TIDMMPL

RNS Number : 0538O

Mercantile Ports & Logistics Ltd

29 September 2023

29 September 2023

Mercantile Ports & Logistics Limited

("MPL", the "Group" or the "Company")

Interim Results

Mercantile Ports & Logistics (AIM: MPL), which is operating

and continuing to develop a port and logistics facility in Navi

Mumbai, Maharashtra, India, announces its interim results for the

period ended 30 June 2023.

Operational review - Jay Mehta, CEO :

We are pleased to see MPL operations building momentum on a year

on year basis. The facility is gaining further traction with its

existing customers, while being in advanced negotiations with new

customers for new commodities including containers, liquid and oil

and gas cargoes. The following table for illustrates this for

cargoes handled during corresponding periods-

Period January to June January to August

------------------ --------------------

2023 2022 2023 2022

--------------- -------- -------- --------- ---------

Cargo handled

(in tonnage) 783,457 494,168 862,962 685,409

--------------- -------- -------- --------- ---------

These cargo movements are handled through contracted agreements

and spot market demand which include multiple commodities such as

coal, steel, cement and project cargo.

Financial review:

-- Group revenue of GBP2.69 million (June 2022: GBP1.91 million) .

-- Positive EBITDA of GBP0.22 million for H1 June 2023 as

against EBITDA loss of GBP0.23 million for H1 June 2022.

-- Loss for 30 June 2023 GBP 5.38 million (June 2022: GBP6.54 million).

-- Net asset value as at 30 June 2023 GBP 90.99 million (June 2022: GBP97.86 million)

-- Total assets of GBP144.47 million (June 2022: GBP153.74

million), a debt to equity ratio of 0.47 (June 2022: 0.47) and cash

of GBP6.40 million at 30 June 2023 (June 2022: GBP2.01

million).

The board believes that these results show an improvement in

all-round performance aligned to a clearer business strategy. The

Group is expecting further strong operational and financial

performance in H2 2023, which we believe will help us achieve our

targets for the current financial year.

Enquiries:

Mercantile Ports & Logistics Jay Mehta

Limited

C/O SEC Newgate

+44 (0)203 757 6880

Cavendish Securities plc Stephen Keys

(Nomad and Broker) +44 (0)207 220 0500

SEC Newgate UK Elisabeth Cowell/ Bob Huxford

(Financial PR) +44 (0)203 757 6880

mpl@secnewgate.co.uk

Chairman's Statement

The Indian economy has shown robust growth during the current

year with GDP growth rate of 7.8% year-on-year in the April - June

2023 quarter and 6.1% year-on-year in the January - March 2023

quarter. India's influence in world affairs continues to develop

positively as evidenced by the successful G20 Summit held in Delhi

recently.

Against this backdrop, our Port of Karanja, located in Mumbai is

uniquely positioned in the most important State in the country

which acts as a gateway to multiple land locked States.

We started the year strongly and continued to build volumes

through the facility. At the same time, we have been pleased with

the increased number of enquiries from potential customers that are

interested in using our facility. While the existing customers are

pleased with the service levels and the overall ease of doing

business at our port, the pipeline of new customers looking to use

our facility is robust and will further expand our business.

Potential customers with whom we are in discussions include some

of the major private sector industrial users but we are also in

advanced discussions with state and federal government entities to

use the Karanja facility. In addition to a variety of bulk

commodities, MPL is looking increase the handling of liquids,

containers and oil & gas cargoes at the port. Our discussions

with the State Government regarding development of a logistics park

at the facility continue to progress productively and we look

forward to updating our shareholders on developments there.

We continue to work closely with our lenders for re-phasement of

the loan facility from a seven-year repayment period to fourteen

years including a two-year moratorium on principal repayments. We

expect the renegotiated facility to become effective within the

next four to six-week period.

We were delighted to receive the support of shareholders when we

raised additional capital over the summer. On behalf of the Board,

I should like to welcome new shareholders and to thank our existing

shareholders for their ongoing support. In particular, I should

like to thank Hunch Ventures for their continued commitment, as

they increased their shareholding at the time of the

fundraising.

Notwithstanding the intense monsoon of this year, our Port is

busy and, we remain confident of a successful outcome in 2023.

