TIDMHAN TIDMHAN TIDMHANA

RNS Number : 6738G

Hansa Investment Company Limited

26 November 2020

Hansa , investing to create

long-term growth

Interim Report

Six months ended

30 September 2020

2020

Welcome

I'm pleased to present the 2020 Interim Report for Hansa

Investment Company Ltd ("the Company", "HICL") to the

shareholders.

As you know, 2020 has been an unprecedented year as the Covid-19

pandemic swept around the globe with a speed and reach that

surprised many. It has caused multiple waves of infection, sadly

leading to increased mortality rates in many countries. It has also

caused economic contraction, forcing governments to implement a

variety of restrictive measures to try to reduce the spread of the

virus, whilst awaiting medical science's development of effective

vaccines. As I write this welcome to you, there are several

encouraging signs that a number of long-hoped-for vaccines are

ending their trial periods and have been found to be safe and

effective, which offers hope that 2021 will see a gradual return to

some new normality.

Your Company's portfolio has shown resilience during the past

six months. I am pleased to say that the majority of the decline in

NAV seen during March 2020 as the markets reacted negatively to the

pandemic, has reversed in the last six months and has continued to

do so following the period covering this Report. I am also pleased

to say your Company and its suppliers have continued to operate

successfully during this period, which is testament to their

planning and resourcefulness.

Of course, Covid-19 has not been the only news in 2020. The

result of the US election seems to have been decided in favour of

Joe Biden whilst the UK's exit from the EU is still being

negotiated. Despite all this, stock markets are at or near record

highs in most countries. I have noted a number of these themes in

my Chairman's Statement and I also draw your attention to the

Portfolio Manager's Review of the period where many of these topics

are expanded upon.

Finally, by the time this Report is published, you will no doubt

have noted that the second quarterly interim dividend, totalling

0.8p per share for the year to 31 March 2021 was paid on 30

November 2020.

I wish you and your families well in these difficult times.

Yours sincerely

THIS DOCUMENT IS IMPORTANT and if you are a holder of Ordinary

shares it requires your immediate attention. If you are in doubt as

to the action you should take or the contents of this document, you

should seek advice from an independent financial advisor,

authorised if in the UK under the Financial Services and Markets

Act 2000, or other appropriately authorised financial advisor if

outside of the UK. If you have sold or transferred your Ordinary

shares in the Company, you should send this document, immediately

to the purchaser or transferee; or to the stockbroker, bank or

other agent through whom the sale or transfer was effected for

onward transmission as soon as practicable.

COMPANY REGISTRATION AND NUMBER: The Company is registered in

Bermuda under company number 54752.

Interim Report

Chairman's Report to the Shareholders

Interim Management Report

Portfolio Manager's Report

Portfolio Statement

Financial Statements

Condensed Income Statement

Condensed Balance Sheet

Condensed Statement of Changes in Equity

Condensed Cash Flow Statement

Notes to the Condensed Financial Statements

Pro-Forma Financial Statements

Condensed Pro-Forma Income Statement for the combined Hansa

Investment Company Ltd Group

Condensed Pro-Forma Balance Sheet for the combined Hansa

Investment Company Ltd Group

Condensed Pro-Forma Statement of Changes in Equity for the

combined Hansa Investment Company Ltd Group

Condensed Pro-Forma Cash Flow Statement for the combined Hansa

Investment Company Ltd Group

Notes to the Condensed Pro-Forma Financial Statements

Investor Information

Company Information

Glossary of Terms

Chairman's Report to the Shareholders

JONATHAN DAVIE

Chairman

Introduction

I am pleased to be able to report that our Portfolio Manager and

the other suppliers of services to Hansa Investment Company Ltd

("the Company", "HICL") have not been badly affected by the Covid

-- 19 problem with the result that we have not experienced any

additional consequential risks to the management of the

Company.

SHAREHOLDER RETURNS

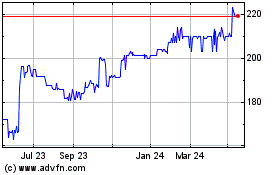

The past six months have shown an increase in net asset value

("NAV") from 230.2p per share to 261.4p, whilst the discount has

narrowed from 43.1% to 37.3% for the Ordinary shares and from 41.2%

to 34.6% for the "A" Ordinary shares.

The Core Regional and Thematic silos of our portfolio have shown

good returns for the past six months. Unfortunately, these have

been overshadowed by the continuing disappointing performance of

our long-term holding in Ocean Wilson Holdings Ltd ("OWHL") which

declined by 6.1% during the period, not helped by the continuing

decline of the Brazilian Real against the US Dollar. However, it is

useful to remind ourselves of the excellent returns investors have

experienced from our investment in OWHL over the past 50 years or

so, together with the encouraging recent news that Wilson Sons Ltd

and OWHL have decided to fully restore their dividend for the year.

History also teaches us that the Real is probably due at least a

bounce against the US Dollar due to the improving economy in Brazil

and the first signs of some headwinds for the US Dollar. Brazil,

like many Emerging Markets, tends to be hit hardest during periods

of extreme market weakness but, being leveraged, plays on the

subsequent recovery and may do much better in an environment of

improving global growth due to greater fiscal impetus.

The performance of our Global Equities silo has also

underperformed, which is due to most of these holdings being in the

value category which continues to disappoint against growth.

Alec Letchfield continues to manage our Fund portfolio very

effectively, manifested by resisting the temptation to sell any of

the portfolio during the market slide in March and April.

PROSPECTS

I write this after the US election has taken place, with a

continuing resurgence in the number of Covid -- 19 cases in the

Northern Hemisphere as winter approaches and little sign of a China

rapprochement with the West. However, the extremely positive news

on a number of vaccine candidates has possibly given the market

some impetus for the long-awaited rotation out of Growth Stocks

into Cyclicals and Value together with steepening yield curves. It

goes without saying that the positive effects for the beaten down

travel and hospitality industries will be immense. The potential

spending by prospective clients will very substantial, due to the

large increases in the savings ratios and the pent-up desire to get

out and have some fun with friends. However, the Schiller

cyclically adjusted price-to-earnings ratio remains very high, only

surpassed in 1929 and 1999 and the increase in IPOs, particularly

using Special Purpose Acquisition Companies ("SPACs"), together

with heightened Merger and Acquisition activity and increasing

retail involvement in the options market leads one to the

inevitable conclusion that a bubble may be forming, particularly in

the growth stocks.

Notwithstanding the above, there continue to be significant

amounts of liquidity on the sidelines which, together with the

greater use of fiscal policy, ongoing economic improvement as the

impact of Covid-19 diminishes with the commencement of vaccination

programmes. This leads us to remain supportive of risk assets. As a

result, whilst we wouldn't be surprised to see increased market

volatility in the coming months, we continue to focus on the upside

in view of our long-term investment horizon.

Despite all the aforementioned challenges, I have great faith

that Alec Letchfield, in his position as the CIO of our Portfolio

Manager, will continue to find quality investments for our

portfolio.

May I take this opportunity to wish the best outcome for all our

shareholders by staying safe and healthy in these challenging and

uncertain times.

Jonathan Davie

Chairman

26 November 2020

Interim Management Report

The Directors present their Report and Condensed Financial

Statements for the period to 30 September 2020.

THE BOARD'S OBJECTIVES

The Board's primary objective is to achieve growth of

shareholders' value over the medium to long -- term.

THE BOARD

Your Board consists of the following persons, each of whom

brings certain individual and complementary skills and experience

to the Board's workings:

Jonathan Davie (Chairman of the Board and Management Engagement

Committee), Richard Lightowler (Chairman of the Audit Committee),

Simona Heidempergher (Chairman of the Remuneration Committee),

William Salomon and Nadya Wells (Chairman of the Nomination

Committee).

Individual profiles for each member of the Board can be found in

the Company's Annual Report each year and on our website.

