TIDMNAH

RNS Number : 1763H

NAHL Group PLC

26 July 2023

Prior to publication, the information contained within this

announcement was deemed by the Group to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

26 July 2023

NAHL Group PLC

("NAHL" or the "Group")

Half Year Trading Update

NAHL (AIM: NAH), a leading marketing and services business

focused on the UK consumer legal market, is pleased to provide a

trading update for the first half of its current financial year,

covering the six months to 30 June 2023 (the "Period").

Highlights

-- Revenue and profit in line with management expectations

-- 178% more claims settled in National Accident Law than last

year, resulting in a 77% increase in cash received from

settlements

-- Market share gains by National Accident Helpline against an

overall contraction in the personal injury claims market

-- Strong performance from Bush & Co., with expert reports

up 15% and increase in personnel to meet growing demand

-- Net debt reduced by 13% to GBP11.6m (31 December 2022: GBP13.3m)

-- The Board expects the Group to meet market expectations for the full year

Group results

Group revenues for the Period are expected to be slightly ahead

of last year at GBP21.0m (H1 2022: GBP20.7m). The Group's strategy

to invest in new claims in its wholly-owned law firm, National

Accident Law ("NAL") - which have a long life cycle but produce

higher returns - and the planned reduction in claims still to

settle in the joint venture partnerships is expected to result in

operating profit of approximately GBP1.8m versus GBP2.3m in H1

2022. This will also result in the charge to profit attributable to

members' non-controlling interests in LLPs being lower than last

year by 30% at GBP1.4m (H1 2022: GBP1.9m). This is in keeping with

our stated strategy of growing NAL, and in the short term these

factors, along with increased borrowing costs due to the rise in UK

interest rates, mean that the Group is expected to report a broadly

breakeven result (before tax) for the Period (H1 2022: GBP0.1m

profit before tax).

The Group has made substantial progress in reducing net debt and

at 30 June 2023, net debt was GBP11.6m, down 13% from GBP13.3m at

31 December 2022 and down 20% from GBP14.5m at 30 June 2022.

The Board expects the Group to meet market expectations for the

full year.

Divisional performance

In the Consumer Legal Services division, the number of personal

injury enquires generated by National Accident Helpline was the

same as last year on a like-for-like basis(1) , in a personal

injury claims market that contracted by 1%. As outlined in the

Group's AGM statement on 25 May 2023, the business received a

higher mix of road traffic accident ("RTA") enquiries in the Period

versus last year, which took up the majority of the capacity in NAL

. The Group's agile placement model and strong demand for enquiries

allowed excess non-RTA cases to be placed with its panel of

third-party law firms although the Group continues to invest in

capacity for non-RTA claims in NAL so that it can also process more

of these in the future.

The total number of enquiries generated remained broadly in line

with the prior year and the Group distributed 4,555 new enquiries

into NAL (H1 2022: 4,531) in the Period. The firm ended the Period

processing 10,611 ongoing claims (31 December 2022: 10,860) after

settling 178% more claims than last year (H1 2023: 1,738; H1 2022:

626). Consequently, NAL increased cash from settlements by 77% to

GBP2.7m (H1 2022: GBP1.5m), further demonstrating the growing

maturity of the firm and contributing to the Group's overall

reduction in net debt.

In the Group's Critical Care division, Bush & Co. traded

strongly, and its ongoing marketing and business development

activities continued to deliver results. Expert witness services

had a particularly strong six months with the number of expert

witness reports issued up 15% in the Period, and in case

management, the number of initial needs assessments delivered was

up 5%. To support the increased demand, the business recruited 40

new associates in the Period and added 3 new colleagues to its

growing team of employed case managers.

Publication of interim results

NAHL expects to announce its results for the six months ended 30

June 2023 in late September 2023.

James Saralis, CEO of NAHL, commented:

"We are pleased with the progress the business has made in the

first half of the financial year. In line with our stated strategy,

we have continued to reduce net debt and settled 178% more claims

in the period than last year. Whilst the Personal Injury market

remains stagnant, we believe that our industry-leading brand,

National Accident Helpline, continues to take market share and our

Critical Care business continues to go from strength to strength,

issuing 15% more expert witness reports than the same time last

year as well as recruiting 40 new associates to meet the growing

demand. As a result, and notwithstanding the difficult

macroeconomic environment, our full year expectations remain

unchanged."

(1) Like-for-like enquiry numbers exclude tariff-only road

traffic accident claims, which the Group ceased to process in

February 2022.

For further information:

NAHL Group PLC via FTI Consulting

James Saralis (CEO) Tel: +44 (0) 20 3727 1000

Chris Higham (CFO)

Allenby Capital (AIM Nominated Adviser & Broker) Tel: +44 (0) 20 3328 5656

Jeremy Porter/Vivek Bhardwaj (Corporate Finance)

Amrit Nahal/Stefano Aquilino (Sales & Corporate

Broking)

FTI Consulting (Financial PR) Tel: +44 (0) 20 3727 1000

Alex Beagley NAHL@fticonsulting.com

Sam Macpherson

Amy Goldup

Notes to Editors

NAHL Group plc (AIM: NAH) is a leader in the Consumer Legal

Services market. The Group provides services and products to

individuals and businesses in the through its two divisions:

-- Consumer Legal Services provides outsourced marketing

services to law firms through National Accident Helpline and claims

processing services to individuals through National Accident Law,

Law Together and Your Law. In addition, it also provides property

searches through Searches UK.

-- Critical Care provides a range of specialist services in the

catastrophic and serious injury market to both claimants and

defendants through Bush & Co.

More information is available at www.nahlgroupplc.co.uk , www.national-accident-helpline.co.uk , www.national-accident-law.co.uk and www.bushco.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUCUMUPWPUA

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

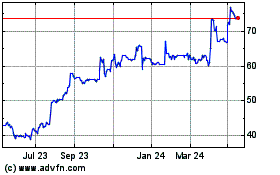

Nahl (LSE:NAH)

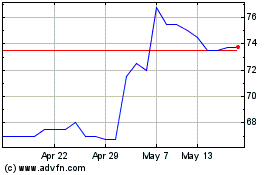

Historical Stock Chart

From Jan 2025 to Feb 2025

Nahl (LSE:NAH)

Historical Stock Chart

From Feb 2024 to Feb 2025