GCP Asset Backed Income Fund Ltd Scrip Share Reference Price (2593X)

09 August 2018 - 4:00PM

UK Regulatory

TIDMGABI TIDMTTM

RNS Number : 2593X

GCP Asset Backed Income Fund Ltd

09 August 2018

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Scrip Share Reference Price

9 August 2018

GCP Asset Backed, which invests in asset backed loans, today

announces the reference price of a new ordinary share under the

scrip dividend alternative for the period from 1 April 2018 to 30

June 2018 (the "Q2 Dividend") of 102.3 pence (the "Scrip Reference

Price").

On the basis of the Scrip Reference Price and the price per

share of the Q2 Dividend, a holder of 67 ordinary shares will

receive 1 new ordinary share.

The Scrip Reference Price was calculated by taking the average

of the Company's closing middle market quotations of an ordinary

share for the ex-dividend date of 2 August 2018 and the four

subsequent dealing days.

Further details of the scrip dividend alternative can be found

in the Scrip Dividend Circular 2018 which was published by the

Company on 26 April 2018, a copy of which is available for

inspection at www.morningstar.co.uk/uk/NSM and on the Company's

website at

https://www.graviscapital.com/funds/gcp-asset-backed/literature.

The Q2 Dividend payment date and the date for admission and

dealing of the new ordinary shares to be issued pursuant to the

scrip dividend alternative is expected to be 3 September 2018.

For further information, please contact:

Gravis Capital Management Limited +44 (0) 20 3405 8500

David Conlon david.conlon@graviscapital.com

Dion Di Miceli dion.dimiceli@graviscapital.com

Cenkos Securities plc +44 (0)20 7397 8900

Tom Scrivens tscrivens@cenkos.com

Oliver Packard opackard@cenkos.com

Sapna Shah sshah@cenkos.com

Notes to Editors

The Company

GCP Asset Backed is a closed ended investment company traded on

the Main Market of the London Stock Exchange. Its investment

objective is to generate attractive risk-adjusted returns primarily

through regular, growing distributions and modest capital

appreciation over the long term.

The Company seeks to meet its investment objective by making

investments in a diversified portfolio of predominantly UK based

asset backed loans which have contracted, predictable medium to

long term cash flows and/or physical assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDMGGRVRFGRZM

(END) Dow Jones Newswires

August 09, 2018 02:00 ET (06:00 GMT)

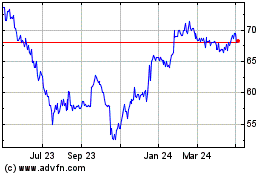

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2024 to May 2024

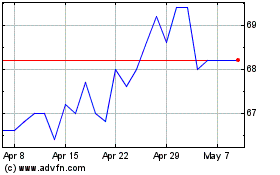

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From May 2023 to May 2024