TIDMJEL

RNS Number : 5291X

Jersey Electricity PLC

20 December 2023

JERSEY ELECTRICITY Plc

Financial Results Summary

Year Ended 30 September 2023

At a meeting of the Board of Directors held on 20 December 2023,

the final accounts for the year ended 30 September 2023 were

approved and have been published on our website

(www.jec.co.uk).

The financial information set out in this summary does not

constitute the statutory accounts for the year ended 30 September

2023, or 2022, but is derived from those accounts. Statutory

accounts for 2022 have been delivered to the Jersey Registrar of

Companies, and those for 2023 will be delivered in early 2024. The

auditor reported on the accounts for both years and their reports

were unmodified.

A final dividend of 11.40p on the Ordinary and 'A' Ordinary

shares in respect of the year ended 30 September 2023 was

recommended (2022: 10.80p) . Together with the interim dividend of

8.00p (2022: 7.60p) the proposed total dividend declared for the

year was 19.40p on each share (2022: 18.40p).

The final dividend will be paid on 15 March 2024 to those

shareholders registered on 23 February 2024. A dividend on the 5%

cumulative participating preference shares of 1.5% (2022: 1.5%)

payable on 1 July 2024 was also recommended.

The Annual General Meeting will be held on 5 March 2024 at 2.00

pm at the Powerhouse, Queen's Road, St. Helier, Jersey.

L.G. Fulton

Chief Financial Officer

Direct Line: 01534 505270

Mobile Number: 07797 778688

Email: lfulton@jec.co.uk

20 December 2023

The Powerhouse

PO Box 45

Queens Road

St. Helier

Jersey JE4 8NY

JERSEY ELECTRICITY plc

Financial Results Summary

Year ended 30 September 2023

The Chair, Phil Austin, comments:

Performance

The Group has achieved another solid year of operational and

financial performance and is strategically well-positioned for the

future. Wholesale prices have eased in the last year, but they

remain high in relative terms, in what continues to be a

challenging economic environment.

Our Energy Business delivered a Return on Assets of 7.2% in the

year, restoring the under recovery of costs from prior years and

bringing the 5-year rolling average to 6.2% within the target range

of 6%-7%.

We implemented a 5% rise in tariffs in January 2023 to help keep

pace with wholesale prices but, due to our strong hedged position,

and coupled with contractual provisions, we have been able to

significantly shelter Islanders from the recent turmoil in energy

markets. However, whilst wholesale prices have recently come down,

they remain well above our long-term hedged position and therefore

we expect further upward pressure on retail prices over the next

few years.

To give customers some certainty over the coming winter, we

announced a further 12% tariff rise in June, to take effect from

January 2024. As we look forward to 2025 - 2027, approximately one

third of our energy is already hedged at fixed prices and our focus

now is on transitioning our customers through this difficult

period, whilst keeping bills as stable and at as low a cost as

possible.

Our other businesses within the Group continued to perform in

line with expectations, providing consistent year-on-year

return.

The Board has recommended a final dividend for the year of

11.40p, a 6% rise on the previous year, payable on 15 March

2024.

Climate Change

In April 2022, the UK became the first G20 country to introduce

legislation, making it mandatory for large businesses to disclose

climate-related financial information in line with the Taskforce on

Climate-related Financial Disclosures (TCFD) recommendations. At

Jersey Electricity, we have made significant progress towards

establishing our net-zero strategy, together with key priorities,

metrics and targets. Details of our progress are set out on pages

22-33 of the 2023 Annual Report and Accounts.

Energy Security

This year we completed a review of our Supply Security Standard.

The review was driven by the recent energy crisis, the demands of

the Government of Jersey's (GoJ) Carbon Neutral Roadmap

(CNR) and the French fishing dispute of 2021. Following this

review, and subject to securing long-term tenure on our site at La

Collette, the Board has approved a four-year GBP22.6m project to

enhance our on-Island emergency generation capacity at La Collette

Power Station.

