TIDMONT

RNS Number : 4874L

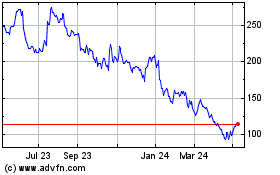

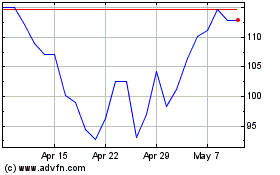

Oxford Nanopore Technologies plc

06 September 2023

06 September 2023

Oxford Nanopore Technologies plc

Interim results for the six months ended 30 June 2023

- Underlying(1) Life Science Research Tools (LSRT) revenue up

53% or 46% on a constant currency basis driven by high quality,

recurring consumables revenue and new customer acquisition

- LSRT gross margin up 280 basis points driven by improvements

to flow cell margins from optimised manufacturing techniques and

efficiency

- Continued investment in innovation and commercial

infrastructure drives increased use of our technology by existing

and new customers, further strengthening market position

Oxford Nanopore Technologies plc (LSE: ONT) ("Oxford Nanopore"

or the "Group"), the company behind a new generation of molecular

sensing technology based on nanopores , today announces its interim

results for the six months ended 30 June 2023.

Gordon Sanghera, Chief Executive Officer, commented:

"We delivered strong performance in the first half, with

underlying Life Science Research Tools revenue up 46% on a constant

currency basis, as more researchers harnessed our sequencing

technology to help find solutions to some of the planet's most

pressing problems. We have invested significantly in innovative new

products and platform enhancements, so that customers can benefit

from richer, faster and more accessible data wherever they need it.

We have also launched important new partnerships and collaborations

aimed at opening opportunities in clinical and applied sequencing

markets."

Summary financial performance

GBP million Change Change

Unless otherwise stated H1 2023 H1 2022 reported CC(2)

=================================================== ======== ======== ========== ========

Total revenue 86.0 122.3 (29.7)% (33.0)%

* Legacy Covid Testing Revenue - 51.8 (100)% (100)%

* Life Science Research Tools (LSRT) revenue 86.0 70.6 +22% +16%

Underlying(1) LSRT revenue 75.6 49.4 +53% +46%

Gross profit 49.5 78.0 (37)%

Gross margin 57.6% 63.7% (610)bps

LSRT Gross margin 57.6% 54.8% +280bps

Adjusted EBITDA(3) (39.4) (34.6) (4.8)

Loss for the period (70.1) (30.2) (39.9)

=================================================== ======== ======== ========== ========

Notes:

Certain numerical figures included herein have been rounded.

Therefore, discrepancies in between totals and the sums may occur

due to such rounding.

1 Underlying revenue excludes revenue from COVID sequencing and

revenue from the Group's largest customer, The Emirati Genome

Program (EGP). All references to underlying growth in this document

have been adjusted for COVID sequencing and EGP revenues.

(2) Constant currency applies the same rate to the H1 23 and H1

22 non-GBP results based on H1 22 rates

3 Adjusted EBITDA is the EBITDA adjusted for i) Share-based

payment expense on founder LTIP ii) Employers' social security

taxes on pre-IPO awards, iii) Revenue and expenses associated with

the settlement of the COVID testing contract with the DHSC and iv)

impairment of investment in associate - see note 4(b).

H1 Financial highlights

-- LSRT revenue increased by 22% to GBP86 million, primarily

driven by new customer acquisition, partially offset by a GBP9.9

million headwind from COVID sequencing, as expected and previously

guided to.

-- Underlying LSRT revenue growth up 46% on a constant currency basis.

-- LSRT growth in all regions; led by the Americas with revenue

up 41% on a reported basis and 72% on an underlying basis.

-- Strong underlying growth across all LSRT customers (S1, S2,

S3, indirect) up 36%, 61%, 53% and 61% respectively.

-- LSRT gross margin increased by 280 bps to 57.6%,

predominantly driven by improvements in manufacturing efficiency,

partially offset by one off costs associated with excess COVID

sequencing kit write offs and investment in compute upgrades.

-- Total revenue and gross margin decline of 29.7% and 610 basis

points respectively, reflects, as expected and previously

announced, the conclusion of the Group's legacy Covid testing

contract with the Department of Health and Social Care (DHSC) in

2022.

-- Adjusted EBITDA loss of GBP(39.4) million (H1 22: GBP(34.6)

million); higher LSRT gross profit offset by increased operating

expenses, reflecting investment in commercial and marketing teams,

to support long term sustainable growth.

-- Increase in loss year-on-year to GBP(70.1) million (H1 22:

GBP(30.2) million). The result for H1 22 included the income from

the conclusion of the Group's Covid testing contract with the DHSC

as described above, a net benefit of GBP37.9 million.

-- Cash, cash equivalents and other liquid investments of

GBP484.6 million[1], compared to GBP558.0 million as of 31 December

2022 .

H1 Key strategic and operational highlights

Continued innovation to strengthen our unique market

position

-- Q20+ chemistry roll-out nearing completion with a large

proportion of all new orders placed being for the upgraded flow

cells and kits. The Q20+ chemistry generates single molecule

accuracy of 99% and is delivering highly accurate variant and

methylation detection at unparalleled scale with no additional

capital investment necessary by our customers, further

strengthening our market position.

-- Acceleration and simplification of sequencing analysis

pipelines with the latest software release enabling Q20+ data to be

generated and basecalled in real time, including methylation, on

the A-series PromethION(R) compute. The A-series compute upgrade is

highly sought after by high-throughput users as they continue to

scale nanopore-based projects. With all basecalling, 5mC, 5hmC and

other modifications fully analysed on the sequencer, customers

workflows are simple and easy to scale.

-- Democratising access to large genomes, transcriptomes and

other high output applications with the PromethION 2 (P2) product

range launch underway. A diverse range of customers have purchased

the P2 Solo, there are now hundreds of P2 Solos in the field in

over 45 countries, with potential to expand the high-output market

to substantially more users. Users can plug these highly accessible

devices into their GridION (R) or a stand-alone compute. The fully

integrated P2(i) is with developers before broader early access

launch later in 2023.

-- Driving the highest accuracy: Early access of High Duplex

flow cells is underway with key users, as they explore nanopore Q30

(99.9%) single molecule accuracy for the most demanding use cases,

such as 'Telomere-to-Telomere' genomes, metagenomic assemblies or

strand specific methylation.

Strategic collaborations and programmes that access and develop

new growth markets, in stated target areas of human genetics,

cancer and infectious disease

-- Collaborations for clinical and applied markets: New

strategic collaborations to optimise the Group's impact in emerging

health and industrial applied markets, including: bioMérieux to

develop innovative infectious disease diagnostics, 4bases in human

and cancer genetics and Pathoquest to advance biological

therapeutics.

-- Large scale UK psychiatric research programme: Announced

22,000 sample cohort study led by the UK National Institute for

Health and Care Research (NIHR) BioResource to further research in

the initial areas of psychiatric, common and rare disease.

-- German programme for rare disease : Announced research

collaboration agreement with "lonGER the 'Clinical Long-read Genome

Initiative' a new national German programme developed to evaluate

the clinical and research applications of comprehensive

nanopore-based sequencing to advance the understanding of rare

disease.

-- Large scale US neurodegeneration research programme: National

Institutes of Health (NIH) Center for Alzheimer's and Related

Dementias (CARD) published an end-to-end pipeline using Oxford

Nanopore technology that produces state-of-the-art single

nucleotide polymorphism (SNP), structural variant and methylation

calls, while being cost-effective and scalable for large

projects.

