TIDMKP2

RNS Number : 3518G

Kore Potash PLC

18 July 2023

18 July 2023

Kore Potash Plc

("Kore Potash" or "the Company")

Review of Operations for the Quarter ended 30 June 2023

Kore Potash (AIM: KP2, ASX: KP2, JSE:KP2), the potash

development company with 97%-ownership of the Kola Potash Project

("Kola" or the "Kola Project") and Dougou Extension ("DX") Potash

Project in the Sintoukola Basin, located in the Republic of Congo

("RoC"), provides its quarterly update for the period ended 30 June

2023 (the "Quarter").

Quarterly Highlights

Projects

-- Discussions continue towards finalising terms for the

Engineering, Procurement and Construction ("EPC") contract at the

Kola Project.

-- PowerChina International Group Limited ("PowerChina") and

SEPCO Electric Power Construction Corporation ("SEPCO") have

commenced work to support the provision of guarantees regarding an

EPC contract for Kola.

-- Summit Consortium ("Consortium") has confirmed that the

financing proposal for the full capital cost of Kola will be

provided within six weeks of finalisation of EPC contract

terms.

-- A review of the strategic options available for the DX Project is underway.

Corporate

-- The Company held its Annual General Meeting ("AGM") on 20 June 2023 .

-- Pablo Hernandez-MacDonald did not offer himself for

re-election as a non-executive director to the Board at the AGM . A

replacement Sociedad Química y Minera de Chile S. A (" SQM ")

nominated non-executive director will be announced in due

course.

-- As of 30 June 2023, the Company held US$2.6 million in cash.

Operational Activities

Kola EPC

Kore Potash signed a Memorandum of Understanding with the

Consortium in April 2021 for the Optimisation of Kola, the

provision of an EPC contract proposal and to provide a debt and

royalty financing proposal for the full construction cost of

Kola.

The results of the Optimisation Study ("Study") announced on 27

June 2022 supported moving to the next phase of Kola's

development.

On 28 June 2022, the Company announced that it had signed a

Heads of Agreement ("HoA") for the construction of Kola with

SEPCO.

Under the HoA, SEPCO undertook to continue negotiations with

Kore Potash towards an EPC contract for the construction of Kola.

Importantly, the HoA recognises the outcomes of the Study, and

confirmed the capital cost of Kola, the construction period and

related EPC contract terms.

Discussions with SEPCO to finalise key EPC terms continue.

Recognising the world-class scale of Kola, the length of the

proposed construction period and the total financing requirement,

Kore Potash has requested that SEPCO's parent company, PowerChina,

provides the typically required EPC contract guarantees, including

performance and retention bonds supporting the completion of

construction and the operating performance of Kola.

PowerChina is now actively involved in the process to finalise

the EPC contract terms. As part of this process, PowerChina is

reviewing aspects of the Kola design and the planned construction

schedule and has had direct communications with the management of

Kore Potash. PowerChina's review has generated a number of

potential design improvements to the Kola Project that identify

potential opportunities to further reduce the capital cost and the

construction schedule. Discussions on incorporating these design

improvements into the EPC contract continue.

PowerChina has engaged a number of external experts to support

its review of the Kola design and they require completion of this

review to support the provision of the required EPC contract

guarantees. PowerChina has not yet advised Kore Potash of the

timeline to complete its reviews and internal approvals.

The process to conclude EPC contract discussions has taken

longer than the Consortium initially envisaged, however it is

necessary to conclude these discussions prior to receiving their

financing proposal.

Kola Financing

Kore Potash continues to work with the Consortium to provide

financing for the full construction cost of Kola which is intended

to be based on royalty and debt finance.

The successful outcomes of the Study were in line with the

Consortium's requirements and supported the ongoing financing

discussions. The financing parties of the Consortium have again

reinforced their ongoing strong interest in financing Kola and

await finalisation of the EPC contract terms.

The Consortium has advised that the financing proposal for the

full construction cost of Kola will be provided to the Company

within six weeks of EPC terms being finalised.

Kore Potash continues to hold the view that the members of the

Consortium have the capability to provide the required financing to

commit to the construction of Kola and that pursuing this financing

opportunity currently remains the best path forward for Kore

Potash's shareholders.

Congo Government Relations

Key members of the Kore Potash Board and the Consortium,

including SEPCO and PowerChina, met with the Ministry of Mines

("Ministry") during the Quarter. The Ministry feedback from the

visit was positive and that it improved the Ministry's

understanding of the financing process.

DX Potash Project

At present, the Company remains focused on completing the

financing of Kola and moving forward to construction of Kola as

soon as possible.