BUSINESS REVIEW FOR THE PERIOD TO 30 SEPTEMBER 2020

The Business Review, which includes a discussion of important

events which occurred within the period to 30 September 2020, is

covered in the Chairman's Report to the Shareholders and the

Portfolio Manager's Report.

Hansa Investment Company Ltd is a Bermudan company formed in

June 2019 to take on the business of Hansa Trust PLC ("Hansa

Trust"). As a company, HICL has limited financial history only

having taken on the business of Hansa Trust in August 2019. As a

result, the Board present two sets of financial reports for

shareholders' review. Firstly, the HICL set of financial reports

covering the six months to 30 September 2020 and comparables for

the period 21 June 2019 (date of incorporation) to 30 September

2019. In addition, the Board includes a pro -- forma set of

accounts amalgamating the financial performance of Hansa Trust for

the comparable period 1 April 2019 to 29 August 2019, with the

results of HICL for the period 21 June 2019 to 30 September 2019.

The Board has prepared these to enable shareholders to make

meaningful comparisons between these pro-forma accounts and

comparables from Hansa Trust for previous periods.

KEY RISKS FOR THE FINANCIAL YEAR TO 31 MARCH 2021

The key risks and uncertainties relating to the period ended 30

September 2020 and for the year ended 31 March 2021 are materially

the same as those reported in the Period-end Report for the Company

for the period ended 31 March 2020.

GOING CONCERN BASIS OF ACCOUNTING FOR THE PERIOD TO 30 SEPTEMBER

2020

The Directors consider it appropriate to adopt the going concern

basis of accounting in preparing these Interim Financial

Statements. The Directors do not know of any material uncertainties

to the Company's ability to continue to adopt this approach over a

period of at least 12 months from the date of approval of these

Financial Statements.

The Directors will include a Long-Term Viability Statement in

each Annual Report.

RELATED PARTY TRANSACTIONS

During the period, Hansa Capital Partners LLP charged portfolio

management fees and company secretarial fees to the Company,

amounting to GBP1,291,000 excluding VAT (six months to 30 September

2019: GBP1,289,000; year to 31 March 2020: GBP2,579,000). Amounts

outstanding at 30 September 2020 were GBP219,000 (30 September

2019: GBP237,000; 31 March 2020: GBP392,000).

THE BOARD'S RESPONSIBILITIES

The Board is charged by the shareholders with responsibility for

oversight of the affairs of the Company. It involves the

stewardship of the Company's assets and liabilities and the pursuit

of growth of shareholder value. These responsibilities remain

unchanged from those detailed in the last Annual Report.

The Directors confirm to the best of their knowledge that:

The statutory condensed set of Financial Statements contained

within the Interim Financial Report further down has been prepared

in accordance with International Accounting Standard 34 'Interim

Financial Reporting' and on a going concern basis.

This Interim Management Report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's Disclosure

and Transparency Rules.

The above Interim Management Report, including the

Responsibility Statement, was approved by the Board on 26 November

2020 and was signed on its behalf by:

Jonathan Davie

Chairman

26 November 2020

Don't look down, but Stock Markets might be walking a

tightrope

Market backdrop

Whilst a little unnerving at times, we have remained steadfastly

pro-equities throughout 2020. The year started well enough but then

the Covid-19 induced sell-off in March caused us to pause and

question whether or not we had misjudged the situation and, with

it, missed calling the next protracted bear market. Ultimately we

concluded that the combination of governments and central banks

adopting a shock and awe approach to policy making, together with

the longer-term attraction of risk assets generally, suggested it

wasn't right to pivot.

Happily, this proved to be the correct decision albeit, if we're

honest, the strength of the subsequent recovery has surprised us

both in terms of its size and speed. Global equities, for example,

bounced by 23.8% over the six months to the end of September and by

3.7% in the third quarter. Driving much of this performance was the

US stock market and the technology sector in particular, which rose

by 27.6% and 40.7% respectively over the six month period. China,

reflecting the fact that it was both first into the crisis and has

high exposure to technology, was also robust and rose by 24.5% over

the period in question.

Even the market laggards generated positive performance over the

past six months. At the regional level, despite still being down

over the year-to-date, Europe, the emerging markets ex-Asia and the

UK were all up for the six month period, rising 19.6%, 15.0% and

3.3% respectively. Similarly, financials rose by 9.0% over the last

six months and is now down by 20.3% year-to-date, while energy fell

another 1.3% to leave it down 40.8% year-to-date.

Other asset classes were also positive, with exceptionally

strong returns from oil, with WTI up by almost 90% for the six

month period and gold up another 14.1%. Hedge funds were typically

more muted albeit again positive for the period.

Stock markets are increasingly walking a tightrope

Whilst encouraged by the strength of stock market performance in

recent months, it does feel the path markets are walking is rapidly

becoming a tightrope. With the coming months likely to see rising

event risk, combined with increasing signs of market excess, we

continue to consider whether or not markets can sustain their

current trajectory, or are in danger of falling off it.

Starting with excesses, and even if we ignore the fact that

markets have risen incredibly strongly since the March lows, a

number of red flags have started to appear over recent months:

Flag 1.......increasing stock market concentration

A classic feature of stock market tops is one where a handful of

companies and sectors drive performance. With one of the

consequences of Covid-19 being the acceleration of many of the

trends in the technology sector, increasingly we are seeing

adoption rates that we had expected to occur over years compressed

into months if not weeks. Online shopping, the transition to the

cloud and online banking, to name a few, have all been forced upon

us whether we liked it or not. As a result of this and the

subsequent outperformance of the technology sector, stock markets

have been driven by a handful of large cap technology names, with

many old economy companies still very much in bear market

territory. Hence whilst the global market is up for the year, in

reality this has been driven by the US, which in turn has largely

been driven by the 10 mega-cap growth stocks. In fact if we strip

out these 10 stocks we find that the US stock market performance is

remarkably close to that of the European Index.

Flag 2.......the growing use of financial engineering

Another warning flag is the growth in financial engineering and

a willingness to take on higher risk, most recently in the growing

use of SPACs. Special Purpose Acquisition Companies are companies

formed with no commercial operations, but instead seek to raise

capital to buy another company and are often called 'blank cheque

companies'. The last 18 months have seen record numbers of SPACs

being created, with well-known names such as Bill Ackman of

Pershing Square fame jumping on the bandwagon with his creation of

a $4 billion SPAC which is the largest ever. Whilst the current

SPACs are undoubtedly of a higher quality than some of the SPACs

listed in the past, they are still a sign that people are prepared

to hand over cash for doing deals as yet unannounced. Maybe it

really is different this time but one cannot help but note that in

the past a rise in the number of SPACs was often associated with

fraud and the end of bull markets.

Flag 3.......records being set

Often when markets enter their more mature phase records start

to be set. One such record has been the level of outperformance of

growth versus value. On a rolling 12-month basis to the end of

September the Russell 1000 Growth Index has outperformed the

Russell 1000 Value Index by some 43.6%. To put this into context

this level of outperformance has never happened before and it is

even larger than the outperformance that occurred at the height of

the internet bubble in the late 1990s, which was followed by seven

years of the Value Index outperforming the Growth Index.

Combining these excesses with a period of more challenging news

flow makes markets particularly vulnerable to any disappointment.

Most obviously on this front is the US presidential election. From

a stock market perspective, whilst Trump is undoubtedly a marmite

character, he was positive for the US stock market. He judged his

own success through the level of the S&P 500, introduced market

friendly tax cuts and harangued Jerome Powell, Chairman of the US

Federal Reserve, into lowering interest rates. Initially the

prospect of a Democratic government was met with caution by

markets. Whilst Biden himself is seen as a known entity, a

relatively moderate Democrat and not someone to be feared by stock

markets, his running mate, Kamala Harris, is seen as leaning more

to the left in terms of her views and policies. The fear is that if

the more radical left leaning side of the party exerts greater

power under a Biden led government then we could see some more

extreme policy measures enacted. With Bernie Sanders and Elizabeth

Warren both calling for greater taxation, healthcare reform and the

break-up of the large cap technology companies, such a shift in US

politics could weigh heavily on stock markets globally.

