TIDMGCP

RNS Number : 5623W

GCP Infrastructure Investments Ltd

13 December 2023

GCP Infrastructure Investments Ltd

("GCP Infra" or the "Company")

13 December 2023

LEI 213800W64MNATSIV5Z47

Annual report and financial statements for the year ended 30

September 2023

The Directors of the Company are pleased to announce the

Company's annual results for the year ended 30 September 2023. The

full annual report and financial statements can be accessed via the

Company's website www.graviscapital.com/funds/gcp-infra/literature

and will be posted to shareholders on 11 January 2024.

About the Company

The Company seeks to provide shareholders with regular,

sustained, long-term dividend income whilst preserving the capital

value of its investments over the long term by generating exposure

to infrastructure debt and/or similar assets. It is currently

invested in a diversified, partially inflation-protected portfolio

of investments, primarily in the renewable energy, social housing

and PPP/PFI sectors.

The Company is a FTSE 250, closed-ended investment company

incorporated in Jersey. It was admitted to the Official List and to

trading on the London Stock Exchange's Main Market in July 2010. It

had a market capitalisation of GBP589.8 million at 30 September

2023.

At a glance - 30 September 2023

FY2021 FY2022 FY2023

-------------------------------------- ------ ------ ------

Net assets GBPm 916.8 998.1 956.6

Profit/(loss) for the year GBPm 62.4 140.3 30.9

Dividends for the year p 7.0 7.0 7.0

Aggregate downward revaluations since

IPO(1) (annualised) % 0.42 0.18 0.36

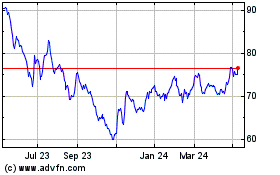

Share price p 100.40 97.80 67.70

NAV per share p 103.92 112.80 109.79

-------------------------------------- ------ ------ ------

Highlights for the year

- Dividends of 7.0 pence per share for the year to 30 September

2023 (30 September 2022: 7.0 pence per share). For the forthcoming

financial year, the Company has set a dividend target(2) of 7.0

pence per share.

- Against a challenging macro-economic backdrop, the Company's

total shareholder return(1) for the year was -25.2% (30 September

2022: 3.8%) with total shareholder return(1) of 57.1% since IPO in

2010. Total NAV return(1) for the year was 3.7% (30 September 2022:

15.8%).

- Profit for the year decreased to GBP30.9 million (30 September

2022: profit of GBP140.3 million), due to a combination of factors

including lower electricity prices and generation and revaluations

in respect of discount rate adjustments. For information on

financial performance for the year, refer to the financial review

below.

- NAV per share at 30 September 2023 of 109.79 pence (30 September 2022: 112.80 pence).

- Limited new loans of GBP9.2 million. Portfolio investments of

GBP129.5 million(3) focused on restructuring and management. This

was offset by repayments of GBP128.0 million(3) , giving a net

investment in the existing portfolio of GBP1.5 million.

- Refinance of two biomass projects generating GBP50.0 million

in net cash proceeds. The proceeds were used to repay the Company's

RCF and led to a 1.2 pence per share uplift to the Company's NAV

primarily from prepayment fees.

- Third party independent valuation of the Company's partially

inflation-protected investment portfolio at 30 September 2023 of

GBP1.0 billion (30 September 2022: GBP1.1 billion). The principal

value of the portfolio was GBP1.0 billion (30 September 2022:

GBP1.0 billion).

- Entered into arrangements to partially hedge the Company's

financial exposure to electricity prices for the summer 2023 and

winter 2023/24 periods.

- Adoption by the Board of a capital allocation policy realising

c.15% (GBP150 million) of the portfolio to rebalance sectors and

reduce equity exposures, and to apply the funds towards a material

reduction in the RCF and facilitate the return of capital to

shareholders of at least GBP50 million before the end of the

calendar year 2024. Refer to the Chairman's statement below.

- Post year end, the Company signed heads of terms for a new

reduced GBP150.0 million RCF with Lloyds, AIB, Mizuho and

Clydesdale, in accordance with the Board's stated intention to

reduce leverage of the Company.

1.APM - for definition and calculation methodology, refer to the

APMs section below.

2.The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

3.Inclusive of non-cash items as disclosed in note 11 to the

financial statements.

Andrew Didham, Chairman of GCP Infra, commented:

The wider financial market in which the Company operates has

continued to face significant challenges. Against a backdrop of

increased inflation, higher interest rates and high energy prices,

the Company has continued to deliver stable and predictable income

for shareholders through its focus on debt investments in

infrastructure assets vital to the efficient operation of modern

society.

The Company generated total profit and comprehensive income for

the year of GBP30.9 million (30 September 2022: GBP140.3 million)

and paid a dividend of 7.0 pence per ordinary share (30 September

2022: 7.0 pence). For the forthcoming financial year, the Company

has set a dividend target(1) of 7.0 pence per share. At the year

end, the Company's share price was 67.70 pence, representing a

38.3% discount(2) to NAV (30 September 2022: 97.80 pence,

representing a 13.3% discount(2) to NAV). The Board believes the

discount at which the Company's shares have traded to the stated

NAV is not reflective of the strength in the Company's underlying

investment portfolio, with the effective yield considerably higher

than the discount rate on investments determined by the independent

Valuation Agent. Underlying portfolio performance also remains

strong, with loans continuing to be serviced.

The Board and the Investment Adviser are committed to the

Company's intentions to re-allocate capital towards reducing

gearing, buying back shares while they remain an attractive

investment opportunity and disposing of assets to rebalance the

portfolio and generate funds. Subject to market conditions and the

ability to agree acceptable terms, the Board has adopted a capital

allocation policy of realising c.15% (GBP150 million) of the

portfolio to rebalance sectors and reduce equity exposures, and to

apply the funds towards a material reduction in the RCF and

facilitate the return of capital to shareholders of at least GBP50

million before the end of the calendar year 2024, whilst

maintaining the dividend target(1) . The Board believes that this

capital allocation policy will underline the Company's position as

a leading investor in infrastructure debt, with a strong focus on

sustainable investments.

1.The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

2.APM - for definition and calculation methodology, refer to the

APMs section below.

Investment objectives and KPIs

The Company's purpose is to invest in UK infrastructure debt

and/or similar assets to meet the following key objectives:

Dividend income Diversification Capital preservation

To provide shareholders To invest in a diversified To preserve the capital

with regular, sustained, portfolio of debt and/or value of its investments

long-term dividends. similar assets secured over the long term.

against UK infrastructure

projects.

------------------------- -------------------------- -------------------------

Key performance indicators

The Company paid a dividend The investment portfolio The Company has generated

of 7.0 pence in respect is exposed to a wide a NAV total return(5)

of the year. A dividend variety of assets in for the year of 3.7%

target(1) of 7.0 pence terms of project type and 169.5% since the

has been set for the and the source of its Company's IPO in 2010.

forthcoming financial underlying cash flow.

year. 109.79p

51 NAV per share at 30 September

7.0p Number of investments 2023

Dividends paid for the at 30 September 2023

year ended 30 September 0.36%

2023 12.0%(3) Aggregate downward revaluations

Size of largest investment since IPO (annualised)(5)

GBP30.9m as a percentage

Profit for the year ended of total portfolio

30 September 2023

--------------------------- --------------------------- --------------------------------

Sustainability indicators

Portfolio contributing Portfolio that benefits Board gender and ethnic

to green economy(2) end users within society(4) diversity(6)

65% 35% 50%

---------------------- ---------------------------- -----------------------

Further information on Company performance can be found in the

financial review below.

