TIDMEML

RNS Number : 8142E

Emmerson PLC

23 October 2018

Emmerson Plc / Ticker: EML / Index: LSE / Sector: Mining

23 October 2018

Emmerson Plc ("Emmerson" or the "Company")

Potential for Very Low Capital Cost Electrical and Gas Supply at

Khemisset Potash Project

Emmerson Plc, the Moroccan focused potash development company,

is pleased to announce that it has completed the preliminary cost

estimates for the capex required to ensure electricity and gas

supply at its 100% owned Khemisset Potash Project located in

northern Morocco ("Khemisset" or "the Project"). This work has been

completed by independent consultant Golder Associates ("Golder"),

as part of the forthcoming Scoping Study, which the Company expects

to be completed in early Q1 2019. These estimates have confirmed

the potential for significant capital cost savings for the Project

due to its proximity to excellent infrastructure. To view the press

release with the illustrative maps and diagrams please use the

following link:

http://www.rns-pdf.londonstockexchange.com/rns/8142E_1-2018-10-22.pdf

Highlights

-- Total budgeted cost for construction of connection to

existing electrical infrastructure is approximately US$5.7 million

including a 30% contingency

-- Discussions with largest gas provider in Morocco confirms

Company's expectation that onsite gas (LPG) storage facility can be

constructed at supplier's expense, with zero capex required by

Emmerson

-- Estimated capital cost saving for similar work package of

approximately 93%, or over US$75 million, relative to estimates for

average Canadian potash mine development[1]

-- Proposed site location is only 5.5km from the expected

connection point to 60kV electricity lines, and 7km from nearest

electrical substation

-- Design and estimate completed by Golder according to AusIMM

guidelines for capital cost estimates

-- Further enhances Management's strong belief in potential for

Khemisset to be a low capital cost potash mine development,

following the announcements of low capex mine access and low capex

logistics solution, which have the potential to save Emmerson over

US$1.1 billion when compared to benchmark projects (refer RNS dated

18 September and 08 October 2018)

Hayden Locke, CEO of Emmerson, commented:

"The Khemisset Project benefits from access to outstanding

infrastructure and this manifests itself in significant capital

cost savings for the Project. Morocco has invested heavily in

electrical generation and transmission capacity throughout the

country. As a result, the Project is within close proximity of

numerous sites to connect to the electrical grid.

"Our discussions with one of the largest gas suppliers in

Morocco confirm that it is willing to design, build and maintain

the gas storage infrastructure required for the mine and

processing. This saves us considerable capex which would otherwise

be required to construct either a pipeline or onsite storage, at

our own expense.

"The design and cost estimates for the access to mineralisation

and connection to logistics highlighted significant cost savings

already available to the Khemisset Project. This announcement

further enhances our belief that the Scoping Study for Khemisset

will present a low capital cost, high margin proposition which

should result in compelling economic metrics."

Comparison to Peers

The electrical and gas supply capex estimates for the Khemisset

Project, completed by independent engineers Golder as a part of the

Scoping Study, indicates that the capital cost requirement to

ensure electricity and gas availability should be far lower than

the equivalent connections for the majority of potash development

projects globally. A comparison to other development stage potash

projects is shown in Figure 1 below.

Figure 1. Capital costs to connect to logistics solution in

selected potash projects

Electrical Connection Overview

Golder, which was appointed by the Company to manage the

delivery of its Scoping Study, has completed basic design and cost

estimates for the electrical connection at Khemisset. Designs and

estimates have been prepared in line with Scoping Study guidelines

provided by the Australasian Institute of Mining and Metallurgy

("AusIMM").

Electrical Grid Connection

There is an existing 60 kV network in the area, with two

transmission lines running to the north and west of the proposed

process plant site. The nearest connection point to that line is

5.5 kilometres due west of the site. The nearest substation is the

60/22 kV Khemisset substation approximately 7 kilometres north west

of the site. Figure 2 below indicates the proposed location for

connection to site.

Figure 2. Approximate distances to nearest point on 60 kV line

and Khemisset Substation

There are multiple possible connection points to the electricity

grid, of which the Khemisset substation, and its transmission

lines, are the closest. A detailed power study, to confirm

availability of the full 40MW estimated peak power requirement has

not yet been completed, but initial discussions with the Moroccan

electricity network, and work completed by local consultants,

indicate that there is sufficient capacity both on the 60 kV

network and at the Khemisset substation for the Project's

needs.

The larger Meknes substation which is located approximately 38

kilometres due east of the proposed mine, has confirmed capacity

for the mine and offers a viable alternative to the Khemisset

substation.