While we continue to deploy solar PV across the Island, with a

view to increasing energy sovereignty and long-term supply

diversity, as well as supporting the local economy, we have at the

same time continued more detailed investigations into the viability

of offshore wind generation and how it might integrate into

Jersey's future energy system. We are actively engaging with GoJ to

determine the future approach and role Jersey Electricity Plc

(JE)should play in the development of such a project.

In Conclusion

I am very proud of the response efforts from the JE team and our

customers following storm Ciarán. I wish to thank all our teams and

fellow Board members for their hard work and dedication this past

year, as well as our shareholders for their continued support. We

have achieved much together during what has been a very successful

year, while keeping Jersey Electricity on course to take advantage

of the opportunities the future holds and meet the challenges it

will demand of us.

Financial Performance

Financial Highlights 2023 2022

Revenue GBP125.1m GBP117.4m

Profit before tax GBP14.9m GBP10.6m

Earnings per share 36.81p 27.17p

Dividend paid per share 18.80p 17.80p

Final proposed dividend per share 11.40p 10.80p

Net cash GBP17.4m GBP17.4m

In Year Return on Assets 7.2% 4.2%

Return on Assets - 5 year rolling average 6.2% 6.2%

------------------------------------------- ---------- ----------

2022/23 has seen a return to a less volatile operating

environment following the pandemic. Our hedging strategy for the

procurement of power has protected us against a volatile wholesale

energy market which has seen prices reach over 10 times historical

levels in the same period. Escalating inflation has put pressure on

the cost base as the business continues to maintain performance and

build towards a decarbonised future. Our balance sheet continues to

be healthy underpinned by high quality assets.

Group revenue for the year to 30 September 2023 increased year

on year by GBP7.7m (6.5%) due to tariff price increases in the

Energy Business. Revenue across the wider group remained in line

with the previous financial year.

Group Profit before tax for the year to 30 September 2023 was

GBP14.9m compared to GBP10.6m in 2022. The profit increase is

attributed to GBP1.8m from the energy business and GBP1.6m income

from interest earnings. In the year the energy business received a

rebate of GBP3.6m relating to prior year wholesale energy costs and

following a full review, our property portfolio was devalued by

GBP1.2m.

Underlying profit before tax (excluding the impacts of the

rebate and property valuation) was GBP12.5m in 2023 against GBP9.6m

in 2022.

Energy Business: Operating Profit, excluding the rebate of past

energy costs, at GBP9.3m, was GBP1.8m above the GBP7.5m achieved in

2022. This is due a GBP7.4m increase in revenues, following a

tariff price increase on 1 January 2023 which has been offset by a

GBP5.6m increase in wholesale energy costs and operating costs.

Operating costs have increased due to increased inflation and

increased investment in our systems and people, as we head into a

period of increased capital investment and enhancing our capability

as we continue to achieve our net-zero ambition and supporting the

GoJ in meeting its Carbon Neutral Roadmap objectives and a net-zero

Jersey.

Our 2023 in year Return on Assets (see other information,

Alternative Performance Measures, p127 of the 2023 Annual report

and Accounts) is 7.2% compared to 4.2% in 2022. This increase is

effectively a 'truing up' of prior years under recovery and

includes the rebate on prior year energy costs. We target Return on

Assets to be within a 6% to 7% range over a 5-year rolling average

basis. Our 2023 5-year rolling average Return on Assets is

6.2%.

Property: The GBP1.1m profit in our property division, is

GBP0.3m lower than in 2022 due to one of the commercial spaces

being vacated in March 2023. A new tenant is expected for the space

during early 2024.

Powerhouse.je: Our Powerhouse retail business saw profits fall

22% from GBP1.2m to GBP0.9m, despite a marginal fall in revenues of

1%, due to increased overheads in staff and storage costs.

JEBS: Profits fell by GBP0.1m across our building services

business due to an under recovery in revenue from a

lower-than-expected number of fuel switches. The reduction was due

to a slowing in the pace of switching for a short time as the

government incentive scheme was being launched.