More recently, however, market sentiment has shifted from

focusing on some of the longer-term potential negatives of a

Democratic led government to the more immediate prospect of greater

stability under Biden and potentially more fiscal spending under a

Democratled government. With monetary policy increasingly exhausted

in terms of its effectiveness in supporting economies, the

consensus has shifted from a post -- Global Financial Crisis belief

that countries should aspire to balance their budgets, to one of

viewing greater fiscal spending as key to restoring global

economies to health post the impact of Covid-19 and the resultant

lockdowns. Typically this is positive for economic growth,

companies and stock markets, at least in the early days of its

implementation.

Biden will become the next President of the United States. As to

who gets control of the Senate, current polls, for what they are

worth, suggest that the Republicans are set to retain control

albeit the Democrats may still achieve a clean sweep if they win

the run-off elections in January. Even if the Republicans do retain

control of the Senate under a Democratic president we are not

overly cautious on this point. Generally in the early years of a

new presidency, it is incumbent upon the Senate to respect the

nation's decision and not to undermine the power of the President

purely for the sake of partisan gain. This would especially be the

case in a post -- Covid-19 world with the US population unlikely to

look favourably upon a party which prevents fiscal spending

designed to save jobs and underpin the economy. Arguably stock

markets may actually view the split as being positive with some of

the more extreme Democratic policies unlikely to be enacted under a

split system.

The other key event risk is that of a second wave in Covid-19

cases as we enter the colder winter months in the Northern

hemisphere and as economies reopen, with governments attempting to

return countries back to some form of normality. Arguably this

should come as little surprise to markets. Even a cursory look at

prior epidemics and pandemics, such as SARS, shows that rolling

waves in reinfection are entirely normal and to be expected as

human contact picks up post-lockdown. Nonetheless one can't help

but feel a little cautious if the flare up in infection rates leads

to a return of more widespread and protracted lockdowns and the

consequential scarring to economies and affected sectors,

especially in light of just how strong markets have rebounded

post-March.

Our view is that whilst a meaningful return to lockdowns would

undoubtedly weigh on markets in the near-term, we see a number of

mitigating factors that suggest limited action by long-term

investors, such as ourselves, may be the best strategy. The first

point is that whilst infection rates have picked up sharply, the

number of people being hospitalised has fallen significantly from

the first wave. Moreover the mortality rates are also down

dramatically. Whilst still very much in the learning phase as to

what we know about the virus and its treatment, there are a whole

host of reasons underlying these improvements. Doctors have a much

better understanding of treatments to both prevent hospitalisation,

but also to significantly reduce death rates for those

hospitalised. Infection rates have also risen much more sharply in

younger people this time round where the potential impacts of the

disease are considerably more muted. There is also an active debate

as to whether the virulence of the disease is lessening over time

and the potential for community immunity as more people are exposed

to the disease.

Perhaps the main game changer however is the recent positive

news flow on several of the potential vaccine candidates. The

interim results of clinical trials were better than anyone had

hoped with several vaccines appearing to be over 90% effective.

Whilst still very much work in progress, the initial signs are

extremely positive and bode well for the other vaccine candidates.

Irrespective of the timing of availability, or how long it would

take to vaccinate a sufficient proportion of the population to make

them effective, we think the main point is that a working

vaccine(s) will become available. Stock markets are forward looking

discounting machines and the mere prospect of a solution is likely

to be enough to enable them to look through the shorter-term

challenges as to how and over what time frame a vaccine is brought

to market.

From an economic perspective there are also a number of

potential negative events that could weigh on stock markets. As

alluded to above, the consensus has increasingly shifted from the

view that governments should aspire to be fiscally prudent, to one

of seeing public spending as preferable to austerity. Even the IMF,

which was a staunch advocate of balanced budgets post the Global

Financial Crisis, is now arguing that countries should spend their

way out of the current malaise. Such policy measures do however

come at a cost. Global public debt is expected to hit a record high

of almost 100% of the world's GDP in 2020 and classically large

scale fiscal policy is typically inflationary.

Clearly if both debt levels and inflation start to spiral out of

control this would be a major issue for global stock markets. There

is however a scenario that could actually see the current backdrop

as providing something of a goldilocks scenario for equity markets.

Given the desire by central banks to maintain zero or even negative

interest rates, the cost of funding these deficits is negligible

(rather perversely in Japan, where two thirds of debt is on

negative yields, a big debt burden is actually good for the

government finances!). Hence governments can sustain high levels of

debt and at the same time increase spending - albeit ensuring they

maintain the confidence of financial markets is key if they are to

continue accessing funding and if currencies are not to go into

freefall.

Equally it would seem entirely logical that governments would

pursue a more inflationary backdrop. When debt levels are at such

high levels, inflating your way out of the problem seems eminently

sensible. The US Federal Reserve's shift to targeting average

inflation rates throughout cycles, rather than at one set point,

seems to reinforce this view. At this stage we're wary of calling a

shift from a multi-year deflationary trend, driven by the

deflationary triangle of technology, globalisation and the

diminishing power of the labour force, but there is certainly a

scenario whereby we could see more inflation entering the system

and potentially a more normal interest rate cycle on the back of

it. This blend of higher spending and modest inflation is typically

very attractive for equities and certainly much better than for

bonds at current yields.

Such a scenario as described above also has the potential to

change some of the key themes seen in markets in recent times.

Better economic growth typically sees emerging markets outperform

developed markets due to their higher beta (especially if the US

Dollar continues to weaken), cyclicals and real assets may start to

perform and, perhaps most importantly, value may start to

outperform growth. We note these for now but will develop our

thoughts in greater detail in future Hansa House Views.

Conclusion

Clearly the coming months will be testing for global markets. As

discussed above, the blend of potential event risk with more mature

markets beginning to show some of the characteristics of a

market-top undoubtedly makes them more vulnerable to any

missteps.

Despite this, for long-term investors such as ourselves we are

not minded to attempt to time the markets and we favour sticking to

our central view of favouring equities over defensive assets such

as government bonds. For all the reasons we have articulated

before, such as there being few real alternatives to equities, an

abundance of liquidity and an expectation that economies continue

to rebound as we emerge from the Covid-19 induced lockdowns, we see

little reason for changing our current stance. That is not to say

we are dismissive of the risks faced by markets from potential bad

news in the coming months. Clearly when stock markets are mature,

valuations are high and one starts to see signs of excess, they are

undoubtedly vulnerable to any disappointment on the news flow

front. Nonetheless, on balance, we see the longer-term upside as

reason to maintain a more pro-risk position. As discussed above

there are a set of circumstances that could see this outlook

improve even further, through a combination of higher growth on the

back of higher fiscal expenditure together with modest

inflation.

Portfolio Review and Activity

Your Company has returned 14.2% over the financial year to date

and -4.7% over the past 12 months on a NAV total return basis. The

key performance indicators for the period were 23.8% for the MSCI

ACWI NR Index (GBP), 1.2%% for the FTSE UK Gilts All Stocks TR

Index, and 0.5% for UK CPI. Over the last 12 months these KPIs were

5.1%, 3.4%, and 0.6%, respectively. The Company's NAV per share

increased from 230.2 pence per share at the end of March 2020 to

261.4 pence at the end of September 2020. The Core and Thematic

funds continued to perform well this half, while Ocean Wilsons

Holdings and Global Equities struggled with the challenging

underlying environment in Brazil impacting Wilson Sons. Markets

continued to recover from their Covid-19 induced declines with the

US and Emerging Markets performing better than European and Latin

American markets.

In line with our House View we continue to maintain an equity

bias, with a relatively modest exposure to defensive assets which

account for just over 10% of the total assets. Undoubtedly the

exposure to Brazil has weighed heavily on the Fund in recent years,

but with Wilson Sons now accounting for under 10% of NAV we view

this as unwarranted in light of the quality of the assets held

within the other silos. As noted before the current discount, at

35.5% and 45.8% if we include the discount at Oceans Wilson

Holdings looks distinctly unjustified and Wilson Sons is arguably

'in for free'! Ultimately whilst Brazil is highly cyclical we would

see the holding in Wilson Sons as providing additional leverage to

the Fund as the country exits a multi-year recession and the

challenges of Covid-19 start to recede into the background.

