TIDMJD.

RNS Number : 7959E

JD Sports Fashion Plc

13 April 2011

13 April 2011

JD SPORTS FASHION PLC

PRELIMINARY RESULTS

FOR THE 52 WEEKS ENDED 29 JANUARY 2011

JD Sports Fashion Plc (the 'Group'), the leading retailer and

distributor of sport and athletic inspired fashion apparel and

footwear, today announces its Preliminary Results for the 52 weeks

ended 29 January 2011.

2011 2010

GBP000 GBP000 % Change

Revenue 883,669 769,785 +15%

======== ========

Gross profit % 49.5% 49.3%

======== ========

Operating profit (before exceptional items) 79,927 67,294 +19%

Share of results of joint venture before

exceptional items

(net of income tax) 1,475 539

Net financial income / (expenses) 163 (442)

-------- --------

Profit before tax and exceptional items 81,565 67,391 +21%

Exceptional items (see note 3) (4,284) (4,986)

Share of exceptional items of joint venture

(net of income tax) (a) 1,348 (1,012)

-------- --------

Profit before tax 78,629 61,393 +28%

======== ========

Basic earnings per ordinary share 114.84p 88.16p +30%

Adjusted basic earnings per ordinary share

(see note 5) 116.86p 93.64p +25%

Total dividend payable per ordinary share 23.00p 18.00p +28%

Net cash at end of period (b) 86,140 60,465

a) The exceptional items in the current year relate to

unrealised gains on foreign exchange contracts and the reversal of

the impairment of the investment held by Focus Brands Limited in

Focus Group Holdings Limited, following repayment of original

purchase consideration by the vendors of Focus Group Holdings

Limited. The exceptional items in the prior year relate entirely to

unrealised losses on foreign exchange contracts.

b) Net cash consists of cash and cash equivalents together with

interest-bearing loans and borrowings.

Highlights

-- Total revenue increased by 14.8% to GBP883.7 million (2010:

GBP769.8 million) with like for like revenue increased by 3.1%

(Sports Fascias 3.8%; Fashion Fascias -0.7%)

-- Gross margin improved to 49.5% (2010: 49.3%) with increased

margin in all reporting segments although the increase is diluted

by greater participation in Group performance from lower margin

distribution businesses which now represent 9.5% of Group revenue

(2010: 5.4%)

-- Group profit before tax and exceptional items up 21% to

GBP81.6 million (2010: GBP67.4 million)

-- Profit before tax up 28% to GBP78.6 million (2010: GBP61.4

million)

-- Net cash position at the period end increased to GBP86.1

million (2010: GBP60.5 million)

-- Acquisition of Sonneti, Chilli Pepper and Nanny State

brands

-- Capital expenditure increased by GBP10.1m to GBP33.0m (2010:

GBP22.9m) which included the first three JD stores in France

-- The new leased warehouse building shell in Rochdale (866,250

sq ft including mezzanines) has now been handed over by the

developers and the fit out process has started. Total anticipated

fit out costs are approximately GBP20.0m of which GBP3.9m was

incurred in the year. The move to full operational use will be

phased through the early months of 2012

-- Final dividend payable increased by 31% to 19.2p (2010:

14.7p) bringing the total dividends payable for the year up to

23.0p (2010: 18.0p), an increase of 28% with a cumulative rise of

92% over the last two years

-- Acquisition of Champion completed post year end, enhancing

presence in the Republic of Ireland

Peter Cowgill, Executive Chairman, said:

"The year ended 29 January 2011 has been the seventh successive

year of good progress in revenue and profitability for the Group.

Profit before tax and exceptional items improved by 21% to GBP81.6

million (2010: GBP67.4 million). Such sustained performance

continues to reflect the strength and uniqueness of our brand and

fascia offers as well as the strength of our management teams. Our

very strong cash position has also allowed us to continue to invest

in brands, our store portfolios and new businesses during the year

and since the year end.

"Confidence arising from the sustained period of results

improvement and the strength of our balance sheet has enabled the

Board to propose another significant increase in the level of

dividends with a final proposed dividend increase of 31% to 19.2p

(2010: 14.7p) bringing the total dividends payable for the year to

23.0p (2010: 18.0p), an increase of 28% following on from the rises

of 50% and 41% in the last two years.

"Following successive years of record results for the Group, the

retail environment has recently been significantly impacted by

adverse fiscal changes in addition to the multiple current economic

pressures. Our core business already possesses very strong sales

densities and margins, being the result of continual growth in both

measures for several years. Against that background, therefore, it

is inevitable that the Board is extremely cautious in its outlook,

particularly when the profits achieved for the year to 29 January

2011 are effectively rebased purely as a result of the impact of

increased VAT.

"Management remain highly focused on all avenues of revenue

growth, margin protection and cost control available to us to

endeavour to deliver the optimum outturn, minimise the impact of

the factors above, and with a strong balance sheet and dominant

market position in our core business, we expect to be able to

deliver operational and financial progress for the Group over the

long term."

Enquiries:

JD Sports Fashion Plc Tel: 0161 767 1000

Peter Cowgill, Executive Chairman

Barry Bown, Chief Executive Officer

Brian Small, Finance Director

MHP Communications Tel: 020 3128 8100

Andrew Jaques

Barnaby Fry

Ian Payne

Executive Chairman's Statement

Introduction

The year ended 29 January 2011 has been the seventh successive

year of good progress in revenue and profitability for the Group.

Profit before tax and exceptional items improved by 21% to GBP81.6

million (2010: GBP67.4 million). Such sustained performance

continues to reflect the strength and uniqueness of our brand and

fascia offers as well as the strength of our management teams. Our

very strong cash position has also allowed us to continue to invest

in brands, our store portfolios and new businesses during the year

and since the year end.

Group profit before tax increased by 28% in the year to GBP78.6

million (2010: GBP61.4 million) and Group profit after tax has

increased by 31% to GBP55.9 million (2010: GBP42.7million).

Group operating profit (before exceptional items) for the year

was up 19% to GBP79.9 million (2010: GBP67.3 million) and comprises

a Sports Fascias profit of GBP73.3 million (2010: GBP64.1 million),

a Fashion Fascias profit of GBP6.4 million (2010: GBP3.3 million)

and a Distribution segment profit of GBP0.2 million (2010: loss of

GBP0.1 million).

The year end net cash position has risen to GBP86.1 million

(2010: GBP60.5 million). The Group has recently negotiated terms on

new committed rolling credit and working capital facilities

totalling GBP75 million. These new facilities expire in October

2015 and when combined with our cash resources give the Group the

funding capability to continue to develop operationally and by

acquisition both in the United Kingdom and overseas. Confidence

arising from the sustained period of results improvement and the

strength of our balance sheet has enabled the Board to propose

another significant increase in the level of dividends with a final

proposed dividend increase of 31% to 19.2p (2010: 14.7p) bringing

the total dividends payable for the year to 23.0p (2010: 18.0p), an

increase of 28% following on from the rises of 50% and 41% in the

last two years.

Acquisitions

The Sports and Fashion retail offers continue to provide

consumers with a unique mix of sports and fashion brands in both

apparel and footwear including a substantial range of exclusive

products as well as exclusive licensed and own brands such as

McKenzie and Carbrini. We have continued to invest in increasing

the own brand offers through the acquisition of the Sonneti, Chilli

Pepper, and Nanny State brands for a total consideration of GBP2.1

million. Since the year end we have continued this strategy by

acquiring the Fenchurch brand for GBP1.1 million.