1.The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

2.The LSE Green Economy Mark recognises London-listed companies

generating more than half their revenues from green environmental

products and services. The Company's portfolio is 65% invested in

the renewable energy sector.

3.The Cardale PFI loan is secured on a cross -- collateralised

basis against 18 operational PFI projects, with no exposure to any

individual project being in excess of 10% of the total

portfolio.

4.The Company's portfolio is 33% invested in PPP/PFI projects in

the healthcare, education, waste, housing, energy efficiency and

justice sectors which are measured in alignment with the UN SDGs,

and 2% of the portfolio is invested in PPP/PFI leisure

projects.

5.APM - for definition and calculation methodology, refer to the

APMs section below.

6.For further information please refer to the Nomination

committee report in the full annual report on the Company's

website.

Portfolio at a glance:

The Company's portfolio comprises underlying assets across the

UK which fall under the following classifications:

Number % of portfolio

Sector of assets

-------------------- ---------- --------------

Geothermal 1 1

Solar 53,179 25

PPP/PFI 134 24

Supported living 905 11

Hydro-electric 14 2

Gas peaking 2 1

Biomass 761 9

Electric vehicles 250 1

Wind 11 17

Anaerobic digestion 23 9

-------------------- ---------- --------------

Senior ranking security

42%

Weighted average annualised yield(1)

7.9%

Average life

10 years

Partially inflation protected

41%

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Chairman's statement

I am pleased to present the Company's annual report for the year

ended 30 September 2023.

Andrew Didham

Chairman

Introduction

Political and economic volatility have continued to impact UK

markets this financial year. Against a backdrop of wider economic

turmoil and uncertainty, the Company has continued to deliver

stable and predictable income for shareholders through its focus on

debt investments in infrastructure assets vital to the efficient

operation of modern society.

The underlying portfolio assets have performed as expected, with

loans continuing to be serviced. However, it is important to

recognise the Company's share price has come under pressure, with

shares trading at a persistent discount(1) to NAV throughout the

year and a substantial portion of the prior year, after eleven

years of the shares trading at an average premium(1) .

This issue is not individual to the Company; other investment

companies focused on the provision of income from infrastructure

and renewable energy generation have faced similar share price

pressure. This is primarily due to high levels of economic

uncertainty in the UK, with a higher energy price environment

stemming from Russia's invasion of Ukraine and unrest in the Middle

East post year end, as well as increased inflation and higher

interest rates. The Board believes the discount at which the

Company's shares have traded to the stated NAV is not reflective of

the strength in the Company's underlying investment portfolio.

Proposed combination

On 11 August 2023, the Company announced that it had agreed

heads of terms with GCP Asset Backed in respect of a proposed

combination of the two companies (the "Scheme"). As set out at the

time, the Board believed the Scheme would benefit both existing and

new shareholders in the Company.

Following the announcement, the Board and its advisers consulted

widely with shareholders. The majority of shareholders recognised

the Company's efforts to put forward a constructive proposal that

sought to accelerate: (i) the reduction of the Company's

outstanding debt; (ii) the return of capital to shareholders; and

(iii) the reset of the return and risk being generated by the

Company's portfolio of investments.

The Board understood that there was a divergence of views,

predominantly amongst the shareholders of GCP Asset Backed. The

Board determined that if the Scheme was completed with a

significant minority of GCP Asset Backed shareholders that were not

supportive, it would risk the ability of the Scheme to achieve its

intended purpose. Therefore, on 18 September 2023, the Company

announced that it had ceased discussions relating to the

Scheme.

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Capital allocation

Following the termination of discussions in relation to the

Scheme, the Board has reconfirmed the intended capital allocation

policy for the forthcoming year:

- prioritise the reduction of leverage whilst interest rates

remain high, by using capital proceeds from disposals and

refinances to repay the RCF;

- improve the risk adjusted return of the existing portfolio by

reducing equity risks as well as exposure to the social housing

sector; and

- buy back the Company's shares while they remain an attractive

investment opportunity and/or otherwise return capital to

shareholders.

At the year end, the average term of the portfolio was ten

years. The Company has historically been able to complete strategic

refinances and disposals before the end of the term of the loan.

For the forthcoming financial year, the Board and Investment

Adviser intend to refocus on refinances and disposals. Subject to

market conditions and the ability to agree acceptable terms, the

Board has set a conditional target of releasing GBP150 million

(c.15% of the portfolio) of funds in order to materially reduce the

RCF and return at least GBP50 million of capital to shareholders

before the end of the calendar year 2024, whilst maintaining the

dividend target(1) .

The Board believes that the capital allocation policy will

emphasize the Company's position as a leading investor in

infrastructure debt, with a strong focus on sustainable

investments.

Market context

The wider financial market in which the Company operates has

continued to face significant challenges. Russia's invasion of

Ukraine has caused a global energy shock, increasing the cost of,

and volatility in, the prices of electricity and gas. Post period

end, further geopolitical tension between Israel and Hamas in the

Middle East has resulted in additional uncertainty in the market,

contributing to volatility in short-term power prices. In tandem

with this, inflation has continued to increase, with the UK's

inflation rate reaching its highest level in 40 years.

The UK's mini-budget in September 2022 led to a dramatic

increase in the cost of borrowing, with a rapid increase in central

bank rates. At the year end, interest rates had risen to 5.25% in

the UK, with higher rates aiming to reduce headline inflation. The

twelve month CPI rate peaked at 11.1% in October 2022, and reduced

to 6.7% in September 2023, materially above the Bank of England's

target rate of 2.0%. At the time of writing, CPI is 4.6%. While

headline energy costs have reduced from their peak in late 2022,

the UK has continued to see labour market strength, with low

unemployment, strong wage growth and increasing costs.

Whilst the relative yields explain some of the reduction in the

Company's share price, the Board believes the discount at which the

Company's shares have traded to the stated NAV is not reflective of

the strength in the Company's underlying investment portfolio, with

the effective yield considerably higher than the discount rate on

investments determined by the independent Valuation Agent. Despite

this, underlying portfolio performance remains strong.

Financial performance

It has been a challenging financial year for the Company, with

investment revaluations negatively impacting profitability. The

Company generated total profit and comprehensive income of GBP30.9

million (30 September 2022: GBP140.3 million). The comparative

period last year included material positive revaluations resulting

from increased electricity price forecasts, with higher power

prices driven by the war in Ukraine generating higher than expected

cash flows from renewable generating assets. Further information on

financial performance can be found below.

The net assets of the Company decreased to GBP956.6 million

(109.79 pence per share) from GBP998.1 million the previous year

(112.80 pence per share). At the year end, the Company's share

price was 67.70 pence, representing a 38.3% discount(2) to NAV (30

September 2022: 97.80 pence, representing a 13.3% discount(2) to

NAV).

