TIDMNFX

RNS Number : 5107V

Nuformix PLC

14 December 2021

Nuformix plc

("Nuformix", the "Company" or the "Group")

Half year Report

14 December 2021: Nuformix plc (LSE: NFX), a pharmaceutical

development company targeting unmet medical needs in fibrosis and

oncology via drug repurposing, announces its unaudited results for

the six months ended 30 September 2021.

Operational highlights (including post-period end)

-- Gross proceeds of GBP1.565 million (net GBP1.4 million) raised

from the placing of new ordinary shares in March 2021 have

been used to fund R&D work to advance the pipeline assets

of NXP002 (pre-clinical stage) and NXP004 (research phase)

-- Successfully performed a number of pre-clinical studies on

NXP002, which is the lead asset being developed for the treatment

of Idiopathic Pulmonary Fibrosis ("IPF"), to generate a robust

data package. Studies on the technical feasibility of inhalation

and the pharmacokinetic / pharmacodynamic profile of NXP002

after inhalation in the rat have, in the opinion of the Company's

Directors, been positive to date and endorse the further

progression of this asset. The final study in the data package

on the durability of the pharmacodynamic response is expected

to readout in early 2022

-- NXP002 patent application granted in the USA, which is the

most important territory for IPF

-- Filed a US patent application on 10 November 2021 in relation

to NXP004, that represents new forms of a blockbuster oncology

drug, which has identified a new family of co-crystals with

benefits over the original drug

-- Licensing agreement signed with Oxilio Ltd on 10 September

2021 for the development and commercialisation of NXP001

for oncology indications

-- Leadership team enhanced with the appointment of Dr Alastair

Riddell as Non-Executive Chairman (with post-period appointment

as Executive Chairman from 1 December 2021), who brings significant

pharma and biotech experience in R&D, corporate development

and general leadership

-- Dr Anne Brindley (CEO) resigned in July 2021 and will be

leaving the Company at the end of her six-month notice period.

Dr Joanne Holland resigned as a director and left the Company

as an employee at the end of May 2021 but has continued as

a consultant advising on physical form science and research

Financial Highlights

-- Total revenue of GBP50,000 (30 September 2020: GBP195,550)

-- Loss before tax GBP449,022 (30 September 2020: loss of GBP475,874)

-- Loss on ordinary activities (after tax credit) of GBP449,022

(30 September 2020: loss of GBP474,659)

-- Loss per share 0.08p (30 September 2020: 0.10p)

-- Net assets of GBP5,250,968 (30 September 2020: GBP4,301,236)

including GBP1,071,831 of cash and cash equivalents (30 September

2020: GBP216,412)

Dr Alastair Riddell, Executive Chairman of Nuformix, said: "The

new positive data sets on NXP002, patent progress on NXP004 and the

licensing deal for NXP001 form the basis for further value creation

in the next 12 months. Both our current lead assets address

billion-dollar markets in fibrosis and oncology. The results have

given the Board the confidence to progress further work on our

products and investment in additional business development resource

for the Company."

Dr Anne Brindley, CEO of Nuformix, said: "We have made

significant progress on all three of our assets including

successfully completed the licensing deal for NXP001 with Oxilio,

as well as significantly advancing the data package on NXP002 that

has shown positive data to date and filing a new patent application

on NXP004. We have achieved this with very prudent use of funds

ensuring the Company is on a firm financial footing for the

foreseeable future. Although regretfully I am moving on from

Nuformix, I remain very optimistic that Nuformix has assets of

value that the Group can advance to further develop the company and

I wish the Board and the company much success in these

endeavours."

Enquiries:

Nuformix plc via Walbrook

Dr Alastair Riddell, Executive Chairman

Dr Anne Brindley, CEO

Allenby Capital Limited +44 (0) 20 3328 5656

Nick Athanas / George Payne (Corporate

Finance)

Stefano Aquilino / Matt Butlin (Sales

and Corporate Broking)

Walbrook PR nuformix@walbrookpr.com

or

+44 (0)20 7933 8780

Anna Dunphy / Phillip Marriage Tel: +44 (0)7876 741 001

/

+44 (0)7867 984 082

About Nuformix

Nuformix is a pharmaceutical development company targeting unmet

medical needs in fibrosis and oncology via drug repurposing. The

Company aims to use its expertise in discovering, developing and

patenting novel drug forms, with improved physical properties, to

develop new products in new indications that are, importantly,

differentiated from the original (by way of dosage, delivery route

or presentation), thus creating new and attractive commercial

opportunities. Nuformix has an early-stage pipeline of preclinical

and Phase 1-ready assets with potential for significant value and

early licensing opportunities.