Other business units (Jersey Energy, Jendev, Jersey Deep Freeze

and fibre optic lease rentals) produced combined profits of

GBP0.6m, being GBP0.1m higher than last year.

Net interest income was GBP0.3m in 2023 compared to a net

interest cost of GBP1.3m in 2022 due to a higher level of interest

earned on deposits from rising interest rates. Taxation at GBP3.4m

was higher than the previous year, due to increased taxable

profits.

Group basic and diluted earnings per share, at 36.81p, compared

to 27.17p in 2022, rose due to increased profitability. Dividends

paid in the year, net of tax, rose by 6%, from 17.80p in 2022 to

18.80p in 2023. The proposed final dividend for this year is

11.40p, a 6% rise on the previous year. Dividend cover, at 2 times

has increased from 1.5 times in 2022.

Net cash flows from operating activities at GBP17.6m was GBP3.6m

lower than in 2022. Investing activities, at GBP11.4m, was 3%

higher than the prior financial year. Dividends paid were GBP5.8m

compared to GBP5.5m in 2022. The resultant position was that net

cash at the year-end was GBP17.4m, being GBP30.0m of borrowings

offset by GBP47.4m of cash and cash equivalents, which was the same

as last year.

Consolidated Income Statement for the year ended 30 September

2023

2023 2022

GBP000 GBP000

Revenue 125,078 117,421

Cost of sales (80,924) (77,242)

Rebate of past energy costs - non recurring 3,593 -

item

------------------------------------------------ --------- ---------

Gross Profit 47,747 40,179

Movement in valuation of investment properties (1,215) 1,020

Operating expenses (32,010) (29,293)

------------------------------------------------- --------- ---------

Group operating profit 14,522 11,906

Finance income 1,871 218

Finance costs (1,528) (1,523)

------------------------------------------------- --------- ---------

Profit from operations before taxation 14,865 10,601

Taxation (3,432) (2,135)

Profit from operations after taxation 11,433 8,466

Attributable to:

Owners of the Company 11,280 8,326

Non-controlling interests 153 140

------------------------------------------------- --------- ---------

11,433 8,466

Earnings per share

- basic and diluted 36.81p 27.17p

Consolidated Statement of Comprehensive Income

2023 2022

GBP000 GBP000

Profit for the year 11,433 8,466

Items that will not be reclassified subsequently

to profit or loss:

Actuarial (loss)/gain on defined benefit

scheme (815) 8,976

Income tax relating to items not reclassified 163 (1,795)

--------------------------------------------------- -------- --------

(652) 7,181

Items that may be reclassified subsequently

to profit or loss:

Fair value (loss)/gain on cash flow hedges (3,361) 4,815

Income tax relating to items that may be

reclassified 672 (963)

--------------------------------------------------- -------- --------

(2,689) 3,852

Total comprehensive income for the year 8,092 19,499

Attributable to:

Owners of the Company 7,939 19,359

Non-controlling interests 153 140

--------------------------------------------------- -------- --------

8,092 19,499

Consolidated Balance Sheet as at 30 September 2023

2023 2022

GBP 000 GBP 000

NON-CURRENT ASSETS

Intangible assets 681 967

Property, plant and equipment 216,136 216,235

Right of use assets 3,194 3,280

Investment properties 27,615 28,830

Trade and other receivables 300 300

Retirement benefit asset 25,545 26,434

Derivative financial instruments 129 2,640

Other investments 5 5

----------------------------------------------- -------- ------------------

Total non-current assets 273,606 278,691

----------------------------------------------- -------- ------------------

CURRENT ASSETS

Inventories 9,187 7,173

Trade and other receivables 25,959 19,934

Derivative financial instruments 64 483

Cash and cash equivalents 47,429 47,397

----------------------------------------------- -------- ------------------

Total current assets 82,639 74,987

----------------------------------------------- -------- ------------------

Total assets 356,245 353,678

----------------------------------------------- -------- ------------------

LIABILITIES

Trade and other payables 19,459 21,043

Current tax liabilities 3,301 2,088

Lease liabilities 81 69

Derivative financial instruments 536 330

----------------------------------------------- -------- ------------------

Total current liabilities 23,377 23,530

----------------------------------------------- -------- ------------------

NET CURRENT ASSETS 59,262 51,457

----------------------------------------------- -------- ------------------

NON-CURRENT LIABILITIES

Trade and other payables 26,249 25,162

Lease liabilities 3,193 3,251

Derivative financial instruments 225 -

Financial liabilities - preference shares 235 235

Borrowings 30,000 30,000

Deferred tax liabilities 31,422 32,126

----------------------------------------------- -------- ------------------

Total non-current liabilities 91,324 90,774

----------------------------------------------- -------- ------------------

Total liabilities 114,701 114,304

----------------------------------------------- -------- ------------------

Net assets 241,544 239,374

----------------------------------------------- -------- ------------------

EQUITY

Share capital 1,532 1,532

Revaluation reserve 5,270 5,270

ESOP reserve (35) (38)

Other reserves (455) 2,234

Retained earnings 235,100 230,232

----------------------------------------------- -------- ------------------

Equity attributable to owners of the company 241,412 239,230

Non-controlling interests 132 144

----------------------------------------------- -------- ------------------

Total equity 241,544 239,374

----------------------------------------------- -------- ------------------

Consolidated Statement of Changes in Equity for the year ended

30 September 2023

Share Revaluation ESOP Other Retained Total

capital reserve reserve reserves* earnings

GBP GBP GBP GBP

000 GBP 000 000 000 000 GBP 000

At 1 October 2022 1,532 5,270 (38) 2,234 230,232 239,230

Total recognised income

and expense for the year - - - - 11,280 11,280

Amortisation of employee

share option scheme - - 3 - - 3

Movement on hedges (net

of tax) - - - (2,689) - (2,689)

Actuarial gain on defined

benefit scheme (net of

tax) - - - - (652) (652)

Equity dividends - - - - (5,760) (5,760)

At 30 September 2023 1,532 5,270 (35) (455) 235,100 241,412

======== ================== =========== ========== ============= ========

At 1 October 2021 1,532 5,270 (79) (1,618) 220,178 225,283

Total recognised income

and expense for the year - - - - 8,326 8,326

Amortisation of employee

share option scheme - - 41 - - 41

Movement on hedges (net

of tax) - - - 3,852 - 3,852

Actuarial gain on defined

benefit scheme (net of

tax) - - - - 7,181 7,181

Equity dividends - - - - (5,453) (5,453)

At 30 September 2022 1,532 5,270 (38) 2,234 230,232 239,230

======== ================== =========== ========== ============= ========

*'Other reserves' represents the foreign currency hedging

reserve.

Consolidated Statement of Cash Flows for the year ended 30

September 2023

2023 2022

GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Operating profit 14,522 11,906

Depreciation and amortisation charges 11,581 11,094

Share based reward charges 3 41

Loss/(gain) on revaluation of investment

property 1,215 (1,020)

Pension operating charge less contributions

paid 73 1,303

Deemed interest income from hire purchase

arrangements 183 50

Profit on sale of property, plant and

equipment (3) (7)

----------------------------------------------- --------- ---------

Operating cash flows before movement in

working capital 27,574 23,367

Working capital adjustments:

Increase in inventories (2,014) (257)

Increase in trade and other receivables (3,835) (1,926)

(Decrease)/increase in trade and other

payables (617) 4,444

----------------------------------------------- --------- ---------

Net movement in working capital (6,466) 2,261

Interest paid (1,368) (1,380)

Preference dividends paid (9) (9)

Income taxes paid (2,089) (3,020)

----------------------------------------------- --------- ---------

Net cash flows from operating activities 17,642 21,219

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (13,046) (11,001)

Investment in intangible assets (92) (319)

Deposit interest received 1,688 168

Net proceeds from disposal of fixed assets 3 7

----------------------------------------------- --------- ---------

Net cash flows used in investing activities (11,447) (11,145)