-- Pathogen sequencing in ICU improves outcomes: Guy's and St

Thomas' hospital published evidence of respiratory metagenomics

workflow using Oxford Nanopore resulting in improved patient

outcomes. Project scaleup continues.

-- Stanford shows methylation helps monitor cancer: A Stanford

University team published a nanopore-based method for

characterising cell-free DNA methylomes, highlighting the future

potential of applying this method for longitudinal monitoring of

cancer during treatment.

Investment in operations and people to support growth

strategy

-- Improving global distribution for faster and easier product

delivery: Agreement signed with UPS to drive rapid and easy global

logistics and ease of delivery for broad customer base, with

specific impact in North America and Asia Pacific. Flow cells will

be stored in UPS Healthcare's high tech distribution facility in

Singapore for the first time and be delivered within 24 to 48 hours

through UPS's distribution capabilities to destinations across Asia

Pacific.

-- Expansion of teams to optimise commercial traction: Global

Commercial headcount increased to 346 at 30 June 2023.

-- Board expansion reflects Pharma/Biotech potential: Kate

Priestman appointed as Non-Executive Director, adding extensive

experience as a biopharma executive, serving in leadership roles

across commercial, operations, corporate strategy, communications,

and government affairs.

A full list of announcements in H1 23 can be found here

Key post period end highlights

-- Using Oxford Nanopore alone, for 'platinum'

telomere-to-telomere (T2T) human genomes: Researchers from a

Chinese consortium published the first T2T human reference genome

for a Han Chinese male, using Oxford Nanopore's ultra-long reads,

further illustrating that ultra-high quality T2T human genomes are

now possible using only Oxford Nanopore sequencing technology,

having previously been assembled with a mixture of

technologies.

-- Research shows cancer utility of nanopore single cell RNA

analysis: A research team at Northwestern University, USA,

developed a computational tool, scNanoGPS (single cell Nanopore

sequencing analysis of Genotypes and Phenotypes Simultaneously) to

accelerate RNA sequencing analysis of same-cell genotypes and

phenotypes in tumours, as detailed in a study published in

Nature.

-- Using Oxford Nanopore to detect drug-resistant tuberculosis

and infectious disease: The World Health Organization (WHO)

announced that a rapid sequencing solution being developed by

Oxford Nanopore meets the class-based performance criteria to

detect drug resistance after TB diagnosis, to guide clinical

decision-making for drug-resistant TB treatment.

Financial guidance

We expect full year 2023 LSRT revenue growth of 18-25% on a

constant currency basis, within the range we previously guided to.

This range includes:

- COVID sequencing revenue: anticipated headwind of

approximately GBP18m, slightly lower than previously expected.

- EGP revenue: expected to be lower than the prior year period (FY22: GBP13.2 million).

FY23 Underlying LSRT revenue growth, excluding COVID sequencing

and the EGP, is expected to be more than 40% on a constant currency

basis.

We now expect gross margin to be greater than 57% for FY23,

reflecting i) the one off impact of investment in upgrading the

compute towers on our large PromethION devices, which delivers

competitive performance advantage by delivering high output rapid

data analysis for large datasets, to drive higher long term

utilisation and new customer acquisition and also ii) the write off

of excess COVID sequencing kits.

All medium-term (FY26) targets are unchanged:

-- Underlying LSRT revenue growth of more than 30% per annum on a constant currency basis

-- LSRT gross margin of greater than 65% by FY26

-- Adjusted EBITDA breakeven by FY26

Presentation of results

Management will host a conference call and webcast today at

12:00pm GMT/ 7:00am ET.

For details, and to register, please visit

https://nanoporetech.com/about-us/investors/reports . The webcast

will be recorded and a replay will be available via the same link

shortly after the presentation.

For further details please contact ir@nanoporetech.com

Capital Markets Day - 19 October 2023

Oxford Nanopore will be hosting a Capital Markets Day for

sell-side analysts and institutional investors on Thursday, 19

October 2023 from 12:00pm. The event will be held at The Science

Museum, Exhibition Rd, South Kensington, London SW7 2DD.

The event will include presentations and Q&A sessions from

Oxford Nanopore's Executive Leadership Team and includes a customer

panel and product demonstrations.

Places are limited so if you would like to attend in-person

please contact ir@nanoporetech.com . The event will also be webcast

live.

-S-

For further information, please contact:

Oxford Nanopore Technologies plc

Investors: ir@nanoporetech.com

Media: media@nanoporetech.com

Teneo (communications adviser to the Company)

Tom Murray, Olivia Peters

+44 (0) 20 7353 4200

OxfordNanoporeTechnologies@teneo.com

About Oxford Nanopore Technologies plc:

Oxford Nanopore Technologies' goal is to bring the widest

benefits to society through enabling the analysis of anything, by

anyone, anywhere. The company has developed a new generation of

nanopore-based sensing technology that is currently used for

real-time, high-performance, accessible, and scalable analysis of

DNA and RNA. The technology is used in more than 120 countries, to

understand the biology of humans, plants, animals, bacteria,

viruses and environments as well as to understand diseases such as

cancer. Oxford Nanopore's technology also has the potential to

provide broad, high impact, rapid insights in a number of areas

including healthcare, food and agriculture.

For more information please visit: www.nanoporetech.com

Forward-looking statements

This announcement contains certain forward-looking statements.

For example, statements regarding expected revenue growth and

profit margins are forward-looking statements. Phrases such as

"aim", "plan", "expect", "intend", "anticipate", "believe",

"estimate", "target", and similar expressions of a future or

forward-looking nature should also be considered forward-looking

statements. Forward-looking statements address our expected future

business and financial performance and financial condition, and by

definition address matters that are, to different degrees,

uncertain. Our results could be affected by macroeconomic

conditions, the COVID pandemic, delays in our receipt of components

or our delivery of products to our customers, suspensions of large

projects and/or acceleration of large products or accelerated

adoption of pathogen surveillance. These or other uncertainties may

cause our actual future results to be materially different than

those expressed in our forward-looking statements.

Business Review

Notes:

In this section, all growth rates are year-on-year unless

otherwise stated. Underlying revenue equals LSRT revenue minus

COVID sequencing and EGP revenues. All underlying growth rates

referred to in this report have been adjusted for EGP and COVID

sequencing. See reconciliation on pages 12-13.

Certain numerical figures included herein have been rounded.

Therefore, discrepancies in between totals and the sums may occur

due to such rounding.

Performance summary

The Group delivered strong performance in the first half of

2023, delivering LSRT revenue of GBP86.0 million, up 22% on a

reported basis and 16% on a constant currency basis. This includes

a GBP9.9 million year-on-year headwind from COVID sequencing as

expected and a GBP0.9 million decline in revenue from the EGP.

Total revenue of GBP86.0 million for H1 23 compares to GBP122.3

million in H1 22, which included the one off GBP51.8 million of

revenue from the conclusion of the Group's legacy Covid testing

contract with the DHSC, as previously announced.

On an underlying basis, excluding revenues from the EGP and

COVID sequencing, we delivered 46% LSRT revenue growth on a

constant currency basis. The strong results we continue to deliver

are a testament to our highly differentiated sequencing technology

platform and the strength and dedication of our teams across the

globe.

Growth continues to be driven by high quality, recurring

consumables revenue, accounting for 75% of LSRT revenue in H1 23,

largely consistent with last year. Growth in consumables was

strong, up 18% year-on-year despite a GBP9.9 million headwind from

COVID sequencing, which predominantly comprised consumables

revenue. The continued increase in the user base and utilisation of

our technology is reflected in the growth of both i) consumables

and ii) device, licence and warranty and other revenue during the

period, up 36% year-on-year.