The Company is now exploring what strategic options are

available for the DX project.

Corporate

At the Company's AGM held on 20 June 2023, all resolutions were

duly passed on a poll by the requisite majority.

Pablo Hernandez-MacDonald having resigned from SQM to pursue

other interests and did not offer himself for re-election at the

AGM. A replacement SQM nominated non-executive director will be

announced in due course.

As at 30 June 2023, the Company held US$2.6 million in cash.

There were no mining production or construction activities

during the Quarter.

Quarterly cashflow report

In accordance with the ASX Listing Rules, the Company will also

lodge its cashflow report for the Quarter today. Included in those

cashflows are non-executive directors' fees and the CEO's salary of

US$198,000 settled in cash.

The Company invested US$1,083,000 in exploration in the Quarter,

which comprised US$1,015,000 related to the Kola Study and

US$68,000 for the DX DFS Study. The Company ended the Quarter with

US$2.6 million in cash.

This announcement has been approved for release by the Board of

Kore Potash.

Market Abuse Regulation

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

S

For further information, please visit www.korepotash.com or

contact:

Kore Potash Tel: +27 84 603

Brad Sampson - CEO 6238

Tavistock Communications Tel: +44 (0) 20

Emily Moss 7920 3150

Adam Baynes

SP Angel Corporate Finance - Nomad Tel: +44 (0) 20

and Broker 7470 0470

Ewan Leggat

Charlie Bouverat

Shore Capital - Joint Broker Tel: +44 (0) 20

Toby Gibbs 7408 4050

James Thomas

Questco Corporate Advisory - JSE Tel: +27 (11) 011

Sponsor 9205

Doné Hattingh

Tenement Details and Ownership

The Company is incorporated and registered in England and Wales

and wholly owns Kore Potash Limited of Australia. Kore Potash

Limited has a 97% shareholding in Sintoukola Potash SA ("SPSA") in

the RoC. SPSA has 100% ownership of Kola Potash Mining SA ("KPM").

KPM has 100% ownership of the Kola Mining Lease on which the Kola

Deposit is situated. The Kola Deposit is located within the Kola

Mining Lease. SPSA is also the 100% owner of the Dougou Mining

Lease. The Dougou Mining lease hosts the Dougou Deposit and the DX

Deposit.

Under the existing Mining Convention, the RoC Government is

entitled to 10% ownership in the Kola and DX Projects. The transfer

of this 10% awaits instructions from the Government and the Mineral

Resources and Ore Reserves are shown below in gross and 90%

attributable bases.

Table 1: Schedule of mining tenements (Republic of Congo)

Project & Tenement Issued Company Interest Title Registered

Type to

Kola Decree 2013-412 100% Kola Potash Mining

Mining of 9 August potassium rights S.A.

2013 only

------------------ ------------------- -------------------

Dougou Decree 2017-139 100% Sintoukola Potash

Mining of 9 May 2017 potassium rights S.A.

Revised Decree only

No 2021-389

of 2 August

2021

------------------ ------------------- -------------------

Kore Potash Mineral Resources and Ore Reserves - Gross and

according to future 90% interest (10% by the RoC government)

KOLA SYLVINITE DEPOSIT

Gross Net Attributable (90% interest)

-------------------------------------------- --------------------------------------------

Mineral Resource Sylvinite Average Contained Sylvinite Average Contained

Category Million Tonnes Grade KCl KCl million Million Tonnes Grade KCl KCl million

% tonnes % tonnes

---------------- ----------- ------------- ---------------- ----------- -------------

Measured 216 34.9 75.4 194 34.9 67.8

---------------- ----------- ------------- ---------------- ----------- -------------

Indicated 292 35.7 104.3 263 35.7 93.9

---------------- ----------- ------------- ---------------- ----------- -------------

Sub-Total

Measured +

Indicated 508 35.4 179.7 457 35.4 161.7

---------------- ----------- ------------- ---------------- ----------- -------------

Inferred 340 34.0 115.7 306 34.0 104.1

---------------- ----------- ------------- ---------------- ----------- -------------

TOTAL 848 34.8 295.4 763 34.8 265.8

---------------- ----------- ------------- ---------------- ----------- -------------

Gross Net Attributable (90% interest)

Ore Reserve Sylvinite Average Contained Sylvinite Average Contained

Category Million Tonnes Grade KCl KCl million Million Tonnes Grade KCl KCl million

% tonnes % tonnes

---------------- ----------- ------------- ---------------- ----------- -------------

Proved 62 32.1 19.8 56 32.1 17.9

---------------- ----------- ------------- ---------------- ----------- -------------

