Foresight Solar Fund Limited Q3 2021 NAV, Operational and Gearing Update (9943Q)

02 November 2021 - 6:00PM

UK Regulatory

TIDMFSFL

RNS Number : 9943Q

Foresight Solar Fund Limited

02 November 2021

2 November 2021

Foresight Solar Fund Limited (the "Company")

Q3 2021 Net Asset Value ('NAV'), Operational and Gearing

Update

Foresight Solar Fund Limited, a fund investing in a diversified

portfolio of ground-based solar PV and battery storage assets in

the UK and internationally, announces that as at 30 September 2021

its unaudited Net Asset Value was GBP635.0 million (30 June 2021:

GBP596.4 million), resulting in a NAV per Ordinary Share of 104.1

pence (30 June 2021: 98.0 pence per share).

The increase in NAV during the third quarter is the result of

several factors. The most significant was a reduction in discount

rates applied to the UK operational portfolio from 6.5% to 6.0%,

resulting in a NAV increase of approximately 3.3 pence per share.

The revised discount rate is considered an accurate rate for the

operational portfolio based on data points from recent market

transactions and the opinion of the Investment Manager.

Other relevant NAV movements include a further upward revision

in power price forecasts as high gas prices and low wind power

generation in the UK led to a significant increase in near term

wholesale power prices. This increase, based upon forecasts from

three independent consultants available as at 30 September 2021,

resulted in a positive impact on NAV for the quarter of

approximately 1.5 pence per share.

Alongside the power price forecasts, the UK portfolio has also

benefitted from the exposure to merchant revenues at a time of

exceptionally high power prices. This is the primary driver behind

the actual cash generated by the projects being ahead of budget,

which has delivered a positive uplift of 0.7 pence per share.

Additionally, the Company has entered into further fixed price

offtake agreements for the UK portfolio that have been secured at

prices above forecast, delivering an increase in NAV of

approximately 0.5 pence per share.

During the period the Company also revised the assumption for

useful economic lives on the Australian assets from 30 years to 40

years where this is within the restrictions of the lease. This

aligns the Australian assets with the UK portfolio and delivered a

further 0.7 pence per share to the NAV.

The Gross Asset Value ("GAV"), including Company and

subsidiaries, as at 30 September 2021, was GBP1,106.3 million (30

June 2021: GBP1,057.2 million).

Operational Update

Total revenue for the Company portfolio for the same period was

14% ahead of budget, supported by the significant increase in UK

merchant power prices during the period.

Electricity generation for the Company portfolio was 3.2% below

base case for the 9-month period to the end of September, driven by

underperformance of the Australian assets as a result of grid

outages on the network combined with lower than forecast

irradiation.

Gearing Update

The Company's total outstanding debt as of 30 September 2021 was

GBP471.3 million, including long-term debt of GBP371.3 million and

revolving credit facilities of GBP100.0 million.

The total outstanding long-term debt of GBP371.3 million

represents approximately 33.6% of GAV of the Company and

Subsidiaries as at 30 September 2021.

The total outstanding debt including revolving credit facilities

of GBP471.3 million represents approximately 42.6% of GAV of the

Company and Subsidiaries as at 30 September 2021.

Dividend

The Company remains on target to deliver an annual dividend of

6.98 pence per share for the year ending 31 December 2021.

For further information, please contact:

Foresight Group

+44 (0)20 3911

Nish Sivarajan 2318

(InstitutionalIR@ForesightGroup.eu)

+44(0)20 7029

Jefferies International Limited 8000

Neil Winward

Gaudi Le Roux

+44(0)20 7638

Citigate Dewe Rogerson 9571

Toby Moore

Lucy Gibbs

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFSDEEFEFSESF

(END) Dow Jones Newswires

November 02, 2021 03:00 ET (07:00 GMT)

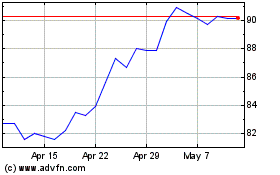

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

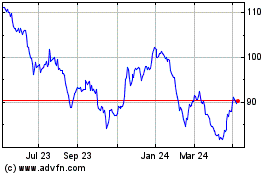

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Apr 2023 to Apr 2024