We delivered strong underlying growth across all LSRT customer

groups in H1. After excluding revenue from the EGP and COVID

sequencing, year-on-year underlying growth in the S1, S2 and S3

customer groups was 36%, 61% and 53% respectively. In addition,

sales through distributors (the "indirect" group) increased by 61%

year-on-year on an underlying basis.

LSRT gross margin increased by 280 basis points year-on-year to

57.6%. This margin expansion was predominantly driven by

improvements to flow cell margins from optimised manufacturing

techniques, more than offsetting the net negative impact of one-off

costs including the write-off of COVID sequencing kits.

At a regional level, we delivered LSRT growth across all three

regions, led by the Americas.

Americas - achieved growth of 72% on an underlying basis, driven

by strong demand for PromethION devices and consumables. Strong

commercial execution in this region reflects increased investment

in commercial resources and growing demand for our unique

technology platform. For our largest customers revenue growth in

this region is principally driven by research in human disease in

the USA and Canada, including projects looking at cancer and

neurological diseases.

EMEAI - revenue grew by 57% on an underlying basis. Growth was

driven by sales of consumables and PromethION devices in the UK and

Germany where our largest customers are conducting human genetics

and cancer research.

APAC - revenue grew 23% on an underlying basis, driven by growth

in consumables and services sold through our distributors. APAC is

dominated by China, which was unchanged year-on-year, but showed a

strong underlying growth after excluding COVID sequencing.

Adjusted EBITDA loss of GBP(39.4) million, an increase of GBP4.8

million (H1 22: GBP(34.6) million). This was primarily driven by

higher LSRT gross profit offset by increased operating expenses,

reflecting investment in innovation and investment in commercial

and marketing teams, to support long-term sustainable growth.

The loss for the period was GBP(70.1) million, a year-on-year

increase of GBP39.9 million (H1 22: GBP(30.2) million). The result

for H1 22 included the income from the conclusion of the Group's

Covid testing contract with the DHSC as described above, a net

benefit of GBP37.9 million.

At 30 June 2023, cash and cash equivalents and liquid

investments [2] totalled GBP484.6 million, compared to GBP558.0

million at 31 December 2022.

Like many other similar technology companies, we took a decision

last year to secure the long-term supply of inventory, to mitigate

global supply risks affecting multiple technology and life science

industries, that could potentially affect availability of core

components. At the balance sheet date, inventory was GBP102.9

million, GBP15.2 million higher than at 31 December 2022. The

significant increase in inventory in H1 reflects the shortening of

lead times on core components, leading to earlier than planned

deliveries of these items.

We expect inventory levels and capital expenditure on assets

under operating leases to return to normal levels in relation to

sales from 2024 onwards.

Execution of our strategy

Disruptive Innovation

Our commitment to continuous innovation is central to our

strategy for growth, as our technology delivers both new and

improved ways for customers to answer biological questions and

therefore reshapes the market. In line with the strategic

priorities set out earlier this year we have focused on driving

rapid adoption of PromethION 2 (P2) Solo, strengthening the

PromethION 24 (P24) and PromethION 48 (P48) with accelerated

compute, and Q20+ chemistry. In addition, we are rogressing our

innovation pipeline with upcoming releases, including products such

as P2i, the "project TurBOT" [3] automation system and MinION Mk1D

device.

High-performance and rapid sequencing, across the nanopore

sequencing platform:

In the first half of 2023 we continued to focus on driving

performance improvements in the field through the rollout of our

Q20+ chemistry, consisting of Kit 14 sample preparation kits and

flow cells containing the new R10.4.1 nanopore chemistry. Q20+

chemistry combines very high single-molecule accuracy with the

ability to reach all parts of the genome and characterise all types

of genetic variation, through the ability to sequence any length

fragments of native DNA/RNA. The platform now delivers simplex

accuracy (when a single strand is read by the nanopore) of over

99%. Simplex accuracy delivers market leading detection and

characterisation of Single Nucleotide Polymorphisms (SNP),

Structural Variants (SV) and methylations. This mode is extensively

used by all large studies of plants, animals and humans.

Field performance with our new chemistry continues to move from

strength to strength and it has been exciting to see the first wave

of scientific publications come through.

In one preprint , researchers from the University of California,

Santa Cruz and the National Cancer Institute sequencing on

PromethION 48 noted that using a single flow cell with the latest

'Q20+ chemistry', they could " detect SNPs with F1-score better

than short read sequencing " and " discover structural variants

with F1-scores comparable to state-of-the-art methods involving

[alternative long read sequencing] and trio information (but at

lower cost and greater throughput )". The paper also describes how

with nanopore-based phasing, it is possible to combine and phase

small and structural variants at megabase scales, all of which

combines to give the clearest picture yet of the whole genome.

In a peer-reviewed Nature publication , researchers from the

Children's Hospital of Philadelphia used Q20+ chemistry to

demonstrate a low-cost method for targeted long-read RNA

sequencing. Called TEQUILA-seq, the method enhances throughput for

long-read RNA sequencing by targeted sequencing, using a

preselected gene panel to analyse full-length transcripts of 468

cancer genes in 40 breast cancer cell lines. They identified novel

isoforms and revealed a mechanism for inactivating tumour

suppressor genes via aberrant isoform variation and

degradation.

In the first half of the year, we also announced the early

availability of the High Duplex flow cells, suitable for the most

challenging of applications, such as 'Telomere-to-Telomere'

assembly of genomes, metagenomic assemblies and strand specific

methylation research. Duplex refers to the analysis of combined

measured signals from double-stranded DNA to produce 99.9% single

molecule accuracy (Q30).

Enabling accessible, distributed sequencing for anyone,

anywhere

We continue to innovate towards a new future of near-sample,

real-time, low-cost technology that can characterise biological

samples in any environments from clinics to factories to

classrooms.

The P2 Solo rollout continues, opening up new high-output

sequencing possibilities with compact form factor. Developer access

to the P2i, with integrated compute and screen, started in H1 and

will continue through the year.

We have been pleased to see the strong interest in both of these

devices across a diverse set of customers. P2 Solo has now been

deployed into hundreds of laboratories in over 45 countries.,

across a broad range of users and applications. We have received

orders from over 500 customers to date, with approximately 20%

coming from new accounts.

With MinION, an upcoming software release will enable users to

take full advantage of Apple(R) [4] 's latest silicon development

(the M2, M2Max and M2Pro, enabling customers to pair our most

affordable sequencer with the convenience of Apple hardware and

generate, basecall and analyse data on the go. In addition, the

MinION will be revamped for the first time since 2015 and the new,

smaller format, with iPad(R) (4) connectivity (the "MK1D") will be

with developers in H2 23 [5] ), ahead of a wider launch in 2024.

The new MinION will continue to enable a broad scientific community

to take control of their high-performance experiments, rapidly and

in any environment. The MK1D will have improved temperature control

enabling customers to deploy it in a broader set of environments

whilst maintaining the temperature in range to generate Q20+ data.

An iPad (R) case, in development, will offer easy compatibility

from the MinION Mk1D to an iPad Pro (R) , enabling it to use all

the latest features including long battery life, accelerated

processing, 5G mobile connectivity and more.

Also, in development and now showing "Q20+" sequencing, is a

new, small and low-power chip (application specific integrated

circuit - ASIC) which will further drive the ability to analyse

anything, anywhere. This new ASIC will underpin a new family of

lower-cost, lower-power devices, including the MinION MkII while

the standard MinION ASIC is also being revamped to deliver data

more quickly.