Nuformix plc shares are traded on the London Stock Exchange's

Official List under the ticker: NFX. For more information, please

visit www.nuformix.com .

Executive Chairman's statement

Operational review

NXP002 (new form of tranilast) - Idiopathic Pulmonary Fibrosis

(IPF)

NXP002 is the Group's pre-clinical lead asset and a potential

novel inhaled treatment for IPF. It is a proprietary, new form of

the drug tranilast, to be delivered in an inhaled formulation. IPF

is a devastating lung disease associated with a higher mortality

rate than many cancers and where there is a need for additional

treatment options. Thus IPF represents a high unmet medical need

and a significant commercial opportunity. Tranilast has a long

history of safe use as an oral drug for allergies but there is

evidence that supports its potential in fibrosis, including IPF.

NXP002 is differentiated as it is a new form of tranilast that is

being formulated for delivery direct to the lungs by inhalation, a

new route of administration for this drug. The inhalation route is

a well-known strategy for treatment of lung diseases to yield

greater efficacy and reduce systemic side-effects compared to oral

treatment. Nuformix has filed two patent applications on new forms

of tranilast, one of which is granted globally and a second has

been issued (granted) in the USA. The positioning of such an

inhaled treatment for IPF could be either added to standard of care

or administered as a monotherapy.

Within the last six months, since the fundraise in March 2021,

the Group has utilised these proceeds to generate a robust data

package with the goal of increasing the value of this asset and

rendering it more attractive to licensing partners. The Company has

successfully progressed studies on NXP002 as follows:

-- Manufactured a supply of the active ingredient NXP002 to be

used in formulation development activities, nebulisation feasibility

studies and in vivo studies

-- Progressed formulation and nebulisation studies and demonstrated

that it is feasible to formulate NXP002 into a simple and

stable solution which has suitable properties for delivery

via nebulisation. The data generated on these formulations

also show that the drug can be efficiently delivered in the

right particle size range for lung delivery using off-the-shelf

and commonly used nebuliser devices. Thus, the Directors of

the Company believe that the delivery of NXP002 by nebulisation

is feasible

-- Progressed several in vivo pharmacokinetic and pharmacodynamic

studies of NXP002 formulated as a solution for inhalation

(nebulisation) and delivered to the rat

-- The first of the in vivo studies evaluated the

pharmacokinetics

of NXP002 when delivered by nebulisation to rats.

This

study demonstrated that NXP002 can be efficiently

delivered

to the lung, achieving significant drug levels,

whilst

limiting systemic exposure compared to oral dosing

-- The second in vivo study evaluated the

pharmacodynamics

of NXP002 when delivered by nebulisation. This

study

showed that inhaled NXP002 could dose-dependently

regulate

the production of fibrosis-relevant mediators

-- The final planned study as part of the NXP002 pre-clinical

data package is an in vivo study investigating the durability

of the pharmacodynamic effect. This study is ongoing and the

Company anticipates receiving the data for this study in early

2022.

Overall, the Board is encouraged by the progress of the studies

and the positive data generated to date and is considering next

steps, including potential further R&D studies to add further

value and licensing activities.

NXP001 (new form of aprepitant) - Oncology

NXP001 is a proprietary new form of the drug aprepitant that is

currently marketed as a product in the oncology supportive care

setting (chemotherapy induced nausea and vomiting). A disadvantage

of aprepitant is that its sub-optimal properties necessitate a

complex formulation. The Group has discovered new forms of

aprepitant (NXP001) with improved properties and it has been

granted patents on these new forms. Literature data suggests that

aprepitant could have benefits in oncology, i.e., beyond the

currently marketed indications.

To date, the Group has conducted preclinical studies and a Phase

1 study, which demonstrated bioavailability of NXP001, similar to

the marketed product but without requiring a complex formulation.

Further refinement of the formulation will be required ahead of

initiating any future Phase 1 studies.