The strength of the JD offering gives potential for further

replication internationally, albeit in Europe initially. We see

this as a key opportunity wherever brands recognise our strength in

developing brands and maintaining their prestige. We started to

exploit this opportunity when we acquired the French retailer

Chausport in May 2009. The first full year since the acquisition

contributed GBP36.4 million of revenue and GBP0.5 million of

operating profit. Like for like sales grew by 12.5% in the year and

gross margin improved by 2.7% but overheads increased to support

the opening of three JD stores in France which opened late in the

year. These latter stores are performing to expectations so

far.

We are looking at potential acquisitions and joint ventures in

other territories on a regular basis and we have no doubt that the

Chausport acquisition has enhanced our visibility and credibility

as an overseas investor. Since the year end we have acquired a

further Sports Fascia chain in the Republic of Ireland, Champion

Sports (Holdings) ('Champion'), for a nominal amount and have also

advanced EUR17.1 million to allow it to settle all of its

indebtedness save for EUR2.5 million of leasing finance. This has

added 22 stores to the 8 already operated in the Republic of

Ireland and gives us a significant market position throughout the

whole of Ireland. It also gives us more local knowledge and a

strong management team on the ground.

After the year end we also acquired 80% of Kukri Sports Limited

which provides a bespoke teamwear offering across a wide range of

sports in a number of countries.

Sports Fascias

The Sports Fascias' total revenue increased by 8% during the

period to GBP667.2 million (2010: GBP615.5 million) with like for

like sales for the year up by a further 3.8% (2010: 2.3%).

Gross margin achieved in the Sports Fascias increased from 50.6%

to 51.0% which we attribute to the continued improvement in the

terminal stock position in JD plus the impact from the extension of

enhanced Group supplier terms into the Chausport business.

As a result of this improved margin and continuing enhancement

of the store portfolio and its efficiencies, the operating profit

(before exceptional items) of the Sports Fascias rose to GBP73.3

million (2010: GBP64.1 million) in the year, including a

contribution of GBP0.5 million from Chausport (2010: GBP0.7

million). The contribution from Chausport is lower than the

previous year due to the seasonal losses incurred in the early part

of the year which were pre-acquisition in the prior year.

The programme of store development has continued with 28 store

openings and 24 refurbishments or conversions. These include the

opening of our first 3 JD stores in France (of which 1 was a

conversion of a former Chausport store in Lille), 5 new Chausport

stores, 2 new Size? stores and 3 new JD stores in airport

locations. We have also opened a JD store at one of the UK's

busiest train stations (Liverpool Street) which is our first store

in this type of location and, if successful, could be replicated in

other major stations. 21 Sports Fascias stores were closed in the

period including 6 smaller Chausport stores.

Fashion Fascias

The Fashion Fascias are Bank and Scotts.

The Bank Fascia stores sell largely branded fashion to both

males and females, predominantly for the teenage to mid twenties

sector. In the year the store portfolio grew from 65 stores to 74

stores, still based predominantly in the North and the Midlands.

Total revenue in the year was GBP102.4 million (2010: GBP82.8

million). This represents an organic decrease of 0.9% (2010: +4.7%)

although this decrease came from trading in the first half of the

year when the organic performance was measured against heavy

clearance from the prior year. This reduction in clearance activity

is reflected in the fact that gross margin achieved improved by a

further 0.5% to 48.9% (2010: 48.4%) after an increase of 2.3% in

the prior year. Operatingprofit (before exceptional items) was

GBP5.2 million (2010: GBP3.0 million). The Board remains confident

that there is a significant opportunity to grow operating margin in

this Fascia through better stock management, own brand development

and disciplined store rollout although this will be challenging in

2011 as a result of VAT, cotton and other fibre price increases and

changes in brand distribution policy.

The Scotts Fascia stores sell branded fashion to older more

affluent males and there were 37 stores at the year end, largely in

the North and the Midlands. Total revenue in the year was GBP31.7

million (2010: GBP31.8 million) which was flat organically.

However, the balance of trading towards full price full margin

improved significantly driving an increase in the gross margin

achieved to 49.5% (2010: 47.4%). This has led to an improved

operating result with operating profit (before exceptional items)

of GBP1.2 million (2010: GBP0.3 million).

Distribution

The Distribution businesses delivered a small operating profit

of GBP0.2 million (2010: loss of GBP0.1 million) with a profit from

Canterbury offset by ongoing investment to build Getthelabel.com

within Topgrade, and by losses incurred in Kooga's quietest trading

period of the year, much of which fell prior to its acquisition

last year.

Canterbury delivered an operating profit of GBP1.1 million

(2010: GBP0.1 million) on total revenues of GBP48.3 million (2010:

GBP15.4 million) with a strong performance in both Australia and

New Zealand where the brand was more sheltered from the events that

led to the administration of the former UK based Canterbury

business in 2009. The brand is still rebuilding its global network

and it is hoped that longer term gains will come from the new

licences in South Africa and Argentina, and the launch of a UK

based business (in which we are the 75% majority shareholder)

focusing on developing a more fashion based product offer to

leverage the brand's image and credibility. Canterbury will be

providing the kit for 4 teams at the forthcoming Rugby World Cup

and the Board are confident that this global exposure will enhance

the reputation and penetration of the Brand.

The Getthelabel.com online and catalogue business within

Topgrade has now been trading for over a year. Its sales progress

is encouraging and on schedule but the marketing and other

investment required to achieve this means that we believe it could

take a further two years before it has sufficient critical mass to

deliver profits to the Group. This is not unusual in such

businesses and we remain optimistic about the long term

profitability of this venture. As a consequence of this, sales rose

to GBP26.6 million (2010: GBP19.7 million) but losses rose to

GBP0.8 million (2010: GBP0.4 million) in the year. This was in line

with our expectations and we subsequently increased our stake in

Topgrade from 51% to 80% during the year at a cost of GBP1.2

million.

Kooga Rugby went through a difficult period under its previous

ownership and a lot of effort has been focused on improving control

over the commerciality of the sponsorship properties and the

profitability of product ranges and accounts. An operating loss of

GBP0.3 million was recorded for the year (2010: profit of GBP0.2

million for the post-acquisition period) on sales of GBP6.5 million

(2010: GBP5.0 million). We have strengthened the management team

which we believe will lead to improvements in operating performance

in due course.

Nicholas Deakins recorded a profit of GBP0.2 million (2010:

GBP0.0 million) on turnover of GBP3.4 million (2010: GBP2.5

million) in the year.

Joint Venture

Focus Brands Limited, is involved in the design, sourcing and

distribution of footwear and apparel both for own brand and under

license brands for both group and external customers. Our share of

operating results for the year was an operating profit before

exceptional items and after tax of GBP1.5 million (2010: GBP0.5

million).

The exceptional items in the current year relate to unrealised

gains on foreign exchange contracts and the reversal of the

impairment of the investment held by Focus Brands Limited in Focus

Group Holdings Limited, following repayment of original purchase

consideration by the vendors of Focus Group Holdings Limited. The

exceptional items in the prior year relate entirely to unrealised

losses on foreign exchange contracts.

After the year end we increased our holding in this business to

80% at an initial cost of GBP1.0 million with potential further

deferred consideration of GBP250,000 depending on performance. The

performance of this business will be included in the Distribution

segment in future.

Group Performance

Revenue

Total revenue increased by 14.8% in the year to GBP883.7 million

(2010: GBP769.8 million) principally as a result of three factors:

the Group's positive like for like sales performance of 3.1%, a net

increase of 15 stores and GBP41.5 million of sales from the pre

acquisition period of the Chausport, Canterbury and Kooga

businesses.

Gross margin

Gross margin achieved increased in all segments. However, an

increase in the participation of the lower margin distribution

businesses within the Group's overall performance from 5.4% to 9.5%

means that the growth in overall Group gross margin was limited to

0.2%.