Core and Thematic Funds

The Core Regional and Thematic silos both enjoyed comparatively

strong halves, returning 24.8% and 36.4% respectively. Over the

past 12 months the Core Regional silo was up 9.2% and the Thematic

silo was up 29.6%.

In the Core Regional silo, the Fund's US and Japanese holdings

were the largest contributors to the return over the half. Pershing

Square Holdings was a top contributor, returning 44.6% during the

period. Our positions in Lowe's and Chipotle Mexican Grill also

contributed positively as the lockdown ended in the US and

consumers started spending. Lowe's, in particular, has been a

direct beneficiary from the growth in home improvement activity.

Chipotle benefitted from an increase in take-out eating during the

Covid-19 crisis and with lockdowns easing has seen strong

performance as more customers return to eating in. Other strong

performers in the US were Findlay Park American, Select Equity and

Vulcan Value Equity which were up 21.7%, 22.7% and 27.8%,

respectively, over the half.

Of the Japanese funds in the Core Regional silo, Indus Japan

Long Only enjoyed a strong half returning 27.9%. This was mainly

driven by strong performance in August as investor confidence

increased on the hope that progress was being made towards a

Covid-19 vaccine. LIXIL, a producer of sanitary ware and home

building materials, surged on the back of the sale of two non-core

divisions and the streamlining of its product lines as a

restructuring plan started to take effect. Retailer Ryohin Keikaku

also performed well as it accelerated its restructuring and started

selling more merchandise online. Goodhart Partners: Hanjo Fund was

slightly more subdued this half, up 14.2%.

Some of the emerging market holdings performed well over the

half. Schroder Asian Total Return and NTAsian Discovery Fund were

the main contributors in this sector, returning 33.6% and 28.7%,

respectively. For the Schroder fund, Taiwan Semiconductor was a

strong performer as it reported increased revenues in July and

August, while estimates of the potential size of the semiconductor

market continued to grow in advance of the launch of Apple's first

5G iPhone. Alibaba was also a positive contributor after reporting

record sales in June and the expectation that its cloud-computing

business would turn a profit in 2021. Performance for NTAsian was

driven by BFI Finance and Mobile World. BFI resumed loan

disbursements in July as the lockdown eased in Indonesia, while

Mobile reported solid revenue growth in July and August as its

grocery chain scaled up. Prince Street DigDec Fund also had a

strong half, returning 55.5%.

RA Capital Healthcare was one of the top contributors in the

Thematic bucket, returning 34.7% over the half. A position in

Zogenix performed well after their fenfluramine drug for treatment

of the most severe cases of epilepsy syndrome was approved by US

regulators. Axsome Therapeutics also positively contributed after

several trials produced positive indications in MDD, migraine and

Alzheimer's agitation for a combination therapy it has been

developing for some years. The other biotechnology holding, BB

Biotech, performed well, returning 28.9%. Other strong performers

in the Thematic bucket were GAM Star Disruptive Growth (up 40.2%)

and Impax Enviromental Markets (up 34.2%). Impax has benefitted

from stock markets broadly rising during the period with Generac, a

power systems manufacturer, performing particularly strongly off

the back of strong earnings growth and a new home power storage

product being launched. DSM, a provider of health, nutrition and

materials solutions, also performed well as its animal nutrition

business continued to produce strong earnings.

Diversifying Funds

The Diversifying silo ended the half with a return of 3.5%

taking the return over the last 12 months to -0.1%. The holdings in

this silo are designed to show lower correlation to the equity

market.

Apollo Total Return was one of the bigger contributors over the

half returning 8.5%. The fund benefitted from broad gains in both

Emerging Markets and US High Yield credit early in the period.

Lower rated credits continued to outperform their higher rated

counterparts throughout the half. The fund continues to be more

defensively positioned than the broader market given the concerns

over the response of markets to Covid-19. The CTA funds both

struggled this half with GAM Systematic Core Macro down 1.8% and

Schroder GAIA BlueTrend down 8.3%. The GAM fund generally performs

more strongly when markets are more stable, which is what was seen

during this half explaining its slightly better performance.

BlueTrend performs more strongly when markets are choppy and fast

changing.

Global Event Partners recovered after a difficult period at the

end of the previous financial year, gaining 19.3% this half. Hard

and soft catalyst positions have contributed positively as the US

market strongly rebounded from the collapse seen in March. A soft

catalyst investment in Elanco Animal Health was a large

contributor, following the completion of a merger with Bayer Animal

Health which led to enhanced earnings power. An investment in

Howmet also gained. BioPharma Credit and Hudson Bay both performed

well this half, up 13.4% and 6.4% respectively.

Ocean Wilsons Holdings

Brazil has been hard hit by Covid-19 since the start of this

financial year, leading to a dramatic slowdown in economic

activity. For the half, the MSCI Brazil was up 14.1% (in GBP terms)

with a notable pick up in the financial markets towards the end of

the period. The Brazilian Real has continued to devalue which was a

drag on the performance of the stock market when looking at it in

Sterling terms.

The performance of Wilson Sons this half has been resilient.

During the period the results for the first half of 2020 were

released, which showed that revenues were down 13% to $174.2

million compared to the same period in 2019 ($199.2 million),

principally due to the currency devaluation, a decline in logistics

revenues and lower offshore support base revenues. In BRL terms

revenues actually rose 11%. That said, operating profit was $4.2

million higher than the comparative period in 2019 at $39.3

million, principally due to improved operating margins in the

period. Wilson Sons continues to perform well in challenging

conditions.

Port terminals and logistics revenue is predominantly

denominated in BRL and so was hardest hit by the devaluation of the

BRL against the USD, declining 26%. Container terminal revenue was

16% lower at $67.4 million (2019: $80.6 million) mainly due to the

higher average USD/BRL exchange rate. Container volumes handled at

the Rio Grande container and Salvador container terminals for the

period were marginally lower than the comparative period. Lower

international trade and cabotage volumes were partially offset by

higher trans -- shipment and inland navigation volumes. Cabotage

and import volumes decreased 11%, reflecting a slowdown in domestic

consumption and industrial activity in Brazil due to the Covid-19

pandemic. Logistics revenue declined 42% to $14.8 million (2019

$25.2 million) due to the end of a specific high-volume contract,

the impact of the Covid-19 outbreak on import volumes and the

weaker BRL. Brasco revenue decreased $7.0 million to $4.5 million

(2019: $11.5 million) against a backdrop of a weak oil and gas

sector.

Towage revenue, which is predominantly denominated in USD,

increased 11% to $82.3 million (2019: $74.1 million) reflecting an

improved sales mix and higher revenue from special operations.

Special operations revenue at $8.4 million, was $4.8 million higher

than the comparative period (2019: $3.6 million) principally due to

higher activity for LNG and an increase in salvage operations.

Wilson Sons has made extensive operational changes during the

Covid pandemic to protect staff and maintain continuity of business

operations. For example, mandatory pre-boarding Covid-19 testing of

towage and offshore support vessel crew and increases in the length

of crew shifts to significantly reduce contact risks, together with

numerous other precautions have all helped to minimise the risk of

Covid contamination in the workplace.

Following a turbulent year so far in global equity markets the

valuation of the investment portfolio and cash under management is

slightly down at $281.8 million at 30 September 2020, from the 31

December 2019 valuation of $285.3 million, although two dividends

of $2.5 million each were paid to Ocean Wilsons Holdings in May and

August 2020. The portfolio continues to be biased towards equities,

both public and private, reflecting its long-term nature, but also

includes some assets which display lower correlation to equity

markets.