Transforming PromethION devices

In 2022, we upgraded the PromethION compute from NVIDIA (R) 's

V100 to A-series technology on new PromethION devices. As with the

rest of our devices, existing PromethION users are offered seamless

upgrade routes to the A-Series compute with its increased

processing power enabling it to keep up with basecalling and

methylation detection.

In the first half of 2023, we have seen strong demand for new

devices and upgrades from our existing users. With the integration

of our latest Algorithm architecture Dorado into our device

software MinKNOW, users are seeing a 4.5x increase in basecalling

speed by combining the new compute and new software. Our teams have

further improvements coming as we look to accelerate further and

begin to onboard secondary analysis pipelines.

Direct RNA sequencing launching in H2 23

In the first half of 2023 we announced that a new kit and flow

cell for direct RNA sequencing will launch in H2 23. The new RNA

kit and flow cell will deliver increased accuracy and output, with

the potential to unlock a new field of biological analysis. This

update will enable significant advancements in the RNA research

market alongside novel applications of direct single molecule

sensing such as mRNA vaccine research, where non-natural RNA bases

used in their development need to be sequenced. Single molecule

raw-read accuracy has increased significantly, while output has

improved 3-4x compared to existing Oxford Nanopore RNA sequencing

chemistry.

RNA, the messenger molecule that carries genetic information

from DNA and directs the synthesis of proteins, has traditionally

been sequenced by conversion to cDNA. New understanding of RNA's

functional significance - and related emergence in RNA-based

therapies including vaccines - has underscored the importance of

RNA-related research.

Oxford Nanopore offers the only direct RNA sequencing

technology, where other technologies rely on conversion of RNA to

cDNA, which loses important information in the process. This

represents an opportunity to provide a new generation tool and

develop new applications in RNA sequencing.

Simplifying products and workflows to support broader usage

To support different users taking advantage of nanopore

sequencing, innovations are being introduced to simplify and make

more accessible the end-to-end sequencing process. These include

provision of easy-to-use data analysis tools in EPI2ME, the

analytics tool set, for increasingly broad applications, from

infectious disease, biopharma quality control testing, human

variations and single cell. This enhanced interface equips users at

all levels of expertise with the information they need, wherever

they are. New features also include the ability to run on local

hardware or seamlessly integrate with cloud compute.

Our analysis platform EPI2ME support users doing applications

such as metagenomics, pathogen detection, single cell analysis and

others. Our Human Variation Workflow enables users in one analysis

to combine small variants, structural variants and methylation into

one simple pipeline.

Commercial execution

Our commercial model focuses on driving rapid adoption and

utilisation of our products to catalyse change and growth of the

sequencing and analysis market.

Continued growth and diversification of customer base

In the first half of 2023, we increased year-on-year LSRT

revenue in all customer groups and across all geographical regions,

driven by consumables sales and new customer acquisition.

Growth was driven by the Americas, up 41% year-on-year, or 72%

on an underlying basis, reflecting commercial expansion in this

region. After excluding revenue from the EGP and COVID sequencing,

year-on-year underlying growth in the S1, S2 and S3 customer groups

was 36%, 61% and 53% respectively. In addition, sales through

distributors (the "indirect" group) increased by 61% year-on-year

on an underlying basis.

S3 customers

Our S3 customers generate revenue greater than $250,000 per year

per account. These customers are typically the established large,

centralised sequencing researchers, or operators of large

programmes and service providers. Our growth in this group is

driven by use of our PromethION 24 and 48 devices. A key part of

this market is large scale human genomics programmes, some of which

support national genomics strategies, where thousands of samples

are sequenced for novel insights at scale. We have key partnerships

with customers including G42 in the EGP, and other high-throughput

human genomics projects including Genomics England with a cancer

screening project, and National Institutes of Health (NIH) in the

USA, which are using our information-rich data at scale for

analysis of clinical samples with neurodegenerative conditions.

Underlying S3 revenues have grown by GBP6.8 million or 53%

year-on year, with average spend per customer of approximately

$573,000 per year.

New S3 customers in the period included, a contract laboratory

using PromethION for plasmid sequencing. Requiring the ability to

sequence longer fragments, high-accuracy and high-output data at a

low cost of cost of entry, the customer decided to invest in and

standardise using Oxford Nanopore technology.

S2 customers

Our S2 customers generate between $25,000 and $250,000 per year

per account and are predominantly GridION users. These customers

are often experienced users of genomics technology, typically

research teams or smaller university departments. In some cases,

these customers have an existing sequencing platform and are taking

their first steps into nanopore based sequencing, to add greater

biological value to their projects or services. In other cases,

these are accounts that do not have access to large capital

budgets, previously sending samples to service providers. These

customers benefit from our affordable, plug- and-play platforms to

generate real-time sequencing data as part of their workflow.

S2 revenues have seen the highest level of growth year-on-year.

Underlying revenue growth in S2 customers, was GBP11.6 million or

61% year-on-year.

We continue to grow customers in this group which we believe is

uniquely open to Oxford Nanopore. We have added an additional 130

customers in this group, since the end of last year, whilst

maintaining average spend per customer of approximately $66,000 per

annum.

S1 customers

Our S1 customers generate revenue up to $25,000 per year per

account. These are typically MinION users that are key to providing

new insights in biology, exploiting the unique richness and

rapidity of nanopore sequence data, or everyday users of sequencing

technology for routine analyses. They also represent an easy entry

point for nanopore sequencing; many S1 users progress to

larger-scale genomics projects, or develop methods for small format

devices to potentially be used at scale (for example, in future

applied markets for near-sample analyses). We drive sales in this

customer group primarily through digital marketing and our unique

e-commerce platform.

Underlying S1 growth of GBP4.0 million, represented a growth

rate of 36% year-on-year, driven by a net increase of more than 350

customers in the period. Average revenues remained stable at

approx. $5,500 per annum.

To better communicate our distributor revenues, the Avantor

indirect sales channel which had been included previously in S1

have been moved into the indirect group with the other

distributors. This has been reflected in both the H1 22 and H1 23

numbers in this report.

Indirect (distributor served customers)

We are increasingly investing in improving the level of service

to more difficult to reach countries. We utilise an expanding

network of regionalised distributors to help us. Revenues for these

indirect customers increased by GBP3.8m (or 61%) year-on-year,

which was largely due to strong performance from Avantor, one of

our distributors for entry level products such as MinION.

New collaborations paving the way for clinical and applied

markets

We continue to focus on driving expansion from use of our

technology in LSRT for scientific discovery, through the

translational journey where methods are developed and piloted that

address needs in future clinical diagnostic or industrial "applied

market" applications. In the first half of 2023 we established new

collaborations across a broad range of applications to optimise our

impact in emerging health (such as clinical research) and

industrial applied markets. These included:

-- Cancer: Agreement with 4bases S.A. to provide for use of

nanopore sequencing devices in conjunction with 4bases' CE-IVD kits

to support rapid, high-accuracy analyses in human and cancer

genetics in Italy and Switzerland, with a first target of same-day

BRCA1 and BRCA2 analysis

-- Industrial applied markets: Collaboration with PathoQuest to

bring the first GMP-accredited, nanopore-based biologics genetic

characterisation test to market, for the biopharmaceutical industry

and the advancement of biological therapeutics

-- Technology: Collaboration with Tecan to configure Tecan

automation to enable easier nanopore library preparation for

high-output or larger sample numbers

-- Infectious disease: New strategic collaboration with

bioMérieux to develop innovative infectious disease diagnostics.

