TIDMGTC

RNS Number : 4773N

GETECH Group plc

23 January 2023

23 January 2023

Getech Group plc

("Getech" or the "Company" and with its subsidiaries "the

Group")

Post-Close Trading Update

Consistent Year-on-Year Double-Digit Growth with Record Order

Book and Strong Pipeline

Getech (AIM: GTC), a company that locates energy and minerals

for the energy transition, is pleased to announce an update on

trading for the year ended 31 December 2022 and current

outlook.

Financial Highlights - Continued Growth

-- Double-digit revenue growth, ahead of market expectations:

GBP5.0 million (FY2021: GBP4.3 million) with a 66%/23% split

between transitional petroleum and critical minerals

-- Record orderbook: GBP4.6 million, a 39% increase (31 December

2021: GBP3.3 million, +25% on 2020)

-- Strong cash position: GBP4.3 million at 31 December 2022,

with cash held flat across H2 2022 by sales momentum and careful

capital management (31 December 2021: GBP5.9 million)

Strategic Progress - Aligned to Global Energy Transition

-- War in Ukraine led to renewed focus on energy security and

underlined the role of oil and gas as transitional sources of

primary energy. In 2022, Getech continued to benefit from high

petroleum customer retention rates and, by aligning its offering

with carbon storage solutions, Getech is futureproofing its role in

a sector that is expected to remain a significant near-term engine

of revenue.

-- In the last two years, Getech has built new low carbon

solutions for critical minerals, geothermal, green hydrogen and

carbon storage by repurposing data and software that it developed

for the petroleum industry.

o Value proven - In 2022, customers have purchased Getech's

solutions to locate copper, gold, cobalt, and helium, to manage

carbon storage licensing rounds and to explore for geothermal

energy. Getech is now expanding its offering to include lithium and

natural hydrogen.

o Significant potential to scale-up revenue from other sectors

looking to decarbonise - In 2022 Getech secured its first fast

moving consumer goods customer, delivering an integrated

decarbonisation solution for their global portfolio of assets that

helps them achieve their ESG objectives.

-- When locating energy and minerals, Getech may selectively

obtain a carried/low-cost interest at the early stages of an

asset's life cycle, in lieu of revenue, thereby building an asset

base to create long term shareholder value. Getech will retain

multiple options to monetise such positions with the aim to

maximise value and minimise capital risk.

o Getech has formed a strategic partnership with Eavor , a

global geothermal technology company, to jointly locate and

appraise closed-loop geothermal projects in Latin America.

o At Shoreham Port, Getech increased phase 1 hydrogen design

capacity from 800 kg/day to 2.5 tonne/day due to bigger local

demand and extended its commercial exclusivity to 2027.

o In Invern ess, progress was slowed by a reshuffle in the

executive team of council officers and a focus on securing the

Cromarty Firth Greenport. Discussions with the Highland Council

about the Highland Hydrogen Network have now regained momentum.

o To accelerate value creation and reduce Getech's direct costs

in establishing green hydrogen transportation hubs , the Company is

advancing discussions with strategic investment partners and

progressing significant grant funding opportunities .

Strong Outlook

-- Getech starts 2023 with a strong balance sheet, sales

pipeline growth, plus good customer and partner momentum. Getech's

Board has no current plans to raise capital from shareholders.

-- Work to sell Kitson House is progressing, and the property is

currently under offer. However, completion of this sale has been

impacted and delayed by the ongoing volatility in the commercial

lending market.

-- The macro environment outlook remains strong for companies

such as Getech that are focussed on the energy transition. F

orecasts indicate that a $1 trillion per annum increase in energy

investment is required to resolve the dual challenge of energy

affordability and security, across both clean energy and

hydrocarbons.

Dr Jonathan Copus, Getech CEO commented:

"Our consistent year-on-year growth reflects the strength of our

integrated solutions and the urgency of energy security and

transition. Leveraging our unique digital twin of the Earth with

400 million years of data we are well-positioned to analyse the

subsurface for the benefit of accelerating net zero achievement. We

can locate sweet spots for geothermal energy, critical mineral

deposits, hydrocarbon accumulations, zones for carbon storage, and

the best places for green hydrogen mobility sites."

"While we are making good progress with our development projects

at Shoreham and Inverness we also continue to generate revenue from

our extensive data, cross-sector expertise and advanced analytics

through licensing and solution sales."

"Looking ahead, we are confident that our solutions will gain

even more momentum as every company is now facing the challenge to

decarbonize their activities. We have a strong pipeline for this

year and beyond, which will fuel the company's continued growth -

unlocking value for all stakeholders."

