TIDMKMR

This announcement ("Announcement") does not constitute, or form part of,

an invitation or offer of ordinary shares or other securities to be

issued, offered or sold in connection with the Capital Restructuring (as

defined below) for subscription, sale or purchase by any person.

The distribution of this Announcement, and any other document issued by

the Company in connection with the issue, offer or sale of ordinary

shares or other securities in connection with the Capital Restructuring

into jurisdictions other than Ireland and the United Kingdom may be

restricted by law and therefore persons into whose possession these

documents come should inform themselves about and observe such

restrictions. Any failure to comply with any such restrictions may

constitute a violation of the securities laws or regulations of such

jurisdictions. In particular, subject to certain exceptions, this

announcement should not be distributed, forwarded to or transmitted in

or into any the United States, Canada, Australia or Japan.

Kenmare Resources plc ("Kenmare" or "the Company")

29 April, 2016

Update on Proposed Deleveraging Plan

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide the following update on its proposals to materially

reduce the Group's outstanding debt (from outstanding debt of US$367.8

million as of 31 December, 2015 to not more than US$100 million); to

provide the Group with additional liquidity from part of the net

proceeds of a capital raise; and to amend the terms of residual loans.

It is expected that existing events of default under the current debt

facilities would also be remedied upon implementation of the proposals.

These proposals represent the components of a material deleveraging plan

("Deleveraging Plan") required to be delivered to the Group's lenders

(the "Lenders") under the terms of the project loan amendment agreement

entered into in April 2015 ("the April 2015 Amendment"). While it was a

requirement of the April 2015 Amendment that a Deleveraging Plan be

delivered to, and agreed with, Lenders by 31 January, 2016, a

Deleveraging Plan has not yet been agreed. However, significant progress

has been made on such a plan and the Lenders continue to work with the

Group on satisfaction of the pre-conditions necessary for the

implementation of a Deleveraging Plan.

Deleveraging Plan and Summary Details of the Capital Restructuring

The Deleveraging Plan includes the following key elements (together "the

Capital Restructuring"):

1. A US$100 million placing of new ordinary shares with State General

Reserve Fund, a sovereign wealth fund of the Sultanate of Oman ("SGRF"),

and a US$100 million placing of new ordinary shares with King Ally

Holdings Limited ("King Ally") (in aggregate US$200 million) ("the

Cornerstone Placing") and an additional firm placing, at the same issue

price ("Issue Price") as the Cornerstone Placing, of not less than US$75

million ("Firm Placing") for which participation commitments will be

sought from a number of new and existing institutional shareholders;

2. Application of US$200 million of the proceeds of the Cornerstone Placing

and Firm Placing to repay US$250 million of debt, together with the

discharge of an amount equal to interest accruing on project loans

(excluding the Super Senior Facility) from 25 November, 2015 until the

date of receipt of Lender approvals, with the balance of the net proceeds

(after expenses of the issue and of the Capital Restructuring) of the

Cornerstone Placing and Firm Placing being retained by the Company for

working capital purposes;

3. An open offer ("Open Offer") to existing shareholders to subscribe for

new ordinary shares on the same terms as under the Cornerstone Placing

and Firm Placing. The maximum size of the Open Offer will be such as to

enable the discharge of all remaining outstanding indebtedness in the

event of full subscription under the Open Offer on the basis that for

every US$3 raised under the Open Offer US$4 of debt obligations are

extinguished;

4. To the extent that subscriptions under the Open Offer are insufficient to

reduce outstanding indebtedness to US$100 million, the amount of debt in

excess of US$100 million will be equitised at the Issue Price;

5. A share capital reorganisation will also be proposed as part of the

Capital Restructuring pursuant to which ordinary shares in issue will be

consolidated, with all new ordinary shares to be issued under the Capital

Restructuring being on a post-consolidation basis.

The net effect of these arrangements will be that the amount of debt

remaining outstanding following the completion of the Capital

Restructuring will not be more than US$100 million and (dependent on the

level of subscription for new ordinary shares under the Open Offer)

could be less.

The participants in the Cornerstone Placing are each expected to hold

new ordinary shares representing a maximum of 29.9% in the enlarged

issued share capital of the Company following completion of the Capital

Restructuring. The actual percentage represented by their respective

interests will depend on the funds raised in excess of the required

minimum of US$275 million. Similarly, the percentage of equity (if any)

owned by the Lenders following completion of the Capital Restructuring

will depend, amongst other things, on the funds raised in excess of the

required minimum of US$275 million.