Operating profits

Operating profit (before exceptional items) increased by GBP12.6

million to GBP79.9 million (2010: GBP67.3 million), a 19% increase

on last year which follows a 24% rise in the previous year. Group

operating margin (before exceptional items) has therefore increased

by a further 0.3% to 9.0% (2010: 8.7%).

Following a decrease in the exceptional items to GBP4.3 million

(2010: GBP5.0 million), Group operating profit rose from GBP62.3

million to GBP75.6 million.

The exceptional items (excluding share of exceptional items in

joint venture) comprise:

GBPm

Impairment of investment property 1.0

Loss on disposal of fixed assets 1.5

Onerous lease provision 1.8

Total exceptional charge 4.3

-----

The impairment of investment property relates to a writedown in

the valuation of the St Albans warehouse occupied by Focus.

The loss on disposal includes both closed stores and assets

written off in refurbished stores.

The charge for onerous lease provisions includes GBP1.1 million

for non-trading stores and GBP0.7 million for trading stores.

Working capital and financing

As a consequence of having net cash throughout the year, the

Group has net financing income of GBP0.2 million compared to net

financing costs in the prior year of GBP0.4 million.

Year end net cash of GBP86.1 million represented a GBP25.6

million improvement on the position at January 2010 (GBP60.5

million).

Net capital expenditure including disposal costs and premia

received increased in the year to GBP32.4 million (2010: GBP23.0

million) with capital expenditure excluding disposal costs

increasing by GBP10.1 million to GBP33.0 million (2010: GBP22.9

million). This increase was focused on the core Sports Fascias

where the spend increased by GBP10.7 million to GBP25.6 million

which included an additional GBP3.9 million in the French business

combined with GBP3.9 million of spend connected with the new

866,250 sq ft warehouse (616,250 sq ft footprint) at Kingsway,

Rochdale. The Board anticipate that approximately GBP15 million

will be incurred in the year to 28 January 2012 on fitting out of

the warehouse. The demonstrable success of investing in the store

portfolio means that we anticipate maintaining spend on the stores

at the current level.

Spend in the Fashion fascias decreased slightly by GBP0.7

million to GBP6.7 million. This decrease does not mean that the

Group is reducing its investment in the Fashion fascias and is more

a function of availability of appropriate property and the timing

of the projects.

Working capital remains well controlled with suppliers

continuing to be paid to agreed terms and settlement discounts

taken whenever due.

Store Portfolio

We have made a further significant investment in the store

portfolio during the year with expenditure on both new stores and

refurbishments of existing space. We have also continued to

rationalise our store portfolio wherever possible but, with the

current economic climate impacting heavily on retail property

occupancy levels, it remains very difficult to dispose of

underperforming and/or duplicate stores.

There was a net increase of 6 stores in the UK & Ireland JD

& Size? portfolios with 21 new stores offset by 15 closures.

Our overall presence has increased in France by 1 store with 7 new

stores (including 2 JD stores in Paris and Lyon) offset by the

closure of 6 smaller Chausport stores. In addition, one Chausport

store has been converted to the JD 'King of Trainers' format in

Lille and the success of that trial means that we will convert a

further 2 Chausport stores (in Angers and Amiens) to this format in

the current period.

There was a net addition of 9 stores in the Bank fascia with 13

store openings offset by the closure of 4 stores. A loss making

duplicate Scotts store in Chester was also closed in the

period.

We have refurbished a total of 29 stores in the year (including

3 stores where space has been transferred between fascias). This

means that over the last four years we have opened a total of 108

stores and refurbished a further 123 stores.

During the year, store numbers (excluding trading websites)

moved as follows:

Sports Fascias

JD & Size? (UK

& Eire) JD (France) Chausport Total

000

000 sq sq 000 sq 000 sq

Units ft Units ft Units ft Units ft

Start of

year 345 1,100 - - 75 78 420 1,178

New stores 21 65 2 4 5 10 28 79

Transfers

(1) - (1) 1 1 (1) (1) - (1)

Closures (15) (35) - - (6) (6) (21) (41)

Remeasures - 2 - - - (2) - -

------ -------- -------- ------ -------- ------- -------- -------

Close of

year 351 1,131 3 5 73 79 427 1,215

------ -------- -------- ------ -------- ------- -------- -------

(1) One JD store (Cardiff) was transferred to Bank in the period

offset by the transfer of one store from Bank to JD (Sutton

Coldfield). One former Chausport store (Lille) was converted into a

JD store.

Fashion Fascias

Bank Scotts Total

000 sq 000 sq 000 sq

Units ft Units ft Units ft

Start of

year 65 176 38 85 103 261

New stores 13 42 - - 13 42

Transfers - 1 - - - 1

Closures (4) (9) (1) (6) (5) (15)

Remeasures - - - (3) - (3)

------ ------- ------ ------- ------ -------

Close of

year 74 210 37 76 111 286

------ ------- ------ ------- ------ -------

Dividends and Earnings per Share

The Board proposes paying a final dividend of 19.20p (2010:

14.70p) bringing the total dividend payable for the year to 23.00p

(2010: 18.00p) per ordinary share. The proposed final dividend will

be paid on 1 August 2011 to all shareholders on the register at 6

May 2011. The final dividend has been increased by 31% with total

dividends payable for the year increased by 28%. This follows a 50%

increase in the full year dividend in the prior year.

The adjusted earnings per ordinary share before exceptional

items were 116.86p (2010: 93.64p).

The basic earnings per ordinary share were 114.84p (2010:

88.16p).

Employees

As ever, after another record year, it is right to give credit

and thanks to all our employees around the world for delivering

such exceptional results. We remain committed to continuing to

develop their skills and prospects through our success, training

and quality of operation.

Current Trading and Outlook

Following successive years of record results for the Group, the

retail environment has recently been significantly impacted by

adverse fiscal changes in addition to the multiple current economic

pressures. Specifically, the increase in VAT for the year to 28

January 2012 means that the same level of gross takings will

produce a contribution of approximately GBP16 million less than the

previous year. Simultaneously, but quite separately, we anticipate

a reduction of real expenditure levels by consumers at a time when

product costs, particularly imported goods, are increasing at a

material rate.

Trading for the early part of the current financial year has

been difficult to gauge when Easter falls three weeks later than

last year. For the 8 weeks to 26 March 2011 gross like for like

sales (including e-commerce) were +0.4% whilst net sales have

declined 1.2% (Sports Fascias -1.4%, Fashion Fascias +0.0%). The

decline in net sales and the resulting reduced margin are directly

as a result of the fiscal changes referred to above.

Our core business already possesses very strong sales densities

and margins, being the result of continual growth in both measures

for several years. Against that background, therefore, it is

inevitable that the Board is extremely cautious in its outlook,

particularly when the profits achieved for the year to 29 January

2011 are effectively rebased purely as a result of the impact of

increased VAT.

On the positive side the business delivers strong operating

ratios and high levels of free cash generation. It has a robust

balance sheet with GBP86.1 million net cash balances at the year

end which leaves the Group well positioned to extend the retail

opportunities which may arise and to continue to pursue a

progressive dividend policy.

Management remain highly focused on all avenues of revenue

growth, margin protection and cost control available to us to

endeavour to deliver the optimum outturn, minimise the impact of

the factors above and, with a strong balance sheet and dominant

market position in our core business, we expect to be able to

deliver operational and financial progress for the Group over the

long term. Opportunities for profit growth overseas and development

of our differentiated and own brand proposition, combined with

prospects for growth in our Distribution business, all help to

reduce the current threats to long term Group profitability and

give us the opportunity to maintain positive long term momentum in

our business.