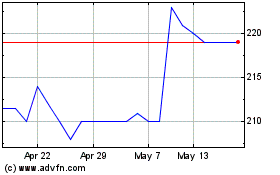

The Ocean Wilsons Holdings share price fell 2.6% during the

half, which takes account of the 24.3 pence dividend paid to the

Company in June 2020. Over the last 12 months the share price has

fallen by 30.7%, or by 28.2% on a total return basis, also taking

account of the June 2020 dividend. The share price represents a

discount to the look-through NAV of 49%, based on the market value

of the Wilson Sons shares, together with the latest valuation of

the investment portfolio.

Alec Letchfield

November 2020

Portfolio Statement

as at 30 September 2020

Investments Fair value Percentage of

GBP000 Net Assets

Core Regional Funds

Findlay Park American Fund 22,882 7.3

Vulcan Value Equity Fund 16,243 5.2

Select Equity Offshore Ltd 14,898 4.8

BlackRock European Hedge 13,100 4.2

Goodhart Partners: Hanjo Fund 12,346 3.9

Adelphi European Select Equity Fund 12,260 3.9

Schroder ISF Asian Total Return 8,862 2.8

Pershing Square Holdings Ltd 6,958 2.2

Indus Japan Long-Only Fund 6,457 2.1

Egerton Long-Short Fund Ltd 6,346 2.0

Prince Street Institutional Offshore Ltd 5,633 1.8

BlackRock Frontiers Investment Trust PLC 2,503 0.8

NTAsian Discovery Fund 2,466 0.8

SR Global Fund Inc. Frontiers Markets 2,358 0.8

Vanguard FTSE Developed Europe ex UK Equity

Index Fund 1,936 0.6

Total Core Regional Funds 135,248 43.2

Strategic

Ocean Wilsons Holdings Investments Limited

(through the holding

in Ocean Wilsons Holdings)* 29,667 9.5

Wilson Sons (through our holding in Ocean Wilsons

Holdings)* 27,385 8.7

Total Strategic 57,052 18.2

Global Equities

Interactive Brokers Group Inc 4,770 1.5

Exor NV 3,858 1.2

Nexon Co. Ltd 3,444 1.1

Samsung Electronics Co Ltd 3,340 1.1

Iridium Communications Inc 3,323 1.1

Dollar General 2,553 0.8

CK Hutchison 2,484 0.8

Berkshire Hathaway Inc 2,338 0.7

Hilton Food Group PLC 2,079 0.7

Alphabet Inc 2,039 0.7

Orion Engineered Carbons SA 1,916 0.6

Grupo Catalana Occidente SA 1,853 0.6

CVS Health Corp 1,829 0.6

Arch Capital Group Ltd 1,696 0.5

TripAdvisor Inc 1,295 0.4

Subsea 7 1,192 0.4

C&C Group PLC 1,057 0.3

Coats Group PLC 978 0.3

Total Global Equities 42,044 13.4

Diversifying

Global Event Partners Ltd 9,018 2.9

DV4 Ltd** 8,417 2.7

Hudson Bay International Fund Ltd 4,101 1.3

Vanguard US Govt Bond Index Fund 3,004 1.0

MKP Opportunity Offshore Ltd 2,953 0.9

Selwood AM Liquid Credit Strategy 2,544 0.8

Keynes Systematic Absolute Return Fund 2,277 0.7

Apollo Total Return Fund 2,272 0.7

BioPharma Credit PLC 1,421 0.5

CZ Capital Absolute Alpha UCITS Fund 1,231 0.4

GAM Systematic Core Macro (Cayman) Fund 1,003 0.3

Schroder GAIA Blue Trend 773 0.3

DV3 Ltd** 30 0.0

Total Diversifying 39,044 12.5

Thematic

GAM Star Fund PLC - Disruptive Growth 21,308 6.8

Impax Environmental Markets Fund 3,768 1.2

BB Biotech AG 3,571 1.1

RA Capital International Healthcare Fund 3,259 1.0

Worldwide Healthcare Trust PLC 2,258 0.7

Total Thematic 34,164 10.8

Total Investments 307,552 98.1

Net Current Assets 2,905 0.9

Non-Current Assets 3,179 1.0

Net Assets 313,636 100.0

*Hansa Investment Company Ltd owns 9,352,770 shares in Ocean

Wilsons Holdings Limited ("OWHL"). The two subsidiaries of OWHL,

Wilson Sons and Ocean Wilsons (Investments) Ltd ("OWIL"), are shown

separately above. The fair value of the Company's holding in OWHL

has been apportioned across the two subsidiaries in the ratio of

the latest reported NAV of OWIL, that being the NAV of OWIL shown

per the 30 June 2020 OWHL quarterly update, to the market value of

OWHL's holding in Wilson Sons, that being the bid share price of

Wilson Sons multiplied by the number of shares held by OWHL at 30

September 2020.

**DV3 Ltd and DV4 Ltd are unlisted Private Equity holdings. As

such, its value is estimated as described in Note 1(k) to the

Statutory Financial Statements and they are listed as a Level 3

Asset in note 21 of the Statutory Financial Statements and Note 10

of the Pro-forma Financial Statements 31 March 2020. All other

valuations are either derived from information supplied by listed

sources, or from pricing information supplied by third party fund

managers.

Condensed Income Statement

For the six months ended 30 September 2020

(Unaudited) (Unaudited) (Audited)

21 June 2019 21 June 2019

Six months ended to to

30 September 30 September

2020 2019 31 March 2020

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Gains/(losses) on investments

held at

fair value through profit

or loss - 38,310 38,310 - 2,989 2,989 - (50,965) (50,965)

Foreign exchange losses - (47) (47) - - - - (104) (104)

Investment income 2,817 - 2,817 149 - 149 1,159 - 1,159

2,817 38,263 41,080 149 2,989 3,138 1,159 (51,069) (49,910)

Portfolio management fees (1,231) - (1,231) (227) - (227) (1,441) - (1,441)

Other expenses (592) - (592) (750) - (750) (1,488) - (1,488)

(1,823) - (1,823) (977) - (977) (2,929) - (2,929)

Profit/(loss) before finance

costs 994 38,263 39,257 (828) 2,989 2,161 (1,770) (51,069) (52,839)

Finance costs - - - (1) - (1) (1) - (1)

Profit/(loss) for the period 994 38,263 39,257 (829) 2,989 2,160 (1,771) (51,069) (52,840)

Return per Ordinary and 'A'

non -- voting Ordinary share 0.8p 31.9p 32.7p (0.7)p 2.5p 1.8p (1.5)p (42.6)p (44.1)p

The Company does not have any income or expense not included in

the Profit for the period. Accordingly the "Profit for the period"

is also the "Total Comprehensive Income for the period", as defined

in IAS 1 (revised) and no separate Statement of Comprehensive

Income has been presented.

The total column of this Statement represents the Income

Statement, prepared in accordance with IAS 34. The supplementary

revenue and capital return columns are both prepared under guidance

published by the Association of Investment Companies.

All revenue and capital items in the above Statement derive from

continuing operations.

Condensed Balance Sheet

as at 30 September 2020

(Unaudited) (Unaudited) (Audited)

30 September 30 September 31 March

2020 2019 2020

GBP000 GBP000 GBP000

Non -- current assets

Investments in subsidiary at fair value through

profit or loss^ 3,179 138,179 3,179

Investments held at fair value through profit

or loss 307,552 333,139 273,264

310,731 471,318 276,443

Current assets

Trade and other receivables 102 116 2,503

Cash and cash equivalents 6,380 1,330 1,066

6,482 1,446 3,569

Current liabilities

Trade and other payables (3,577) (138,585) (3,713)

Net current assets/(liabilities) 2,905 (137,139) (144)

Net assets 313,636 334,179 276,299

Capital and reserves

Called up share capital 1,200 1,200 1,200

Contributed surplus 326,979 330,819 327,939

Retained earnings (14,543) 2,160 (52,840)

Total equity shareholders' funds 313,636 334,179 276,299

Net asset value per Ordinary and 'A' non --

voting Ordinary share 261.4p 278.5p 230.2p

^This represents Hansa Investment Company Ltd's investment in

Hansa Trust and its associated intercompany loan at fair value.