Business Overview

Getech's strategy is to deliver near term revenue growth through

energy and minerals solutions sales and build longer term

shareholder value through select asset participation .

Getech generates revenue by locating new energy and mineral

resources. The Group does this with its proprietary digital twin

model of the Earth ("Globe") that combines significant amounts of

data with a software interface which allows users to make sense of

this data. Developed across twenty years, and built originally for

the petroleum industry, Getech has repurposed Globe to also locate

critical minerals, geothermal energy, hydrogen, and carbon storage

sites.

Globe uniquely models the Earth's evolution over the last 400

million years, and its integrated geologic, climatic, and

oceanographic data provides valuable insight to locate natural

resources in the subsurface. Value is further enhanced through

advanced analytics that integrate above-ground socio-economic

energy-demand data and allow users to filter potential locations

for the most cost-effective solutions. The resulting solutions are

provided in an easy-to-use digital map.

By operating across multiple sectors, Getech is uniquely

positioned to collaborate with companies and governments at each

step of their energy transition journey, delivering diversified yet

integrated, low-carbon solutions to accelerate their path to net

zero.

For longer term value creation, Getech is also monetising its

unique data, software and expertise through early-stage asset

opportunities. Shoreham and Inverness are the prime examples of

creating long term shareholder value. As its asset operations

mature, Getech's Board envisages a path to spinning entities out -

establishing their own boards, capital structures and strategic

pathways.

In order not to overextend its resources and to retain an

efficient capital structure, the Company seeks to build strategic

partnerships where in exchange for locating assets Getech receives

a carried/low-cost interest at the early stages of an asset's life

cycle.

Getech is advancing partnerships with various Development

Expenditure investors. These provide asset-level investment to

advance projects to the point where they are ready for construction

and capital financing. At that point, the project may be sold for a

Developers' Fee, or the parties can remain invested with a minority

or carried interest. In late 2022, Getech signed a Heads of Terms

on the first of these partnerships, which focuses on its hydrogen

operations.

Financial Update

In 2022, Getech signed over 100 new contracts with a total value

of GBP6.5 million. This lifted revenue by 16% to GBP5.0 million

(FY2021: GBP4.3 million) and marked the second consecutive year of

double-digit revenue growth since Getech completed its GBP6.25

million equity raise in 2021. 66% of revenue came from transitional

petroleum while 23% - from critical minerals. The Company aims to

further diversify its revenue streams.

A key component of this growth has been license-based and

recurring in nature. In 2022, the number of software licences sold

rose by 42% and Getech secured two new customers for Globe.

This growth expanded Getech's orderbook by 39%, to GBP4.6

million, a record year-end position (31 December 2021: GBP3.3

million). Annualised recurring revenue increased 14% to GBP2.4

million (31 December 2021: GBP2.1 million).

Getech finished 2022 with a strong cash position of GBP4.3

million (31 December 2021: GBP5.9 million). The Group held its cash

balances flat across H2 2023 through sales growth and careful cost

management in its hydrogen asset development operations.

Work to sell Kitson House (Getech's office in Leeds) is also

progressing, and the property is currently under offer. However,

completion of this sale has been impacted and delayed by the

ongoing volatility in the commercial lending market.

Whilst being marketed for sale, Kitson House's general and

rateable costs have been minimised by moving out of the building's

listed portion. To maintain its condition for sale, GBP50k was

spent in 2022 on general maintenance and roof repairs - the

majority of which was funded from insurance.

Having begun 2023 with balance sheet strength, sales pipeline

growth and good customer and partner momentum, Getech's Board has

no current plans to raise capital from shareholders.

Operational Update

In 2022, Getech focused its resources on energy transition

challenges where it could test the commercial value of its data and

software. The success of this work is clear.

Transitional Petroleum - High Retention Rates, Continued

Growth

The road to reducing greenhouse gas emissions to zero by 2050

has never been more urgent, but geopolitical tensions, supply chain

disruptions and rising inflation have led to renewed focus on

energy security.

Experts argue the energy industry has been under-investing since

the peak of 2014 while the overall growth of the investments in

renewables was not sufficient to compensate for that. In the coming

years, focus will be on balancing climate goals with energy

security.

As a result, 2022 saw a strong recovery in Getech's petroleum

market activities, alongside an expansion into the emerging carbon

storage sector. Getech's work in exploration, development

optimisation and operational spatial management has been

particularly strong.

