RNS Number:4952X

Dart Group PLC

20 June 2002

FOR IMMEDIATE RELEASE 20 June 2002

DART GROUP PLC

PRELIMINARY RESULTS FOR YEAR ENDED 31 MARCH 2002

Dart Group PLC, the distribution and aviation services group, announces its

preliminary results for the year ended 31 March 2002.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the year ended 31 March 2002.

Profit before tax and before the amortisation of goodwill has risen to £10.0m

(2001 - £9.7m), on turnover of £194.2m (2001 - £190.9m). Earnings per share

before the amortisation of goodwill were 19.87p (2001 - 19.4p). The Board is

recommending a final dividend of 4.26p (2001 - 4.16p) taking the total dividend

for the year to 6.11p (2001 - 5.96p), an increase of 2.5%. The dividend, if

approved, will be payable on 23 August 2002 to shareholders on the register on

28 June 2002.

The last financial year has been a challenging one for the Group with less

buoyant trading conditions leading to lower than expected turnover in the

Distribution Division and markedly higher aviation, vehicle and general

insurance costs. Despite the challenges, the Group has progressed during the

year.

Capital expenditure amounted to £26.9m (2001 - £24.3m) and mainly related to

the purchase of the Group's second Boeing 737-300QC aircraft, aircraft

maintenance, the purchase of land and buildings at its consolidation centres in

Kent, and a new computer system for the Distribution Division. Net borrowings

at 31 March 2002 stood at £22.5m (2001 - £2.3m), which represents gearing of 66%

(2001 - 8%). On 3 May 2002 the Group announced the acquisition of four

Boeing 737-300 aircraft which had previously been in service with Ansett

Australia Ltd.

The Group has two operating divisions - Aviation Services and Distribution, the

activities of which are also described in the more detailed Review of Operations

following this statement.

Aviation Services

In June and August of 2001, Channel Express (Air Services) commenced operating

two Boeing 737-300 Quick Change aircraft which the Group had purchased from

Lufthansa. The Quick Change concept allows the interiors of the aircraft to be

reconfigured between passenger and freighter roles in less than 45 minutes,

enhancing the aircraft's earning potential.

The aircraft are currently based at Stansted and Edinburgh airports and each

operates night mail flights and day-time passenger charters. Whilst the Group

believes that there are a limited number of airports at which both day-time

passenger and night-time freight operations can be successfully combined in this

way, we also see potential for Boeing 737-300 aircraft that have been converted

to pure freighters to take over the operation of night freight services from

older, noisier aircraft that are currently being retired for environmental

reasons.

The Group has, therefore, purchased four additional Boeing 737-300s which had

been in passenger service with Ansett Australia Ltd since new. These aircraft

are being delivered in the first half of the current financial year. Two will

initially remain as passenger aircraft whilst two are converted to freighter or

Quick Change configuration. These will be re-delivered to us in 2003. The new

aircraft are expected to make a positive contribution to the profitability of

the Group in the 2003/04 financial year. The Group anticipates adding further

Boeing 737 series aircraft to its fleet in due course and Channel Express (Air

Services) aims to become one of the leading European providers of the type,

together with associated training and parts support services.

Channel Express (Air Services) also currently operates four Airbus A300 "

Eurofreighters", seven Fokker F27s and one remaining Lockheed Electra cargo

aircraft which are contracted to operate cargo services on behalf of express

parcel companies, postal authorities, freight forwarders and other airlines.

Together the fleet offers customers payload capacities of 6 tonnes (F27), 17

tonnes (B737) and 45 tonnes (A300). This range of payloads enables us to match

our customers' needs as they develop their services.

In line with the growth of the Group's aircraft operations, Channel Express

Parts Trading, our aircraft spares business, is expanding its services to also

provide parts support for the Group's Boeing 737s and for those of other

operators. Office and warehouse premises have recently been taken at Stansted

airport, at which the low cost passenger airlines operate large fleets of Boeing

737s. We expect the development of the Group's operations with the type to

offer good opportunities for Parts Trading, which has hitherto mainly

specialised in supporting Airbus A300s, operated by both ourselves and other

airlines.