Condensed Statement of Changes in Equity

For the six months ended 30 September 2020

(Unaudited)

Contributed

Share Surplus Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2020 1,200 327,939 (52,840) 276,299

Profit for the period - - 39,257 39,257

Dividends - (960) (960) (1,920)

Net assets at 30 September 2020 1,200 326,979 (14,543) 313,636

Condensed Statement of Changes in Equity

For the period 21 June 2019 to 30 September 2019

(Unaudited)

Contributed

Share Surplus Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 21 June 2019 - - - -

Issue of share capital 29 August 2019 1,200 - - 1,200

Transfer of assets from Hansa Trust - 330,819 - 330,819

Profit for the period - - 2,160 2,160

Net assets at 30 September 2019 1,200 330,819 2,160 334,179

Condensed Statement of Changes in Equity

For the period 21 June 2019 to 31 March 2020

(Audited)

Contributed

Share Surplus Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 21 June 2019 - - - -

Issue of share capital 29 August 2019 1,200 - - 1,200

Transfer of assets from Hansa Trust - 330,819 - 330,819

Loss for the period - - (52,840) (52,840)

Dividends - (2,880) - (2,880)

Net assets at 30 September 2019 1,200 327,939 (52,840) 276,299

Condensed Cash Flow Statement

For the six months ended 30 September 2020

(Unaudited) (Audited)

(Unaudited) Period Period

Six months 21 June 21 June

ended 2019 to 2019 to

30 September 30 September 31 March

2020 2019 2020

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit/(loss) before finance costs 39,257 2,161 (52,839)

Adjustments for:

Realised losses/(gains) on investments 4,028 - (644)

Unrealised (gains)/losses on investments (42,338) (2,989) 51,609

Foreign exchange 47 - 104

Decrease/(Increase) in trade and other receivables 2,401 (116) (2,503)

(Decrease)/Increase in trade and other payables (136) 363 534

Purchase of non-current investments (8,412) - (17,059)

Sale of non-current investments 12,434 - 22,980

Net cash inflow/(outflow) from operating activities 7,281 (581) 2,182

Cash flows from financing activities

Interest paid on bank loans - (1) (1)

Drawdown of loan - 43 -

Inter-Company Loan with Hansa Trust - 1,869 1,869

Dividends paid (1,920) - (2,880)

Net cash (outflow)/inflow from financing activities (1,920) 1,911 (1,012)

Increase in cash and cash equivalents 5,361 1,330 1,170

Cash and cash equivalents at start of year/period 1,066 - -

Foreign exchange (47) - (104)

Cash and cash equivalents at end of period 6,380 1,330 1,066

Notes to the Condensed Financial Statements

1 ACCOUNTING POLICIES

(a) Basis of preparation

The Financial Statements of the Company have been prepared in

accordance with International Financial Reporting Standards

("IFRS"). These comprise standards and interpretations approved by

the International Accounting Standards Board ("IASB"), together

with interpretations of the International Accounting Standards and

Standing Interpretations Committee approved by the International

Accounting Standards Committee ("IASC") that remain in effect, to

the extent that IFRS have been adopted by the European Union.

These Financial Statements are presented in Sterling because

that is the currency of the primary economic environment in which

the Company operates.

The Financial Statements have been prepared on an historical

cost and going concern basis, and also in line with the Board's

analysis of the impact of Covid-19 on the Company except for the

valuation of investments. The Financial Statements have also been

prepared in accordance with the AIC Statement of Recommended

Practice ("SORP") for investment trusts, issued by the AIC in

October 2019 to the extent that the SORP does not conflict with

IFRS. The principal accounting policies adopted are set out

below.

(b) Basis of non-consolidation

IFRS 10 stipulates that subsidiaries and associates of

Investment Entities are not consolidated but, rather, stated at

fair value unless the conditions for certain exemptions from this

treatment are met. Hansa Investment Company Ltd meets all three

characteristics of an Investment Entity as described by IFRS 10.

The Company has one, 100% owned, subsidiary Hansa Trust PLC. The

Company became the 100% owner of Hansa Trust's shares as part of

the Scheme of Arrangement on 29 August 2019. It is the Intention

for Hansa Trust PLC to be dissolved now that the legal title of the

portfolio Investments have been transferred to the Company.

(c) Presentation of Income Statement

In order to better reflect the activities of an investment

company and in accordance with guidance issued by the AIC,

supplementary information which analyses the Income Statement

between items of a revenue and capital nature, has been presented

alongside the Income Statement.

(d) Non-current investments

As the Company's business is investing in financial assets, with

a view to profiting from their total return in the form of income

received and increases in fair value, investments are classified at

fair value through profit or loss on initial recognition in

accordance with IFRS 9. The Company manages and evaluates the

performance of these investments on a fair value basis, in

accordance with its investment strategy and information about the

investments is provided on this basis to the Board of

Directors.

Investments are recognised and de-recognised on the trade date.

For listed investments fair value is deemed to be bid market

prices, or closing prices for SETS stocks sourced from the London

Stock Exchange. SETS is the London Stock Exchange's electronic

trading service, covering most of the market including all FTSE 100

constituents and most liquid FTSE 250 constituents, along with some

other securities.

Fund investments are stated at fair value through profit or loss

as determined by using the most recent available valuation. In some

cases, this will be by reference to the most recent valuation

statement supplied by the fund's manager. In other cases, values

may be available through the fund being listed on an exchange or

via pricing sources such as Bloomberg.

Private equity Investments are stated at fair value through

profit or loss as determined by using various valuation techniques,

In accordance with the International Private Equity and Venture

Capital Valuation Guidelines. In the absence of a valuation at the

balance sheet date, additional procedures to determine the

reasonableness of the fair value estimate for Inclusion In the

financial statements may be used. These could Include direct

enquiries of the manager of the Investment to understand, amongst

others, the valuation process and techniques used, external experts

used in the valuation process and updated details of underlying

portfolio. In addition, the Company can obtain external Independent

valuation data and compare this to historic valuation movements of

the asset. Further, recent arms-length market transactions between

knowledgeable and willing parties where available might also be

considered. The investment in the Company's subsidiary undertaking

Is stated at fair value.

Unrealised gains and losses, arising from changes in fair value,

are included in net profit or loss for the period as a capital item

in the Income Statement and are ultimately recognised in the

Capital Reserves.

(e) Cash and cash equivalents

Cash and cash equivalents comprise cash at bank, short-term

deposits and cash funds with an original maturity of three months

or less and are subject to an insignificant risk of changes in

capital value.

(f) Investment Income and return of capital

Dividends receivable on equity shares are recognised on the

ex-dividend date. Where no ex-dividend date is quoted, dividends

are recognised when the Company's right to receive payment is

established. Dividends and Real Estate Investment Trusts' ("REIT")

income are all stated net of withholding tax. In many cases,

Bermudan companies cannot recover foreign incurred taxes withheld

on dividends and capital transactions. As a result, any such taxes

incurred will be charged as an expense and included here.

When an investee company returns capital to the Company, the

amount received is treated as a reduction in the book cost of that

investment and is classified as sale proceeds.

(g) Expenses

All expenses are accounted for on an accruals basis. Expenses

are charged through the revenue column of the Income Statement

except as follows:

(i) expenses which are incidental to the acquisition or disposal

of an investment are included in gains on investments held at fair

value through profit or loss in the Income Statement.

(h) Taxation

Under current Bermuda law, the Company is not required to pay

taxes in Bermuda on either income or capital gains. The Company has

received an undertaking from the Bermuda government exempting it

from all local income, withholding and capital gains taxes being

imposed and will be exempted from such taxes until 31 March

2035.

(i) Foreign Currencies

Transactions denominated in foreign currencies are recorded in

the local currency, at the actual exchange rates as at the date of

the transaction. Assets and liabilities denominated in foreign

currencies at the balance sheet date are reported at the rate of

exchange prevailing at the balance sheet date. Any gain or loss

arising from a change in exchange rates, subsequent to the date of

the transaction, is included as an exchange gain or loss in the

capital or revenue column of the Income Statement, depending on

whether the gain or loss is of a capital or revenue nature

respectively.