The dividend of 7.0 pence per share for the year was 0.5 times

covered on an earnings cover(2) basis, which includes investment

revaluations in accordance with IFRS, and 1.2 times covered on an

adjusted earnings cover(2) basis, calculated on the Investment

Adviser's assessment of adjusted net earnings(2) in the year;

further information can be found below.

1. The dividend target set out above is a target only and not a

profit forecast or estimate and there can be no assurance that it

will be met.

2.APM - for definition and calculation methodology, refer to the

APMs section below.

Investment activity

The Company undertook very little investment activity during the

year: there was very limited follow-on and new investments before

the dramatic shift in interest rates became embedded early in the

year; later, investment activity was confined to portfolio

restructuring and management. The Board and the Investment Adviser

remain committed to the Company's intentions to reallocate capital

towards reducing gearing, buying back shares whilst they trade at a

significant discount and, where appropriate and attractive,

disposing of assets to rebalance the portfolio and generate

funds.

At the start of the year, the Company's borrowings totalled

GBP99.0 million, with drawings against the Company's RCF peaking at

GBP154.0 million in December 2022. At year end, the borrowings had

fallen to GBP104.0 million following repayments. In March 2023, the

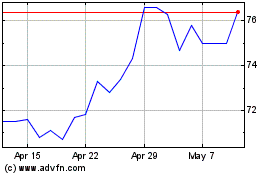

Company commenced a share buyback programme of shares up to a

maximum aggregate value of GBP15.0 million. Since commencement of

the programme and up to the year end, the Company has invested

GBP10.6 million in shares under the authority at an average price

of 78.16 pence per share, a discount(1) to the prevailing NAV. Post

year end, the Company invested a further GBP2.2 million in shares

at an average price of 63.47 pence per share. The Board notes that

buying back shares at a discount(1) to the NAV provides a highly

attractive investment for the Company's shareholders, and is

focused on maximising value by reducing leverage, disposing of

assets and buying back shares before making any new

investments.

The Company made new loans of GBP9.2 million in the year.

Portfolio investments of GBP129.5 million focused on restructuring

and management. This was offset by repayments of GBP128.0 million,

giving a net investment in the existing portfolio of GBP1.5

million.

Investment activity in the year focused on portfolio management

to enhance the Company's security position and generate new

repayments. Portfolio investments advanced to existing borrowers

included: GBP46.4 million in the fourth quarter of 2022 to repay

third party senior debt secured against a portfolio of commercial

solar projects and a portfolio of renewable and PPP assets, which

improved the Company's security; and in May 2023 the Company

entered into agreements for the refinancing of two existing loan

notes in the biomass sector and committed to a new GBP50.0 million

loan note as part of a syndicated facility.

This refinancing generated c.GBP50.0 million of net cash

proceeds that were used to repay the Company's RCF and led to a 1.2

pence per share uplift to the Company's NAV, primarily from

prepayment fees. The refinance improved the Company's security

position whilst also earning prepayment fees of GBP8.7 million.

Financing

The Company maintains a RCF with a number of lenders, with total

commitments of GBP190.0 million, maturing in March 2024, of which

GBP104.0 million is drawn at the date of the report. The Investment

Adviser, on behalf of the Company, has engaged positively with its

lenders. Post year end, in December 2023, the Company signed heads

of terms for a new debt facility at the reduced amount of GBP150.0

million, in line with the Board's stated intention of reducing

Company leverage.

Further details on the Company's financing activity are provided

below and details of the RCF can be found in note 15.

ESG

The Company's portfolio continues to have a positive impact by

contributing to the generation of renewable energy and financing

infrastructure that has clear benefits to users in society. The

Board believes that by ensuring the Company's investments are

focused on their environmental and social impact, the risks

associated with long-term investments are reduced, and the

borrowers' ability to service the loans is increased as users of

the products or services tend to prefer sustainable providers.

The Company has made good progress this year with the ESG

objectives set out in the 2022 annual report. Of particular note

has been the Global Real Estate Sustainability Benchmark ('GRESB')

assessment completed by the Investment Adviser for one of the wind

assets in the portfolio, which achieved a rating of four green

stars and a score of 90 out of 100. The GRESB assessment marks the

first step in the Company's external assurance journey, with the

intention of sharing the lessons learned across the portfolio

assets and replicating policies and management approach for other

assets.

More details of the Company's work in relation to sustainable

investment are given in the sustainability section below.

Share repurchases

The Board is aware of market volatility and its impact on share

prices, including the impact on the Company's share price. The

Company's shares have traded at an average discount(1) of 14.3%

during the year and, at prior year end, an average premium(1) of

8.8% since IPO. At 30 September 2023, the share price was 67.70

pence, representing a discount(1) to NAV of 38.3%.

As outlined above, the Company has undertaken a share repurchase

scheme as part of its ongoing investment strategy, particularly

given the high discount(1) to NAV it has experienced. These

purchases are an attractive use of shareholders' funds relative to

the pipeline of potential new investments, and they are expected to

enhance earnings per share and dividend cover going forward.

The Board continues to support and authorise share repurchases

from time to time, subject to the prevailing share price

discount(1) and availability of cash resources relative to cash

commitments.

Outlook

Bank of England base rates, which at the time of writing are

5.25%, have increased throughout the financial year in a bid to

reduce inflation. Whilst year-on-year CPI peaked in October 2022

and has since fallen, it is still materially above the Bank of

England's target rate of 2.0%. Markets have predicted that interest

rates will reduce in time, but are set to remain higher for longer

than markets were pricing earlier in the year.

Energy prices have fallen from the highs experienced in the

previous financial year, but like interest rates, they are

predicted to stay higher for longer than in this period last year.

Furthermore, the UK has retained its commitment to decarbonise the

electricity grid by 2035. Despite this commitment, and the need for

new renewable electricity generation infrastructure to achieve it,

there were no bids to build new offshore wind capacity under the

most recent contracts-for-difference auction round run by the UK

Government. The Committee for Climate Change has expressed concerns

to Parliament about the pace of change required to meet the UK's

climate goals over the course of the 2030s. The failure to secure

bids to build incremental offshore wind generating capacity is

likely to make these targets even harder to achieve, which will

likely lead to higher power prices for longer.

A total of 41% of the portfolio benefits from some form of

inflation protection, meaning that higher inflation is set to

benefit the existing portfolio. In addition, renewable energy

generators make up around two-thirds of the portfolio and are set

to benefit from power prices being structurally higher than when

the Company originally invested. Thus, the current market and

market outlook are positive for the Company's portfolio.

Higher interest rates have caused a shift in credit markets and,

as a result, opportunities to make new loans within the Company's

risk appetite at rates of interest that reflect the steep change in

rates across asset classes may emerge. Given the continuing need

for new infrastructure to decarbonise the economy, the Board is

confident in the Investment Adviser's ability to continue building

a pipeline of attractive investments for the Company. This gives

the Company the opportunity to reset the long -- term returns on

its investments at a higher yield when it resumes investment

activity.