I am also delighted to report the excellent progress made by our freight

management company, Benair Freight International. Against industry trends,

this company's business has profitably developed reflecting the high standard of

service it provides.

Distribution

The Dart Distribution companies have continued to develop their services in

order to meet the ever evolving requirements of their supermarket customers.

Over the past few years the Group has built its distribution business both

organically and through the acquisition in 1994 of Fowler Welch, which

distributes fresh produce grown in and imported into Lincolnshire, and the

acquisition in 1999 of Coolchain, which distributes locally grown and imported

fruit from its centres in Kent.

The division has continued to win new business during the financial year.

However, turnover has shown relatively little growth due to, it is believed,

both poor trading conditions in the first half, a tighter economy and

refinements in the way our customers organise the supply of their products.

A significant development affecting the Distribution Division's operations in

the year ahead will be the introduction of "factory gate" pricing whereby the

retailer takes responsibility for product, including its distribution, from

suppliers at the point of despatch. The division's challenge will be to meet

the price expectation of our supermarket customers whilst still delivering the

service they have come to expect. We are acutely aware of the fundamental

importance of the division's role in the extremely efficient multiple retailers'

supply chains and take our responsibilities in the distribution of highly

perishable products very seriously.

The distribution of fresh produce and other short shelf-life products is both

specialised and time-sensitive requiring hands-on and dedicated managers who are

used to working long and anti-social hours. Volumes can vary dramatically with

both weather and social factors influencing short-term demand. We are

fortunate to have highly experienced management in the companies within this

division. They fully recognise that the division must continually develop and

re-organise its business to deliver a quality service at the most competitive

price.

The Dart Distribution Division is well placed to benefit from the expected

long-term growth in the consumption of fresh produce and freshly prepared

chilled foods. The distribution industry is expected to continue to

consolidate and the Group's policy remains to grow both organically, by winning

more business, and through carefully selected acquisitions.

Our Staff

Both the Aviation Services and Distribution divisions operate 24 hours a day,

365 days a year, offering time sensitive specialised services. The Group is,

therefore, uniquely dependent on the contribution of every member of the

operational and administrative teams. Our continued success is a reflection of

our dedicated and hard working staff to whom I am extremely grateful. We are

committed to promoting from within wherever possible, to training and personal

development and, through best health and safety practices, to the development of

a safe workplace.

Outlook

I believe increased profits will be difficult to achieve in the current

financial year. However, I expect the addition of the Group's further Boeing

737-300 aircraft to enable profit growth to resume thereafter with both

divisions being well positioned to take advantage of opportunities in their

evolving markets. Finally, I am pleased to say that the current year's trading

has commenced satisfactorily.

Philip Meeson

Chairman

20 June 2002

For further information about Dart Group PLC and its subsidiary companies please

visit our website, http://www.dartgroup.co.uk/

REVIEW OF OPERATIONS

Aviation Services

With the addition of the four Boeing 737-300 aircraft purchased by the Group in

May 2002 from the Administrators of Ansett Australia Ltd, Channel Express (Air

Services) will be operating 18 aircraft, flying contract services on behalf of

express parcel companies, postal authorities, freight forwarders and other

passenger and cargo airlines throughout Europe and to the Middle East.

The company's current operating freighter fleet consists of four Airbus A300 "

Eurofreighters", each offering a payload of 45 tonnes, two Boeing 737-300 Quick

Change (QC) aircraft offering 17 tonnes, seven Fokker F27s offering 6 tonnes and

our remaining 15 tonne payload Lockheed Electra.

After an extensive analysis of the European cargo market's likely future

aircraft requirements, the company chose to develop its operations with the

Boeing 737 series. Increasingly stringent airport noise regulations are

hastening the retirement of older freighters, such as the Boeing 727 series

which carry up to 27 tonnes and have until now been the backbone of express

carriers' fleets. Its slightly larger replacement, already chosen by one

leading operator, is the Boeing 757-200 offering a payload of 30 tonnes. It

is believed that Boeing 737-300 freighters, with up to 18 tonnes payload, will

be needed to serve less developed and lower volume routes. The company's

Lockheed Electra aircraft previously filled this niche.