Probable 91 32.8 29.7 82 32.8 26.7

---------------- ----------- ------------- ---------------- ----------- -------------

TOTAL 152 32.5 49.5 137 32.5 44.6

---------------- ----------- ------------- ---------------- ----------- -------------

Ore Reserves are not in addition to Mineral Resources but are derived from

them by the application of modifying factors

DOUGOU EXTENSION SYLVINITE DEPOSIT (HWSS and TSS)

Gross Net Attributable (90% interest)

-------------------------------------------- --------------------------------------------

Mineral Resource Sylvinite Average Contained Sylvinite Average Contained

Category Million Tonnes Grade KCl KCl million Million Tonnes Grade KCl KCl million

% tonnes % tonnes

---------------- ----------- ------------- ---------------- ----------- -------------

Measured 20 32.4 6.5 18 32.4 5.9

---------------- ----------- ------------- ---------------- ----------- -------------

Indicated 8 23.1 1.8 7 23.1 1.6

---------------- ----------- ------------- ---------------- ----------- -------------

Sub-Total

Measured +

Indicated 28 29.9 8.3 25 29.9 7.5

---------------- ----------- ------------- ---------------- ----------- -------------

Inferred 101 23.5 23.8 91 23.5 21.4

---------------- ----------- ------------- ---------------- ----------- -------------

TOTAL 129 24.8 32.1 116 24.8 28.9

---------------- ----------- ------------- ---------------- ----------- -------------

Gross Net Attributable (90% interest)

Ore Reserve Sylvinite Average Contained Sylvinite Average Contained

Category Million Grade KCl KCl million Million Grade KCl KCl million

Tonnes % tonnes Tonnes % tonnes

-------------- ----------- ------------- -------------- ----------- ---------------

Proved 6.1 32.5 2.0 5.5 32.5 1.8

-------------- ----------- ------------- -------------- ----------- ---------------

Probable 3.2 41.8 1.3 2.9 41.8 1.2

-------------- ----------- ------------- -------------- ----------- ---------------

TOTAL 9.3 35.7 3.3 8.4 35.7 3.0

-------------- ----------- ------------- -------------- ----------- ---------------

Ore Reserves are not in addition to Mineral Resources but are derived from

them by the application of modifying factors

DOUGOU CARNALLITE DEPOSIT

Gross Net Attributable (90% interest)

------------------------------------------ ----------------------------------------------

Mineral Million Average Contained Million Average Contained

Resource Tonnes Grade KCl KCl million Tonnes Grade KCl KCl million

Category carnallite % tonnes carnallite % tonnes

-------------- ----------- ------------- -------------- ----------- -----------------

Measured 148 20.1 29.7 133 20.1 26.8

-------------- ----------- ------------- -------------- ----------- -----------------

Indicated 920 20.7 190.4 828 20.7 171.4

-------------- ----------- ------------- -------------- ----------- -----------------

Sub-Total

Measured +

Indicated 1,068 20.6 220.2 961 20.6 198.2

-------------- ----------- ------------- -------------- ----------- -----------------

Inferred 1,988 20.8 413.5 1,789 20.8 372.2

-------------- ----------- ------------- -------------- ----------- -----------------

TOTAL 3,056 20.7 633.7 2,750 20.7 570.3

-------------- ----------- ------------- -------------- ----------- -----------------

KOLA CARNALLITE DEPOSIT

Gross Net Attributable (90% interest)

------------------------------------------ ----------------------------------------------

Mineral Million Average Contained Million Average Contained

Resource Tonnes Grade KCl KCl million Tonnes Grade KCl KCl million

Category carnallite % tonnes carnallite % tonnes

-------------- ----------- ------------- -------------- ----------- -----------------

Measured 341 17.4 59.4 307 17.4 53.5

-------------- ----------- ------------- -------------- ----------- -----------------

Indicated 441 18.7 82.6 397 18.7 74.4

-------------- ----------- ------------- -------------- ----------- -----------------

Sub-Total

Measured +

Indicated 783 18.1 142.0 705 18.1 127.8

-------------- ----------- ------------- -------------- ----------- -----------------

Inferred 1,266 18.7 236.4 1,140 18.7 212.8

-------------- ----------- ------------- -------------- ----------- -----------------

TOTAL 2,049 18.5 378.5 1,844 18.5 340.6

-------------- ----------- ------------- -------------- ----------- -----------------

Competent Persons Statements

All Mineral Resource and Ore Reserves are reported in accordance

with the JORC Code (2012 edition). Numbers are rounded to the

appropriate decimal place. Rounding 'errors' may be reflected in

the "totals".