As noted above, the Board is focused on maximising value for

shareholders by reducing leverage, disposing of assets where

pricing is attractive to generate funds and optimise the portfolio,

and buying back shares, given the attractive risk adjusted returns

from doing so, before making any new investments.

Andrew Didham

Chairman

12 December 2023

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Strategic overview

The Company's purpose is to invest in UK infrastructure debt

and/or similar assets to provide regular, sustained, long-term

dividends and to preserve the capital value of its investments over

the long term.

Investment strategy

The Company's investment strategy is set out in its investment

objective, policy and strategy below. It should be considered in

conjunction with the Chairman's statement and the strategic report

which provides an in-depth review of the Company's performance and

future strategy. Further information on the business model and

purpose is set out below.

Investment objective

The Company's investment objective is to provide shareholders

with regular, sustained, long-term dividends and to preserve the

capital value of its investment assets over the long term.

Investment policy and strategy

The Company seeks to generate exposure to the debt of UK

infrastructure project companies, their owners or their lenders and

related and/or similar assets which provide regular and predictable

long -- term cash flows.

Core projects

The Company will invest at least 75% of its total assets,

directly or indirectly, in investments with exposure to

infrastructure projects with the following characteristics (core

projects):

- pre-determined, long-term, public sector backed revenues;

- no construction or property risks; and

- benefit from contracts where revenues are availability based.

In respect of such core projects, the Company focuses

predominantly on taking debt exposure (on a senior or subordinated

basis) and may also obtain limited exposure to shareholder

interests.

Non-core projects

The Company may also invest up to an absolute maximum of 25% of

its total assets (at the time the relevant investment is made) in

non-core projects, taking exposure to projects that have not yet

completed construction, projects in the regulated utilities sector

and projects with revenues that are entirely demand based or

private sector backed (to the extent that the Investment Adviser

considers that there is a reasonable level of certainty in relation

to the likely level of demand and/or the stability of the resulting

revenue).

There is no, and it is not anticipated that there will be any,

outright property exposure of the Company (except potentially as

additional security).

Diversification

The Company will seek to maintain a diversified portfolio of

investments and manage its assets in a manner which is consistent

with the objective of spreading risk. No more than 10% in value of

its total assets (at the time the relevant investment is made) will

consist of securities or loans relating to any one individual

infrastructure asset (having regard to risks relating to any cross

default or cross-collateralisation provisions). This objective is

subject to the Company having a sufficient level of investment

capital from time to time, the ability of the Company to invest its

cash in suitable investments and the investment restrictions in

respect of 'outside scope' projects described above.

It is the intention of the Directors that the assets of the

Company are (as far as is reasonable in the context of a UK

infrastructure portfolio) appropriately diversified by asset type

(e.g. PPP/PFI healthcare, PPP/PFI education, solar power, social

housing, biomass etc.) and by revenue source (e.g. NHS Trusts,

local authorities, FiT, ROCs etc.).

Non-financial objectives of the Company

The key non-financial objectives of the

Company are:

- to build and maintain strong relationships with all key

stakeholders of the Company, including (but not limited to)

shareholders and borrowers;

- to continue to focus on creating a long -- term, sustainable

business relevant to the Company's stakeholders;

- to develop and increase the understanding of infrastructure

debt as an asset class and to use that understanding continually to

review the Company's investment strategy; and

- to focus on the long-term sustainability of the portfolio and

make a positive impact; through contributing towards the generation

of renewable energy and financing infrastructure that is integral

to society.

Key policies

Distribution

The Company seeks to provide its shareholders with regular,

sustained, long-term dividend income.

The Company has the authority to offer a scrip dividend

alternative to shareholders. The offer of a scrip dividend

alternative was suspended at the Board's discretion for all

dividends during the year, due to the discount(1) between the

likely scrip dividend reference price and the relevant quarterly

NAV per share of the Company. The Board intends to keep the payment

of future scrip dividends under review.

Leverage and gearing

The Company intends to make prudent use of leverage to finance

the acquisition of investments and enhance returns for

shareholders. Structural gearing of investments is permitted up to

a maximum of 20% of the Company's NAV immediately following

drawdown of the relevant debt.

The calculation of leverage under the UK AIFM Regime in note 15

to the financial statements includes derivative financial

instruments as is required by the applicable regulation.

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Business model

The Company's purpose is to invest in UK infrastructure debt

and/or similar assets to provide regular, sustained, long-term

dividends and to preserve the capital value of its investments over

the long term.

Investment Sustainability Implementation of investment Key performance Sustainability

objectives considerations strategy indicators indicators

Generate Governance Board of Directors Stewardship Generate Governance

dividend The Company and oversight dividend income 50%

income operates under 7.0p Board gender

a robust Dividends and ethnic

To provide governance per share diversity

shareholders framework, declared for at

with regular, read more the 30 September

sustained, on pages 90 year ended 2023

long -- term to 119 of 30 September

dividends. the full 2023 Environmental

annual 1,398 GWh

Preserve report on Preserve Renewable

c apital the Company's capital energy

To preserve website. 109.79p exported

the capital NAV per share by portfolio

value of its Environmental at assets(1)

investment The Investment 30 September

assets over Adviser 2023 Social

the long term. positively 856

screens for Provide FTEs at

Provide divers assets which diversification portfolio

ification benefit the 51 asset level

To invest environment, Number of at 30 June

in a read more investments 2023(1)

diversified below. at 30 September

portfolio 2023 Financial

of debt and/or Social 0.5 times(2)

similar assets The Investment Basic dividend

secured Adviser cover (IFRS)

against positively at 30

UK screens for September

infrastructure assets which 2023

projects. benefit

society, read

more below.

Financial

The Company

uses credit

facilities,

hedging

arrangements,

cash flow

forecasts

and stress

scenarios

to ensure

financial

viability,

read more

below.

-------------- -------------- --------------- --------------

Investing ESG due Operating ESG data

The Company diligence The Company collection

seeks pays careful

to generate attention

exposure to the

to control

infrastructure and management

debt and/or of the

similar portfolio

assets and its

in the operating

renewable costs.

energy,

social The day-to-day

housing provision

and PPP/PFI of investment

sectors. advice

and

The Investment administration

Adviser of the

provides Company

advisory is provided

services by the

relating Investment

to the Adviser

portfolio and the

in accordance Administrator

with the respectively,

Company's whose

investment roles

objective are overseen

and policy. by the

Board.

-------------- -------------- --------------- --------------

Financing ESG Managing Assessing

The Company positive As an climate

raises investment investment risk

capital company,

on a highly the Company

conservative seeks

basis, to take

with investment

consideration risk.

given

to scheduled The Investment

capital Adviser

repayments. works

alongside

The Company the Board

will seek to manage

to raise risks

capital and shape

when it the risk

has an policy

advanced of the

pipeline Company.

of investment It is

opportunities. also

It also responsible

makes for risk

prudent monitoring,

use of measuring

leverage and managing.

to finance

the

acquisition

of investments

and enhance

returns.

-------------- -------------- -------------- ---------- -------------- ----------- --------------- --------------

1.Twelve month period to 30 June 2023 to facilitate data

inclusion in the annual report.

