Foresight Group Holdings Limited Commencement of share buyback programme (6009R)

28 October 2023 - 2:44AM

UK Regulatory

TIDMFSG

RNS Number : 6009R

Foresight Group Holdings Limited

27 October 2023

Foresight Group Holdings Limited - Commencement of share buyback

programme

LEI: 213800NNT42FFIZB1T09

27 October 2023

Foresight Group Holdings Limited

Commencement of share buyback programme

Foresight Group Holdings Limited ("Foresight", the "Company" or

the "Group"), a sustainability-led infrastructure and private

equity investment manager, is pleased to announce that it has

appointed Numis Securities Limited (which is trading for these

purposes as Deutsche Numis) ("Deutsche Numis") to conduct a share

buyback programme of up to GBP5 million for Foresight (in

accordance with certain pre-set parameters) (the "Share Buyback")

to buy back (repurchase) Ordinary Shares (as defined in Foresight's

articles of incorporation) (the "shares" or "Ordinary Shares") in

the capital of Foresight. Deutsche Numis will be authorised by the

board of directors of Foresight (the "Board") to make trading

decisions in relation to the Share Buyback independently of

Foresight.

The Share Buyback will take place within the limitations of the

authority granted to the Board of Foresight at its annual general

meeting ("General Authority"), held on 10 August 2023 (the "AGM"),

pursuant to which the maximum number of shares which may be bought

back is 11,627,121.

About the Share Buyback

-- The Share Buyback will be financed through existing cash

resources.

-- The aggregate number of Ordinary Shares acquired by the

Company pursuant to the Share Buyback shall not exceed the

maximum number of Ordinary Shares which the Company is authorised

to purchase pursuant to the General Authority.

-- In accordance with the General Authority, the maximum price

paid per Ordinary Share acquired by the Company pursuant

to the Share Buyback is to be no more than the higher of

(i) 105% of the average middle market closing price of an

Ordinary Share on the London Stock Exchange for the five

business days preceding the date of purchase; and (ii) the

higher of the price of the last independent trade of an

Ordinary Share, and the highest independent bid for the

Ordinary Shares as derived from the London Stock Exchange

Trading System at the time of the purchase. Further, in

accordance with the General Authority the minimum price

payable per Ordinary Share acquired by the Company pursuant

to the Share Buyback is GBPnil.

-- The Share Buyback will commence on the date of this announcement

and will continue until the earlier of the expiration of

the General Authority or until the number of Ordinary Shares

equal to the maximum pecuniary amount have been purchased

under the Share Buyback or the process is terminated or

paused .

-- The purchased Ordinary Shares will be held by the Group

in treasury at the Group's discretion for later reissue

or cancellation. Shares held in treasury are, subject to

the Companies (Guernsey) Law, 2008, not entitled to distributions

or dividends and the rights and obligations of such shares

shall be suspended (including any voting rights at the Group's

general meetings).

-- Shareholders approved a waiver of Rule 9 of the Takeover

Code at the AGM. If the General Authority was exercised

in full, as the concert party of Bernard Fairman, Gary Fraser

and David Hughes are not participating, their aggregate

shareholdings would increase from 34.1% to 37.9%.

-- Share repurchases will take place in open market transactions

and may be made from time to time depending on market conditions,

share price and trading volume. There is no certainty that

any buybacks will be completed. The Share Buyback may be

paused at any time if deemed appropriate by Deutsche Numis

with respect to the market conditions.

-- The Company confirms that it is not in a closed period and

currently has no unpublished inside information.

-- The Share Buyback will operate in accordance with and under

the terms of the relevant General Authority, and within

the regulatory limit on the quantity of Ordinary Shares

the Company may purchase on a single day. The Share Buyback

will be conducted within the parameters of the Market Abuse

Regulation 596/2014/EU and the delegated regulations made

pursuant to it (as incorporated into English law by virtue

of the European Union (Withdrawal) Act 2018 and as amended

from time to time).

-- However, there will be circumstance where the Group conducts

share repurchases such that they exceed 25 per cent of the

average daily volume in Ordinary Shares for the 20 trading

days prior to the share repurchase.

-- As at 26 October 2023, the Group's total issued share capital

consisted of 116,271,212 Ordinary Shares, with one voting

right per share. The Group does not as at this date hold

any Ordinary Shares in treasury. Therefore, the total number

of voting rights in the Group was 116,271,212.

The Board has determined that the commencement of a share

buyback programme is an optimal use of cash resources and is in the

best interests of the Company and its shareholders.

For further information please contact:

Foresight Group Investors

Liz Scorer / Ben McGrory

+44 (0) 7966 966956 / +44 (0) 7443 821577

ir@foresightgroup.eu

Deutsche Numis

Stephen Westgate / Charles Farquhar

+44 (0) 207 260 1000

Citigate Dewe Rogerson

Caroline Merrell / Toby Moore

+44 (0) 7852 210329 / +44 (0) 7768 981763

caroline.merrell@citigatedewerogerson.com /

toby.moore@citigatedewerogerson.com

About Foresight Group Holdings Limited

Foresight Group was founded in 1984 and is a leading listed

infrastructure and private equity investment manager. With a

long-established focus on ESG and sustainability-led strategies, it

aims to provide attractive returns to its institutional and private

investors from hard-to-access private markets. Foresight manages

over 400 infrastructure assets with a focus on solar and onshore

wind assets, bioenergy and waste, as well as renewable energy

enabling projects, energy efficiency management solutions, social

and core infrastructure projects and sustainable forestry assets.

Its private equity team manages eleven regionally focused

investment funds across the UK and an SME impact fund supporting

Irish SMEs. This team reviews over 2,500 business plans each year

and currently supports more than 250 investments in SMEs. Foresight

Capital Management manages four strategies across seven investment

vehicles.

Foresight operates in eight countries across Europe, Australia

and United States with AUM of GBP12.1 billion (*) . Foresight Group

Holdings Limited listed on the Main Market of the London Stock

Exchange in February 2021 and is a constituent of the FTSE250

index. https://www.foresightgroup.eu/shareholders

(*) Based on unaudited AUM as at 30 September 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSEASEXALLDFFA

(END) Dow Jones Newswires

October 27, 2023 11:44 ET (15:44 GMT)

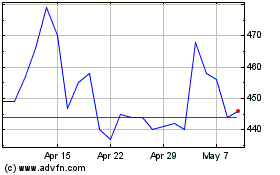

Foresight (LSE:FSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foresight (LSE:FSG)

Historical Stock Chart

From Apr 2023 to Apr 2024