(j) Reserves

Contributed surplus

The following are credited or charged to this reserve via the

capital column of the Income Statement:

gains and losses on the disposal of investments;

exchange differences of a capital nature;

expenses charged to the capital column of the Income Statement

in accordance with the above accounting policies; and

increases and decreases in the valuation of investments held at

the balance sheet date.

Retained Earnings

The following are credited or charged to this reserve via the

revenue column of the Income Statement:

-- net revenue recognised in the revenue column of the Income Statement.

(k) Significant Judgements and Estimates

The key significant estimate to report, concerns the Company's

valuation of its holding in DV4 Ltd. DV4 is valued using the most

recent estimated NAV as advised to the Company by DV4, adjusted for

any further drawdowns, distributions or redemptions between the

valuation date and 30 September 2020. The most recent valuation

statement was received on 25 August 2020 stating the value of the

Company's holding as at 30 June 2020. The Company has considered

the ongoing impact of Covid-19, the associated financial impact on

certain industries and its potential impact on asset values. In the

absence of a valuation for 30 September 2020 from DV4, the Company

performed additional procedures to determine the reasonableness of

the fair value estimate for inclusion in the Financial Statements.

Direct enquiries of the manager of DV4 were made in July 2020 to

understand, amongst others, valuation process and techniques used,

external experts used in the valuation process and updated details

of underlying property portfolio. In addition, the Company has

obtained external independent valuation data and compared the

historic valuation movements of DV4 to that data. Based on the

information obtained and additional analysis performed the Company

is satisfied that DV4 is carried in these Financial Statements at

an amount that represents its best estimate of fair value at 30

September 2020. It is believed the value of DV4 as at 30 September

2020 will not be materially different, but this valuation is based

on historic valuations by DV4, does not have a readily available

third party comparator and, as such, is an estimate. There are no

significant judgements.

(l) Intercompany loan

The Intercompany loan Is recognised at cost, being the fair

value of the consideration receivable. The amounts falling due for

repayment within one year are Included under current liabilities In

the Balance Sheet.

2 INCOME

(Unaudited) (Unaudited) (Audited)

21 June

Six months 21 June 2019 to

ended to 31 March

30 September 30 September

2020 2019 2020

GBP000 GBP000 GBP000

Income from quoted investments

Dividends 2,817 149 1,158

Other income

Interest receivable on AAA rated money market

funds - - 1

Total income 2,817 149 1,159

3 DIVIDS PAID

(Unaudited) (Unaudited) (Audited)

21 June

Six months 21 June 2019 to

ended to 31 March

30 September 30 September

2020 2019 2020

GBP000 GBP000 GBP000

Third interim dividend for 2020 (paid 28 February

2020): 0.8p - - 960

Fourth interim dividend for 2020 (paid 29 May

2020): 0.8p 960 - -

First interim dividend for 2021 (paid 28 August

2020): 0.8p

(2020: First and Second interim dividends: 1.6p) 960 - 1,920

1,920 - 2,880

Note: The second interim dividend payable for the period ended

31 March 2021 was announced on 13 October 2020. The payment

totalling 0.8p per share (GBP0.96 million) was paid on 30 November

2020.

4 RETURN PER SHARES

The returns stated below are based on 120,000,000 shares, being

the weighted average number of shares in issue during the

period.

Revenue Capital Total

Pence Pence Pence

GBP000 per share GBP000 per share GBP000 per share

Six months ended 30 September

2020 (Unaudited) 994 0.8 38,263 31.9 39,257 32.7

Period 21 June to 30 September

2019 (Unaudited) (829) (0.7) 2,989 2.5 2,160 1.8

Period 21 June 2019 to 31 March

2020 (Audited) (1,771) (1.5) (51,069) (42.6) (52,840) (44.1)

5 FINANCIAL INFORMATION

The financial information for the six months ended 30 September

2020 was approved by a committee of the Board of Directors on 26

November 2020.

6 NET ASSET VALUE PER SHARE

The NAV per share is based on the net assets attributable to

equity shareholders of GBP313,636,000 (30 September 2019:

GBP334,179,000; 31 March 2020 GBP279,299,000) and on 120,000,000

shares, being the number of shares in issue at the period ends.

7 COMMITMENTS AND CONTINGENCIES

The Company has no outstanding commitments as at 30 September

2020 (30 September 2019: GBPnil; 31 March 2020: GBPnil.)

8 PRINCIPAL RISKS AND UNCERTAINTIES

The principal financial and related risks faced by the Company

fall into the following broad categories - External and Internal.

External risks to shareholders and to their returns are those that

can significantly influence the investment environment within which

the Company operates, including: government policies, taxation,

economic recession, declining corporate profitability, rising

inflation and interest rates and excessive stock market

speculation. Internal and operational risks to shareholders and to

their returns are: portfolio (stock and sector selection and

concentration), balance sheet (gearing), and/or administrative

mismanagement.

A review of the current period and the outlook for the Company

can be found in the Chairman's Report to the Shareholders and in

the Portfolio Manager's Review.

Information on each of these areas is given in the Strategic

Report within the Period End Report for the period ended 31 March

2020. In the view of the Board these principal risks and

uncertainties are applicable to the remaining six months of the

financial year as they were to the six months under review.

9 FAIR VALUE HIERARCHY

Fair Value Hierarchy

IFRS 13 'Fair Value Measurement' requires an entity to classify

fair value measurements, using a fair value hierarchy that reflects

the significance of the inputs used in making the measurements. The

fair value hierarchy has the following levels:

Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability not based on

observable market data (unobservable inputs).

The financial assets and liabilities measured at fair value in

the Statement of Financial Position are grouped into the fair value

hierarchy, as detailed below:

Level Level Level

1 2 3 Total

30 September 2020 (Unaudited) GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Quoted equities 115,807 - - 115,807

Unquoted equities - - 8,447 8,447

Fund investments - 183,298 - 183,298

Investment in subsidiary - - 3,179 3,179

Fair value 115,807 183,298 11,626 310,731

Level Level Level

1 2 3 Total

30 September 2019 (Unaudited) GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Quoted equities 157,652 - - 157,652

Unquoted equities - - 9,340 9,340

Fund investments 3,508 162,639 - 166,147

Investment in subsidiary - - 138,179 138,179

Fair value 161,160 162,639 147,519 471,318

Level Level Level

1 2 3 Total

31 March 2020 (Audited) GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Quoted equities 116,310 - - 116,310

Unquoted equities - - 9,276 9,276

Fund investments - 147,678 - 147,678

Investment in subsidiary - - 3,179 3,179

Fair value 116,310 147,678 12,455 276,443

There have been no transfers during the period between

levels.

The Company's policy is to recognise transfers into and out of

the different fair value hierarchy levels at the date of the event

or change in circumstances that caused the transfer to occur.

A reconciliation of fair value measurements in Level 3 is set

out in the following table:

(Unaudited) (Unaudited) (Audited)

30 September 30 September 31 March

2020 2019 2020

Equity Equity Equity

investments investments investments

GBP000 GBP000 GBP000

Opening Balance 12,455 - -

Purchases (Capital Drawdown) - 9,340 9,276

Purchase of Hansa Trust PLC - 332,019 332,019

Distributions received from Hansa Trust PLC - (193,840) (328,840)

Total gains or losses included in gains on investments

in the Income Statement:

- on assets sold - - -

- on assets held at year end (829) - -

Closing Balance 11,626 147,519 12,455

As at 30 September 2020, the investments in DV3 and DV4 Ltd have

been classified as Level 3. The investments in DV3 and DV4 have

been valued using the most recent estimated NAV as advised to the

Company by DV3 and DV4, adjusted for any further drawdowns,

distributions or redemptions between the valuation date and 30

September 2020. The most recent valuation statement was received on

25 August 2020, with an estimated NAV based on the unaudited

capital statement of DV3 and DV4 as at 30 June 2020. If the value

of the unquoted Level 3 equity investments were to increase or

decrease by 10%, while all other variables had remained constant,

the return and net assets attributable to shareholders for the

period ended 30 September 2020 would have increased or decreased by

GBP844,700 respectively. Additionally, the investment in the

Company's subsidiary at 30 September is also shown as a Level 3

asset.