A further update will be made in our Interim Management

Statement no later than 17 June 2011.

Peter Cowgill

Executive Chairman

13 April 2011

Consolidated Income Statement

For the 52 weeks ended 29 January 2011

52 weeks to

52 weeks to 30 January

29 January 2011 2010

Continuing Continuing

Operations Operations

Note GBP000 GBP000

Revenue 883,669 769,785

Cost of sales (446,657) (390,248)

-------------------------------------- ----- ----------------- ------------

Gross profit 437,012 379,537

Selling and distribution expenses

- normal (326,296) (288,462)

Selling and distribution expenses

- exceptional (3,277) (6,458)

Administrative expenses - normal (32,966) (26,051)

Administrative expenses - exceptional (1,007) 1,472

Other operating income 2,177 2,270

Operating profit 75,643 62,308

Before exceptional items 79,927 67,294

Exceptional items 3 (4,284) (4,986)

------------

Operating profit 75,643 62,308

Share of results of joint venture

before exceptional items (net

of income tax) 4 1,475 539

Share of exceptional items (net

of income tax) 4 1,348 (1,012)

-------------------------------------- ----- ----------------- ------------

Share of results of joint venture 4 2,823 (473)

Financial income 618 385

Financial expenses (455) (827)

-------------------------------------- ----- ----------------- ------------

Profit before tax 78,629 61,393

Income tax expense (22,762) (18,647)

-------------------------------------- ----- ----------------- ------------

Profit for the period 55,867 42,746

-------------------------------------- ----- ----------------- ------------

Attributable to equity holders

of the parent 55,884 42,900

Attributable to non-controlling

interest (17) (154)

Basic earnings per ordinary share 5 114.84p 88.16p

-------------------------------------- ----- ----------------- ------------

Diluted earnings per ordinary 5 114.84p 88.16p

share

-------------------------------------- ----- ----------------- ------------

Consolidated Statement of Comprehensive Income

For the 52 weeks ended 29 January 2011

52 weeks to 52 weeks to

29 January 30 January

2011 2010

GBP000 GBP000

Profit for the period 55,867 42,746

Other comprehensive income:

Exchange differences on translation

of foreign operations 95 (248)

------------------------------------------ ------------ ------------

Total other comprehensive income for

the period 95 (248)

------------------------------------------ ------------ ------------

Total comprehensive income and expense

for the period

(net of income tax) 55,962 42,498

------------------------------------------ ------------ ------------

Attributable to equity holders of the

parent 55,979 42,652

Attributable to non-controlling interest (17) (154)

------------------------------------------ ------------ ------------

Consolidated Statement of Financial Position

As at 29 January 2011

As at

30 January

2010

As at (restated

29 January -

2011 see note 1)

GBP000 GBP000

Assets

Intangible assets 58,315 50,215

Property, plant and equipment 78,120 67,434

Investment property 3,000 4,053

Other assets 13,047 13,232

Equity accounted investment in

joint venture 3,458 635

Deferred tax assets 125 -

Total non-current assets 156,065 135,569

--------------------------------------------- ------------ -------------

Inventories 84,490 74,475

Trade and other receivables 37,105 31,657

Cash and cash equivalents 90,131 64,524

--------------------------------------------- ------------ -------------

Total current assets 211,726 170,656

--------------------------------------------- ------------ -------------

Total assets 367,791 306,225

--------------------------------------------- ------------ -------------

Liabilities

Interest-bearing loans and borrowings (2,874) (2,712)

Trade and other payables (128,445) (115,742)

Provisions (2,591) (2,920)

Income tax liabilities (12,370) (10,789)

--------------------------------------------- ------------ -------------

Total current liabilities (146,280) (132,163)

--------------------------------------------- ------------ -------------

Interest-bearing loans and borrowings (1,117) (1,347)

Other payables (28,782) (24,050)

Provisions (6,437) (7,395)

Deferred tax liabilities - (748)

--------------------------------------------- ------------ -------------

Total non-current liabilities (36,336) (33,540)

--------------------------------------------- ------------ -------------

Total liabilities (182,616) (165,703)

--------------------------------------------- ------------ -------------

Total assets less total liabilities 185,175 140,522

--------------------------------------------- ------------ -------------

Capital and reserves

Issued ordinary share capital 2,433 2,433

Share premium 11,659 11,659

Retained earnings 171,916 125,341

Other reserves (1,918) (244)

Total equity attributable to equity holders

of the parent 184,090 139,189

Non-controlling interest 1,085 1,333

--------------------------------------------- ------------ -------------

Total equity 185,175 140,522

--------------------------------------------- ------------ -------------

Consolidated Statement of Changes in Equity

For the 52 weeks ended 29 January 2011

Total Equity

Foreign Attributable

Ordinary Currency To Equity

Share Share Retained Other Translation Holders Of

Capital Premium Earnings Equity Reserve The Parent

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31

January 2009 2,433 11,659 88,378 - 4 102,474

Profit for the

period - - 42,900 - - 42,900

Other

comprehensive

income:

Exchange

differences on

translation of

foreign

operations - - - - (248) (248)

Total other

comprehensive

income - - - - (248) (248)

----------------- --------- -------- --------- -------- ------------ -------------

Total

comprehensive

income for the

period - - 42,900 - (248) 42,652

Dividends to

equity holders - - (5,937) - - (5,937)

Acquisition of

non-controlling

interest - - - - - -

Balance at 30

January 2010 2,433 11,659 125,341 - (244) 139,189

Profit for the

period - - 55,884 - - 55,884

Other

comprehensive

income:

Exchange

differences on

translation of

foreign

operations - - - - 95 95

----------------- --------- -------- --------- -------- ------------ -------------

Total other

comprehensive

income - - - - 95 95

----------------- --------- -------- --------- -------- ------------ -------------

Total

comprehensive

income for the

period - - 55,884 - 95 55,979

Dividends to

equity holders - - (9,002) - - (9,002)

Put options held

by

non-controlling

interests - - - (1,769) - (1,769)

Acquisition of

non-controlling

interest - - (627) - - (627)

Disposal of

non-controlling

interest - - 320 - - 320

----------------- --------- -------- --------- -------- ------------ -------------

Balance at 29

January 2011 2,433 11,659 171,916 (1,769) (149) 184,090

----------------- --------- -------- --------- -------- ------------ -------------

Put options are held by the 49% non-controlling interest in

Canterbury of New Zealand Limited and 25% non-controlling interest

in Canterbury International (Australia) Pty Limited.