On 23 September 2020, Oxilio, a privately held pharmaceutical

development company, was granted a six-month option to license

NXP001 globally for repurposing in oncology. On 23 March 2021,

Oxilio exercised the option and on 10 September 2021 a global

license deal was executed. As a result, Nuformix has licensed its

patent estate and know-how on NXP001 in return for an upfront

payment, development milestones and a royalty on net sales, capped

at GBP2 million per annum.

NXP004 (new forms of undisclosed drug) - Oncology

The Group has discovered novel forms of an undisclosed marketed

oncology drug that is approved globally for the treatment of

several cancers, which has significant sales (more than GBP1

billion per annum in 2020) and is showing further sales growth. The

Group filed one patent application in September 2020 on new forms

of this drug and has utilised certain of the proceeds from the

March 2021 placing to do further research on novel forms. This

research has been successful, identifying a new family of

co-crystal forms and on 10 November 2021, post period, the Company

filed a second patent application. This application complements the

previous patent application on NXP004 co-crystals, thus expanding

the Company's intellectual property portfolio. If the patent

applications on these new forms are granted, there is potential for

patent expiry to extend to 2040/2041. The Group will seek to

license NXP004 to the originator of the marketed drug to

potentially extend their patent protection, thus potentially adding

significant value for the originator.

Board changes

In the period from April 2021 to September 2021 a number of

Board changes have occurred:

-- May 2021 - appointment of Dr Alastair Riddell as Non-Executive

Chairman, replacing Dr Chris Blackwell who resigned in February

2021

-- May 2021 - resignation of Dr Karl Keegan as Non-Executive

Director

-- May 2021 - resignation of Dr Joanne Holland as Chief Scientific

Officer; however, Joanne remains a consultant to Nuformix

and is supporting physical form research and science on Nuformix

assets

-- July 2021 - resignation of Dr Anne Brindley as CEO. Anne

has continued to work for the Company through her six-month

notice period

On 1 December 2021 Dr Alastair Riddell was appointed as

Executive Chairman to ensure there is a suitable executive in place

for when Anne Brindley leaves the Company.

Outlook

The success of the fundraise earlier in the year has enabled the

Company to continue to advance and exploit the current assets

within the portfolio through additional R&D and business

development activities as set out above. R&D studies have

progressed successfully on both NXP002 and NXP004, while business

development activities secured the license agreement for NXP001 and

therefore good progress has been made on all fronts. Moreover, the

successful fundraise has provided a good cash runway for the

Company to fund limited operations for the foreseeable future.

The strategy of the Group is to continue to increase the value

of its existing assets while maintaining tight control of costs,

including conducting business development / licensing activities

using a structured and data-driven approach, with the goal of

seeking global licensing deals. The positive data from the R&D

studies performed in the last six months has increased the Board's

confidence that the Nuformix assets have significant value and thus

further investment in and progression of these assets are

warranted.

Financial Review

In the first half of the financial year, the Board has continued

to focus expenditure on R&D activities that add value to the

current assets while optimising the operation to minimise

administrative expenditure and the operational cost-base. Revenue

was received from the second instalment of the upfront payment from

Oxilio on execution of the full licensing agreement for NXP001.

Dr Alastair Riddell

Executive Chairman

14 December 2021

Nuformix plc

Unaudited Interim Results

Consolidated Income Statement and Statement of Comprehensive

Income for the six months ended 30 September 2021

6 months 6 months

ending ending Year ending

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Note GBP GBP GBP

Revenue 50,000 195,550 195,550

Cost of sales (1,695) (115,507) (62,307)

-------------- --------------- --------------

Gross profit 48,305 80,043 133,243

Total administrative expenses (497,327) (554,822) (1,507,221)

Other operating income - 1,300 1,300

-------------- --------------- --------------

Operating loss (449,022) (473,479) (1,372,678)

Finance costs - (2,395) (3,054)

-------------- --------------- --------------

Loss before tax (449,022) (475,874) (1,375,732)

Income tax receipt - 1,215 122,235

Loss for the period and total

comprehensive income for the

period (449,022) (474,659) (1,253,497)