Jeremy Warner Allan, Chairman

Mercantile Ports & Logistics Limited

29 September 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2023

Note

6 months 6 months Year ended

ended ended 31 Dec

30 June 30 June 2022

2023 2022 (restated)

*

GBP000 GBP000 GBP000

CONTINUING OPERATIONS

Revenue 2,685 1,913 4,872

Operating costs (1,234) (410) (1,449)

Administrative expenses (4,037) (4,717) (9,978)

Operating profit / (loss) before

depreciation 2 217 (228) (324)

Depreciation 2 (2,803) (2,986) (6,231)

-------------------------------------- ----- -------------- ------------------ --------------

OPERATING LOSS (2,586) (3,214) (6,555)

Finance income 15 22 38

( 5,543

Finance cost (2,809) (3,323) )

-------------- ------------------ --------------

NET FINANCING COST (2,794) (3,301) (5,505)

-------------- ------------------ --------------

LOSS BEFORE TAX (5,380) (6,515) (12,060)

Tax expense for the period - (25) 2,421

-------------- ------------------ --------------

LOSS FOR THE PERIOD (5,380) (6,540) (9,639)

Loss for the period attributable

to:

Non-controlling interest (10) (13) (18)

Owners of the parent (5,370) (6,527) (9,621)

-------------- ------------------ --------------

Loss for the period / year (5,380) (6,540) (9,639)

============== ================== ==============

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss

Re-measurement of net defined

benefit liability - - 1

Items that may be reclassified

to profit or loss

Exchange differences on translating

foreign operations 5 (3,108) 4,190 808

-------------- ------------------ --------------

Other comprehensive loss for

the period / year (3,108) 4,190 809

-------------- ------------------ --------------

Total comprehensive loss for

the period / year (8,488) (2,350) (8,830)

============== ================== ==============

Total comprehensive loss for

the period / year attributable

to:

Non-controlling interest (10) (13) (18)

Owners of the parent (8,478) (2,337) (8,812)

-------------- ------------------ --------------

(8,488) (2,350) (8,830)

============== ================== ==============

Loss per share (consolidated):

Basic & Diluted, for the period ( GBP 0.122p) ( GBP 0.157p) ( GBP 0.232p)

attributable to ordinary equity

holders

* The Consolidated Statement of Comprehensive Income for the 6 months

ended 30 June 2022 has been restated as certain operating costs aggregating

to GBP 196 ('000) have been presented as administrative expenses.

The restatement is carried out to align the presentation of these

costs in line with the annual audited financial statements and current

half year.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Note Period Period Year ended

ended ended 31 Dec

30 June 30 June 2022

2023 2022

GBP000 GBP000 GBP000

Assets

Property, plant and equipment 8 120,256 135,332 127,382

Intangible asset 14 20 14

Non-current tax assets 2,077 - 2,108

--------- --------- -----------

Total non-current assets 122,347 135,352 129,504

--------- --------- -----------

Inventory of traded goods - - 96

Trade and other receivables 9 15,726 16,380 14,110

Cash and cash equivalents 6,398 2,010 558

--------- --------- -----------

Total current assets 22,124 18,390 14,764

Total assets 144,471 153,742 144,268

========= ========= ===========

Liabilities

Non-current

Employee benefit obligations 56 3 53

Borrowings 7 36,047 42,097 39,165

Lease liabilities payables 763 1,569 1,611

Non-current liabilities 36,866 43,669 40,829

--------- --------- -----------

Current

Employee benefit obligations 481 440 529

Borrowings 7 4,113 1,865 2,307

Current tax liabilities 73 404 17

Leases Liabilities payable 1,490 798 817

Trade and other payables 10,457 8,705 8,388

--------- --------- -----------

Current liabilities 16,614 12,212 12,058

--------- --------- -----------

Total liabilities 53,480 55,881 52,887

--------- --------- -----------

Net assets 90,991 97,861 91,381

========= ========= ===========

Equity

Share capital and share

premium 151,949 143,851 143,851

Retained earnings (31,392) (22,929) (26,022)

Translation reserve (29,537) (23,047) (26,429)

Equity attributable to

owners of parent 91,020 97,875 91,400

Non-controlling interest (29) (14) (19)

--------- --------- -----------

Total equity and liabilities 90,991 97,861 91,381

========= ========= ===========

CONDENSED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2023

Note 6 months 6 months Year ended

ended ended 31 Dec 2022

30 June 30 June

2023 2022

GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax for the period /

year (5,380) (6,515) (12,060)