2.The dividend of 7.0 pence per share is fully covered by an

adjusted EPS(3) of 8.58 pence per share.

3.APM - for definition and calculation methodology, refer to the

APMs section below.

Investment Adviser's report

The Company's focus remains on investing in UK infrastructure

debt in project companies that have the specific purpose to build,

own and operate assets that benefit from public sector backed

revenues.

UK infrastructure market

Infrastructure investments are typically characterised by high

upfront capital costs, paid back in consideration for the provision

of a service over long asset lives. The infrastructure the Company

seeks to invest in has inherent environmental and social benefits.

For example, some of the assets in the Company's portfolio generate

renewable electricity to displace polluting fossil fuel fired power

stations, while others provide quality accommodation for members of

society who need support to live a productive life with dignity and

independence.

Encouraging the construction and operation of such assets has

historically required Government intervention, initially by way of

subsidies or long -- term revenue guarantees, and more recently by

the UK Government creating long -- term market incentives to

support their business case.

Infrastructure investment has broad cross-party political

backing to support economic, social and fiscal outcomes. In the UK

Government's 2023 Green Finance Strategy, it was noted that,

"Private investment will be crucial to delivering net zero,

building climate resilience and supporting nature's recovery. We

estimate that to deliver on the UK's net zero ambitions through the

late 2020s and 2030s, an additional GBP50 -- 60 billion capital

investment will be required each year."(1) Furthermore, a 2021

report from the Green Finance Institute estimated that over the

next ten years, the UK's domestic nature-related goals could

require between GBP44 -- 97 billion of investment(2) .

With increased policy initiatives incentivising investment in

infrastructure, there are significant opportunities to enhance the

Company's existing portfolio and continue making attractive risk --

adjusted investments.

Challenges and opportunities

The table below sets out some of the challenges and associated

opportunities for infrastructure investment.

Challenge Infrastructure Government support/intervention Investment

opportunities characteristics

Decarbonisation Inflation-linked

of the UK * Further investment in established renewable sectors * CfD subsidy support

economy such as wind and solar but reliant on merchant

by 2050, with prices long term

intermediary

targets in

place

such as the

decarbonisation

of the

electricity

system by 2035

* Deployment of less-established renewables across * Green Gas Support Scheme and Net Zero Hydrogen Scheme

electricity, heat generation and transport

* Various grant and capital support

--------------- --------------------------------------------------------- ----------------------------------------------------------- -----------------------

High energy Exposure to wholesale

prices * Low-marginal cost domestic renewable generators * Price cap energy prices. Some

and reliance on contractual income

foreign (some inflation-linked)

suppliers from capacity mechanism

into the energy or grid service

system arrangements

* Nuclear (including small modular reactors) * Carbon pricing

* Grid infrastructure such as interconnectors * Energy profits levy

-

* Energy storage

-

* Energy efficiency schemes

--------------- --------------------------------------------------------- ----------------------------------------------------------- -----------------------

Climate change Limited current

adaptation: * Flood defences * The Government has a large direct investment flood investment

increased defence programme opportunities,

frequency but expected to

of extreme be a growth area

weather

events in new

geographies

-

* River flood mitigation measures

--------------- --------------------------------------------------------- ----------------------------------------------------------- -----------------------

A growing and Investment

ageing * Housing * This has been a recent focus of direct Government opportunities

population will funding, with a limited role for private sector are typically in

place different investors in public procurements the private sector

demands on (e.g. private care

social homes, private

infrastructure schools).

These have more

corporate or property

investment

characteristics

which are less

attractive

to the Company

-

* Healthcare and social care provision

-

* Transport

-

* Education

-

* Utilities

--------------- --------------------------------------------------------- ----------------------------------------------------------- -----------------------

Digitalisation Demand-based risks

drives * Broadband infrastructure * Capital support for rural deployment and, in certain

a greater need geographies,

for competition

access to for customers

online

services

* Data centres and associated energy systems

--------------- --------------------------------------------------------- ----------------------------------------------------------- -----------------------

1."Mobilising green investment: 2023 green finance strategy", UK

Government, April 2023.

2.Finance Gap for UK Nature Report, Green Finance Institute,

October 2021.

Company position

The Company has a well-diversified portfolio across a wide range

of operational renewable projects, social infrastructure (through

PPP/PFI schemes), and supported living social housing. The explicit

objective of diversification has historically enabled the Company

to respond to more challenging conditions in any one asset class

(such as decreasing yields and/or more competition) by diversifying

into other areas.

Over the life of the Company, the Investment Adviser has seen

several sectors in which the Company has historically been invested

mature over time. PFI, PPP, certain renewable asset classes and

supported social housing have all seen increased demand for

investment, with risks better understood and accepted by

investors.

The Company's response to the current market environment is as

follows:

1. Reduce gearing:

- The Company's debt under the RCF is priced at a margin to

SONIA. Rising interest rates have meant the margin between the

rates charged to borrowers and the cost of the Company's debt has

fallen. Reducing borrowing in this high rate environment is low

risk but enables higher returns for the Company.

2. Buy back shares:

- The Board and the Investment Adviser both consider the implied

yield on the Company's shares, which are trading at a significant

discount(1) to NAV, is higher than the actual risk on the

underlying investments given the positive ongoing performance of

the portfolio. Therefore, buying back the Company's shares offers

an attractive risk-adjusted return for shareholders.

3. Optimise the portfolio:

- The Company's average loan life is ten years. However, the

Investment Adviser continues to seek opportunities to optimise the

portfolio by seeking early refinances or disposals where

appropriate. The Investment Adviser is actively seeking to return

capital to the Company by reducing exposure to the social housing

sector and by de-risking the equity investments.

- The Investment Adviser has identified a number of

opportunities to extend the lives of assets, or to enable assets to

provide additional services that create supporting revenue streams

which will increase the valuation of the assets.

- The debt market has undergone significant change over the last

twelve months and it has created opportunities to invest at a

similar risk level whilst generating higher returns. As such, the

Company remains focused on recycling capital to reduce gearing and

investing in share buybacks. However, over the long term, the need

for new sustainable infrastructure and the higher rates available

in the market will provide attractive opportunities when the

Company resumes making new investments.

Differentiation

The Company retains some key differentiators that make it well

positioned to take advantage of attractive risk-adjusted returns,

despite infrastructure investment opportunities remaining

competitive. These include:

Scale Diversification Track record Debt focus

------------------------ -------------------------- ----------------------- -------------------------

The Company can Having the explicit The Company has The Company's focus

make investments objective been on debt, and flexibility

that are too small of diversifying investing in new across senior and

for certain investors across a range infrastructure sectors subordinated positions,

(such as commercial of asset classes for over a decade. means that it is

banks) to consider, means that The Investment Adviser well placed to match

particularly where the Investment Adviser has the investment risk

there is an opportunity can an established model with an appropriate

to scale an investment seek the most attractive to assess and evaluate capital structure

over time through risk-adjusted returns, opportunities in solution.

follow -- on financing and is not bound new asset classes.

to existing borrowers. to invest in sectors Moreover,

that remain unattractive this track record

due to means the Investment

higher competition Adviser has developed

or asset characteristics. expertise in a

number of asset

classes,

such as anaerobic

digestion

and biomass, that

other investors

are not likely to

benefit from.