============== =============== ==============

Loss per share - basic and

diluted 4 0.08p 0.10p 0.22p

Nuformix plc

Registration number: 09632100

Unaudited Interim Results

Consolidated Statement of Financial Position as at 30 September

2021

30 September 30 September 31 March

2021 2020 2021

Note Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 5 698 64,661 957

Intangible assets 6 4,168,640 4,225,381 4,186,868

4,169,338 4,290,042 4,187,825

------------- ------------- ------------

Current assets

Trade and other receivables 53,663 88,956 32,260

Income tax asset 121,020 - 121,020

Cash and cash equivalents 1,071,831 216,411 1,669,780

1,246,514 305,368 1,823,060

------------- ------------- ------------

Total assets 5,415,852 4,595,410 6,010,885

============= ============= ============

Equity and liabilities

Equity

Share capital 7 591,609 490,145 591,609

Share premium 6,384,835 4,480,400 6,384,835

Merger relief reserve 10,950,000 10,950,000 10,950,000

Reverse acquisition reserve (8,005,195) (8,005,195) (8,005,195)

Share option reserve 2,019,681 1,847,988 2,005,952

Retained earnings (6,689,962) (5,462,102) (6,240,940)

------------- ------------- ------------

Total equity 5,250,968 4,301,236 5,686,261

------------- ------------- ------------

Current liabilities

Trade and other payables 164,884 243,846 324,624

Loans and borrowings 0 50,328 0

------------- ------------- ------------

164,884 294,174 324,624

Total equity and liabilities 5,415,852 4,595,410 6,010,885

============= ============= ============

Nuformix plc

Unaudited Interim Results

Consolidated Statement of Changes in Equity for the six months

ended 30 September 2021

Share Share Merger Reverse Share Retained Total

capital premium Relief acquisition option earnings GBP

GBP GBP Reserve reserve reserve GBP

GBP

GBP

At 31 March 2020 490,145 4,480,400 10,950,000 (8,005,195) 1,814,613 (4,987,443) 4,742,520

Loss for the half-year

and total - - - - - (474,659) (474,659)

comprehensive loss

Issue of share capital

Share and warrant

based - -

payment - - - - 33,375 - 33,375

--------- ----------- ------------ ---------------------- ----------- ------------------ -----------

As at 30 September

2020 490,145 4,480,400 10,950,000 (8,005,195) 1,847,988 (5,462,102) 4,301,236

Loss for the half-year

and total

comprehensive

loss - - - - - (778,838) (778,838)

Issue of share capital 101,464 2,113,535 - - - - 2,214,999

Share issue costs (209,100) (209,100)

Share and warrant based

payment - - - - 157,964 - 157,964

-

- - - - - -

--------- ----------- ------------ ---------------------- ----------- ------------------ -----------

At 31 March 2021 591,609 6,384,835 10,950,000 (8,005,195) 2,005,952 (6,240,940) 5,686,261

Loss for the half-year

and total

comprehensive

income - - - - - (449,022) (449,022)

Share and warrant based

payment - - - - 13,729 - 13,729

--------- ----------- ------------ ---------------------- ----------- ------------------ -----------

As at 30 September

2021 591,609 6,384,835 10,950,000 (8,005,195) 2,019,681 (6,689,962) 5,250,968

========= =========== ============ ====================== =========== ================== ===========

Nuformix plc

Unaudited Interim Results

Consolidated Statement of Cash Flows for the six months ended 30

September 2021

6 months 6 months

ending ending Year Ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Loss for the year (449,022) (474,659) (1,253,497)

Adjustments to cash flows from non-cash

items

Depreciation and amortisation 18,488 41,337 93,052

Loss on disposal of plant, property and

equipment - - 6,179

Finance costs/ (income) - 2,395 3,054

Income tax expense - - (122,235)

Share and warrant based payment 13,729 33,375 191,339

(416,805) (397,552) (1,082,108)

Working capital adjustments

(Increase) decrease in trade and other

receivables (21,403) (9,460) 47,237

Increase (decrease) in trade and other

payables (159,740) (89,739) 16,099

-------------- --------------- -------------

Cash generated from operations (597,948) (496,751) (1,018,772)

Income taxes (paid)/received 172,391 173,606

-------------- --------------- -------------

Net cash flow from operating activities (597,948) (324,360) (845,166)

Cash flows from investing activities

Acquisitions of property plant and equipment - (605) (605)

Disposals of property plant and equipment - - 44,322

Net cash flows from investing activities - (605) 43,717

-------------- --------------- -------------

Cash flows from financing activities

Proceeds of share issue - - 2,005,899

Interest paid (2,395) (3,054)

Reduction in other loans - - (75,388)

Net cash flows from financing activities - (2,395) 1,927,457

-------------- --------------- -------------

Net (decrease)/increase in cash and cash

equivalents (597,948) (327,360) 1,126,008

Cash and cash equivalents at start of

period 1,669,780 543,772 543,772

Cash and cash equivalents at end of period 1,071,832 216,412 1,669,780

-------------- --------------- -------------

Nuformix plc

Unaudited Interim Results

Notes to the Consolidated Financial Statements for the six

months ended 30 September 2021

1. Basis of preparation of interim financial information

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles of

International Accounting Standards as endorsed by the UK

Endorsement Board ("IAS").