Non cash flow adjustments (1) 6 5,600 6,284 11,748

--------- --------- -------------

Net cash generated/(used in) operating

activities 220 (231) (312)

--------- --------- -------------

Net changes in working capital 6 651 810 305

Taxes paid (46) -- (85)

--------- --------- -------------

Net cash from operating activities 825 579 (92)

--------- --------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and

equipment (283) (1,143) (1,425)

Finance income 15 18 38

--------- --------- -------------

Net cash generated/(used in) investing

activities (268) (1,125) (1,387)

--------- --------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES

From issue of additional shares 4,368 -- --

Subscription money received (2) 1,951 -- 2,452

Repayment of bank borrowing principal (117) (63) (881)

Interest paid on borrowing (759) (2,009) (4,217)

Repayment of leasing liabilities

principal (net) (160) (179) (138)

Interest payment on leasing liabilities -- (9) --

Net cash generated / (used in)

from financing activities 5,283 (2,260) (2,784)

--------- --------- -------------

Net change in cash and cash equivalents 5,840 (2,806) (4,262)

Cash and cash equivalents, beginning

of the period 558 4,783 4,783

Exchange differences on cash and

cash equivalents -- 33 37

--------- --------- -------------

Cash and cash equivalents, end

of the period 6,398 2,010 558

========= ========= =============

(1) The adjustments and working capital movements have been

combined in the above Statement of Cash Flows.

(2) As in previous fundraises, a process is required to be

followed to enable the Company to receive Hunch's subscription

monies in the Company's Indian bank account. This will conclude

shortly but, in the meantime, the Company has a corporate guarantee

in place and has on-demand access to the Hunch subscription monies

at all times.

Consolid ated St atement of Changes in Equity

for the PERIOD ended 30 JUNE 2023

Stated Translation Retained Other Non- controlling Total

Capital Reserve Earnings Components Interest Equity

of equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- ------------ ---------- ------------ -----------------

Balance at 1 January

2022 143,851 (27,237) (16,402) -- (1) 100,211

Transaction with owners

in their capacity as

owners -- -- -- -- -- --

Loss for the period -- -- (9,621) -- (18) (9,639)

Foreign currency translation

differences for foreign

operations -- 808 -- -- -- 808

Re-measurement of net

defined benefit pension

liability -- -- -- 1 -- 1

Re-measurement of net

defined benefit pension

liability transfer to

retained earning -- -- 1 (1) -- --

Total comprehensive income

for the year -- 808 9,620 -- (19) (8,830)

--------- ------------ ---------- ------------ ----------------- --------

Balance at 31 December

2022 143,851 (26,429) (26,022) -- (19) 91,381

========= ============ ========== ============ ================= ========

Balance at 1 January

2023 143,851 (26,429) (26,002) -- (19) 91,381

Issue of share capital 9,044 -- -- -- -- 9,044

Share issue costs (946) -- -- -- -- (946)

--------- ------------ ---------- ------------ ----------------- --------

Transaction with owners

in their capacity as

owners 8,098 -- -- -- -- 8,098

--------- ------------ ---------- ------------ ----------------- --------

Loss for the period -- -- (5,370) -- (10) (5,380)

Foreign currency translation

differences for foreign

operations -- (3,108) -- -- -- (3,108)

--------- ------------ ---------- ------------ ----------------- --------

Total comprehensive income

for the period -- (3,108) (5,370) -- (10) (8,488)

--------- ------------ ---------- ------------ ----------------- --------

Balance at 30 June 2023 151,949 (29,537) (31,392) -- (29) 90,991

========= ============ ========== ============ ================= ========

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

1. Reporting entity

Mercantile Ports & Logistics Limited (the "Company") was

incorporated in Guernsey under the Companies (Guernsey) Law 2008 on

24 August 2010. The condensed interim consolidated financial

statements of the Company for the period ended 30 June 2023

comprises the financial statement of the Company and its

subsidiaries (together referred to as the "Group"). The Company has

been established to develop, own and operate port and logistics

facility.

2. General information and basis of preparation

The condensed interim consolidated financial statements are for

6 months' period ended 30 June 2023 and are not the full year

accounts. The condensed interim consolidated financial statements

are prepared in accordance with IAS 34 Interim Financial Reporting

as adopted by the European Union (EU) and under AIM 18 guidelines.