Of the six Boeing 737-300s now owned by the Group, two are already operating in

QC configuration allowing them to carry cargo or passengers, and two will be

converted to QCs or dedicated freighters during 2003. Two will remain as

passenger aircraft until they are also converted in 2004.

The dual role passenger or freighter capability of the QC aircraft obviously

enhances the potential to maximise utilisation. However, timing is critical to

the success of Quick Change operations in order to complete day-time passenger

flying prior to the role change and commencement of time sensitive night freight

flights. This does limit the level of day-time utilisation achievable and the

number of suitable airports at which the Quick Change concept can be used.

The reception that the company's current passenger and cargo service has

received from its customers has been very encouraging. The Group's two owned

QC aircraft, based at Edinburgh and Stansted airports, are each contracted to

fly approximately 1,000 hours of passenger services during the months April to

October this year. At night the aircraft fly mail services between the two

airports on behalf of the Royal Mail and together the combination produces an

efficient, value for money service for both the Royal Mail and our passenger

customers.

The financial difficulties which led to the administration of Ansett Australia

Ltd offered the Group the opportunity to acquire four well-maintained Boeing

737-300s, which had been with the same operator since new, at a competitive

price. During the period that these aircraft are being converted to QCs or

freighters their contribution to the Group will be limited. However, the Boeing

737 fleet is expected to make increasing positive contributions to the long-term

profitability of the Group from the 2003/4 financial year from both freight and

passenger flying.

Channel Express (Air Services) currently operates four Airbus A300

"Eurofreighters" - two of which are owned by the Group, with two on flexible

lease terms from Finova Capital Corporation. During the year the Eurofreighter

has achieved a remarkable 99.5% technical record of on-time departures. This

is a reflection of the excellent teamwork between our aircrew and engineering

staff and the company is naturally proud of this result.

The Fokker F27 turbo prop fleet remains busy flying express parcel and mail

services and the Group's own general freight service to and from the Channel

Islands for which the type is ideally suited. In recent years this fleet has

suffered from a high turnover of pilots, with staff being attracted to other

operators of jet aircraft as they expanded. A less buoyant industry generally

and the prospect of a clear promotional path to the Boeing 737 fleet has

resulted in better retention of F27 pilots, increasing operational standards and

reducing training costs. The company expects to operate F27s for several years

to come and is investing in an upgrade programme to meet the Royal Mail's need

for higher volumes and quicker loading by fitting a new load netting system

thereby enhancing the competitiveness of the aircraft.

We are particularly proud of the excellent training offered to aircrew joining

and progressing through Channel Express (Air Services)' fleets. The high

standards that result, coupled with the professional and dedicated support of

our engineers, enables the company to offer its customers reliable and efficient

operations - we are extremely grateful to everyone concerned.

Whilst Channel Express Parts Trading continues to be a major supplier of Airbus

A300 aircraft components, this year it has focused on extending its product

range and establishing a new parts distribution facility at Stansted airport.

Consignment stock agreements have been negotiated with a number of repair

vendors and parts suppliers for Parts Trading to manage, on their behalf,

stocks for various aircraft types, in particular the Boeing 737. These

arrangements enable Parts Trading to profitably develop its market and

customers, with access to trading stocks that do not require capital investment.

Equally, this allows the Group to have access to low cost spares to support

its own airline's operations, in particular at Stansted, which is becoming an

increasingly important operational base.

Channel Express Parts Trading has recently been awarded a contract to manage the

aircraft stores for a leading low cost airline at its Stansted facility which

promises potential for future mutual business activities.

Benair Freight International, our freight management company, has made progress

during the year in a competitive and demanding market. Benair has

strategically placed offices at London Heathrow, Manchester, East Midlands and

Newcastle airports, together with a wholly-owned subsidiary in Singapore. The

company has a number of niche business areas - the importation of tropical and

fresh water ornamental fish, special logistics services for the aviation and

other time sensitive industries and high quality freight management services to

the USA and Far East.