Initial areas of collaboration will include a test for determining

antibiotic resistance of tuberculosis; an assay to identify

pathogens in normally sterile clinical samples; and validating

Oxford Nanopore's sequencing platform with BIOMÉRIEUX EPISEQ(R) CS

application for rapid infection outbreak monitoring in patient-care

settings

Post period end, the World Health Organization (WHO) announced

that a rapid sequencing solution being developed by Oxford Nanopore

meets the class-based performance criteria to detect drug

resistance after TB diagnosis, to guide clinical decision-making

for drug-resistant TB treatment.

Operational excellence

In line with the strategic priorities set out earlier this year,

we have continued to invest in operational and manufacturing

infrastructure and processes to improve efficiency and drive margin

expansion.

As a result, we were able to improve LSRT margins by 280 basis

points year-on-year despite ongoing inflationary pressures. Margin

expansion was primarily driven by improvements to MinION and

PromethION Flow Cell margins, reflecting improved manufacturing

techniques and efficiency. Margins on consumables increased by

approximately 410 basis points year-on-year, partially offset by an

approximately 140 basis points headwind related to the COVID kit

obsolescence.

In addition, margins on devices and services remained relatively

flat year-on-year reflecting pricing pressures and the increased

cost of compute.

We continued to make good progress automating parts of flow cell

manufacturing during the period, to increase efficiency and scale.

The new automation systems for MinION and PromethION Flow Cells

have now been prepared for introduction into the flow cell

manufacturing processes,

During the period, we continued to invest in operational and

manufacturing infrastructure to ensure our future capacity

requirements are met to support growth. The refurbishment of a new

south Oxfordshire building to align with our occupational

requirements is underway and our intention is to repurpose the

existing building to serve current and future growth needs across

warehousing and logistics, whilst offering new technical labs and

associated office space. This new dedicated facility will

complement our portfolio of existing facilities which are dedicated

to R&D, corporate and manufacturing.

In February 2023, we announced an extension of our collaboration

with UPS Healthcare to accelerate the delivery of our sequencing of

our high-tech manufacturing facility products and consumables

across the Asia Pacific region. The collaboration will strengthen

our supply chain throughout Asia's main markets and our customers

will benefit from faster delivery with less complexity. Flow cells

will be stored in UPS Healthcare's distribution facility in

Singapore for the first time and be delivered within 24 to 48 hours

through UPS's distribution capabilities to destinations across the

Asia Pacific.

Sustainability - Planet, Product, People

From day one, we have sought to make biological information more

accessible to those who need it, and we are delighted to see how

nanopore users are bringing our tools to bear on the challenges

facing the world. Earlier this year we introduced a new

sustainability strategy - Product, Planet, People - that

encapsulates the consistency of our wider business strategy and our

long-term sustainability commitments. Highlights from those

commitments include:

Product

-- Continue to iterate on product design to develop smaller,

easier to use, and lower cost formats to enable more people in

broader communities to use the technology

-- Continue to establish global support and logistics to fulfil

our vision to enable anyone, anywhere to use Oxford Nanopore

products

Planet

-- Reduce the carbon intensity of our operations by identifying

projects to reduce carbon emissions with an updated target to

reduce the tonnes of CO(2) e emitted per GBPm revenue by 2.5% in

2023

-- Carry out further analysis with a view of preparing a

detailed plan by the end of 2023 that will set out how we will

achieve net zero

People

-- Embed the Values in Action programme to support an

employee-engagement culture, where employees have a voice to

contribute ideas that support key decisions

-- Increase our Board gender diversity to at least 40% female

representation within three years of IPO

Outlook and guidance

We are seeing increasing demand around the world for our unique

platform and are hugely proud of the new ground that our customers

are breaking with the aid of our technology, in research areas

spanning large scale human genomics programmes, pathogen

surveillance, human genetics, cancer, and environmental research,

and in emerging clinical and industrial uses including

biopharmaceutical production. This breadth underlines the scale of

the opportunity we see ahead. We enter the second half of the year

in a strong financial position and with a continued deep commitment

to deliver on our vision to enable the analysis of anything, by

anyone, anywhere.

We expect full year 2023 LSRT revenue growth of 18-25% on a

constant currency basis, within the range we previously guided to.

This range includes:

- COVID sequencing revenue: anticipated headwind of

approximately GBP18m, slightly lower than previously expected.

- EGP revenue: expected to be lower than the prior year period (FY22: GBP13.2 million).

FY23 Underlying LSRT revenue growth, excluding COVID sequencing

and the EGP, is expected to be more than 40% on a constant currency

basis.

We now expect gross margin to be greater than 57% for FY23,

reflecting i) the one off impact of investment in upgrading the

compute towers on our large PromethION devices, which delivers

competitive performance advantage by delivering high output rapid

data analysis for large datasets, to drive higher long term

utilisation and new customer acquisition and also ii) the write off

of excess COVID sequencing kits.

All medium-term (FY26) targets are unchanged:

-- Underlying LSRT revenue growth of more than 30% per annum on a constant currency basis

-- LSRT gross margin of greater than 65% by FY26

-- Adjusted EBITDA breakeven by FY26

Financial review

Certain numerical figures included herein have been rounded.

Therefore, discrepancies in between totals and the sums may occur

due to such rounding.

Performance Summary

The Group delivered Life Sciences Research Tools (LSRT) revenue

for the six months ended 30 June 2023 of GBP86.0 million (H1 22:

GBP70.6 million), representing year-on-year growth of 22% on a

reported basis and 16% on a constant currency basis.

Underlying LSRT revenue growth, excluding revenue from the

Emirati Genome Program (EGP) and COVID sequencing, was 46% on a

constant currency basis. Growth continues to be driven by expansion

of the Group's customer base.

Total revenue in the first six months ended June 2023 was 30%

lower than the corresponding period to 30 June 2022, which included

non-recurring revenue of GBP51.8 million following the conclusion

of the Groups Covid testing contract with the Department of Health

and Social Care (DHSC).

Results - at a glance

GBPmillion H1 23 H1 22 Change

Revenue

Legacy Covid testing revenue - 51.8 -

LSRT revenue 86.0 70.6 +22%

Total revenue 86.0 122.3 (30)%

---------------------------------------- ------- ----------- --------

Gross profit 49.5 78.0 (37)%

Gross margin (%) 57.6% 63.7% (610)bps

LSRT gross margin (%) 57.6% 54.8% +280bps

Operating loss (74.8) (23.0) (225)%

Adjusted EBITDA (39.4) (34.6) (4.8)

Loss for the period (70.1) (30.2) (39.9)

GBPmillion 30 June 31 December Change

2023 2022

Cash, cash equivalents and other liquid

investments [6] 484.6 558.0 (13.2)%

Revenue by LSRT customer group & operating segment is shown

below:

GBPmillion H1 23 H1 22 Reported Underlying

growth (%) growth (%)

S1 16.0 12.8 +25% +36%

S2 32.5 24.2 +34% +61%

S3 26.3 24.6 +7%

* EGP 4.9 5.8 (15)%

* S3 Excluding EGP 21.4 18.8 +13% +53%

Indirect 11.2 8.8 +27% +61%

-------------------------- ----- ----- ----------- -----------

Total LSRT revenue 86.0 70.6 +22% +53%

-------------------------- ----- ----- ----------- -----------

Covid testing revenue - 51.8 -

-------------------------- ----- ----- ----------- -----------

Total revenue 86.0 122.3 (30)%

-------------------------- ----- ----- ----------- -----------

Revenue from our S3 customer group grew by 7% compared to H1 22.