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into UK law and became UK-adopted

International Accounting Standards, with future changes being

subject to endorsement by the UK Endorsement Board. The Group

transitioned to UK-adopted International Accounting Standards in

its consolidated financial statements on 1 April 2021. Whilst this

change constitutes a change in accounting framework, there is no

impact on recognition, measurement or disclosure.

The consolidated interim financial statements are unaudited and

do not constitute statutory accounts within the meaning of Section

434 of the Companies Act 2006. Statutory accounts for the year

ended 31 March 2021, prepared in accordance with IAS, have been

filed with the Registrar of Companies. The Auditors' Report on

these accounts was unqualified and included a reference to which

the Auditors drew attention by way of an emphasis of matter,

without qualifying their report, that a material uncertainty

existed that might cast significant doubt on the Group's ability to

continue as a going concern at that time. The Auditors' Report did

not contain any statements under section 498 of the Companies Act

2006.

The consolidated interim financial statements are for the 6

months to 30 September 2021.

The consolidated interim financial information does not include

all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

group's annual financial statements for the year ended 31 March

2021, which were prepared in accordance with IFRS as adopted by the

European Union. As explained above, although this was a different

accounting framework, there is no impact on recognition,

measurement or disclosure.

2. Basis of consolidation

On 16 October 2017 the Company acquired the entire issued

ordinary share capital of Nuformix Technologies Limited and became

the legal parent of Nuformix Technologies Limited. The accounting

policy adopted by the Directors applies the principles of IFRS 3

(Revised) "Business Combinations" in identifying the accounting

parent as Nuformix Technologies Limited and the presentation of the

Group consolidated statements of the Company (the legal parent) as

a continuation of financial statements of the accounting parent or

legal subsidiary (Nuformix Technologies Limited).

3. Going concern

The consolidated interim financial statements have been prepared

on the going concern basis of preparation which, inter alia, is

based on the directors' reasonable expectation that the Group has

adequate resources to continue to operate as a going concern for at

least twelve months from the date of their approval. In forming

this assessment, the directors have prepared cashflow forecasts

covering the period ending 31 March 2023 which take into account

the likely run rate on overheads and research expenditure and the

prudent expectations of income from its lead programmes.

Whilst there can be no guarantee of the successful outcome of

future trials, in compiling the cashflow forecasts the directors

have made cautious estimates of the likely outcome of such trials,

when income might be generated and have considered alternative

strategies should projected income be delayed or fail to

materialise. These strategies include postponing non-committed

research expenditure, securing alternative licensing arrangements

from those currently planned and using the Group's established

network for fundraising.

These circumstances indicate the existence of a material

uncertainty which may cast significant doubt on the Group's ability

to continue as a going concern. The consolidated interim financial

statements do not include any adjustments that would result if the

company or Group was unable to continue as a going concern.

After careful consideration, the directors consider that they

have reasonable grounds to believe that the Group can be regarded

as a going concern and, for this reason, they continue to adopt the

going concern basis in preparing the consolidated interim financial

statements.

4 Loss per Share

Loss per share is calculated by dividing the loss after tax

attributable to the equity holders of the Group by the weighted

average number of shares in issue during the period.

The basic earnings per share for each comparative period is

calculated by dividing the loss in each of those periods by the

legal entity's historical weighted average number of shares

outstanding.

