Herald Investment Trust PLC Statistics and Performance Report (5025B)

10 January 2018 - 11:05PM

UK Regulatory

TIDMHRI

RNS Number : 5025B

Herald Investment Trust PLC

10 January 2018

HERALD INVESTMENT TRUST

STATISTICS AND PERFORMANCE REPORT

Performance

At inception At since Performance Performance

16 February 31 December 30 November YTD (%) since inception

1994 2017 2017 (%) (%)

------------------------- ------------- ------ ------------ ------------ ------------ ------------- ---

NAV (p) excl accrued

income 98.7 p* 1374.2 p +1.2% +26.9% +1292.3%

------------- ------ ------------ ------------ ------------ ------------- ---

NAV (p) incl accrued

income 98.7 p* 1374.9 p +1.1% +26.9% +1380.8% **

------------------------- ------------- ------ ------------ ------------ ------------ ------------- ---

Numis SC + AIM

(capital gains

ex I.T.) 1750.0 6001.8 +2.8% +18.9% +243.0%

------------- ------ ------------ ------------ ------------ ------------- ---

Russell 2000 Technology

Index (capital

gains in Sterling

terms) 673.8 *** 2480.2 -1.4% +7.3% +268.1%

------------------------- ------------- ------ ------------ ------------ ------------ ------------- ---

Share price 90.9 p**** 1171.0 p -1.0% +32.7% +1188.2%

------------------------- ------------- ------ ------------ ------------ ------------ ------------- ---

Premium/(Discount) to NAV (excl accrued income)/share

as at 31st December 2017 (14.8)%

---

UK Equity Portfolio as a % of Net Asset Value at

31st December 2017***** 60.3%

-------------------------------------------------------------------------------- ------------ ------------- ---

Overseas Equity Portfolio as a % of

Net Asset Value at 31st December 2017 32.4%

------------- ---

(Gearing)/Cash as a % of Net Asset

Value at 31st December 2017****** 7.3%

-------------------------------------------------------------- ------------ ------------ ------------- ---

Number of Equity Holdings at

31st December 2017 271

------------------------------------------------ ------------ ------------ ------------ ------------- ---

*100p was the subscription

price before launch costs

of 1.3p

** Total return (in percentage terms)

on 100p invested at inception excluding

warrant.

***Value shown is from 31/03/1996 the date funds

were first available for international investment.

****90.9p is CGT base subscription price for shareholders

adjusting for warrants which were issued on a 1

for 5 basis.

*****Includes 4 convertible

bonds and 1 convertible preference

share.

****** Gearing is total assets (including all debt used for investment

purposes) less all cash and fixed interest securities (excluding

convertibles and corporate bonds) divided by shareholders' funds.

These figures are not audited and are subject to revision when

the income account has been finalised for the year end

At 31/12/2017 the Net Asset Value including current year income

was GBP966.7m (GBP966.2m excluding current year income). Income

is shown net of expenses.

There are 70,307,785 shares

currently in issue.

This Report has been issued on behalf of Herald Investment Trust

plc, and has been approved by Herald Investment Management Limited,

its investment manager. Herald Investment Management Limited

is authorised and regulated by the Financial Conduct Authority.

You should remember that past performance is not necessarily

a guide to the future. Markets and currency movements may cause

the value of shares, and the income from them, to fall as well

as rise, and you may get back less than you invested when you

decide to sell your shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFEFESFASESF

(END) Dow Jones Newswires

January 10, 2018 07:05 ET (12:05 GMT)

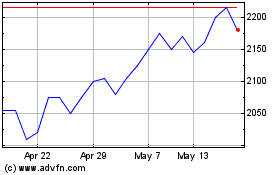

Herald Investment (LSE:HRI)

Historical Stock Chart

From Apr 2024 to May 2024

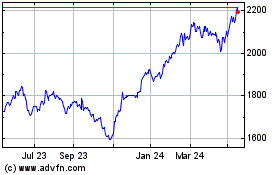

Herald Investment (LSE:HRI)

Historical Stock Chart

From May 2023 to May 2024