CASH FLOWS FROM FINANCING ACTIVITIES

Equity dividends paid (5,760) (5,453)

Dividends paid to non-controlling interest (165) (154)

Repayment of lease liabilities (242) (206)

----------------------------------------------- --------- ---------

Net cash flows used in financing activities (6,167) (5,813)

Net increase in cash and cash equivalents 28 4,261

Cash and cash equivalents at beginning

of year 47,397 43,136

Effect of foreign exchange rates 4 -

---------------------------------------------- --------- ---------

Cash and cash equivalents at end of year 47,429 47,397

Notes to the accounts

Year ended 30 September 2023

1. Basis of Preparation

The consolidated financial statements of Jersey Electricity plc,

for the year ended 30 September 2023, have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union (EU), including International

Accounting Standards and Interpretations issued by the

International Financial Reporting Interpretations Committee

(IFRIC). This is consistent with the accounting policies in the 30

September 2022 annual report and accounts and the 31 March 2023

interim report.

While the financial information included in this summary

announcement has been prepared in accordance with the appropriate

recognition and measurement criteria, this announcement does not

itself contain sufficient information to comply with IFRS. Full

financial statements that comply with IFRS have additionally been

published on our website; www.jec.co.uk.

Segmental information

Revenue and profit information are analysed between the business

segments as follows:

2023 2023 2023 2022 2022 2022

External Internal Total External Internal Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Energy - arising during the

course of ordinary business 97,053 89 97,142 89,683 100 89,783

Building Services 3,349 831 4,180 3,365 780 4,145

Retail 18,514 56 18,570 18,695 41 18,736

Property 2,350 641 2,991 2,345 639 2,984

Other* 3,812 466 4,278 3,333 625 3,958

-------------------------------------- --------- --------- -------- --------- --------- --------

125,078 2,083 127,161 117,421 2,185 119,606

Intergroup elimination (2,083) (2,185)

-------------------------------------- --------- --------- -------- --------- --------- --------

Revenue 125,078 117,421

Operating profit

Energy profit before rebate

of past energy costs** 9,329 7,502

Rebate of past energy costs 3,593 -

-------------------------------------- --------- --------- -------- --------- --------- --------

Energy profit including rebate 12,922 7,502

Building Services 162 266

Retail 917 1,174

Property 1,149 1,436

Other* 587 508

-------------------------------------- --------- --------- -------- --------- --------- --------

15,737 10,886

Revaluation of investment properties (1,215) 1,020

-------------------------------------- --------- --------- -------- --------- --------- --------

Operating profit 14,522 11,906

*Other segment includes the divisions of Jersey Energy, Jendev

as well as Jersey Deep Freeze Limited, the Group's sole

subsidiary.

Materially, all the Group's operations are conducted within the

Channel Islands. All transfers between divisions are on an

arms-length basis. The revaluation of investment properties is

shown separately from Property operating profit.

Revenues disclosed by the business segments above are recognised

both on a point in time and over time basis. The treatment of

revenue recognition in accordance with IFRS 15 is detailed for each

of these business segments in note 1 in the full version of these

financial statements.

**During the year ended 30 September 2023, the Company received

a credit which has been disclosed as 'Rebate of past energy costs -

non-recurring item' within gross profit in these financial

statements. This was a rebate from the French network operator

(RTE) in respect of payments made in 2022 which they were

instructed to return to us as part of a regulatory decision due to

volatility in the energy marketplace during 2022. Due to the

unknown timing, amount and eligibility regarding this

reimbursement, it was not possible to disclose this rebate in

relation to the prior year ending 30 September 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAXAEALNDFFA

(END) Dow Jones Newswires

December 20, 2023 12:51 ET (17:51 GMT)

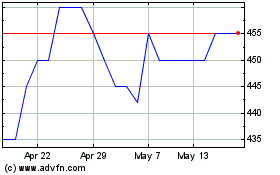

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Jan 2024 to Jan 2025