They have been prepared on a historical cost basis. They do not

include all of the information required in annual financial

statements in accordance with International Financial Reporting

Standards ("IFRS") as issued by the EU. The condensed interim

consolidated financial statements are neither audited in accordance

with International Standards on Auditing (UK) nor subject to review

as per International Standard on Review Engagements (ISRE)

2410.

The condensed interim consolidated financial statements are

presented in Great British Pounds Sterling (GBP), which is the

functional currency of the parent company. The preparation of the

condensed interim consolidated financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

In preparing these, condensed interim consolidated financial

statements, the significant judgements made by management applying

the Group's accounting policies and the key sources of estimation

uncertainty are the same as those applied in the annual IFRS

financial statements. "The Company has successfully raised funds of

GBP9.044 million which will be utilized towards servicing of debt

and working capital requirements. The Company's financing effort to

date is considered sufficient to enable the Company to fund all

aspects of its operations. As a result, the condensed interim

consolidated financial statements have been prepared on a going

concern basis."

The condensed interim consolidated financial statements have

been approved for issue by the Board of Directors on 29 September,

2023.

Operating profit before depreciation

The above information is presented separately in the statement

of comprehensive income as a supplementary information. This

information is a primary measure used by the executive management

and the Board to assess the financial performance of the Group, as

it provides a more comparable assessment of the Group's year on

year performance. It may also be a key metric used by the investor

community to assess the performance of our year-on-year

operations.

3. Significant accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's last

annual financial statements for the year ended 31 December 2022.

The accounting policies have been applied consistently throughout

the Group for the purposes of preparation of these interim

financial statements.

New standards, amendments and interpretations to existing

standards are effective from January 1, 2023

There is an amendment to IAS 12 - deferred tax related to assets

and liabilities arising from a single transaction. This amendment

does not have a significant impact on the Group's interim condensed

consolidated financial statements.

4. Going Concern

The Directors have considered the application of the going

concern basis of accounting.

In making this assessment, the Directors have considered the

current and projected cash balance, borrowing facilities available,

ongoing debt renegotiations with consortium banks, anticipated

future utilisation of available funds, the Company's ability to

control the variable costs, Group's capital investment plans and

the projected operating performance of the business for the 15

months post the signing of these financial statements.

The group had a cash balance of GBP6.40 million as at 30 June

2023, and an additional line of unsecured credit from Hunch

Ventures amounting to GBP4.5 million to mitigate funding risk as

well as ensuring continuity in business. The company will continue

to use the cash generated from operations as well as the balance

subscription money receivable from Hunch Ventures of GBP2.95

million, to manage the projected costs until December 2024.

The Indian subsidiary has been in discussion with its consortium

of banks for restructuring the existing debt facility. The

Directors are confident that a restructured debt facility will be

afforded to the company, that will include an increase in the term

of the loan by an additional 7 years as well as moratorium on

principal repayments for a period of 2 years and a moratorium on

interest payable for 12 months.

Based on the above indicators, after taking into account the

recent fundraising and the renegotiation on the debt restructuring,

the Directors believe that it remains appropriate to continue to

adopt the going concern in preparing the forecasts.

However, the fact that the debt restructure has not been

completed to date represents the existence of a material

uncertainty which may cast significant doubt on the Group's ability

to continue as a going concern. The financial statements do not

include the adjustments that would result if the Group was unable

to continue as a going concern.

5. Comprehensive income

The comprehensive loss for the period is calculated after

debiting a loss of GBP 3.11 million, which arises on the

retranslation of foreign operations to Great British Pounds

Sterling (GBP), which is the functional currency of the Company.

(INR/GBP exchange rate at 30 June 2023 of 103.51, 31 December 2022:

99.74 and 30 June 2022: 95.96 are used).