Consolidated Statement of Changes in Equity (continued)

For the 52 weeks ended 29 January 2011

Total Equity

Attributable

To Equity

Holders Non-Controlling Total

Of The Parent Interest Equity

GBP000 GBP000 GBP000

Balance at 31 January

2009 102,474 1,295 103,769

Profit for the period 42,900 (154) 42,746

Other comprehensive

income:

Exchange differences

on translation of foreign

operations (248) - (248)

Total other comprehensive

income (248) - (248)

-------------------------------- --------------- ---------------- --------

Total comprehensive

income for the period 42,652 (154) 42,498

Dividends to equity

holders (5,937) - (5,937)

Acquisition of non-controlling

interest - 192 192

Balance at 30 January

2010 139,189 1,333 140,522

Profit for the period 55,884 (17) 55,867

Other comprehensive

income:

Exchange differences

on translation of foreign

operations 95 - 95

-------------------------------- --------------- ---------------- --------

Total other comprehensive

income 95 - 95

-------------------------------- --------------- ---------------- --------

Total comprehensive

income for the period 55,979 (17) 55,962

Dividends to equity

holders (9,002) - (9,002)

Put options held by

non-controlling interests (1,769) - (1,769)

Acquisition of non-controlling

interest (627) (573) (1,200)

Disposal of non-controlling

interest 320 342 662

-------------------------------- --------------- ---------------- --------

Balance at 29 January

2011 184,090 1,085 185,175

-------------------------------- --------------- ---------------- --------

Consolidated Statement of Cash Flows

For the 52 weeks ended 29 January 2011

52 weeks to 52 weeks to

29 January 30 January

2011 2010

GBP000 GBP000

Cash flows from operating activities

Profit for the period 55,867 42,746

Share of results of joint venture (2,823) 473

Income tax expense 22,762 18,647

Financial expenses 455 827

Financial income (618) (385)

Depreciation and amortisation of non-current

assets 20,375 17,863

Exchange differences on translation (158) (49)

Impairment of intangible assets - 2,617

Impairment of non-current assets - 408

Impairment of investment property 1,007 -

Profit on disposal of available for sale

investments - (4,089)

Loss on disposal of non-current assets 1,440 2,148

Increase in inventories (9,622) (6,062)

Increase in trade and other receivables (5,209) (8,179)

Increase in trade and other payables 14,676 25,326

Interest paid (455) (827)

Income taxes paid (22,002) (15,848)

---------------------------------------------- ------------ ------------

Net cash from operating activities 75,695 75,616

---------------------------------------------- ------------ ------------

Cash flows from investing activities

Interest received 618 385

Proceeds from sale of non-current assets 1,082 532

Disposal costs of non-current assets (491) (644)

Acquisition of intangible assets (9,560) (6,672)

Acquisition of property, plant and equipment (30,855) (21,472)

Acquisition of non-current other assets (2,114) (1,429)

Cash consideration of acquisitions - (9,100)

Cash acquired with acquisitions - 2,273

Overdrafts acquired with acquisitions - (1,129)

Acquisition of available for sale investment - (9,990)

Proceeds from disposal of available for

sale investment - 16,132

Third party loan repayments - 80

Loan repayments received from joint venture 923 1,750

Net cash used in investing activities (40,397) (29,284)

---------------------------------------------- ------------ ------------

Cash flows from financing activities

Repayment of interest-bearing loans and

borrowings (310) (1,836)

Acquisition of non-controlling interest (1,200) -

Sale of subsidiary shares to non-controlling

interest 662 -

Dividends paid (9,002) (5,937)

---------------------------------------------- ------------ ------------

Net cash used in financing activities (9,850) (7,773)

---------------------------------------------- ------------ ------------

Net increase in cash and cash equivalents 25,448 38,559

---------------------------------------------- ------------ ------------

Cash and cash equivalents at the beginning

of the period 62,097 23,538

---------------------------------------------- ------------ ------------

Cash and cash equivalents at the end

of the period 87,545 62,097

---------------------------------------------- ------------ ------------

Analysis of Net Cash

As at 29 January 2011

At 30 At 29

January January

2010 Cash flow 2011

GBP000 GBP000 GBP000

Cash at bank and in hand 64,524 25,607 90,131

Overdrafts (2,427) (159) (2,586)

--------------------------- --------- ---------- ---------

Cash and cash equivalents 62,097 25,448 87,545

Interest-bearing loans

and borrowings:

Bank loans (885) 310 (575)

Other loans (747) (83) (830)

--------------------------- --------- ---------- ---------

60,465 25,675 86,140

--------------------------- --------- ---------- ---------

1. Prior period restatement

The comparative Group Consolidated Statement of Financial

Position as at 30 January 2010 has been restated to reflect the

completion in the period to 29 January 2011 of initial accounting

in respect of the acquisition of Kooga Rugby Limited made in the

period to 30 January 2010. Adjustments made to the provisional

calculation of the fair value of assets and liabilities acquired,

as reported at 30 January 2010, in the period to 29 January 2011,

resulted in an increase to goodwill of GBP94,000. The impact of

this adjustment on the net liabilities is shown in note 6. As the

acquisition of Kooga Rugby Limited occurred in the year to 30

January 2010 this adjustment has no impact on the Consolidated

Statement of Financial Position as at 31 January 2009 and so it has

not been presented.

2. Segmental analysis

IFRS 8 'Operating Segments' requires the Group's segments to be

identified on the basis of internal reports about components of the

Group that are regularly reviewed by the Chief Operating Decision

Maker to allocate resources to the segments and to assess their

performance. The Chief Operating Decision Maker is considered to be

the Executive Chairman of JD Sports Fashion Plc.

Information reported to the Chief Operating Decision Maker is

focused on the nature of the businesses within the Group. The

Group's reportable segments under IFRS 8 are therefore as

follows:

-- Sport retail - includes the results of the sport retail

trading companies JD Sports Fashion Plc, John David Sports Fashion

(Ireland) Limited, Chausport SA and Duffer of St George Limited

-- Fashion retail - includes the results of the fashion retail

trading companies Bank Fashion Limited and RD Scott Limited

-- Distribution businesses - includes the results of the

distribution companies Topgrade Sportswear Limited, Nicholas

Deakins Limited, Canterbury Limited (including global subsidiary

companies), Kooga Rugby Limited and Nanny State Limited

The Chief Operating Decision Maker receives and reviews

segmental operating profit. Certain central administrative costs

including Group Directors' salaries are included within the Group's

core 'Sport retail' result. This is consistent with the results as

reported to the Chief Operating Decision Maker.

IFRS 8 requires disclosure of information regarding revenue from

major products and customers. The majority of the Group's revenue

is derived from the retail of a wide range of apparel, footwear and

accessories to the general public. As such, the disclosure of

revenues from major products and customers is not appropriate.

Intersegment transactions are undertaken in the ordinary course

of business on arms length terms.

The Board consider that certain items are cross divisional in

nature and cannot be allocated between the segments on a meaningful

basis. The share of results of joint venture is presented as

unallocated in the following tables, as this entity has trading

relationships with companies in all of the three segments. An asset

of GBP3,458,000 (2010: GBP635,000) for the equity accounted

investment in joint venture is included within the unallocated

segment. Net funding costs and taxation are treated as unallocated

reflecting the nature of the Group's syndicated borrowing

facilities and its tax group. A deferred tax asset of GBP125,000

(2010: liability of GBP748,000) and an income tax liability of

GBP12,370,000 (2010: GBP10,789,000) are included within the

unallocated segment.

Each segment is shown net of intercompany transactions and

balances within that segment. The eliminations remove intercompany

transactions and balances between different segments which

primarily relate to the net down of long term loans and short term

working capital funding provided by JD Sports Fashion Plc (within

Sport retail) to other companies in the Group, and intercompany

trading between companies in different segments.