A further service offered this year has been the introduction of a

temperature-controlled storage facility at the company's Heathrow branch. This

is marketed as the Heathrow Perishables Centre and has enabled Benair to expand

its services to serve the Distribution Division's customers, arranging the

seamless temperature-controlled importation and distribution of fresh produce.

Outlook

The Group expects to lease or purchase further Boeing 737 series aircraft and

will offer them to its customers as either full freighters, QC or dedicated

passenger aircraft. Additionally, its existing aircrew and engineering

training facilities are expected to be developed for the training of personnel

from other companies to whom parts support will also be offered through Channel

Express Parts Trading. The Group also plans to continue to carefully expand

Benair's business particularly in its key specialist areas.

Distribution

The year to 31 March 2002 has been one of both opportunities and challenges for

the Dart Distribution companies, Fowler Welch, Coolchain and Channel Express

(CI) and has seen continuing development of their core business activities.

Overall, the division operates from some 500,000 sq ft of temperature-controlled

consolidation facilities and manages a road fleet of over 500 vehicles providing

nationwide temperature-controlled distribution services for fresh produce,

chilled foods and horticultural products on behalf of supermarkets, suppliers

and to traditional wholesale markets.

Fowler Welch and Coolchain have strategically located consolidation centres in

the UK's prime fresh produce growing and horticulture regions. A wide range of

ancillary services is offered for UK and imported temperature-controlled

products, including stock management, pre-packing and labelling prior to

despatch.

The Dutch subsidiary, Fowler Welch BV, operates a daily service into Britain

from the continent, feeding flowers and fresh produce into the division's UK

network. The Group's Channel Islands based subsidiary, Channel Express (CI), is

a provider of temperature-controlled and air transport services for Guernsey and

Jersey horticulture and fresh produce exporters and of temperature-controlled

and express freight services into both Islands from the UK.

As well as their traditional core business of handling fresh produce and

horticulture, the companies are increasingly involved in the distribution of

pre-prepared salads, dairy based foods and ready meals. Deliveries are made 24

hours a day, seven days a week, on behalf of growers, importers and producers of

these short shelf-life products to the regional distribution centres of leading

supermarket chains, traditional wholesale markets and for companies supplying

brewery chains, petrol stations, convenience stores, fast food restaurants and

similar outlets.

Trading during the year has been less buoyant than in previous years with lower

than anticipated turnover generated through the distribution network. Moreover,

retailers are now taking a more active role in the total distribution process

and are seeking further efficiencies from their supply chains.

These factors are creating changes in the overall shape of the division's

business, with some retailers moving to "factory gate" pricing structures with

their suppliers whereby they take responsibility for goods at the point of

despatch. Where this is the case, this has led to a change in the commercial

relationship, with control of the distribution process passing from the supplier

to the retailer as customer.

The continuing evolution of the organisation of the supply chain is creating

demands that are becoming ever more sophisticated and complex. Some multiple

retailers' policies to introduce, for example, continuous store replenishment

techniques have required vehicle loads to comprise smaller quantities of a

greater range of products. To accommodate this, and to provide a high quality

and cost effective service, the division is continuing its development of the

use of multi-temperature warehouses and delivery vehicles together with

management tools such as those provided by the new single computer operating

system.

The division's project to introduce a single computer operating system, which

will offer each of its consolidation centres full visibility of the vehicle

fleet, has progressed during the year. Channel Express (CI) in Guernsey and

Jersey and Coolchain's Portsmouth and Southampton centres are now on line.

Coolchain's remaining operations and Fowler Welch's sites will implement the

system during the first half of the new financial year. Once the software is

fully commissioned, traffic managers will have on line visibility of all vehicle

movements across the division's network. This single operating system is a

platform from which all business processes can be integrated.