Figure 3: Approximate location of Meknes substation in relation

to other connection alternatives

Site Electrical Infrastructure

The 60kV overhead line will feed from the electricity grid into

the mine's 60/11 kV intake substation. Given the relatively large

size of the mine infrastructure area, it is considered impractical

to distribute to all infrastructure at 400V. It is therefore

proposed that a single 11 kV ring will feed all surface and

underground infrastructure, with 11 kV / 400 V step-down pole-mount

transformers or compact substations throughout the mine

infrastructure area. Compact substations with dry-type transformers

are recommended for underground operations.

In most cases, 11 kV and 400 V underground cables are proposed

for the mine infrastructure area. However, 11 kV overhead lines

will be considered for longer runs to reduce costs and transmission

losses.

Gas Supply Overview

Emmerson will require supply of gas, either Liquified Petroleum

Gas ("LPG") or Liquified Natural Gas ("LNG"), for the Khemisset

processing plant. In Morocco, the most common gas source is LPG,

which can be either propane, butane, or a mixture of the two. The

Company has been in discussions with multiple companies capable of

supplying this gas and is comfortable that a reliable supplier can

be contracted who will construct an on-site storage facility and

deliver all required gas at market rates. The storage contemplated

would be of sufficient size to allow 10 days' supply to be stored

at all times. The Company has received written offers which reflect

these terms.

In this scenario, there would be no capex required from Emmerson

with respect to ensuring supply of LPG. Gas prices in operation

would be floating, with reference to global market prices plus

freight and taxes to deliver to site in Morocco.

Cost Estimation

The total budgeted capital cost required to connect the

Khemisset site to the electrical grid and construct onsite gas

storage is US$5.74 million including a 30% contingency. Cost

estimation for the electrical grid connection has been conducted in

line with Scoping Study levels of accuracy of approximately

+/-30-50%.

A summary of the cost breakdown is presented in Table 1

below:

Item US$ millions

------------------------------------ ---------------------------------

Electrical Connection $4,416,000

------------------------------------ ---------------------------------

60 kV Departure Bay $300,000

------------------------------------ ---------------------------------

60 kV overhead lines, connection

to nearest line $116,000

------------------------------------ ---------------------------------

60/11 kV Intake Substation $4,000,000

------------------------------------ ---------------------------------

Gas Storage $0

------------------------------------ ---------------------------------

Contingency (30%) $1,325,000

------------------------------------ ---------------------------------

Total Direct Costs including

Contingency $5,741,000

------------------------------------ ---------------------------------

Table 1: Summary of Direct Costs for Electrical and Gas Supply

Capex

**S**

For further information, please visit www.emmersonplc.com, follow

us on Twitter (@emmerson_plc), or contact: Emmerson Plc Tel: +44 (0) 207 236

Hayden Locke 1177

Edward McDermott

James Biddle Beaumont Cornish Limited Tel: +44 (0) 207 628

Roland Cornish Financial Adviser 3396

Jeremy King Optiva Securities Limited Tel: +44 (0) 3137 1904

Broker

Lottie Wadham St Brides Partners Ltd Tel: +44 (0) 20 7236

Gaby Jenner Financial PR/IR 1177

Notes to Editors

Emmerson's primary focus is on developing the Khemisset Potash

Project located in Northern Morocco. The project has a large JORC

Resource Estimate (2012) of 311.4Mt @ 10.2% K(2) O and significant

exploration potential with an accelerated development pathway

targeting a low capex, high margin mine. Khemisset is perfectly

located to capitalise on the expected growth of African fertiliser

consumption whilst also being located on the doorstep of European

markets. This unique positioning means the project will receive a

premium netback price compared to existing potash producers. The

need to feed the world's rapidly increasing population is driving

demand for potash and Emmerson is well placed to benefit from the

opportunities this presents.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

[1] Based on Hatch Engineering Study, 2012

(http://publications.gov.sk.ca/documents/310/93667-PotashRequirementGuide%20Rev1.pdf)

with 30% contingency added.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLBLBDGXDDBGID

(END) Dow Jones Newswires

October 23, 2018 02:00 ET (06:00 GMT)

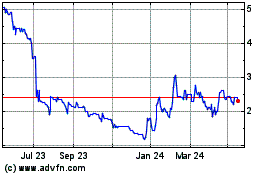

Emmerson (LSE:EML)

Historical Stock Chart

From Mar 2024 to May 2024

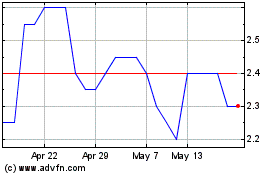

Emmerson (LSE:EML)

Historical Stock Chart

From May 2023 to May 2024