Business Segments

Information regarding the Group's reportable operating segments

for the 52 weeks to 29 January 2011 is shown below:

Income statement

Sport Fashion

Retail Retail Distribution Total

GBP000 GBP000 GBP000 GBP000

Gross revenue 667,224 134,110 85,498 886,832

Intersegment revenue (1,290) (162) (1,711) (3,163)

-------------------------------- -------- -------- ------------- ---------

Revenue 665,934 133,948 83,787 883,669

-------------------------------- -------- -------- ------------- ---------

Operating profit before

exceptional items 73,340 6,399 188 79,927

Exceptional items (2,687) (1,573) (24) (4,284)

-------------------------------- -------- -------- ------------- ---------

Operating profit 70,653 4,826 164 75,643

Share of results of joint

venture 2,823

Financial income 618

Financial expenses (455)

-------------------------------- -------- -------- ------------- ---------

Profit before tax 78,629

Income tax expense (22,762)

-------------------------------- -------- -------- ------------- ---------

Profit for the period 55,867

-------------------------------- -------- -------- ------------- ---------

Total assets and liabilities

Sport Fashion

Retail Retail Distribution Unallocated Eliminations Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Total assets 310,244 56,182 50,822 3,583 (53,040) 367,791

------------- ---------- --------- -------------- ---------- ------------- -------------

Total

liabilities (120,727) (51,546) (51,013) (12,370) 53,040 (182,616)

------------- ---------- --------- -------------- ---------- ------------- -------------

Other segment information

Sport Fashion

Retail Retail Distribution Total

GBP000 GBP000 GBP000 GBP000

Capital expenditure:

Brand licence purchased 7,500 - - 7,500

Brand names purchased 1,710 - 350 2,060

Property, plant and equipment 23,553 6,656 646 30,855

Non-current other assets 2,092 22 - 2,114

Depreciation, amortisation

and impairments:

Depreciation and amortisation

of non-current assets 15,679 3,454 1,242 20,375

Impairment of investment

property 1,007 - - 1,007

------------------------------- -------- -------- ------------- --------

The comparative segmental results for the 52 weeks to 30 January

2010 are as follows:

Income statement

Sport Fashion

Retail Retail Distribution Total

GBP000 GBP000 GBP000 GBP000

Gross revenue 615,507 114,640 42,551 772,698

Intersegment revenue (1,225) (394) (1,294) (2,913)

-------------------------------- -------- -------- ------------- ---------

Revenue 614,282 114,246 41,257 769,785

-------------------------------- -------- -------- ------------- ---------

Operating profit/(loss) before

exceptional items 64,125 3,333 (164) 67,294

Exceptional items (642) (4,355) 11 (4,986)

-------------------------------- -------- -------- ------------- ---------

Operating profit/(loss) 63,483 (1,022) (153) 62,308

Share of results of joint

venture (473)

Financial income 385

Financial expenses (827)

-------------------------------- -------- -------- ------------- ---------

Profit before tax 61,393

Income tax expense (18,647)

-------------------------------- -------- -------- ------------- ---------

Profit for the period 42,746

-------------------------------- -------- -------- ------------- ---------

Total assets and liabilities

Sport Fashion

Retail Retail Distribution Unallocated Eliminations Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Total assets 264,394 51,180 40,572 635 (50,556) 306,225

------------- ---------- --------- -------------- ---------- ------------- -------------

Total

liabilities (112,618) (51,561) (40,543) (11,537) 50,556 (165,703)

------------- ---------- --------- -------------- ---------- ------------- -------------

Other segment information

Sport Fashion

Retail Retail Distribution Total

GBP000 GBP000 GBP000 GBP000

Capital expenditure:

Goodwill on acquisition

(restated - see note 1) - - 1,537 1,537

Brand names on acquisition 2,042 - 453 2,495

Brand names purchased - - 6,672 6,672

Property, plant and

equipment 13,517 7,383 572 21,472

Non-current other assets 1,424 5 - 1,429

Available for sale

investment 9,990 - - 9,990

---------------------------- --------- -------- ------------- ----------

Depreciation, amortisation

and impairments:

Depreciation and

amortisation of

non-current assets 14,067 3,279 517 17,863

Impairment of intangible

assets - 2,617 - 2,617

Impairment of non-current

assets 105 303 - 408

---------------------------- --------- -------- ------------- ----------

Geographical Information

The Group's operations are located in the UK, Republic of

Ireland, France, Australia, New Zealand, United States of America

and Hong Kong.

The following table provides analysis of the Group's revenue by

geographical market, irrespective of the origin of the

goods/services:

52 weeks to 52 weeks to

29 January 30 January

2011 2010

GBP000 GBP000

UK 801,728 722,221

Europe 55,027 45,094

Rest of world 26,914 2,470

--------------- ------------ ------------

883,669 769,785

--------------- ------------ ------------

The revenue from any individual country, with the exception of

the UK, is not more than 10% of the Group's total revenue.

The following is an analysis of the carrying amount of segmental

non-current assets, excluding the investment in joint venture of

GBP3,458,000 (2010: GBP635,000), deferred tax assets of GBP125,000

(2010: GBPnil) and other financial assets of GBPnil (2010:

GBP922,000), by the geographical area in which the assets are

located:

2010

(restated -

2011 see note 1)

GBP000 GBP000

UK 135,852 120,416

Europe 16,362 13,311

Rest of world 268 285

--------------- -------- -------------

152,482 134,012

--------------- -------- -------------

3. Exceptional items

52 weeks to

29 January 52 weeks to

2011 30 January

GBP000 2010 GBP000

Loss on disposal of non-current assets

(1) 1,440 2,148

Impairment of non-current assets (2) - 408

Onerous lease provision (3) 1,837 3,902

Selling and distribution expenses - exceptional 3,277 6,458

------------------------------------------------- ------------ -------------

Impairment of intangible assets (4) - 2,617

Impairment of investment property (5) 1,007 -

Profit on disposal of available for sale

investments (6) - (4,089)

Administrative expenses - exceptional 1,007 (1,472)

------------------------------------------------- ------------ -------------

4,284 4,986

------------------------------------------------- ------------ -------------

(1) Relates to the excess of net book value of property, plant

and equipment and non-current other assets disposed over proceeds

received

(2) Relates to property, plant and equipment and non-current

other assets in cash-generating units which are loss making, where

it is considered that this position cannot be recovered

(3) Relates to the net movement in the provision for onerous

property leases on trading and non-trading stores

(4) Relates to the impairment in the period to 30 January 2010

of the residual goodwill on the acquisition of the entire issued

share capital of RD Scott Limited

(5) Relates to the impairment in the period to 29 January 2011

of investment property

(6) The Group held a non-strategic investment in JJB Sports Plc

until 9 December 2009 when it disposed of 65,018,098 ordinary

shares for 25p per share, giving a realised loss on disposal of

GBP1,988,000. After recognising an impairment of GBP6,077,000 in

the year ended 31 January 2009 this resulted in an exceptional gain

in the period to 30 January 2010 of GBP4,089,000

4. Interest in joint venture

The Group's share of the revenue generated by the joint venture

in the period was GBP15,418,000(2010: GBP11,774,000). The amount

included in the Consolidated Income Statement in relation to the

joint venture is as follows:

After

Before exceptionals Exceptionals exceptionals

GBP000 GBP000 GBP000

Share of result before

tax 2,102 1,549 3,651

Tax (627) (201) (828)

------------------------- -------------------- ------------- --------------

Share of result after

tax 1,475 1,348 2,823

------------------------- -------------------- ------------- --------------

The comparative amount included in the Consolidated Income

Statement for the period ended 30 January 2010 in relation to the

joint venture is as follows:

After

Before exceptionals Exceptionals exceptionals

GBP000 GBP000 GBP000

Share of result before

tax 740 (1,406) (666)

Tax (201) 394 193

------------------------- -------------------- ------------- --------------

Share of result after

tax 539 (1,012) (473)

------------------------- -------------------- ------------- --------------

The exceptional items in the current year relate to unrealised

gains on foreign exchange contracts and the reversal of the

impairment of the investment held by Focus Brands Limited in Focus

Group Holdings Limited, following repayment of original purchase

consideration by the vendors of Focus Group Holdings Limited. The

exceptional items in the prior year relate entirely to unrealised

losses on foreign exchange contracts.

5. Earnings per ordinary share

Basic and diluted earnings per ordinary share

The calculation of basic and diluted earnings per ordinary share

at 29 January 2011 is based on the profit for the period

attributable to equity holders of the parent of GBP55,884,000

(2010: GBP42,900,000) and a weighted average number of ordinary

shares outstanding during the 52 weeks ended 29 January 2011 of

48,661,658 (2010: 48,661,658).