Objectives of the Capital Restructuring

The primary objectives of the Capital Restructuring are to:

1. achieve a new and simplified capital structure for the Group, with a

strengthened balance sheet and a more appropriate debt service and

maturity profile, taking account of the difficult trading conditions

which have characterised the titanium dioxide feedstocks industry in the

period from 2013 to 2016 (inclusive);

2. ensure the Group has sufficient resources to meet its general corporate

and working capital needs;

3. allow the Group to conserve cash resources pending a recovery in product

prices (there will be no principal repayments (semi-annual) in respect of

outstanding debt following completion of the Restructuring until 1

February, 2018));

4. recognise and respect the interests of the stakeholders of the business,

in particular the senior lenders, the subordinated lenders and the

shareholders;

5. avail of the conditional commitment from King Ally and the expected

commitment from SGRF to make a material investment in the Company.

6. provide other institutional investors with the opportunity to invest, in

aggregate, not less than US$75 million at the same Issue Price;

7. provide all shareholders (subject only to jurisdictional selling

restrictions) with an opportunity, alongside, and at the same price as,

the participants in the Cornerstone Placing and the Firm Placing, to

re-invest in the Company and the Mine with a right-sized debt structure,

with such investment reducing (and potentially eliminating) the

proportion of new ordinary shares which would otherwise be held by

Lenders on completion of the fundraising, and in certain circumstances

reducing (and potentially eliminating) total outstanding debt; and

8. deliver the material deleveraging required by the Lenders under the April

2015 Amendment

The Capital Restructuring has been structured so as to recognise the

primacy of cash investment and maximise the debt reduction achieved at

this time. Accordingly, the application of the first US$200 million of

proceeds raised under the capital raise will be applied to repay US$250

million of debt and discharge an amount equal to certain interest

accrued; and, to the extent that additional cash (supplemental to the

US$75 million under the Firm Placing, which will be used to discharge

expenses and for working capital purposes), is raised this will retire

additional debt at a ratio of 4:3.

All of the characteristics of Moma which enabled its original

development and its subsequent expansion in 2010, and which formed the

basis for the additional accommodations and investments since made by

the Lenders and shareholders respectively, still subsist. Moma

constitutes a resource large enough to support very long mine life, is

capable of being mined at low operating cost with surface mineralisation

enabling dredge mining, has access to relatively low cost hydro power,

has a coastal location requiring minimal over land transportation and

the ability to mine and export directly using a dedicated shipping

terminal, and has a diversified worldwide customer base and significant

co-product revenue stream and ilmenite products suitable for both

sulphate and chloride pigment processes without further beneficiation.

The Board believes that, with the implementation of the Capital

Restructuring and the attendant material deleveraging and near-term risk

mitigation in relation to the financial position of the Group, together

with the benefit of the considerable operational experience gained,

efficiencies and improvements being implemented at Moma over recent

years (including in relation to mitigating poor power reliability issues,

increasing the effectiveness of the rutile and zircon circuits and

decreasing operating costs primarily through reductions in the cost and

size of the workforce), the Group will be well placed to benefit from a

recovery in product pricing. While the timing of any such recovery

cannot be foreseen with accuracy, both supply and demand dynamics

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 02:02 ET (06:02 GMT)

(further detail in relation to which is set out in the Kenmare Annual

Report published today) indicate that conditions are conducive to an

improvement in pricing.

Risks to Implementation

The Deleveraging Plan is a complex initiative with multiple

counterparties. As of the date of this announcement, it remains subject

to significant third party, internal and external risks. Moreover any

investment by King Ally and/or any commitment by SGRF, if made, will be

subject to a number of key conditions, including, inter alia, their

being respectively satisfied with the form and content of a prospectus

to be prepared by Kenmare, that a final agreement with lenders is

entered into and reflects the envisaged debt restructuring, and that not

less than, in aggregate, US$275 million is raised by way of an equity

issue, as well as conventional conditions for an equity issue of this

nature. The Lenders have not yet agreed to the Deleveraging Plan.

In addition, the Capital Restructuring will require publication of a

prospectus and convening of an extraordinary general meeting at which

approval of a number of resolutions (expected to include ordinary

resolutions, special resolutions and resolutions on which only certain

independent shareholders can vote) will be required.