The recently introduced satellite trailer tracking system is now proving to be

an important aid to fleet and load security as well as to the utilisation of

vehicle resources. It is intended to link the resultant data into the new

single operating system to provide real time visibility of on board consignments

and route monitoring.

The division employs some 1,200 experienced and dedicated staff. Their health,

well-being and individual development needs are provided for by a comprehensive

programme of health and safety training and skills development courses. New

initiatives, such as increased emphasis on in-house driver training to develop a

larger pool of skilled labour will be introduced in the coming year to respond

to the industry shortages and help staff understand the complexities of meeting

the new service level criteria.

The Fowler Welch main consolidation centre is situated on its 20 acre site at

Spalding from which the division's central and northern supplier base is served.

The centre is supported by secondary consolidation facilities at Chatteris in

Cambridgeshire and Selby, North Yorkshire.

In May 2002, Fowler Welch won significant additional fresh and chilled

temperature-controlled distribution business from a major retailer. This has

been gained against a highly competitive background with a commitment to a cost

efficient operation and continued high service levels. An operating agreement

will be entered into with the retailer which will further strengthen

relationships and provide a platform for future opportunities to develop the

business.

Fowler Welch BV has continued to position itself as the leading provider of

transport to the retail horticulture market between the Netherlands and the UK.

It has also been successful in strengthening its trading relationships with

existing customers and forging links with new users. A new, leased 10,000

square feet temperature-controlled facility has been opened within the

Honselersdijk Flower Market complex in Holland, providing increased capability

to handle new business opportunities. The company has also formed alliances

with other like-minded continental transport operators to widen its European

penetration.

Coolchain has principal operating centres at Teynham and Paddock Wood in Kent

and Portsmouth, Hampshire. These facilities are supported by secondary

operations at Gateshead (Tyne and Wear), Warrington (Cheshire), Southampton

(Hampshire) and Sheerness (Kent).

During the year, Coolchain has been able to increase its efficiency in a number

of operational areas and thereby realise reductions in its cost base. In order

to enable the company to centralise its operations, a new modular office complex

has been installed at Teynham to accommodate its administration, finance and

other support staff.

In October 2001 the company purchased the freehold of its Paddock Wood

consolidation centre, not only to create greater flexibility in the use of its

accommodation both by its own operation and by its tenant suppliers, but also to

extinguish its rental commitments there.

English fruit production in Kent experienced a better than expected season last

year, helping bolster throughput. Sheerness continues to be the country's main

seaport of entry for globally sourced fresh produce, generating important

volumes for distribution. The Teynham packhouse has also benefited from new

work from a supermarket supplier based within the Coolchain facility.

The Portsmouth consolidation and distribution centre has successfully managed

another season of Canary Island imports with volume increases and service level

improvements and was also successful in gaining further business on behalf of a

major retailer in November.

Channel Express (CI), the Channel Islands company, maintains its important role

as a provider of air, sea and road services to the communities of Guernsey and

Jersey. The company's core activity is the export of flowers, pot plants and

fresh produce from the Islands, as well as the importation of

temperature-controlled and time sensitive freight from the UK. Portsmouth is

also the gateway for traffic handled by Channel Express (CI) with its export

volumes being consolidated with south coast products prior to UK delivery.

The company has experienced new growth in its distribution activities during the

year. The Islands' tax regime has encouraged mail order and internet-based

retailers, specialising in plug plants, flowers in boxes and other products

such as health foods and CDs, to market their operations via the Islands

leading to an increase in the company's import and export traffic flows.

Channel Express, as one of the principal carriers for the Guernsey Post Office,

has benefited from this new work.

Outlook

The preference for healthy eating is maintaining strong customer demand for

chilled and fresh goods such as pre-packed salads, chilled foods and ready made

meals. The division's retail customers constantly seek new products attractive

to consumer lifestyles and redefine their own supply chain techniques to achieve

maximum cost efficiency. Increased involvement by supermarkets in the methods

used for the movement of products from suppliers to either their regional

distribution centres or stores has introduced new challenges for the division.