This is despite a decline on EGP revenue from GBP5.8 million in H1

22 to GBP4.9 million in H1 23. Excluding revenue from the EGP and

COVID sequencing, growth was GBP6.8 million or 53%.

The S2 customer group revenue in H1 23 was GBP32.5 million,

growth of 34% compared to H1 22. S2 customers are key to our

expansion over the medium term. Excluding revenue from COVID

sequencing, growth in this customer group was GBP11.6 million or

61% over H1 22.

Looking at our S1 customers which comprise our core user base,

total revenues for the period were GBP16.0 million, representing

growth of 25%. Excluding revenue from COVID sequencing, growth was

GBP4.0 million or 36% over H1 22.

Indirect sales in the period represent sales through

distributors and were GBP11.2 million in H1 23, an increase of 27%.

This growth was driven by our commercial partnership with Avantor

which expands our reach and improves accessibility for entry level

products such as MinION.

Reconciliation of reported revenue to underlying LSRT revenue by

customer group:

GBPmillion H1 23 H1 22 Growth

(%)

S1 16.0 12.8 +25%

Less COVID sequencing (0.7) (1.5)

---------------------------- ----- ----- ------

Underlying S1 revenue 15.3 11.3 +36%

S2 32.5 24.2 +34%

Less COVID sequencing (1.9) (5.2)

---------------------------- ----- ----- ------

Underlying S2 revenue 30.6 19.0 +61%

S3 26.3 24.6 +7%

Less EGP (4.9) (5.8)

Less COVID sequencing (1.7) (6.0)

---------------------------- ----- ----- ------

Underlying S3 revenue 19.6 12.8 +53%

Indirect 11.2 8.8 +27%

Less COVID sequencing (1.2) (2.6)

---------------------------- ----- ----- ------

Underlying Indirect revenue 10.0 6.2 +61%

Geographical trends

The Group aims to make its technology available to a broad range

of scientific users, and currently supports users in around 120

countries. In some territories the Group works with distributors to

achieve or enhance its own commercial presence. In H1 23, the Group

experienced LSRT revenue growth in all territories compared to H1

22.

GBPmillion H1 23 H1 22 Reported Underlying

growth (%) growth (%)

Americas 32.8 23.3 +41% +72%

APAC 17.6 16.6 +6% +23%

EMEAI 35.6 30.6 +16%

* EGP 4.9 5.8 (15)%

* EMEAI Excluding EGP 30.7 24.8 +24% +57%

Total LSRT revenue 86.0 70.6 +22% +53%

Legacy Covid testing Revenue

EMEAI - 51.8 -

--------------------------------- ----- ----- ----------- -------------

Total Revenue 86.0 122.3 (30)%

--------------------------------- ----- ----- ----------- -------------

Reconciliation of reported revenue to underlying LSRT revenue by

geographical region:

GBPmillion H1 23 H1 22 Growth

(%)

Americas 32.8 23.3 +41%

Less COVID sequencing (2.0) (5.5)

---------------------------- ----- ----- ------

Underlying Americas revenue 30.8 17.9 +72%

APAC 17.6 16.6 +6%

Less COVID sequencing (1.1) (3.2)

---------------------------- ----- ----- ------

Underlying APAC revenue 16.5 13.4 +23%

EMEAI 35.6 30.6 +16%

Less EGP (4.9) (5.8)

Less COVID sequencing (2.3) (6.7)

---------------------------- ----- ----- ------

Underlying EMEAI revenue 28.4 18.1 +57%

The Group's Gross profit of GBP49.5 million reduced by 37%

compared to H1 22. The prior period benefited from the positive

impact of the settlement with DHSC, net of impairment of associated

inventory.

LSRT Gross profit contribution in H1 23 was GBP49.5 million, a

growth of 28% from GBP38.7 million in H1 22.

% H1 23 H1 22 Change

LSRT Gross margin % 57.6% 54.8% +280bps

LSRT gross margin improved from 54.8% in H1 22, to 57.6% in H1

23. This is driven by operational improvements including

automation, and improvements in manufacturing techniques to improve

efficiency.

Impact of headcount

Average headcount (FTEs) H1 23 H1 22 Change (%)

Research and development 445 358 +24%

Production 150 150 0%

Selling, general & administration 455 358 +27%

---------------------------------- ----- ----- ----------

Total 1,049 866 +21%

---------------------------------- ----- ----- ----------

In H1 23, the Group increased its average headcount by 21% from

H1 22. This increase was predominantly across research and

development and in the commercial and marketing teams.

The Group invested in bringing onboard new research and

development staff to support the research phase into early product

release across its disruptive platform. Our research and

development teams work on fundamental research for novel sensing

applications, membrane chemistry, sequencing chemistry, nanopores,

enzymes, algorithms, software electronics and arrays to deliver

future platforms and improvement on current products. As a result,

high calibre scientists and researchers have been attracted to join

the company with the goal to realise Oxford Nanopore's vision.

In H1 23 the Groups' manufacturing employees has remained in

line with H1 22. This follows the significant expansion of the team

in 2021, when staff covering all manufacturing stages and processes

expansion were recruited to cater for increased demand from a

growing client base.

The largest increase in the Group's average headcount took place

in the selling, general and administration functions including

legal functions and corporate executives, with an increase of 27%.

The significant expansion of the commercial teams in key geographic

regions supports the Group's business growth objectives globally.

In addition, the investment in in-field and customer support teams

was necessary to maintain and increase customer loyalty and

customer retention.

Research and development expenses

The Group's research and development expenditure is recognised

as an expense in the period as it is incurred, except for the

development costs that meet the criteria for capitalisation as set

out in IAS 38 (intangible assets). Capitalised development costs

principally comprise qualifying costs incurred in developing the

Group's core technology platform and sequencing kits.

Adjusted Research and development expenditure increased by

GBP8.2 million in H1 23 to GBP40.1 million (H1 22: GBP31.9

million).

As amortisation related to internally generated assets has

increased over time, management now consider that it is a more

appropriate presentation to present amortisation and the R&D

tax credit within research and development expenses, rather than as

previously presented within selling, general and administration

expenses. The comparative income statement has been re-presented to

be consistent with the current period presentation.

GBPmillion H1 23 H1 22

Research and development expenses (represented) 48.2 28.6

Adjusting Items

Amortisation of capitalised development

costs (8.7) (6.1)

Employers' social security taxes on pre-IPO

share awards 0.6 9.4

------------------------------------------------ ----- -----

Adjusted R&D Expenses 40.1 31.9

Capitalised development expenses 8.9 9.0

------------------------------------------------ ----- -----

Total R&D Expenses and Capitalised development

expenses 49.0 40.9

------------------------------------------------ ----- -----

This increase in Adjusted Research and development expenses

reflects the groups continued investment in innovation and was

principally due to:

-- a 24% increase in average headcount, coupled with

inflationary pressures of salaries leading to a GBP3.3 million

increased in payroll costs.

-- a GBP4.0 million increase in materials and outsourced costs

Amortisation of capitalised development costs increased by

GBP2.6 million to GBP8.7 million as expected, in line with amounts

capitalised over the last few years.

Selling, general and administration costs

The Group's Adjusted Selling, general and administrative

expenses increased by GBP15.4 million in H1 23 to GBP61.9 million

(H1 22: GBP46.5 million).