These new market conditions led to Getech adding two new Globe

customers, one of which is a global supermajor energy company, and

a 42% year-on-year increase in the number of software subscriptions

sold. Alongside new software sales in the petroleum exploration

market, including a strategic national oil company customer in the

middle East, Getech added further customers in the US onshore shale

gas operations and investment banking sectors. A key strategic

contract with a major energy company joint venture was renewed for

multiple years, providing critical visibility of strong future

revenues.

By aligning its petroleum offerings with carbon storage, Getech

is future-proofing its role in a sector that is expected to remain

a significant near-term engine of revenue. Along with new software

customers in the carbon storage sector, Getech's solutions were

used by the North Sea Transition Authority to support the UK's

first carbon storage licensing round.

Critical Minerals - Identifying New Copper Deposits, Other

Critical Minerals Are Underway

Getech's first critical minerals solution is focused on copper,

the supply gap of which is expected to reach 7.8 million tonnes by

2030. Getech has the technology to discover new sediment-hosted

copper deposits in unexplored areas. Sediment-hosted copper

accounts for just c.20% of total copper production today, but it is

more widely distributed than other sources of copper and can also

be processed with lower carbon footprint. In addition, 80% of

cobalt, a key component of batteries which plays a critical role in

the energy transition, comes from sediment-hosted copper mines.

In 2022, Getech sold its sediment-hosted copper solution to

three critical minerals companies. Using its unique data and

advanced analytics, Getech produced high confidence targeting maps

for areas in Australia, North America, and Canada, and based on

this work a significant land position has already been licenced.

The value-add for these companies is demonstrated by them now being

repeat customers.

Getech also secured its largest ever critical minerals contract

(a $900,000 data and software deal with a multi-mineral global

mining company) and expanded its copper solutions into iron

oxide-copper-gold and epithermal gold deposits. Getech delivered

data and analytics to Helium One, a native helium explorer, and

advanced R&D work on solutions t o predict the location of

lithium and natural ('white') hydrogen resources. Getech looks

forward to bringing these new solutions to market in early 2023.

The World Bank projects that the production of critical minerals,

such as graphite, lithium and cobalt, should increase by nearly

500% by 2050 to achieve a below 2degC future.

Getech is in discussion with mining companies to form strategic

partnerships to jointly locate new deposits, with the option for

Getech to retain a low-cost equity stake or net smelter

royalty.

Green Hydrogen - Assets Progress and Expanded Offering

In 2022, Getech continued to invest in green hydrogen assets.

The Group's most advanced projects are in Shoreham Port and

Inverness, where H2 Green - Getech's wholly owned hydrogen

development company - is working to establish green hydrogen

production and supply hubs.

In Shoreham, following the completion of engineering and

commercial feasibility work, the Port extended H2 Green's

exclusivity on all hydrogen, ammonia and renewable energy

activities to August 2027. Evidence of demand for hydrogen has

grown faster than expected - supported by offtake pledges, letters

of intent and MoUs. As a result, H2 Green has expanded the phase 1

design capacity from 800 kg/day to 2.5 tonne/day and has kicked off

Pre-FEED (Front End Engineering Design) studies on this basis.

In Inverness, H2 Green's partner, SGN, successfully completed

the deconstruction of the city's former gas holder. This work paves

the way to convert a legacy natural gas holder site into a future

green hydrogen storage and distribution facility, which is an

encouraging step in the process to develop a multi-hub green

hydrogen network, with Inverness at its core. Commercial

negotiations with the Highland Council to advance the hydrogen

network across the Highlands progressed more slowly than hoped.

This was due to a reshuffle in the Council's executive team and

their focus on successfully securing the Cromarty Firth Greenport.

With both now completed, the Council's focus has returned to

Getech's Highland Hydrogen Network and an agreement is expected to

progress in a timely manner.

Through this project work, Getech and H2 Green have built

extensive expertise in locating and developing green hydrogen sites

- skills which in 2022 generated GBP100K of revenue from regional

hydrogen network planning for the Scottish Highlands. Having

encountered demand for these skills from other potential customers,

Getech plans to launch a hydrogen advisory service in 2023 which

will broaden its exposure to business development and manage direct

costs.

The macro environment continues to be supportive for hydrogen

development, with the UK hydrogen strategy targeting 10GW of low

carbon hydrogen production capacity by 2030. Green hydrogen is

forecasted to reach 15% of Europe's final energy mix long term.