The Kola Mineral Resources were reported 6 July 2017 in an

announcement titled 'Updated Mineral Resource for the High -Grade

Kola Deposit'. It was prepared by Competent Person Mr. Garth

Kirkham, P.Geo., of Met-Chem division of DRA Americas Inc., a

subsidiary of the DRA Group, and a member of the Association of

Professional Engineers and Geoscientists of British Columbia. The

Ore Reserves for sylvinite at Kola was first stated on 29 January

2019 in an announcement titled "Kola Definitive Feasibility Study"

and was prepared by Met-Chem. The Competent Person for the estimate

was Mr Mo Molavi, member of good standing of Engineers and

Geoscientists of British Columbia. The Ore Reserves were reviewed

when the changes to the underlying assumptions (as detailed in the

27 June 2022 announcement "Kola Project optimisation study

outcomes") were made and Mr Molavi verified that the Ore Reserves

remained unchanged.

The Dougou carnallite Mineral Resources were reported on 9

February 2015 in an announcement titled 'Elemental Minerals

Announces Large Mineral Resource Expansion and Upgrade for the

Dougou Potash Deposit'. It was prepared by Competent Persons Dr.

Sebastiaan van der Klauw and Ms. Jana Neubert, senior geologists

and employees of ERCOSPLAN Ingenieurgesellschaft Geotechnik und

Bergbau mbH and members of good standing of the European Federation

of Geologists.

The Dougou Extension sylvinite Mineral Resource Estimate and Ore

Reserve Estimate were reported in an announcement titled "Updated

Dougou Extension (DX) PFS and Production Target" on 24 January

2023. Dr. Douglas F. Hambley, Ph.D., P.E., P.Eng., P.G of Agapito

Associates Inc., for the Exploration Results and Mineral Resources.

Mr. Hambley is a licensed professional geologist in states of

Illinois (Member 196-000007) and Indiana (Member 2175), USA, and is

an Honorary Registered Member (HRM) of the Society of Mining,

Metallurgy and Exploration, Inc. (SME, Member 1299100RM), a

Recognized RPO included in a list that is posted on the ASX website

from time to time and Dr. Michael Hardy was the Competent Person

for the Ore Reserves, and he is a registered member in good

standing (Member #01328850) of Society for Mining, Metallurgy and

Exploration (SME) which is an RPO included in a list that is posted

on the ASX website from time to time.

The Company confirms that, it is not aware of any new

information or data that materially affects the information

included in the original market announcements and, in the case of

estimates of Mineral Resources or statements of Ore Reserves that

all material assumptions and technical parameters underpinning the

estimates in the relevant market announcement continue to apply and

have not materially changed. The Company confirms that the form and

context in which the Competent Person's findings are presented have

not been materially modified from the original market

announcement.

Forward-Looking Statements

This release contains certain statements that are

"forward-looking" with respect to the financial condition, results

of operations, projects and business of the Company and certain

plans and objectives of the management of the Company.

Forward-looking statements include those containing words such as:

"anticipate", "believe", "expect," "forecast", "potential",

"intends," "estimate," "will", "plan", "could", "may", "project",

"target", "likely" and similar expressions identify forward-looking

statements. By their very nature forward-looking statements are

subject to known and unknown risks and uncertainties and other

factors which are subject to change without notice and may involve

significant elements of subjective judgement and assumptions as to

future events which may or may not be correct, which may cause the

Company's actual results, performance or achievements, to differ

materially from those expressed or implied in any of our

forward-looking statements, which are not guarantees of future

performance. Neither the Company, nor any other person, gives any

representation, warranty, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statement will occur. Except as required by law,

and only to the extent so required, none of the Company, its

subsidiaries or its or their directors, officers, employees,

advisors or agents or any other person shall in any way be liable

to any person or body for any loss, claim, demand, damages, costs,

or expenses of whatever nature arising in any way out of, or in

connection with, the information contained in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFSSIAEDSEIW

(END) Dow Jones Newswires

July 18, 2023 02:30 ET (06:30 GMT)

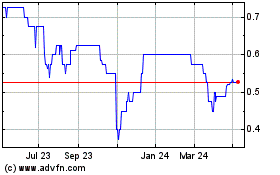

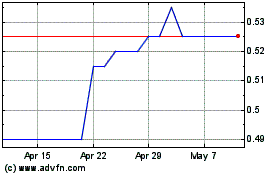

Kore Potash (LSE:KP2)

Historical Stock Chart

From Apr 2024 to May 2024

Kore Potash (LSE:KP2)

Historical Stock Chart

From May 2023 to May 2024