TIDMKEFI

Kefi Gold and Copper PLC

15 March 2022

REACH

15 March 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

KEFI Focused on Three Initial Open Pit Gold Operations

Rescheduled Investor Webinar and Updated Company

Presentation

KEFI (AIM: KEFI), the gold and copper exploration and

development company with projects in the Federal Democratic

Republic of Ethiopia and the Kingdom of Saudi Arabia, is pleased to

announce that its next Investor Webinar will be held at 3pm London

time on Friday 8 April 2022 via the Investor Meet Company platform,

following the anticipated release of the Company's Q1 2022

Quarterly Operational Update.

The Company also advises that an updated presentation is

available today on the Company's website at

https://www.kefi-goldandcopper.com .

This presentation sets out the Company's position that following

recent positive developments in both Ethiopia and Saudi Arabia, and

the improved gold price outlook, the Company is refining its

development strategy by focusing on sequentially developing three

initial open pit gold (and silver) operations - Tulu Kapi in

Ethiopia, Jibal Qutman in Saudi Arabia, followed by Hawiah in Saudi

Arabia. The initial developments at each project would then planned

to be followed by deeper self-funded developments at all three

projects which, at Hawiah, would also yield copper and zinc.

Tulu Kapi, planned to be c. 70%-owned by KEFI, has a granted

mining licence and is construction-ready for a start-up at the

initial production rate of 140,000 oz per annum of gold. The

current focus is on satisfying the conditions precedent for

completing its project financing in mid-2022. The Company believes

that all capital requirements have been arranged via the indicative

offers and non-binding commitments received.

At Jibal Qutman, planned to be 30%-owned by KEFI, development

planning has been re-activated following indications from the

regulatory authorities that the Mining Licence would be clarified

in 2022. The original 2015 Preliminary Economic Assessment was for

an initial production rate of 35,000 oz pa of gold with capital

requirement of US$39 million, targeted to be project-financed as to

75% by project debt, 70% by partners' equity and the remaining US$3

million by KEFI.

Hawiah, planned to be 30%-owned by KEFI, reported its maiden

Mineral Resource Estimate ("MRE") in 2020 and an increased MRE in

January 2022. It is part-way through a Preliminary Feasibility

Study ("PFS"). It is likely that Hawiah's development would follow

that of Tulu Kapi and Jibal Qutman. Given recent successful

exploration results showing near-surface gold at Hawiah and the

nearby Al Godeyer exploration licences, the PFS is being refocused

onto the possibility of initial open pit gold mining, to be

followed by underground mine development to also recover copper and

zinc. Capital requirements for this 2.2 million oz gold-equivalent

project (Hawiah MRE announced on 4 January 2022 of 24.9 Mt at 0.90%

copper, 0.85% zinc, 0.62 g/t gold and 9.81 g/t silver), are

anticipated to be covered by project-level funding combined with

projected surplus cash flows in due course from Tulu Kapi.

Harry Anagnostaras-Adams, KEFI Executive Chairman, commented:

"It is great to see the recent turnaround in Ethiopia coinciding

with a take-off of our projects in Saudi Arabia. KEFI has turned

onto the front foot in both jurisdictions, after some particularly

frustrating years in both.

"We have focused the development planning teams onto starting

with gold open pits in all three projects, to minimise start-up

timetables and capitalise on what seems a very positive gold price

outlook."

Investor Webinar

The Company will provide a Quarterly Update presentation via the

Investor Meet Company platform at 3.00 pm London time on Friday 8

April 2022.

Investors can register to attend using the following link:

https://www.investormeetcompany.com/kefi-gold-and-copper-plc/register-investor

Questions can be submitted pre-event via your Investor Meet

Company dashboard up until 9 am the day before the meeting, or at

any time during the live presentation. Investors who already follow

KEFI on the Investor Meet Company platform will automatically be

invited.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

WH Ireland Limited (Joint Broker) +44 (0) 20 7220 1666

Katy Mitchell, Andrew de Andrade

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

Notes to Editor

KEFI Gold and Copper plc

KEFI started as a grassroots explorer equity-funded via AIM and

is now the operator of large exploration and development joint

ventures with strong local partners in the Arabian-Nubian Shield,

with most funding being sourced at the project level.

KEFI is focused primarily on the development of its advanced

development projects in both Ethiopia and Saudi Arabia, plus the

expansion of its resource base at these projects and through

exploration of its other prospects in the Arabian-Nubian Shield.

KEFI targets that production at its three development projects,

starting with Tulu Kapi Gold in Ethiopia and adding production from

Jibal Qutman Gold and Hawiah Copper-Gold in Saudi Arabia will

generate cash flows for capital repayments, further exploration and

dividends to shareholders.

The following tabular summary presents KEFI's updated estimated

share of the projects' aggregate NPV's, as at mid-2022:

Pence

Tulu Kapi Hawiah Jibal Qutman Total Issued Per

NPV NPV NPV NPV Shares Share

Net Present Value

for KEFI as 31 December

2021 metal prices

30/06/2020 GBP114m 0 0 GBP114m 1,867m 6

31/12/2020 GBP164m GBP80m 0 GBP244m 2,137m 11

30/06/2021 GBP205m GBP74m 0 GBP279m 2,153m 13

31/12/2021 GBP191m GBP128m GBP29m GBP348m 2,939m 12

Footnotes:

Assumed exchange rate was US$1.35:GBP1.00

JV ownership levels: Ethiopia 45% in 2020 and 70% in 2021;