Geothermal - Building Partnerships

Getech supports the geothermal sector through its Heat Seeker(R)

solution, which combines advanced geospatial analytics with

commercial, geoscience and social data. This enables the rapid and

cost-effective identification of sites that are highly prospective

for geothermal energy . In 2022 Getech successfully completed

projects for clients on multiple continents, and the Group expects

continued expansion of its geothermal offering - given the

projected double-digit annual growth rate towards 2030 in

geothermal energy investments.

Getech and Eavor, a global geothermal technology company, have

signed a strategic partnership to jointly locate and appraise a

portfolio of geothermal projects in Latin America. Eavor was

already a customer of Getech's data and services. Through this work

Getech has generated revenue, demonstrated its geothermal

expertise, and built mutual trust. This has now translated to an

asset-based partnership that is broader, more strategic and more

valuable for both parties.

Eavor has attracted venture capital funding from BP, Chevron and

BHP (all customers of Getech petroleum solutions) and recently

secured development financing, totalling up to EUR1bn, from Deep

Energy Capital, for the development of at least five geothermal

projects in North America and Europe.

Using its proprietary Heat Seeker(R) solution, Getech is also

evaluating very early-stage geothermal asset investment

opportunities in locations outside Latin America.

Integrated Decarbonisation Solutions - Potential to Open a New

Global Customer Market

By leveraging the breadth of its low carbon activities, Getech

has recently secured a contract with a global FMCG company. Getech

will deliver to this customer an integrated decarbonisation

solution across its global portfolio of assets to achieve its ESG

objectives. With companies across multiple sectors now looking to

turn decarbonisation planning into practice, this win opens an

exciting door to a potentially vast universe of new customers with

significant potential to scale-up revenue.

Marco Environment and Outlook

Goldman Sachs forecasts a $1 trillion pa increase in energy

investment is required to resolve the dual challenge of energy

affordability and security, across both clean energy and

hydrocarbons.

At the same time, the incremental cost of net zero carbon

continues to improve making it more financially attractive. The US

Inflation Reduction Act is potentially the most transformational

policy in clean tech making green hydrogen, carbon capture and

geothermal some of the more cost-effective paths for energy

transition in the US. Across the globe many governments are moving

in a similar direction with various economic stimulus, including

tax credits and subsidies.

Getech's corporate strategy reflects this underlying trend and

focuses on monetising the Company's core capabilities in most

efficient and valuable ways.

The Group is growing its order book and pipeline and the Board

is confident in the outlook for the business.

Financial Calendar

Getech will present at Cenkos and Proactive Growth &

Innovation Forum on 7 February and Proactive One2One Investor Forum

on 28 February. The Company will host an investor site visit to

Shoreham in March 2023 and intends to publish its Final Results for

the 12 months ended 31 December 2022 in May 2023.

The Company will hold an investor call to discuss the business

update later this week. Details will be communicated

separately.

This update is provided in advance of the financial statements

for the year ended 31 December 2022. The information and commentary

provided is based on unaudited management accounts and other

internal performance measures and is subject to concluding the

routine annual accounting adjustments as well as any adjustments

that arise as a result of the external audit process. Certain

statements made in this trading update are forward-looking

statements. Such statements are based on current expectations and

are subject to a number of risks and uncertainties that could cause

actual events or results to differ materially from any expected

future events or results referred to in these forward-looking

statements.

For further information, please contact:

Getech Group plc Tel: 0113 322 2200

Dr Jonathan Copus, Chief Executive

Irina Logutenkova, Head of Investor Relations

Cenkos Securities plc

Neil McDonald / Pete Lynch (Corporate Finance)

Michael Johnson / Dale Bellis (Sales) Tel: 0207 397 8900

Camarco Tel: 020 3781 8331

Tom Huddart / Toby Strong / Charles Dingwall

Notes to editors:

Getech Group plc (AIM: GTC) generates revenue by locating new

energy and mineral resources using its proprietary Earth digital

twin. The Group works for governments and companies who seek to

decarbonise their operations. Getech expanded the use of data and

technologies built for petroleum industry to critical minerals,

geothermal, hydrogen, carbon storage. Getech's work builds

strategic partnerships that open early-stage asset opportunities.

In exchange for locating assets Getech may seek a carried interest

during the development phase and option to monetise the

position.

For further information, please visit www.getech.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUUUOROUUAUUR

(END) Dow Jones Newswires

January 23, 2023 02:00 ET (07:00 GMT)

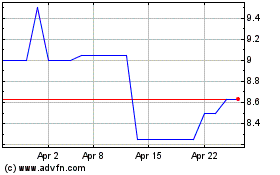

Getech (LSE:GTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Getech (LSE:GTC)

Historical Stock Chart

From Apr 2023 to Apr 2024