KCR Residential REIT PLC New Borrowing (9067A)

04 January 2018 - 6:00PM

UK Regulatory

TIDMKCR

RNS Number : 9067A

KCR Residential REIT PLC

04 January 2018

4 January 2018

KCR Residential REIT plc

New Borrowing

KCR Residential REIT plc ("KCR" or the "Company") is pleased to

announce that it has refinanced the outstanding GBP1.1 million loan

made to the Company on 27 May 2016 and received a further

GBP775,000, taking the total new loan (the "2018 Loan") to

GBP1,875,000.

The net proceeds (after repayment of the original loan) of the

2018 Loan will be applied to the purchase of a further two

long-leasehold apartments within one of its freehold retirement

residential developments, with the balance of the proceeds retained

for working capital purposes.

The 2018 Loan attracts interest at a rate of 12 per cent. per

annum, payable quarterly in arrears and is repayable in full by 2

January 2019. The 2018 Loan is not convertible into equity in the

Company but is secured by a first charge on the shares held by the

Company in K&C (Osprey) Limited ("Osprey"), a wholly owned

subsidiary of the Company. Whilst any of the 2018 Loan is

outstanding, the Company has undertaken to utilise 60 per cent. of

the net proceeds of any disposals of properties held within Osprey

towards reducing the outstanding balance of the 2018 Loan and any

interest then due.

The 2018 Loan has been made to the Company by a consortium of

lenders (the "Lenders"). The pension scheme of Timothy Oakley (the

"Oakley Pension Scheme"), who is a director of K&C (Coleherne)

Limited, a subsidiary of the Company, and a former director of KCR,

is one of the Lenders and is lending GBP275,000 of the 2018 Loan.

This loan is classified as a related-party transaction under the

AIM Rules for Companies.

The directors of KCR consider, having consulted the Company's

nominated adviser, Arden Partners plc, that the terms of the loan

by the Oakley Pension Scheme are fair and reasonable insofar as

shareholders in the Company are concerned.

The purchases of the two apartments are consistent with the

Company's stated strategy to acquire leaseholds within the Osprey

portfolio in order to build long-term value and improve yield

generation. The apartments will be refurbished and added to KCR's

residential property portfolio with a view to Osprey granting long

leases in respect of the apartments.

Contacts:

KCR Residential REIT plc info@kcrreit.com

Dominic White, Chief executive +44 20 3793

5236

Arden Partners plc

William Vandyk

Steve Douglas +44 20 7614 5917

Yellow Jersey PR +44 7747 788

Charles Goodwin 221

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders

through the acquisition of SPVs (Special Purpose Vehicles) with

inherent historical capital gains. The Directors intend that the

group will acquire, develop and manage residential property assets

in residential areas in the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODSSWFWDFASELF

(END) Dow Jones Newswires

January 04, 2018 02:00 ET (07:00 GMT)

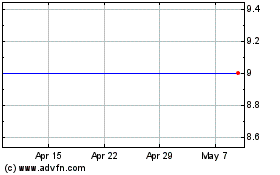

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2024 to May 2024

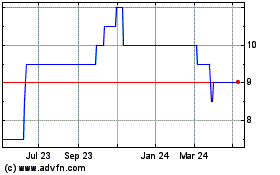

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From May 2023 to May 2024