H1 23 H1 22

Selling, general and administrative

expenses 76.1 72.3

Adjusting items:

Share based payments expense on Founder

LTIP (14.9) (35.4)

Employers' social security taxes on

pre-IPO share awards 0.7 11.0

Expenses associated with the settlement

of the COVID testing contract with DHSC - (1.4)

Adjusted selling, general and administrative

expenses 61.9 46.5

--------------------------------------------- ------ ------

The main changes were:

-- The total increase in the average headcount in Selling,

general and administrative of 27%, this was primarily driven by our

planned increase in headcount in the commercial teams (47% increase

compared to H1 22). Coupled with inflationary pressures of

salaries, this resulted in a GBP8.7 million increase in payroll

costs.

-- An increase in depreciation of GBP0.8 million to GBP6.4

million in H1 23 from GBP5.6 million in H1 22 driven by increases

in Property, plant and equipment purchases in the period.

Total share-based payment charge included in Selling, general

and administrative expenses decreased by GBP20.8 million in H1 23

to GBP19.1 million compared to GBP39.9 million in H1 22. The

reduction was primarily driven by a decrease in the Founder LTIP

charge (from GBP35.4 million in H1 22 to GBP14.9 million in H1

23).

Adjusted EBITDA

GBPmillion H1 23 H1 22

Loss for the period (70.1) (30.2)

Income tax expense 3.5 2.5

Finance income (7.2) (0.9)

Loan interest 0.0 0.1

Interest on lease 1.1 0.6

Depreciation and amortisation 19.9 16.1

EBITDA (52.9) (11.7)

--------------------------------------------- ------ ------

Adjusting items:

Share based payments expense on Founder LTIP 14.9 35.4

Employers' social security taxes on pre-IPO

share awards (1.3) (20.4)

Settlement of Covid testing contract - (37.9)

Impairment of investment in associate (0.1) -

Adjusted EBITDA (39.4) (34.6)

--------------------------------------------- ------ ------

Adjusted EBITDA losses increased from GBP34.6 million to GBP39.4

million. This was primarily driven by increasing operational

expenses associated with the increase in headcount, partly offset

by an increase in LSRT gross profit.

Exchange gains and losses

As the Group receives a significant amount of revenue in US

Dollars, we seek to reduce the exposure of the Group to

fluctuations in currency by entering into a range of derivative

forward contracts.

During 2023, the strengthening of the USD has resulted in a gain

of GBP2.1 million. This is presented in Other gains and losses (H1

22 GBP5.4 million loss).

Balance sheet

Key elements of change in the balance sheet during the period

comprised the following:

-- the net book value of Property, plant and equipment was

GBP43.3 million at 30 June 2023 an increase of GBP6.0 million since

31 December 2022. This has been driven primarily by purchases of

assets subject to operating leases GBP10.8 million, which includes

the purchase of the upgraded PromethION compute from NVIDIA's V100

to A-series technology on new PromethION devices.

-- Inventory of GBP102.9 million at 30 June 2023 has increased

by GBP15.2 million from GBP87.7 million at 31 December 2022. In

particular, device inventory increased by GBP7.8 million, as a

result of the shortening of lead times on long-term supply

contracts.

-- Movements in Other Financial Assets between current and

non-current. In the first half of 2023, the Group has liquidated

its shorter-term deposits and reinvested the funds in investment

bonds (with a maximum duration of three years), leading to an

overall GBP52.8 million decrease. See table below:

GBPmillion 30 June 31 December

2023 2022

Treasury deposits - 101.3

Investment bonds 149.5 100.9

Other financial assets 1.3 1.4

Total 150.8 203.6

----------------------- ------- -----------

Analysed as:

Current 40.9 119.4

Non-current 109.9 84.1

Total 150.8 203.6

----------------------- ------- -----------

Cash flow

-- Cash, cash equivalents and other liquid investments were

GBP484.6 million at 30 June 2023, a decrease of GBP73.4 million

since 31 December 2022 (see note 5).

-- In H1 23 there was a net cash outflow of GBP52.2 million from

operations, compared to a net cash inflow of GBP3.3m in H1 22,

which benefitted from the GBP50 million settlement of the Covid

testing contract.

-- In H1 23, surplus cash was moved from money market deposits

and invested in investment bonds (with a maximum duration of up to

3 years). Net Cash inflows from investing activities of GBP33.0

million (H1 22: GBP17.6 million outflow) includes:

o The proceeds from other financial assets of GBP101.3 million

(treasury deposits) partly offset by the purchase of financial

assets of GBP49.8 million (investment bonds)

o Interest received of GBP7.5 million

Partly offset by:

o The purchase of property, plant & machinery of GBP14.0

million

o The capitalisation of development costs of GBP8.9 million

o An investment in associate (Veiovia) of GBP3.0 million

-- Net Cash outflows from financing activities of GBP1.9 million

(H1 22: GBP2.2 million) includes:

o Lease and interest payments of GBP3.3 million partially offset

by

o Proceeds from the issue of shares of GBP1.4 million (H1 22:

GBP2.3 million)

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 30 JUNE 2023

6 months 6 months

to June to June

2023 2022

GBP000 GBP000

Revenue 4 86,002 122,348

Cost of sales (36,455) (44,394)

----------- -----------

Gross profit 49,547 77,954

Research and development expenses* (48,230) (28,604)

Selling, general and administrative

expenses* (76,101) (72,314)

Loss from operations (74,784) (22,964)

Finance income 7,239 900

Finance expense (1,069) (685)

Other gains and losses 2,139 (4,877)

Share of losses of associates (228) -

Reversal on impairment of investment

in associate 144 -

Loss before tax (66,559) (27,626)

Tax expense 8 (3,540) (2,549)

Loss for the period (70,099) (30,175)

Other comprehensive (loss) / income:

Items that may be reclassified

subsequently to profit or loss:

Fair value movements on investment

bonds (1,236) -

Exchange (losses) / gains arising

on translation on foreign operations (4,079) 4,251

Other comprehensive (loss) / income

for the period, net of tax (5,315) 4,251

Total comprehensive loss (75,414) (25,924)

----------- -----------

2023 2022

Pence Pence

Loss per share 6 8 4

----------- -----------

*re-presented, see note 7

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 31 December

2023 2022

Note GBP000 GBP000

Assets

Non--current assets

Property, plant and equipment 9 43,255 37,294

Intangible assets 10 30,257 30,039

Investments in associates 11 742 826

Right--of--use assets 24,226 25,906

Other financial assets 13 109,902 84,144

Deferred tax assets 8 5,467 7,681

213,849 185,890

Current assets

Inventories 12 102,939 87,698

Trade and other receivables 56,134 62,905

R&D tax credit recoverable 8,484 9,148

Current tax recoverable 8 548 -

Other financial assets 13 40,862 119,411

Derivative financial assets 1,195 2,060

Cash and cash equivalents 334,812 356,778

544,974 638,000

Total assets 758,823 823,890

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 31 December

2023 2022

Note GBP000 GBP000

Liabilities

Non--current liabilities

Lease liabilities 17,900 19,049

Share-based payment liabilities 111 108

Provisions 14 8,721 8,645

26,732 27,802

Current liabilities

Trade and other payables 73,230 80,249

Current tax liabilities 8 - 1,639

Lease liabilities 14,725 15,049

Derivative financial liabilities - 962

Provisions 14 2,926 4,633

90,881 102,532

Total liabilities 117,613 130,334

Net assets 641,210 693,556

Issued capital and reserves attributable to

owners of the parent

Share capital 15 83 83

Share premium reserve 15 628,936 627,557

Share-based payment reserve 189,889 168,200

Translation reserve (372) 3,707

Accumulated deficit (177,326) (105,991)

TOTAL EQUITY 641,210 693,556

The notes on pages 22 to 41 form an integral part of the

condensed consolidated interim financial information.