Although continued innovation will continue to be a feature of business during

the coming year, it is anticipated that there will be a period of settling down

within the supply chain as some of the new strategic plans bed down. The

division will continue to concentrate on growing its businesses organically and

developing related business opportunities within the distribution sector.

The view ahead is therefore one of confidence but with a recognition that the

division will need to continue to innovate and work with even greater

operational flexibility. However, the scale of the division, the expertise at

its disposal and its established business relationships put it in a sound

position to meet the challenges ahead.

For further information contact:

Dart Group PLC Tel: 01202 597676

Philip Meeson,

Group Chairman and Chief Executive Mobile: 07785 258666

Mike Forder,

Group Finance Director Mobile: 07721 865850

Consolidated Profit And Loss Account

for the year ended 31 March 2002

2002 2001

Note £'000 £'000

Turnover

Continuing operations 194,242 190,912

Net operating expenses, excluding amortisation of goodwill (183,233) (180,630)

Amortisation of goodwill (497) (497)

Net operating expenses (183,730) (181,127)

Operating profit

Continuing operations 10,512 9,785

Profit on disposal of fixed assets 232 18

Net interest payable (1,257) (592)

Profit on ordinary activities

before taxation 9,487 9,211

Taxation (3,179) (3,085)

Profit on ordinary activities

after taxation 6,308 6,126

Dividends (2,094) (2,040)

Retained profit for the year 4,214 4,086

Earnings per share

- basic 4 18.41p 17.94p

- basic, excluding the amortisation of goodwill 4 19.87p 19.40p

- diluted 4 18.25p 17.77p

Statement of Total Recognised Gains and Losses

2002 2001

£'000 £'000

Profit on ordinary activities after taxation 6,308 6,126

Exchange (loss)/gain on foreign equity investment (18) 33

6,290 6,159

Balance Sheet

at 31 March 2002

Group Company

2002 2001 2002 2001

Note £'000 £'000 £'000 £'000

Fixed assets

Intangible assets 8,774 9,271 - -

Tangible assets 54,790 41,534 43,271 32,388

Investments - 59 18,279 18,279

63,564 50,864 61,550 50,667

Current assets

Stock 2,507 1,756 - -

Debtors 29,817 29,965 7,639 4,841

Cash at bank and in hand 1,356 7,061 4 1,101

33,680 38,782 7,643 5,942

Current liabilities

Creditors: amounts falling due

within one year (39,546) (49,301) (35,754) (37,421)

Net current liabilities (5,866) (10,519) (28,111) (31,479)

Total assets less current liabilities 57,698 40,345 33,439 19,188

Creditors: amounts falling due after

more than one year (18,970) (6,790) (17,630) (4,867)

Provision for liabilities and charges (4,432) (3,569) (3,987) (3,207)

(23,402) (10,359) (21,617) (8,074)

34,296 29,986 11,822 11,114

Capital and reserves

Called up share capital 1,716 1,710 1,716 1,710

Share premium account 7,659 7,551 7,659 7,551

Profit and loss account 24,921 20,725 2,447 1,853

Shareholders' funds - equity interests 2 34,296 29,986 11,822 11,114

Consolidated Cash Flow Statement

for the year ended 31 March 2002

2002 2001

Note £'000 £'000

Net cash inflow from operating activities 3 21,566 24,909

Returns on investment and servicing of finance (1,257) (592)

Taxation (2,343) (2,089)

Capital expenditure and financial investment (36,205) (12,877)

Equity dividends paid (2,052) (1,798)

Cash (outflow)/inflow before financing (20,291) 7,553

Financing 13,805 (8,147)

Decrease in cash in the year (6,486) (594)

Reconciliation of net cash flow to movement in net debt

2002 2001

£'000 £'000

Decrease in cash in the year (6,486) (594)

Cash outflow from (increase)/decrease in net debt in the year (13,691) 8,267

Change in net debt in the year (20,177) 7,673

Net debt at 1 April (2,326) (9,999)

Net debt at 31 March (22,503) (2,326)

1. Turnover

2002 2001

£'000 £'000

Distribution 120,313 116,065

Aviation Services 73,929 74,847

_______ _______

194,242 190,912

_______ _______

Turnover arising within:

The United Kingdom and the Channel Islands 188,671 185,931

Mainland Europe 4,143 3,300

The Far East 1,428 1,681

________ _______

194,242 190,912

_________ _______

Turnover to third parties by destination is not materially different to that by

source and relates to continuing activities.