------------------------ -------------------------- ----------------------- -------------------------

Key investment activity

This year's focus has been optimising the Company's existing

portfolio and buying back shares, whilst reviewing the use of the

Company's RCF. A full summary of investments and repayments during

the year is shown below.

In December 2022, the Company invested a further GBP36.1 million

into an existing portfolio of commercial solar projects to repay

third party senior debt. These assets are subject to audit by Ofgem

and by replacing the senior debt, the Company was able to manage

the audit process without incurring a potential conflict of

interest with a third party. In May 2023, the Company agreed to a

refinance of two existing loan notes provided to the owners of two

biomass plants.

The loan notes were redeemed at par and the Company received

fees (including prepayment fees) of c.GBP10 million (the effect of

the refinance was equivalent to adding 1.2 pence per share to the

NAV). As part of the refinance, the Company committed a new GBP50.0

million loan note to the owner of the two power plants as part of a

syndicated facility. This refinance improved the Company's security

position, with the new facility including a third operational power

plant. It also increased the total yield projected on the

investment. New investments of note in the year included a GBP7.5

million senior loan to purchase a fleet of electric taxis.

As part of the Company's share buyback programme announced in

March 2023, the Company has invested GBP10.6 million to buyback its

own shares at a discount(1) to the prevailing NAV, providing an

attractive investment for the Company and its shareholders.

The Company has also reduced the use of its RCF given the high

interest rate environment. The drawings under the facility peaked

at GBP154.0 million in December 2022 but were reduced to GBP104.0

million at the year end.

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Investment risk

The table below details the Investment Adviser's view of the

changes to the risk ratings for sectors where changes have been

observed in the past year.

Risk Sector Change in year Description

-------------------------- ---------------- -------------- ----------------------------

Market risk Renewables (all Increased While electricity

The risk of an investment sectors) prices have decreased

being exposed to over the year, volatility

changes in market has persisted. This

prices, such as volatility has also

electricity prices contributed to higher

or inflation. inflation throughout

the year. The Company

has exposure to

electricity prices

and inflation as

part of its renewables

portfolio, and the

higher price environment

has been beneficial

to the assets.

Supported living Increased The rents charged

on the supported

living properties

are inflation linked

and the RPs who

have leased the

properties have

to pass on the inflationary

increases in the

rents they charge

to the local authorities.

-------------------------- ---------------- -------------- ----------------------------

Credit risk Supported living Increased The leases on the

The risk of reliance underlying properties

on customers and have inflation linkage

suppliers to provide and, as such, the

goods and/or services leases charged to

for a project and RPs have increased

manage certain project during the year.

risks as part of The underlying RPs

such arrangements. have to agree to

pass the increases

on to local authorities.

With higher inflation

there is more pressure

on local authorities

to minimise such

rental increases.

-------------------------- ---------------- -------------- ----------------------------

Operational risk Renewables (all Increased The supply chains

The risk of exposure sectors) for spare and replacement

to the construction parts have continued

and/or operations to be impacted by

of a project associated global labour and

with the failure supply chain challenges.

of people, processes The Company has

and/or systems required suffered from delays

to monetise an asset. of this nature during

the year, for example

where a network

operator had a fire

on its site and

had to cease operations

on the wind farm

until repairs were

completed.

-------------------------- ---------------- -------------- ----------------------------

Legal/regulatory Renewables (all Increased There is uncertainty

risk sectors) regarding potential

The risk associated future Government

with changes to intervention in

laws and/or regulations. the energy market,

This covers UK-wide, therefore forecast

non-specific risks, power prices may

such as changes not be realisable

to the tax regime, in reality. The

and specific risks implementation of

such as the change the Electricity

to a subsidy regime Generator Levy in

that a project relies January 2023 has

on. impacted the short-term

profitability of

certain assets in

the portfolio. The

levy will be in

place until 31 March

2028.

-------------------------- ---------------- -------------- ----------------------------

Interest capitalised

The Company received total loan interest income of GBP80.8

million (30 September 2022: GBP74.5 million) from the underlying

investment portfolio. Of this, GBP58.8 million was received in cash

and GBP22.0 million was capitalised in the year (30 September 2022:

GBP52.1 million and GBP22.4 million respectively), refer to note 3

for further information. The capitalisation of interest occurs for

three reasons:

1. Where interest has been paid to the Company late (often as a

result of moving cash through the Company and borrower corporate

structures), a capitalisation automatically occurs from an

accounting point of view.

2. On a scheduled basis, where a loan has been designed to

contain an element of capitalisation of interest due to the nature

of the underlying cash flows.

Examples include projects in construction that are not

generating operational cash flows, or subordinated loans where the

bulk of subordinated cash flows are towards the end of the assumed

life of a project, after the repayment of senior loans.

Planning future capital investment commitments in this way is an

effective way of reinvesting repayments received from the portfolio

back into other portfolio projects.

3. Loans are not performing in line with financial models, resulting in:

(i) lock-up of cash flows to investors who are junior to senior lenders; and

(ii) cash generation is not sufficient to service debt.

Other unscheduled capitalisations in the year related to the

re-direction of cash flows into three gas-to-grid anaerobic

digestion projects in Scotland to address performance issues

encountered in the year.

The table below shows a breakdown of interest capitalised during

the year and amounts paid as part of final repayment or disposal

proceeds:

30 September 30 September 30 September 30 September

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ------------ ------------ ------------

Loan interest received (cash) 58,791 52,079

Capitalised amounts settled as part

of final repayment or disposal proceeds - 9,727

Capitalised (planned) 18,253 15,421

Capitalised (unscheduled) 3,706 6,979

----------------------------------------- ------------ ------------ ------------ ------------

Loan interest capitalised 21,959 22,400

----------------------------------------- ------------ ------------ ------------ ------------

Capitalised amounts subsequently settled

as part of repayments (10,822) 10,822 (13,408) 13,408

----------------------------------------- ------------ ------------ ------------ ------------

Adjusted loan interest capitalised(1) 11,137 8,992

----------------------------------------- ------------ ------------ ------------ ------------

Adjusted loan interest received(1) 69,613 75,214

----------------------------------------- ------------ ------------ ------------ ------------

The table below illustrates the forecast component of interest

capitalised that is planned and unscheduled.

The Investment Adviser and the independent Valuation Agent

review any capitalisation of interest and associated increase to

borrowings to confirm that such an increase in debt, and the

associated cost of interest, can ultimately be serviced over the

life of the asset. To the extent an increase in loan balance is not

serviceable, a downward revaluation is recognised, notwithstanding

that such an amount remains due and payable by the underlying

borrower and where capitalisation has not been scheduled, it

attracts default interest payable.

30 September

----------------------------------

% of total interest 2023 2024 2025 2026 2027 2028

-------------------------- ---- ---- ---- ---- ---- ----

Capitalised (planned) 21% 12% 8% 6% 9% 11%

Capitalised (unscheduled) 4% 5% 1% - - 2%

-------------------------- ---- ---- ---- ---- ---- ----

1.APM - for definition and calculation methodology, refer to the

APMs section below.

