JD Sports Fashion Plc Investment in Joint Venture in South Korea (8243Q)

15 September 2017 - 4:00PM

UK Regulatory

TIDMJD.

RNS Number : 8243Q

JD Sports Fashion Plc

15 September 2017

15 September 2017

JD Sports Fashion Plc

Investment in Joint Venture in South Korea

JD Sports Fashion Plc ('JD'), the leading retailer of sports,

fashion and outdoor brands, announces that, on 14 September 2017,

it entered into a joint venture agreement ('JV') with Shoemarker

Inc ('SMK'), a South Korean retailer of footwear, in relation to

J&S Partners Inc, a company owned by SMK, which currently

trades as the multibranded Hot-T fascia ('Hot-T').

JD has acquired an initial 15% of Hot-T for a cash consideration

of approximately GBP5.5 million. As part of the JV, JD has a call

option, exercisable at JD's discretion, to acquire a further 35%

share of Hot-T following the finalisation of Hot-T's accounts for

its financial year ending 31 December 2017. It is JD's current

intention to exercise this option and to re-fascia the Hot-T stores

as JD. The exercise of this option would result in the

consolidation of the results and net assets of Hot-T into JD's

accounts. The business will continue to be operationally run by its

existing management team.

Additionally, a limited number of put and call options

('Options') have been entered into by JD and SMK as part of the JV.

The value of these Options will be based on the fair value of Hot-T

at the time they are exercised and to the extent the exercise of

any of these Options are not at the sole discretion of the Company,

the fair values have been capped with the consideration payable by

either JV partner for the holding of the other partner capped below

25% of JD's Gross Assets.

Information about SMK and Hot-T

SMK operates two retail businesses, Shoemarker (a multi branded

footwear retailer in the sporting goods sector of the market) with

114 stores in South Korea and Hot-T (a multibranded footwear

retailer in the athletic specialty sector of the market) with 23

stores in South Korea and its own website.

The revenue that relates to Hot-T within the SMK business for

the year to 31 December 2016 was KRW 25.5 billion (approximately

GBP17.2 million), with a store EBITDA of KRW 3.0 billion

(approximately GBP2.0 million), gross assets of KRW 42.6 billion

(approximately GBP28.8 million), an operating profit (before

exceptional items) of KRW 0.6 billion (approximately GBP0.4

million) and a loss before tax after exceptional charges,

principally relating to one off stock write offs, of KRW 6.2

billion (approximately GBP4.2 million).

Peter Cowgill, Executive Chairman, commented:

"We are delighted to be entering into this JV which gives JD the

opportunity to enter a new market of over 50 million people with a

proven operator. This JV will further strengthen JD's global

presence."

Enquiries:

JD Sports Fashion Plc Tel: 0161 767 1000

Peter Cowgill, Executive Chairman

Brian Small, Chief Financial Officer

Neil Greenhalgh, Group Financial Controller

MHP Communications Tel: 0203 128 8100

Andrew Jaques

Barnaby Fry

Gina Bell

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulations (EU) No. 596/2014

("MAR") and is disclosed in accordance with the Company's

obligations under Article 17 of MAR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

JVEEAPNLFESXEFF

(END) Dow Jones Newswires

September 15, 2017 02:00 ET (06:00 GMT)

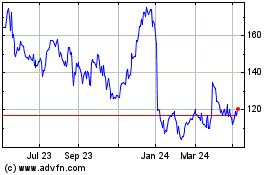

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Apr 2024 to May 2024

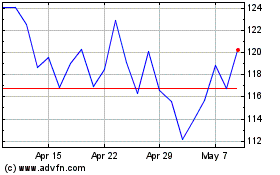

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From May 2023 to May 2024