6. Cash flow adjustments and changes in working capital

The following non-cash flow adjustments and adjustments for

changes in working capital made to profit before tax to arrive at

operating cash flow:

Period Period

ended ended Year ended

30 Jun 30 Jun 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

Adjustments and changes in

working capital

Depreciation 2,803 2,986 6,231

Finance income (15) (18) (38)

Unrealized exchange (loss)/gain -- 3 --

Finance cost 2,809 3,309 5,543

Re-measurement of net defined

benefit liability -- -- (1)

Provision for Gratuity 3 4 13

5,600 6,284 11,748

Change in trade and other payables 705 829 247

Change in trade and other receivables (150) (19) 154

Change in inventory 96 -- (96)

651 810 305

------- ------- -----------

7. Loan facility

Karanja Terminal & Logistics Private Limited (KTLPL), the

Indian subsidiary was sanctioned a term loan of INR 480 crores

(GBP46.63 million) by 4 Indian public sector banks and the loan

agreement was executed on 28th February, 2014. The loan was further

successfully renegotiated with its lenders in June 2021 to reduce

the interest rate from 13.45% to 9.50% p.a. and extend the

commencement of principal repayments out by 24 months.

Outstanding balance as at 30 June 2023 are as follows:

Particular

Amount in Amount

INR Crore in

GBP Million

-----------

Total borrowing 415.68 40.16

----------- -------------

Current 42.57 4.11

Non-current 373.11 36.05

----------- -------------

Balance as at 30 June, 2023 415.68 40.16

----------- -------------

As part of its capital structure optimization, the Indian

subsidiary has initiated discussions with its lenders to

restructure the term loan to allow for re-phasement of the loan

from seven years to fourteen-year period including a two-year

moratorium on principal repayments. We expect this process to

conclude over the coming weeks and the new package to become

effective in H2 2023.

Repayment of schedule of above outstanding loan based on OTR

sanction are as follow:

Repayment amount

INR in Crore GBP in Million

Within 1 year 42.57 4.11

1 to 5 year's 297.21 28.71

After 5 year's 120.25 11.62

Total *460.03 *44.44

============= ===============

* Loan repayment is stated at gross amount, excluding gain on

debt modification GBP4.28 million (INR 44.35 crore).

The rate of interest is a floating rate linked to the Canara

bank base rate (7.40%) with an additional spread of 215 basis

points. The present composite rate of interest is 9.55%. Above

borrowings are secured by the hypothecation of the port facility

and pledge of its shares as well as a personal guarantee by the

Nikhil Gandhi. The carrying amount of the above bank borrowing

considered as a reasonable approximation of the fair value.

8. Property, plant and equipment

As at 30 June 2023, the carrying amount of facility yet to be

capitalized was GBP24.22 million (30 June 2022: GBP25.93

million).

During the 6 months ended 30 June 2023, additions to property

plant and equipment are GBP0.29 million and negative impact of

GBP4.92 million was on account of exchange fluctuation as GBP

became stronger against INR (INR/GBP exchange rate at 30 June 2023

of 103.51, 31 December 2022: 99.74)

Depreciation on the property plant and equipment is included in

the administrative expenses.

9. Trade and other receivables

Trade and other receivable consist of following:

As at As at As at

30-Jun-23 30-Jun-22 31-Dec-22

GBP000 GBP000 GBP000

---------- ---------- ----------

Trade receivable 568 404 896

Deposits 1,230 2,166 1,442

Other receivable

(Advances to contractors, prepayment,

accrued interest) 13,928 13,810 11,772

15,726 16,380 14,110

========== ========== ==========

10. Event Subsequent to the reporting period.

Pursuant to Corporate announcement dated 28 July 2023, MPL

issued 13,333,333 shares amounting to GBP400,000 via the

subscription. Immediately following Admission on 31 July 2023, the

Company's enlarged issued share capital will comprise 356,312,692

Ordinary Shares, of which none are held in treasury.

As in previous fundraises, a process is required to be followed

to enable the Company to receive Hunch's subscription monies in the

Company's Indian bank account. This will conclude shortly but, in

the meantime, the Company has a corporate guarantee in place and

has on-demand access to the Hunch subscription monies at all

times.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCIBDDGXI

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

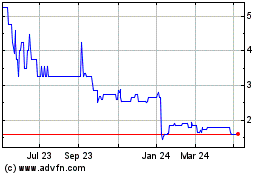

Mercantile Ports & Logis... (LSE:MPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

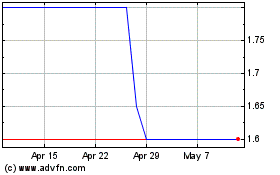

Mercantile Ports & Logis... (LSE:MPL)

Historical Stock Chart

From Apr 2023 to Apr 2024