Having regard to the uncertainties relating to the Capital Restructuring,

the audit report for the year ended 31 December, 2015 includes an

emphasis of matter regarding a material uncertainty in respect of going

concern for the Kenmare Group.

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse

Tel: +44 207 466 5000

J&E Davy (Davy), which is regulated in Ireland by the Central Bank, is

acting exclusively for Kenmare Resources plc in connection with the

Capital Restructuring and for no one else and will not be responsible to

any other person for providing the protections afforded to customers of

Davy or for providing advice in connection with the Capital

Restructuring or any other arrangement referred to in this Announcement.

Apart from the responsibilities and liabilities, if any, which may be

imposed on Davy by the Central Bank or by FSMA or the regulatory regime

established thereunder, Davy does not accept any responsibility

whatsoever and makes no representation or warranty, express or implied,

for the contents of this Announcement, including its accuracy,

completeness or verification or for any other statement made or

purported to be made by Davy, the Company or any other person, in

connection with the Company or any other matter described in this

Announcement and nothing in this Announcement shall be relied upon as a

promise or a representation in this respect, whether as to the past or

the future. Davy accordingly disclaims all and any liability whatsoever,

whether arising in tort, contract or otherwise (save as referred to

above), which it might otherwise have in respect of this Announcement or

any such statement.

Rothschild, which is authorised and regulated in the United Kingdom by

the Financial Conduct Authority is acting exclusively for Kenmare

Resources plc and is acting for no one else in connection with the

Capital Restructuring and will not be responsible to any other person

other than Kenmare Resources plc for providing the protections afforded

to clients of Rothschild or for providing advice in connection with the

Capital Restructuring or any other arrangement referred to in this

Announcement. Apart from the responsibilities and liabilities, if any,

which may be imposed on Rothschild by FSMA or the regulatory regime

established thereunder, Rothschild does not accept any responsibility

whatsoever and makes no representation or warranty, express or implied,

for the contents of this Announcement, including its accuracy,

completeness or verification or for any other statement made or

purported to be made by Rothschild, the Company or any other person, in

connection with the Company or any other matter described in this

Announcement and nothing in this Announcement shall be relied upon as a

promise or a representation in this respect, whether as to the past or

the future. Rothschild accordingly disclaims all and any liability

whatsoever, whether arising in tort, contract or otherwise (save as

referred to above), which it might otherwise have in respect of this

Announcement or any such statement.

This document and any materials distributed in connection with the

Capital Restructuring may contain certain forward-looking statements

regarding the belief or current expectations of Kenmare, the Directors

of Kenmare and other members of its senior management about Kenmare's

financial condition, results of operations and business and the

transactions described in this document. Generally, but not always,

words such as 'may', 'could', 'should', 'will', 'expect', 'intend',

'estimate', 'anticipate', 'assume', 'believe', 'plan', 'seek',

'continue', 'target', 'goal', 'would' or their negative variations or

similar expressions identify forward-looking statements. Such

forward-looking statements are not guarantees of future performance.

Rather, they are based on current views and assumptions and involve

known and unknown risks, uncertainties and other factors, many of which

are outside the control of Kenmare and are difficult to predict, that

may cause the actual results, performance, achievements or developments

of the Group or the industries in which it operates to differ materially

from any future results, performance, achievements or developments

expressed or implied from the forward-looking statements. A number of

material factors could cause actual results to differ materially from

those contemplated by the forward-looking statements. The

forward-looking statements herein relate only to events or information

as of the date on which the statements are made and, except as

specifically required by law, the Listing Rules of the Irish Stock

Exchange or the UK Listing Authority, the Market Abuse Regulations and

Rules of the Central Bank, or the Prospectus Regulations and Rules of

the Central Bank, Kenmare undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new information,

estimates or opinions, future events or results or otherwise.

This Announcement is not a Prospectus.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#2008218

http://www.kenmareresources.com/

(END) Dow Jones Newswires

April 29, 2016 02:02 ET (06:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

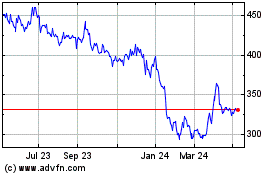

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

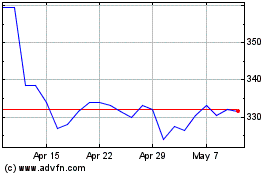

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024