Saudi 34% in 2020 and 30% in 2021

31 January 2021 Analyst Consensus

31 December 2021 Metal Prices: Long Term Prices

Gold Price is US$1,830/oz Gold Price is US$1,607/oz

Copper Price is: US$9,750/t Copper Price is: US$7,590/t

Zinc Price is US$3,590/t Zinc Price is US$2,442/t

Silver Price is US$23/oz Silver Price is US$21/oz

Explanatory Notes:

* NPV is derived by KEFI using independently created financial

models of net cash flows after tax

and debt service, using a discount rate of 8%;

* Tulu Kapi open pit model is based on the Definitive Feasibility

Study ("DFS") as updated for any

refinements during project contracting and in-country experience;

* Tulu Kapi underground mine model is based on the internal Preliminary

Economic Assessment ("PEA");

* Hawiah assumes preliminary mine modelling for open pit and

underground because the MRE has only recently been updated. Also

includes preliminary debt leverage;

* Jibal Qutman model is based on the internal PEA, preliminary

debt-leverage applied.

Note that aggregate NPV's in mid-2025 using the same underlying

assumptions as above, are estimated to be approximately 80% higher

than those at 2022, reflecting that production will have commenced

at Tulu Kapi, assumed to be imminent at Jibal Qutman and

soon-to-follow at Hawiah. This project sequencing will be refined

as the Saudi development studies progress. The scale of the

projects in value terms to KEFI is highlighted by the table above

as at mid-2022, but of equal importance from a financing viewpoint

is the emphasis of project-level capital funding as well as the

sequencing of their development. These aspects are illustrated in

the tabulation below:

TULU JIBAL

KAPI HAWIAH QUTMAN TOTAL

Current ALL 3

Estimate PROJECTS

US$m US$m US$m US$m

--------- ------- -------- ---------

Assumed Year of Commencing Construction 2022 2025 2024

----------------------------------------- --------- ------- -------- ---------

Total Applications, including

Mine Fleet 356 160 39 555

Less Mine Fleet Provided by

Corica 56 0 0 56

Senior Debt 140 120 29 289

Equity-Risk Capital Requirement 160 40 10 210

--------- ------- -------- ---------

Project Partners' Share Subscriptions

into TKGM/G&M 38 28 7 73

Offtake-Linked Mezzanine Finance 45 0 0 45

Cost Overrun Facility, Part

of Mezzanine Facility 15 0 0 15

TKGM/G&M Share Capital to be

subscribed by KEFI 62 12 3 77

--------- ------- -------- ---------

Funded by Subordinated Convertible

into KEFI Shares at Year 3 market

price 15 0 0 15

Funded by KEFI Shares Issued

at end Year 2 at the then market

price 7 0 0 7

Budgeted internal spare cash

generated 12 12 0 24

KEFI Convertible Note Issued

after signing, at premium to

market in H2-2022 20 0 0 20

KEFI Share Issue after closing

each project financing in 2022,

2024, 2025 8 0 3 11

Note that the Dec 2021 warrants

at 1.6p bring in approximately

US$8m

Residual Requirement 0 0 0 0

--------- ------- -------- ---------

KEFI Gold and Copper in Ethiopia

Ethiopia is currently undergoing a remarkable transformation

both politically and economically.

The Tulu Kapi gold project in western Ethiopia is being

progressed towards development, following a grant of a Mining

Licence in April 2015.

The Company has now refined contractual terms for project

construction and operation. Estimates include open pit gold

production of c. 140,000oz pa for a 7-year period. All-in

Sustaining Costs (including operating, sustaining capital and

closure but not including leasing and other financing charges)

remain c. US$800/oz. Tulu Kapi's Ore Reserve estimate totals 15.4Mt

at 2.1g/t gold, containing 1.1Moz.

All aspects of the Tulu Kapi (open pit) gold project have been

reported in compliance with the JORC Code (2012) and subjected to

reviews by appropriate independent experts.

A Preliminary Economic Assessment has been published that

indicates the economic attractiveness of mining the underground

deposit adjacent to the Tulu Kapi open pit, after the start-up of

the open pit and after positive cash flows have begun to repay

project debts. An area of over 1,000 square kilometres adjacent to

Tulu Kapi has been reserved for exploration by KEFI's wholly-owned

Ethiopian subsidiaries upon commencement of development by TKGM,

with a view to adding satellite deposits to development and

production plans.

KEFI Gold and Copper in the Kingdom of Saudi Arabia

In 2009, KEFI formed Gold & Minerals Limited ("G&M") in

Saudi Arabia with local Saudi partner, ARTAR, to explore for gold

and associated metals in the Arabian-Nubian Shield. KEFI has a 30%

interest in G&M and is the operating partner.

ARTAR, on behalf of G&M, and G&M directly hold over 16

Exploration Licence (EL) applications pending the introduction of

the new Mining Law. These new regulations have recently been

proclaimed and G&M now holds 3 EL's. ELs are renewable for up

to three years and bestow the exclusive right to explore and to

obtain a 30-year exploitation (mining) licence within the area.

In addition, G&M has a Mining Licence Application over the

Jibal Qutman Gold Project which recent informal indications by the

authorities provide some confidence that the licence will be

granted in 2022.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAEAADLFFDAEAA

(END) Dow Jones Newswires

March 15, 2022 03:00 ET (07:00 GMT)

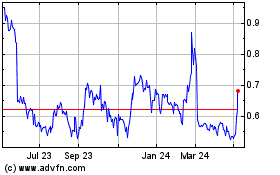

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

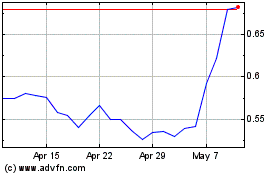

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2023 to Dec 2024