voting rights in the Company, and, following admission

may be used by shareholders as the denominator for the calculation

by which they can determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the Financial Conduct Authority's Disclosure and Transparency

Rules.

ECR CEO Andrew Haythorpe commented: "I am delighted to announce

that we have received strong support from new and existing

investors following my recent visit to London to attend the 121

Mining Investment and Mines and Money events. As outlined above,

the funds raised will be used to progress our projects at Victoria

and Queensland and also to explore new opportunities."

"I look forward to reporting further progress on our project

portfolio very shortly."

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0) 20 7929 1010

David Tang, Non-Executive Chairman

Andrew Haythorpe, CEO

Email:

info@ecrminerals.com

Website: www.ecrminerals.com

WH Ireland Ltd Tel: +44 (0) 207 220 1666

Nominated Adviser

Katy Mitchell / Andrew de Andrade

SI Capital Ltd Tel: +44 (0) 1483 413500

Broker

Nick Emerson

Novum Securities Limited Tel: +44 (0) 20 7399 9425

Broker

Jon Belliss

Brand Communications Tel: +44 (0) 7976 431608

Public & Investor Relations

Alan Green

ABOUT ECR MINERALS PLC

ECR Minerals is a mineral exploration and development company.

ECR's wholly owned Australian subsidiary Mercator Gold Australia

Pty Ltd ("MGA") has 100% ownership of the Bailieston and Creswick

gold projects in central Victoria, Australia, has six licence

applications outstanding which includes one licence application

lodged in eastern Victoria. (Tambo gold project). MGA is currently

drilling at the Bailieston Blue Moon Project (EL5433) and

undertaking geochemical exploration on the Creswick (EL6148)

project and has an experienced exploration team with significant

local knowledge in the Victoria Goldfields and wider region.

ECR also owns 100% of an Australian subsidiary LUX Exploration

Pty Ltd ("LUX") which has three approved exploration permits

covering 946 km(2) over a relatively unexplored area in Queensland,

Australia.

Following the sale of the Avoca, Moormbool and Timor gold

projects in Victoria, Australia to Fosterville South Exploration

Ltd (TSX-V: FSX) and the subsequent spin-out of the Avoca and Timor

projects to Leviathan Gold Ltd (TSX-V: LVX), Mercator Gold

Australia Pty Limited has the right to receive up to A$2 million in

payments subject to future resource estimation or production from

projects sold to Fosterville South Exploration Limited.

ECR holds a 70% interest in the Danglay gold project; an

advanced exploration project located in a prolific gold and copper

mining district in the north of the Philippines, which has a 43-101

compliant resource. ECR also holds a royalty on the SLM gold

project in La Rioja Province, Argentina and can potentially receive

up to US$2.7 million in aggregate across all licences

View source version on businesswire.com:

https://www.businesswire.com/news/home/20221212005409/en/

CONTACT:

ECR Minerals plc

SOURCE: ECR Minerals plc

Copyright Business Wire 2022

(END) Dow Jones Newswires

December 12, 2022 06:08 ET (11:08 GMT)

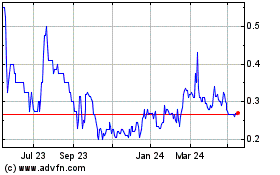

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Mar 2024 to May 2024

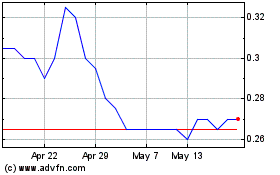

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From May 2023 to May 2024