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (449,022) (474,659) (1,253,497)

Weighted average number of shares 591,609,368 490,145,083 580,629,372

Basic and diluted loss per share 0.08p 0.10p 0.22p

5. Property, Plant and

Equipment Leasehold Computer Laboratory

improvements equipment equipment Total

GBP GBP GBP GBP

Cost or valuation

At 31 March 2020 113,618 17,633 17,084 148,335

Additions - 605 - 605

--------------- ------------ ------------- ----------

At 30 September 2020 113,618 18,238 17,084 148,940

Disposals (113,618) (16,677) (17,084) (147,379)

--------------- ------------ ------------- ----------

At 31 March 2021 - 1,561 - 1,561

At 30 September 2021 - 1,561 - 1,561

--------------- ------------ ------------- ----------

Depreciation

At 31 March 2020 42,950 12,751 9,722 65,423

Charge 15,521 2,145 1,190 18,856

--------------- ------------ ------------- ----------

At 30 September 2020 58,471 14,896 10,912 84,279

Charge 11,846 917 439 13,202

Eliminated on disposal (70,317) (15,209) (11,351) (96,877)

--------------- ------------ ------------- ----------

At 31 March 2021 - 604 - 604

Charge - 259 - 259

--------------- ------------ ------------- ----------

At 30 September 2021 - 863 - 863

--------------- ------------ ------------- ----------

Carrying amount

At 30 September 2020 55,147 3,342 6,172 64,661

=============== ============ ============= ==========

At 31 March 2021 - 957 - 957

=============== ============ ============= ==========

At 30 September 2021 - 698 - 698

=============== ============ ============= ==========

6. Intangible Assets

Goodwill Patents Total

GBP GBP GBP

Cost

At 31 March 2020 4,023,484 449,611 4,473,095

----------- ---------- ----------

At 30 September 2020 4,023,484 449,611 4,473,095

----------- ---------- ----------

At 31 March 2021 4,023,484 449,611 4,473,095

----------- ---------- ----------

At 30 September 2021 4,023,484 449,611 4,473,095

=========== ========== ==========

Amortisation

At 31 March 2020 - 225,233 225,233

Amortisation charge - 22,481 22,481

----------- ---------- ----------

At 30 September 2020 - 247,714 247,714

Amortisation charge - 38,513 38,513

----------- ---------- ----------

At 31 March 2021 - 286,227 286,227

Amortisation charge - 18,228 18,228

----------- ---------- ----------

At 30 September 2021 - 304,455 304,455

=========== ========== ==========

Net book value

At 30 September 2020 4,023,484 201,897 4,225,381

----------- ---------- ----------

At 31 March 2021 4,023,484 163,384 4,186,868

----------- ---------- ----------

At 30 September 2021 4,023,484 145,156 4,168,640

----------- ---------- ----------

For impairment testing purposes, management consider the

operations of the Group to represent a single cash-generating unit

("CGU") focused on research and development. Consequently, the

goodwill is effectively allocated and considered for impairment

against the business as a whole being the single CGU.

7. Share Capital

Allotted, called up and fully paid shares

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

No. GBP No. GBP No. GBP

--------------- ------------ --------------- ------------ -------------------- ----------------

Ordinary shares

of GBP0.001

each 591,609,368 591,609 490,145,083 490,145 591,609,368 591,609

--------------- ------------ --------------- ------------ -------------------- ----------------

8 Share Options and Warrants

The Group operates share-based payments arrangements to

remunerate directors and key employees in the form of a share

option scheme. Equity-settled share-based payments are measured at

fair value (excluding the effect of non-market-based vesting

conditions) at the date of grant. The fair value determined at the

grant date of the equity-settled, share-based payments and is

expensed on a straight-line basis over the vesting period, based on

the Group's estimate of shares that will eventually vest and

adjusted for the effect of non-market based vesting conditions.

Statement of Directors' Responsibilities

We confirm that to the best of our knowledge:

1. this interim condensed set of financial statements has been

prepared in accordance with UK adopted IAS 34 'Interim Financial

Reporting';

2. the interim management report includes a fair review of the information required by:

2.1. DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

2.2. DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

The directors of Nuformix plc are listed in the Group's 2021

Annual Report and Accounts and the current board are set out on the

Investors Information section of Nuformix's website at: Investors

Information - Nuformix

Dr Alastair Riddell

Executive Chairman

Further copies of this document are available from the company's

registered address and will be available on the company's website

later today.

Nuformix plc

Registration number: 09632100

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPGMWPUPGPUW

(END) Dow Jones Newswires

December 14, 2021 02:00 ET (07:00 GMT)

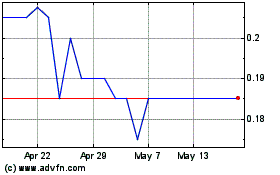

Nuformix (LSE:NFX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nuformix (LSE:NFX)

Historical Stock Chart

From Jul 2023 to Jul 2024