Renewables

Renewable projects generate renewable energy across the heat,

electricity and transport sectors and benefit from long -- term

Government subsidies.

65%

Percentage of portfolio by value

GBP683.8m

Valuation of sector

Background

Renewable energy involves the sustainable production of energy

for electricity, heat production and transport. In its 2023 Green

Finance Strategy, the UK Government estimated that to deliver on

the UK's net zero ambitions through the late 2020s and 2030s, an

additional GBP50 to GBP60 billion capital investment will be

required each year. This will provide the Company with significant

investment opportunities across the renewables sector.

Current position

The UK remains committed to decarbonising the electricity system

by 2035 and becoming net zero by 2050. However, the Climate Change

Institute recently noted that "Better transparency is no substitute

for real delivery. Our confidence in the UK meeting its goals from

2030 onwards is now markedly less than it was in our previous

assessment a year ago".(1)

An example of this apparent failure to deliver can be seen in

the results of round five of the UK's flagship renewable support

mechanism, the contract-for-difference ('CfD') published on 8

September 2023. No offshore wind projects bid into the auction, a

technology that has historically been the major beneficiary of the

CfD. As a result of this, questions have been raised over the UK's

target to build 50 GW of offshore wind by 2030 and decarbonise the

electricity grid by 2035, or 2030 under a Labour Government. The

reasons for the failure to attract bids have been well publicised:

the administrative strike price (the maximum price that bidders can

achieve in the CfD auction) was set at a level too low to make new

investment attractive.

Future outlook

Further Government support and intervention is likely to deliver

the new renewable energy generation capacity required to meet the

UK's decarbonisation targets. In the short term, this is likely to

support the price of renewable energy sold by the Company's

existing portfolio of borrowers, and in the medium term is likely

to create further investment opportunities for the Company.

Impact

1,398 GWh Renewable energy exported by portfolio assets(2)

SDG alignment

7 - Affordable and clean energy

8 - Decent work and economic growth

1."Better transparency is no substitute for real delivery",

Climate Change Institute, June 2023.

2.Data at 30 June 2023 to facilitate inclusion in the annual

report.

Evermore and Widnes projects

Refinance of two operational biomass plants

The Evermore project is a c.15.8 MWe waste wood combined heat

and power station located in Lisahally, Northern Ireland. The

project uses c.90,000 tonnes of waste wood per annum, sourced

principally from the construction and demolition industry, to fuel

a steam turbine that generates electricity and supplies heat to a

virgin wood drying system. The project benefits from two ROCs per

MWh of electricity generated for 20 years from its commissioning

date, providing a stable, RPI-linked public sector backed revenue

stream.

The Widnes project is a 20.2 MWe waste wood to energy combined

heat and power station located in Cheshire. It uses up to 147,000

tonnes per annum of waste wood. The plant is eligible for 1.4 ROCs

per MWh of electricity.

The Company originally provided subordinated loans against the

construction and operation of both plants, investing in Evermore in

2013, and committing GBP23.2 million to the financing of its

construction as part of a total financing package of c.GBP80.0

million, with the project completing construction in 2015.

The Company has built a strong working relationship with the

borrowers of both Evermore and Widnes since the initial investments

were made. In the previous financial year, the Company, alongside

another lender, completed the refinance of the senior loans and

subordinated debt, replacing them with 'unitranche' debt, a

flexible form of financing. This resulted in the Company taking a

senior, rather than subordinated, position, removing the associated

lock-up and interest capitalisation risks.

Furthermore, this year the Company completed the refinancing of

the unitranche debt, while retaining exposure to the two plants and

one additional biomass project by participating in a new syndicated

facility. The refinancing repaid the Company at par, while

generating GBP8.7 million of early prepayment fees, demonstrating

the valuation of the loans.

Sustainability indicators

Environment

252 GWh Energy exported in 2022/23(1)

Social

48 FTEs at portfolio asset level(1)

Governance

8 ISO certifications(1)

Financial

GBP33.8m Valuation at 30 September 2023

1.Data at 30 June 2023 to facilitate inclusion in the annual

report.

Supported Living

Supported living projects create long-dated cash flows supported

by the UK Government through the secured pledge of centrally funded

benefits.

11% Percentage of portfolio by value

GBP111.6m Valuation of sector

Background

The Company has historically targeted a subset of the social

housing sector provision referred to as 'supported living' through

the financing of development or conversion of existing

accommodation to suit specific care needs for individuals with

learning, physical or

mental disabilities. The Company has provided debt finance to

entities that own and develop properties, which are leased under a

long-term fully repairing and insuring lease to RPs who operate and

manage the properties. The RPs receive housing benefits for

individuals housed in such properties. The budget for housing

benefit in this sector is funded by the central Government and has

historically been, and remains, highly protected and uncapped.

During the last financial year, the Company refinanced 78

operational supported living properties let by three of the

Company's

borrowers to a single RP. The refinancing facilitated the return

of c.GBP50 million of cash to the Company and an increase in the

Company's expected return on the loan.

Current position

RPs that have leased properties from the Company's borrowers

have continued to be challenged in respect of governance and

financial viability by the Regulator of Social Housing ("RSH"). In

the year under review, these RPs have continued to focus on

improving processes, people and systems in seeking to address the

RSH's governance concerns. Furthermore, the Company has consented

to

a number of amendments in the relationships between RPs and the

Company's borrowers that seek to enhance the financial viability of

the applicable RPs.

It is the Investment Adviser's view that the fundamentals of the

sector, underpinned by a well -- protected housing benefit budget

and a

care model that has demonstrated healthcare and financial

benefits for the recipients, and the UK Government, remain

attractive. The RSH has itself noted its desire to see higher

deployment of care under a supported living model and for this to

be financed by the private sector.

Future outlook

The Company maintains the position that it does not intend to

grow its exposure to the social housing sector in any new projects

as a result of concerns raised by the RSH in respect of the

governance and financial viability of RPs. The Investment Adviser

also notes there is increased competition in this sector, which has

put pressure on potential returns. The Company continues to work

with its borrowers to seek to optimise the portfolio in order to

stabilise the rental yields received by the borrowers from the RPs

and to consider further refinances or other transactions as

appropriate.

Impact

3,119 People housed in supported accommodation(1)

SDG alignment

11 - Sustainable cities and communities

9 - Industry, innovation and infrastructure

1.Twelve month period to 30 June 2023 to facilitate data

inclusion in the annual report.

Westmoreland Supported Housing

Improving governance at a portfolio of supported living

accommodation

The Company has invested in a portfolio of 13 properties and 51

units of supported living accommodation designed to meet the

individual and unique needs of adults with learning disabilities,

mental health issues and physical or sensory disabilities. The

portfolio is leased to Westmoreland Supported Housing Limited

('Westmoreland'), a Registered Provider of social housing.

From 2018, the Company recognised that the supported living

sector had grown rapidly and various RPs were failing to keep up

with the

rapid growth they were experiencing, leading to management

issues at some RPs. Furthermore, the RSH indicated that the funding

model used by the sector did not align with its preferences. This

model involved RPs taking out long leases for properties they let

to local authorities under exempt rents. The Company has not made

any further investments in the sector since then.