Introduction to the Pro-Forma Financial Statements

For the six months ended 30 September 2020

NOTE OF EXPLANATION:

During the 12 month period ended 31 March 2020, the Scheme of

Arrangement ("the Scheme") to re-domicile the business of HICL's

predecessor, Hansa Trust, via a Scheme was brought to shareholders

for their consideration. At a series of shareholder votes on 29

July 2019, the Scheme received strong support from shareholders

which, following Court approval, resulted in the transfer of the

business (all assets and liabilities) on 29 August 2019 from Hansa

Trust to HICL (HICL having been incorporated on 21 June 2019). At

the same time, the shares of Hansa Trust were de-listed and

cancelled before being reissued to HICL. HICL then issued new

shares to the former Hansa Trust shareholders with the same two

share classes being retained, but with five HICL shares being

issued for every one share of Hansa Trust that had been

cancelled.

From the perspective of an ongoing shareholder, whilst there are

a number of legal, jurisdictional and Board changes as a result of

the Scheme, the key facets of the business remain unchanged. The

investment strategy and policy remain unchanged.

HICL was incorporated on 21 June 2019 for the sole purpose of

continuing the business of Hansa Trust. As a result, International

Accounting Standards require that the Financial Statements for HICL

present only the results of HICL from the date of incorporation (21

June 2019) and do not incorporate comparable information from Hansa

Trust. The Board believes it is more meaningful to present to

shareholders the results of operations of Hansa Trust and HICL on a

pro-forma combined basis for the six month period from 1 April 2020

to 30 September 2020 and include comparable information for the

period 1 April 2019 to 30 September 2019. The comparable

information incorporates elements of Hansa Trust operations (1

April 2019 to 30 September 2019) as well as HICL (21 June 2019 to

30 September 2019). Therefore, in addition to the required Interim

Financial Statements further down, the Board also presents a number

of relevant pro-forma statements further down that amalgamate Hansa

Trust and HICL, on a pro--forma basis, and are shown as "Hansa

Investment Company Ltd Group" or "Combined Group". The pro-forma

Financial Statements seek to paint a fuller picture of the

historical performance of the business, regardless of which legal

entity that business sat in at a point in time. Similarly, the

Board presents the results of the Combined Group for the 12 months

to 31 March 2020 as a relevant comparative period.

Condensed Pro-Forma Income Statement for the combined Hansa

Investment Company Ltd Group

For the six months ended 30 September 2020

(Unaudited)

Six months (Unaudited)

(Unaudited) ended Year ended

Six months ended 30 September 31 March

30 September 2020 2019 2020

Hansa

Hansa Investment

Trust Company Combined

Total Total Total Combined Combined

GBP000 GBP000 GBP000 Total GBP000 Total GBP000

Gains/(losses) on investments

held at fair value through profit

or loss - 38,310 38,310 (4,015) (57,969)

Foreign exchange losses - (47) (47) 8 (96)

Investment income - 2,817 2,817 6,112 7,122

- 41,080 41,080 2,105 (50,943)

Portfolio management fees - (1,231) (1,231) (1,227) (2,441)

Other expenses - (592) (592) (2,128) (2,866)

- (1,823) (1,823) (3,355) (5,307)

Profit/(Loss) before finance costs - 39,257 39,257 (1,250) (56,250)

Finance costs - - - (1) (1)

Profit/(Loss) for the period - 39,257 39,257 (1,251) (56,251)

Return per Ordinary and 'A' non

-- voting Ordinary share - 32.7p 32.7p (1.0)p (46.9)p

The Group does not have any income or expense not included in

the Profit/(Loss) for the period. Accordingly the "Profit/(Loss)

for the period" is also the "Total Comprehensive Income for the

period", as defined in IAS 1 (revised) and no separate Statement of

Comprehensive Income has been presented.

Separate revenue and capital return columns are not shown above

to aid the reader and avoid unnecessary complexity.

Condensed Pro-Forma Balance Sheet for the combined Hansa

Investment Company Ltd Group

as at 30 September 2020

(Unaudited) (Unaudited) (Unaudited)

Combined Combined Combined

Group Group Group

30 September 30 September 31 March

2020 2019 2020

GBP000 GBP000 GBP000

Non -- current assets

Investments held at fair value through profit

or loss 307,552 333,139 273,264

Current assets

Trade and other receivables 102 116 2,503

Cash and cash equivalents 6,380 1,330 1,066

6,482 1,446 3,569

Current liabilities

Trade and other payables (398) (406) (534)

Net current assets 6,084 1,040 3,035

Net assets 313,636 334,179 276,299

Capital and reserves

Called up share capital 1,200 1,200 1,200

Contributed surplus reserve 326,979 330,819 327,939

Retained earnings (14,543) 2,160 (52,840)

Total equity shareholders' funds 313,636 334,179 276,299

Net asset value per Ordinary and 'A' non --

voting Ordinary share 261.4p 278.5p 230.2p

Condensed Pro-Forma Statement of Changes in Equity for the

combined Hansa Investment Company Ltd Group

For the six months ended 30 September 2020 (Unaudited)

Capital Contributed

Share redemption surplus Retained

capital reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2020 1,200 - 327,939 (52,840) 276,299

Profit for the period - - - 39,257 39,257

Dividends - - (960) (960) (1,920)

Net Assets 30 September 2020 1,200 - 326,979 (14,543) 313,636

Condensed Pro-Forma Statement of Changes in Equity for the

combined Hansa Investment Company Ltd Group

For the six months ended 30 September 2019 (Unaudited)

Capital Contributed

Share redemption surplus Retained

capital reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2019 1,200 300 - 335,850 337,350

Hansa Trust loss for the period - - - (3,411) (3,411)

Dividends paid by Hansa Trust - - - (1,920) (1,920)

Capital reorganisation as part of the

scheme - (300) 330,819 (330,519) -

Hansa Investment Company Ltd profit for

the period - - - 2,160 2,160

Net assets at 30 September 2019 1,200 - 330,819 2,160 334,179

Condensed Pro-Forma Statement of Changes in Equity for the

combined Hansa Investment Company Ltd Group

For the year ended 31 March 2020 (Unaudited)

Capital Contributed

Share redemption surplus Retained

capital reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2019 1,200 300 - 335,850 337,350

Hansa Trust loss for the year - - - (3,411) (3,411)

Dividends paid by Hansa Trust - - - (1,920) (1,920)

Capital reorganisation as part of the

scheme - (300) 330,819 (330,519) -

Hansa Investment Company Ltd loss for

the year - - - (52,840) (52,840)

Dividends paid by Hansa Investment Company

Ltd - - (2,880) - (2,880)

Net assets at 31 March 2020 1,200 - 327,939 (52,840) 276,299

Condensed Pro-Forma Cash Flow Statement for the combined Hansa

Investment Company Ltd Group

For the six months ended 30 September 2020

(Unaudited) (Unaudited) (Unaudited)

Combined Combined Combined

Group Group Group

30 September 30 September 31 March

2020 2019 2020

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit/(loss) before finance costs 39,257 (1,250) (56,250)

Adjustments for:

Realised losses/(gains) on investments 4,028 (2,407) (3,051)

Unrealised (gains)/losses on investments (42,338) 6,422 61,020

Foreign exchange 47 (8) 96

Decrease/(increase) in trade and other receivables 2,401 1,002 (1,385)

(Decrease) in trade and other payables (136) (1,670) (1,499)

Purchase of non-current investments (8,412) (12,925) (29,984)

Sale of non-current investments 12,434 11,562 34,542