2. Reconciliation of movements in shareholders' funds

Group Company

2002 2001 2002 2001

£'000 £'000 £'000 £'000

Profit for the year 6,308 6,126 2,688 3,324

Dividends (2,094) (2,040) (2,094) (2,040)

______ ______ ______ ______

4,214 4,086 594 1,284

Currency translation differences (18) 33 - -

Issue of shares under share option schemes 114 119 114 119

_____ ______ _____ ______

Net addition to

shareholders' funds 4,310 4,238 708 1,403

Opening shareholders' funds 29,986 25,748 11,114 9,711

______ ______ ______ _____

Closing shareholders' funds 34,296 29,986 11,822 11,114

______ ______ ______ _____

3. Reconciliation of operating profit to net cash flow from operating

activities

2002 2001

£'000 £'000

Operating Profit 10,512 9,785

Depreciation 12,527 14,690

Amortisation of goodwill 497 497

(Increase)/decrease in stock (751) 17

Decrease/(increase) in debtors 148 (4,776)

(Decrease)/increase in creditors (1,349) 4,663

Exchange differences (18) 33

______ ______

Net cash inflow from operating activities 21,566 24,909

______ ______

4. Earnings per share

The calculation of basic earnings per share is based on earnings

for the year ended 31 March 2002 of £6,308,000 (2001 - £6,126,000) and on

34,255,405 shares (2001 - 34,143,816) being the weighted average number of

shares in issue for the year.

The calculation of basic earnings per share, excluding the

amortisation of goodwill, is based on earnings of £6,805,000, as calculated

below, for the year ended 31 March 2002 (2001 - £6,623,000) and on 34,255,405

shares (2001 - 34,143,816) being the weighted average number of shares in

issue for the year.

2002 2001

£'000 £'000

Profit on ordinary activities after taxation 6,308 6,126

Amortisation of goodwill 497 497

_____ _____

6,805 6,623

_____ _____

The diluted earnings per share is based on earnings for the year ended 31 March

2002 of £6,308,000 (2001 - £6,126,000), and on 34,571,105 ordinary shares

(2001 - 34,474,149) calculated as follows:

2002 2001

000's 000's

Basic weighted average number of shares 34,255 34,144

Dilutive potential ordinary share:

Employee share options 316 330

_______ ______

34,571 34,474

_______ ______

5. The financial information for the years ended 31 March 2001 and 2002

does not constitute statutory accounts, as defined in Section 240 of the

Companies Act 1985, but is based on the statutory accounts for the years then

ended. Statutory accounts for the year ended 31 March 2001, on which the

auditors issued an unqualified opinion pursuant to Section 235 of the Companies

Act 1985, have been filed with the Registrar of Companies. Statutory accounts

for the year ended 31 March 2002, on which the auditors issued an unqualified

opinion pursuant to Section 235 of the Companies Act 1985, will be filed with

the Registrar of Companies in due course.

6. The proposed final dividend of 4.26 pence per share will, if

approved, be payable on 23 August 2002 to shareholders on the Company's register

at the close of business on 28 June 2002.

7. The 2002 Annual Report and Accounts (together with the Auditors

Report) will be posted to shareholders on 12 July 2002. The Annual General

Meeting will be held on 8 August 2002.

This information is provided by RNS

The company news service from the London Stock Exchange

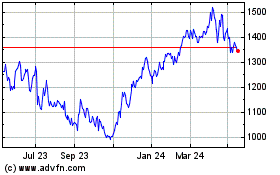

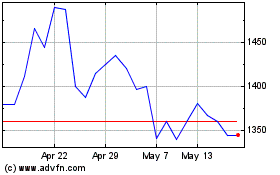

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024