As a business that has grown very quickly, Westmoreland

experienced significant financial distress in 2019. This led the

RSH to use its

statutory powers to elect new officers to Westmoreland's board

at the end of 2019, closely followed by a board-directed change in

the

executive team at the start of 2020.

In 2021, the Company's borrower entered into an agreement with

Westmoreland to provide a defined level of financial support

while

Westmoreland worked to address their financial distress and

improve their governance and financial viability. In changing the

board and

executive team, and restructuring the lease payment

arrangements, Westmoreland sought to address the wider concerns

raised by the RSH.

The Company has supported Westmoreland over this period.

Westmoreland is now in a materially better financial position and

has made significant progress in improving its governance and

financial viability, with historic issues addressed as they look

towards consolidation and future growth. As a result, Westmoreland

continues to provide high quality accommodation and care for

its vulnerable tenants.

Sustainability indicators

Environment

45% EPC rating A-C(1)

Social

23 FTEs at portfolio asset level(1)

Governance

4 Governance policies implemented(1)

Financial

GBP9.0m Valuation at 30 September 2023

1. Data at 30 June 2023 to facilitate inclusion in the annual

report.

PPP/PFI

PPP/PFI enables the procurement of private sector infrastructure

financing through access to long -- term, public sector backed and

availability-based payments.

24%

Percentage of portfolio by value

GBP251.2m

Valuation of sector

Background

Partnerships between the public and private sectors to develop,

build, own and operate (or a combination thereof) infrastructure

have taken a number of forms, with the best known as PFI (Public

Finance Initiative), which originated in the UK in the mid-1990s.

Since this time, over GBP60.0 billion has been invested in the

development of new projects across the healthcare, education,

leisure, transport and other sectors under such schemes. The design

and implementation of revenue support mechanisms such as PFI has

been devolved to the Scottish, Welsh and Northern Irish

administrations. The Company has exposure to a number of sectors

within the PPP/PFI sector including education, healthcare, waste,

leisure and housing.

Current position

The PPP/PFI model for procuring infrastructure fell out of

favour before 2020 and there are no material new projects expected

to be procured this way in the medium term, meaning there are

currently limited opportunities for further investments. During the

year, the Company indirectly acquired equity in 13 Scottish hub

projects engaged in the education, health, leisure and community

facilities in which it was already a lender, investing GBP885,000

in total.

Future outlook

There have been no indications that the UK or devolved

governments intend to reverse policies to procure new

infrastructure using private sector finance which is supported by

long-term availability-based payments. To the extent that there are

any such opportunities in the future, the Company will consider

them as investment opportunities.

The Investment Adviser will continue to monitor any PPP schemes

(or similar structures) and secondary markets for potential

opportunities.

Impact

c.26,688 School places in portfolio(1)

SDG alignment

4 - Quality education

3 - Good health and well-being

1.Twelve month period to 30 June 2023 to facilitate data

inclusion in the annual report.

Salford Social Housing PFI

Refurbishment of a portfolio of social housing accommodation

The Salford Social Housing PFI project was formed with the aim

of delivering the refurbishment and management of social housing

accommodation consisting of 1,270 existing dwellings located in

Greater Manchester and owned by Salford City Council.

The Company invested GBP10.9 million in a junior bond on 17

September 2013. The notes were issued by FHW Dalmore (Salford

Pendleton Housing) plc. The senior lender is Pension Insurance

Corporation plc. Together Housing provided the initial equity

investment.

The refurbishment contract completed on 24 February 2017, ahead

of the scheduled contract date of 30 May 2017. From this date,

Pendleton Together Operating Limited became operational.

Following the tragic events at Grenfell, a comprehensive review

of the refurbishment works was undertaken to determine what action

needed to be undertaken on the accommodation. As a result, the

cladding used on the project's nine tower blocks was tested and

failed to meet building safety standards.

A detailed further works programme was developed and funded by

the Company after the Government stated it would not provide

funding for the cladding removal. The programme is currently being

implemented with the involvement of all project stakeholders to

ensure the long-term fire safety of the accommodation.

The Company agreed to pay 40% of the coupon it receives as

junior bond holder to Together Housing Association as they made

additional funding available to undertake the works.

Refurbishment started with remedial works undertaken across the

nine residential buildings. The works cover both internal and

external remediation and are progressing well and according to the

plan agreed with contractors. Completion is expected in 2025.

Sustainability indicators

Environment

73% EPC rating A-C(1)

Social

20 FTEs at portfolio asset level(1)

Financial

GBP9.7m Valuation at 30 September 2023

1.Data at 30 June 2023 to facilitate inclusion in the annual

report.

Investment portfolio

The Company is exposed to a portfolio of 51 investments with a

weighted average annualised yield(1) of 7.9% and average life of

ten years.

Portfolio performance

The portfolio has largely performed in line with expectations

during the year.

For the renewables portfolio, rainfall was lower than expected

over the key winter period across large parts of Scotland, however

it has since improved. Lower rainfall can reduce the amount of

revenue due to lower electricity production from hydro-electric

assets. Furthermore, wind speeds have been slower than average, and

increased maintenance times at wind farms has caused generation to

be below budget. Meanwhile, solar generation and operations have

been in line with expectations.

In relation to the supported living assets, the Company has no

direct control over the underlying occupancy level of the

properties it has lent against, but it continues to work with

borrowers and the underlying RPs to ensure the assets are

maintained to a high quality to attract tenants to the

properties.

As part of an agreed refinancing of existing loans to two

operational biomass plants, the Company received GBP8.7 million in

prepayment fees with the existing loans repaid at par. This

demonstrates the conservative valuation of the portfolio and the

Investment Adviser's ongoing efforts to maximise the value for

shareholders.

A total of GBP50.0 million of the proceeds were reinvested into

the holding company of the two plants, with a further operational

biomass plant brought into the security net, improving the

seniority of the loan along with increasing the level of security

of the loan.

Last year, the Company noted that there were ongoing challenges

at a portfolio of gas-to-grid anaerobic digestion projects in

Scotland. Upgrade works to make the sites more resilient to storm

damage have since been completed and to date have addressed the

issues. Furthermore, the Investment Adviser worked closely with the

landlords and operators of the sites, as well as the gas network

operator, to improve the sites' access to the local gas grid. This

resulted in the implementation of a more reliable method of

injecting biogas into the gas grid. Before the changes were made,

if the demand for gas on the network was low (for example, on warm

summer nights), then the gas network operator would restrict the

amount of gas that could be injected into the grid and sold. The

improvements mean that it is less likely the output of the plant

will be constrained in the future.

The Company continues to have exposure to the outcome of ongoing

Ofgem audits relating to the accreditation and ongoing compliance

of eight ground-mounted commercial solar projects accredited under

the Renewables Obligation. During the year, Renewable Obligation

Certificates ("ROCs") for one of nine projects under audit were

revoked by Ofgem. Three projects in total in the portfolio have now

had their ROCs revoked. Eleven projects have been audited and

retained their ROCs, while a further eight remain subject to

audit.

The Company has made a claim in connection with its rights under

the original investment documentation in respect of the losses it