52 weeks

52 weeks to to

29 January 30 January

2011 2010

Issued ordinary shares at beginning and

end of period 48,661,658 48,661,658

----------------------------------------- ------------ ------------

Adjusted basic and diluted earnings per ordinary share

Adjusted basic and diluted earnings per ordinary share have been

based on the profit for the period attributable to equity holders

of the parent for each financial period but excluding the post-tax

effect of certain exceptional items. The Directors consider that

this gives a more meaningful measure of the underlying performance

of the Group.

52 weeks 52 weeks

to to

29 January 30 January

2011 2010

Note GBP000 GBP000

Profit for the period attributable to

equity holders

of the parent 55,884 42,900

Exceptional items excluding loss on

disposal of non-current assets 3 2,844 2,838

Tax relating to exceptional items (514) (1,184)

Share of exceptional items of joint

venture (net of income tax) 4 (1,348) 1,012

------------------------------------------- ----- ------------ ------------

Profit for the period attributable to

equity holders of the parent excluding

exceptional items 56,866 45,566

------------------------------------------- ----- ------------ ------------

Adjusted basic and diluted earnings per 116.86p 93.64p

ordinary share

------------------------------------------- ----- ------------ ------------

6. Acquisitions

Current period acquisitions

Acquisition of non-controlling interest in Topgrade Sportswear

Limited

On 21 June 2010, the Group acquired a further 29% of the issued

share capital of Hallco 1521 Limited (the intermediate holding

company of Topgrade Sportswear Limited) for a cash consideration of

GBP1,200,000. This takes the Group's holding to 80%. The Group's

original share of 51% was acquired on 7 November 2007. Topgrade

Sportswear Limited is a distributor and multichannel retailer of

sports and fashion clothing and footwear. As the Group already had

control of Hallco 1521 Limited, the increase in Group ownership has

been accounted for as an equity transaction.

Nanny State Limited

On 4 August 2010, the Group (via its new subsidiary Nanny State

Limited) acquired the global rights to the fashion footwear and

apparel brand, 'Nanny State', from D.R.I.P Brands Limited (in

administration) and D.R. Shoes Limited (in administration) for a

cash consideration of GBP350,000. Inventory with a value of

GBP141,000 and other debtors with a value of GBP86,000 were also

acquired. The book value of the assets acquired is considered to be

the fair value.

Included in the result for the 52 week period to 29 January 2011

is revenue of GBP771,000 and a loss before tax of GBP15,000 in

respect of Nanny State Limited.

Prior period acquisitions

Acquisition of Kooga Rugby Limited

On 3 July 2009, the Group acquired 100% of the issued share

capital of Kooga Rugby Limited for a consideration of GBP1 together

with associated fees of GBP30,000. Kooga Rugby Limited is involved

in the design, sourcing and wholesale of rugby apparel, footwear

and accessories and is sole kit supplier to a number of

professional rugby union and rugby league clubs.

During the 12 month period following acquisition, certain

measurement adjustments have been made to the provisional fair

values of the net liabilities of Kooga Rugby Limited as at the

acquisition date in accordance with IFRS 3 'Business Combinations'.

The adjustments from 1 August 2009 to 30 January 2010 are shown in

the Annual Report and Accounts 2010. The adjustments from 31

January 2010 to determine the final fair value of liabilities

acquired are shown below:

Provisional

fair value Fair value

at 30 January Fair value at 29 January

2010 adjustments 2011

GBP000 GBP000 GBP000

Acquiree's net liabilities

at the acquisition date:

Intangible assets 453 - 453

Property, plant and

equipment 102 - 102

Inventories 1,082 (94) 988

Trade and other receivables 1,018 - 1,018

Interest-bearing loans and

borrowings (1,449) - (1,449)

Trade and other payables (2,035) - (2,035)

Provisions (584) - (584)

Net identifiable liabilities (1,413) (94) (1,507)

----------------------------- --------------- ------------- ---------------

Goodwill on acquisition 1,443 94 1,537

----------------------------- --------------- ------------- ---------------

Consideration paid -

satisfied in cash 30 - 30

----------------------------- --------------- ------------- ---------------

Acquisition of Chausport SA

On 19 May 2009, the Group (via its new subsidiary JD Sports

Fashion (France) SAS) acquired 100% of the issued share capital of

Chausport SA for a cash consideration of GBP7,211,000

(EUR8,000,000) together with associated fees of GBP696,000.

Chausport SA is a French retailer, which at the time of acquisition

had 78 stores in premium locations in town centres and shopping

centres across France.

During the 12 month period following acquisition, no measurement

adjustments were made to the provisional fair values of the net

assets of Chausport SA as at the acquisition date.

Provisional

fair value Fair value

at 30 January Fair value at 29 January

2010 adjustments 2011

GBP000 GBP000 GBP000

Acquiree's net assets at the

acquisition date:

Property, plant and

equipment 1,558 - 1,558

Non-current other assets 9,278 - 9,278

Inventories 5,770 - 5,770

Trade and other receivables 1,350 - 1,350

Cash and cash equivalents 639 - 639

Interest-bearing loans and

borrowings (2,318) - (2,318)

Trade and other payables (8,370) - (8,370)

Net identifiable assets 7,907 - 7,907

----------------------------- --------------- ------------- ---------------

Goodwill on acquisition - - -

----------------------------- --------------- ------------- ---------------

Consideration paid -

satisfied in cash 7,907 - 7,907

----------------------------- --------------- ------------- ---------------

Canterbury Limited

On 4 August 2009, the Group (via its new subsidiary Canterbury

Limited) acquired the global rights to the rugby brands

'Canterbury' and 'Canterbury of New Zealand' from Canterbury Europe

Limited (in administration) for a cash consideration of

GBP6,672,000. Inventory with a fair value of GBP4,289,000 was also

acquired. The book value of the assets acquired was considered to

be the fair value and no goodwill arose on the acquisition.

The final fair value of the net assets acquired was

GBP10,961,000. During the 12 month period following acquisition, no

measurement adjustments have been made to the provisional fair

values of the net assets of Canterbury Limited as at the

acquisition date.

Canterbury International (Far East) Limited

On 4 August 2009, Canterbury Limited acquired 100% of the issued

share capital of Canterbury International (Far East) Limited for a

cash consideration of GBP1. The provisional fair value of the

assets and liabilities acquired was GBP1. No goodwill arose on this

acquisition.

The final fair value of the net assets acquired was GBP1. During

the 12 month period following acquisition, no measurement

adjustments have been made to the provisional fair values of the

net assets of Canterbury International (Far East) Limited as at the

acquisition date.

Canterbury (North America) LLC

On 24 November 2009, Canterbury Limited (via its new subsidiary

Canterbury (North America) LLC) acquired the key trading assets

from Sail City Apparel Limited (in liquidation). The total cash

consideration paid was GBP442,000 which included inventory with a

value of GBP392,000 with associated fees of GBP50,000. The book

value of the assets acquired was considered to be the fair value

and no goodwill arose on the acquisition.

The final fair value of the net assets acquired was GBP442,000.

During the 12 month period following acquisition, no measurement

adjustments have been made to the provisional fair values of the

net assets of Canterbury (North America) LLC as at the acquisition

date.

Acquisition of Canterbury International (Australia) Pty

Limited

On 23 December 2009, Canterbury Limited acquired 100% of the

issued share capital of Canterbury International (Australia) Pty

Limited for a cash consideration of GBP2 together with associated

fees of GBP100,000. Canterbury International (Australia) Pty

Limited operates the Canterbury brand in Australia.

During the 12 month period following acquisition, no measurement

adjustments have been made to the provisional fair values of the

net assets of Canterbury International (Australia) Pty Limited as

at the acquisition date.

Provisional

fair value Fair value

at 30 January Fair value at 29 January

2010 adjustments 2011

GBP000 GBP000 GBP000

Acquiree's net assets at the

acquisition date:

Property, plant and

equipment 144 - 144

Inventories 1,866 - 1,866

Trade and other receivables 1,175 - 1,175

Cash and cash equivalents 918 - 918

Trade and other payables (3,386) - (3,386)

Intercompany loan (617) - (617)

Net identifiable assets 100 - 100

----------------------------- --------------- ------------- ---------------

Goodwill on acquisition - - -

----------------------------- --------------- ------------- ---------------

Consideration paid -

satisfied in cash 100 - 100

----------------------------- --------------- ------------- ---------------

Acquisition of Canterbury of New Zealand Limited

On 23 December 2009, Canterbury Limited acquired 51% of the

issued share capital of Canterbury of New Zealand Limited for a

cash consideration of GBP1 together with associated fees of

GBP200,000. Canterbury of New Zealand Limited operates the

Canterbury brand in New Zealand.

During the 12 month period following acquisition, no measurement

adjustments have been made to the provisional fair values of the

net assets of Canterbury of New Zealand Limited as at the

acquisition date.

Provisional

fair value Fair value

at 30 January Fair value at 29 January

2010 adjustments 2011

GBP000 GBP000 GBP000

Acquiree's net assets at the

acquisition date:

Property, plant and

equipment 123 - 123

Inventories 1,501 - 1,501

Trade and other receivables 1,256 - 1,256

Cash and cash equivalents 504 - 504

Trade and other payables (1,450) - (1,450)

Income tax liabilities (8) - (8)

Intercompany loan (771) - (771)

Shareholder loan (763) - (763)

Net identifiable assets 392 - 392

----------------------------- --------------- ------------- ---------------

Non-controlling interest

(49%) (192) - (192)

Goodwill on acquisition - - -

----------------------------- --------------- ------------- ---------------

Consideration paid -

satisfied in cash 200 - 200

----------------------------- --------------- ------------- ---------------

Acquisition of Duffer of St George Limited

On 24 November 2009, the Group acquired 100% of the issued share

capital of Duffer of St George Limited for a cash consideration of

GBP863,000. Duffer of St George Limited owns the global rights to

the brand name 'The Duffer of St George'.

During the 12 month period following acquisition, no measurement

adjustments have been made to the provisional fair values of the

net assets of Duffer of St George Limited as at the acquisition

date.

Provisional

fair value Fair value

at 30 January Fair value at 29 January

2010 adjustments 2011

GBP000 GBP000 GBP000

Acquiree's net assets at the

acquisition date:

Intangible assets 2,042 - 2,042

Trade and other receivables 220 - 220

Cash and cash equivalents 212 - 212

Interest-bearing loans and

borrowings (1,616) - (1,616)

Deferred tax asset 5 - 5

Net identifiable assets 863 - 863

----------------------------- --------------- ------------- ---------------

Goodwill on acquisition - - -

----------------------------- --------------- ------------- ---------------

Consideration paid -

satisfied in cash 863 - 863

----------------------------- --------------- ------------- ---------------

7. Disposals

Disposal of 25% of issued ordinary share capital of Canterbury

International (Australia) Pty Limited

On 28 January 2011, Canterbury Limited disposed of 25% of the

issued ordinary share capital of Canterbury International

(Australia) Pty Limited to the local management team by issuing new

shares in exchange for a cash consideration of AUD $1,100,000. This

takes the Group's shareholding to 75%. As the Group has maintained

control of Canterbury International (Australia) Pty Limited, the

decrease in Group ownership has been accounted for as an equity

transaction.

8. Subsequent events

Acquisition of Kukri Sports Limited

On 7 February 2011, the Group acquired 80% of the issued share

capital of Kukri Sports Limited for a cash consideration of GBP1.

Kukri Sports Limited has a number of subsidiaries around the world,

which source and provide bespoke sports teamwear to schools,

universities and sports clubs. In addition, Kukri Sports Limited is

sole kit supplier to a number of professional sports teams. For the

year ended 30 April 2010, Kukri Sports Limited had a turnover of

GBP12.9 million, an operating loss of GBP0.3 million, a loss before

tax of GBP0.2 million and gross assets of GBP2.5 million. The fair

value of the assets and liabilities acquired is currently being

determined.

Acquisition of additional shares in Focus Brands Limited

On 16 February 2011, the Group acquired a further 31% of the

issued share capital of Focus Brands Limited for a cash

consideration of GBP1,000,000, with potential further deferred

consideration of GBP250,000 depending on performance. The Group's

original share of 49% was acquired on 3 December 2007. Focus Brands

Limited was originally incorporated in order to acquire Focus Group

Holdings Limited and its subsidiary companies and was an entity

jointly controlled by the Group and the former shareholders of

Focus Group Holdings Limited. The additional shares purchased since

the reporting date take the Group's holding in Focus Brands Limited

to 80%, thereby giving the Group control. Focus Brands Limited is

now a subsidiary of the Group rather than a jointly-controlled

entity.

Acquisition of Champion Sports (Holdings)

On 4 April 2011, the Group acquired 100% of the issued share

capital of Champion Sports (Holdings) for a cash consideration of

EUR7 and have also advanced EUR17.1 million to allow it to settle

all of its indebtedness save for EUR2.5 million of leasing finance.

Champion was founded in 1992 and is one of the leading retailers of

sports apparel and footwear in the Republic of Ireland with 22

stores in premium locations in town centres and shopping centres.

In addition, Champion has one store in Northern Ireland. For the

year ended 31 December 2009, Champion had a turnover of EUR54.0

million, an operating loss of EUR1.8 million, a loss before tax of

EUR4.9 million and gross assets of EUR36.2 million. The fair value

of the assets and liabilities acquired is currently being

determined.

New committed bank facility

On 12 April 2011, the Group agreed a new syndicated committed

GBP75,000,000 bank facility for 54 months to 11 October 2015. The

principal terms of this facility are:

-- Current margin 1.25%

-- Arrangement fee 0.60%

-- Commitment fee 45% of applicable margin

The new facility encompasses cross guarantees between the

Company, Bank Fashion Limited, RD Scott Limited, Topgrade

Sportswear Limited, Nicholas Deakins Limited, Canterbury Limited,

Canterbury of New Zealand Limited and Focus International

Limited.

9. Accounts

The financial information set out above does not constitute the

Group's statutory accounts for the 52 weeks ended 29 January 2011

or 30 January 2010 but is derived from those accounts. Statutory

accounts for the 52 weeks ended 30 January 2010 have been delivered

to the Registrar of Companies, and those for the 52 weeks to 29

January 2011 will be delivered in due course. The auditor has

reported on those accounts; their reports were (i) unqualified,

(ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

Copies of full accounts will be sent to shareholders in due

course. Additional copies will be available from JD Sports Fashion

Plc, Hollinsbrook Way, Pilsworth, Bury, Lancashire, BL9 8RR or

online at www.jdplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ITMFTMBABBJB

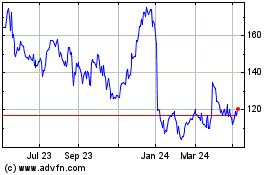

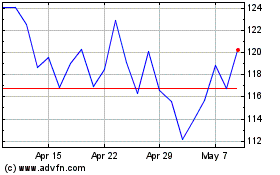

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024