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Share-based Foreign

payment exchange Accumulated

Share capital Share premium reserve reserve deficit Total equity

----------------------------- ------------------ ----------------- --------------- ---------------- ---------------------- ----------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

============================= ================== ================= =============== ================ ====================== ================

Note 15 15 15

============================= ================== ================= =============== ================ ====================== ================

At 1 January 2023 83 627,557 168,200 3,707 (105,991) 693,556

============================= ================== ================= =============== ================ ====================== ================

Loss for the period - - - - (70,099) (70,099)

============================= ================== ================= =============== ================ ====================== ================

Exchange gain on translation

of foreign operations - - - (4,079) - (4,079)

============================= ================== ================= =============== ================ ====================== ================

Fair value movements

on investment bonds - - - - (1,236) (1,236)

============================= ================== ================= =============== ================ ====================== ================

Comprehensive loss

for the 6 months to

June 2023 - - - (4,079) (71,335) (75,414)

============================= ================== ================= =============== ================ ====================== ================

Issue of share capital - 1,379 - - - 1,379

============================= ================== ================= =============== ================ ====================== ================

Employee share--based

payments - - 21,807 - - 21,807

============================= ================== ================= =============== ================ ====================== ================

Tax in relation to

share-based payments - - (118) - - (118)

============================= ================== ================= ================ ====================== ================

Total contributions

by and distributions

to owners - 1,379 21,689 - - 23,068

----------------------------- ------------------ ----------------- ---------------- ---------------------- ----------------

At 30 June 2023 83 628,936 189,889 (372) (177,326) 641,210

============================= ================== ================= =============== ================ ====================== ================

At 1 January 2022 82 623,760 96,350 (314) (15,902) 703,976

============================= ================== ================= =============== ================ ====================== ================

Loss for the period - - - - (30,175) (30,175)

============================= ================== ================= =============== ================ ====================== ================

Exchange gain on translation

of foreign operations - - - 4,251 - 4,251

============================= ================== ================= =============== ================ ====================== ================

Total comprehensive

gain / (loss) for

the 6 months to June

2022 - - - 4,251 (30,175) (25,924)

============================= ================== ================= =============== ================ ====================== ================

Issue of share capital - 2,299 - - - 2,299

============================= ================== ================= =============== ================ ====================== ================

Cost of share issue - (1) - - - (1)

============================= ================== ================= =============== ================ ====================== ================

Employee share--based

payments - - 44,344 - - 44,344

============================= ================== ================= =============== ================ ====================== ================

Tax in relation to

share-based payments - - 1,382 - - 1,382

============================= ================== ================= =============== ================ ====================== ================

Total contributions

by and distributions

to owners - 2,298 45,726 - - 48,024

============================= ================== ================= =============== ================ ====================== ================

At 30 June 2022 82 626,058 142,076 3,937 (46,077) 726,076

============================= ================== ================= =============== ================ ====================== ================

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE 6 MONTHS TO 30 JUNE 2023

30 June

30 June

2023 2022

Note GBP000 GBP000

Net cash (outflow) / inflow from operating activities 17 (52,199) 3,312

Investing activities

Purchase of property, plant and equipment (14,016) (8,950)

Capitalisation of development costs (8,940) (8,968)

Investment in associate (3,000) -

Interest received 7,511 932

Purchase of other financial assets (49,794) (643)

Proceeds from sale of other financial assets 101,274 -

Net cash inflow / (outflow) in investing activities 33,035 (17,629)

Financing activities

Proceeds from issue of shares 1,412 2,269

Costs of share issue - (2,381)

Principal elements of lease payments (2,247) (1,411)

Interest paid - (73)

Interest paid on leases (1,045) (601)

Net cash outflow from financing activities (1,880) (2,197)

Net decrease in cash and cash equivalents before foreign exchange movements (21,044) (16,514)

Effect of foreign exchange rate movements (922) 322

Cash and cash equivalents at beginning of period 356,778 487,840

Cash and cash equivalents at the end of period 17 334,812 471,648

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TO 30 JUNE 2023

1 General information

The condensed consolidated interim information for the period

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006.

The summary of results for the year ended 31 December 2022 is an

extract from the published Annual Report and Financial Statements

which were approved by the Board of Directors on 20 March 2023,

have been reported on by the Group's auditors and delivered to the

Registrar of Companies. The audit report on the Annual Report and

Financial Statements was unqualified, did not contain an emphasis

of matter paragraph and did not contain any statement under s498

(2) or (3) of the Companies Act 2006.

2 Significant Accounting Policies

2.1. Basis of preparation

The annual financial statements of Oxford Nanopore Technologies

plc ("Oxford Nanopore" / "the Company") are prepared in accordance

with United Kingdom adopted International Financial Reporting

Standards. The condensed set of financial statements included in

this half yearly financial report has been prepared in accordance

with United Kingdom adopted International Accounting Standard 34

'Interim Financial Reporting'.

The condensed interim financial statements have been prepared in

accordance with the accounting policies set out in our Annual

Report and Financial Statements for the year ended 31 December

2022.

2.2 Going concern

As at 30 June 2023, the Group held GBP484.6 million in cash,

cash equivalents and other liquid investments on the Statement of

Financial Position.

The going concern assessment period is at least 12 months to the

30 September 2024.

In order to satisfy the going concern assumption, the Directors

of the Group review its budget periodically, which is revisited and

revised as appropriate in response to evolving market

conditions.

The Directors have considered the budget and forecast prepared

through to 30 September 2024, the going concern assessment period,

and the impact of a range of severe, but plausible, scenarios,

including supply chain issues driven by demand, logistics

interruptions, the pandemic, heightened geopolitical tension;

particularly between Taiwan and the People's Republic of China and

the war in Ukraine. In particular, the impact of key business risks

on revenue, profit and cash flow are as follows:

-- Reduced revenues due to decline in customer demand,

regulatory and research and development ("R&D") delays; and

-- Increased costs due to supply chain restrictions, rising

utilities costs, rising wages & salary costs, additional

R&D requirements and rising costs of component parts.

Under all scenarios, the Group had sufficient funds to maintain

trading before taking into account any mitigating actions that the

Directors could take. Accordingly, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operation for the foreseeable future and at least one year from the

date of approval of the financial statements. On the basis of these

reviews, the Directors consider it remains appropriate for the

going concern basis to be adopted in preparing these financial

statements.

3. Critical accounting judgements and sources of estimation uncertainty

In applying the Group's accounting policies, the Directors are

required to make judgements, estimates and assumptions about the

carrying amounts of assets and liabilities that are not readily

apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. Actual results may differ from

these estimates.

Critical judgements in applying the Group's accounting

policies

The following are the critical judgements and estimates that the

Directors have made in the process of applying the Group's

accounting policies and that have the most significant effect on

the amounts recognised in the financial information.

Judgements

i. Internally Generated Intangible Assets - research and development expenditure ("R&D")

Critical judgements are required in determining whether

development spend meets the criteria for capitalisation of such

costs as laid out in IAS 38 "Intangible Assets", in particular

whether any future economic benefit will be derived from the costs

and flow to the Group. The Directors believe that the criteria for

capitalisation as per IAS 38 paragraph 57 for specific projects

were met during the period and accordingly all amounts in relation

to the development phase of those projects have been capitalised as

an intangible asset during the period. All other spend on R&D

projects has been recognised within R&D expenses in the income

statement during the period.

Management do not have a formal timesheet process for monitoring

time spent by employees on projects in their development stage.

Instead, Management consults with the relevant project leaders on a

regular basis to understand and estimate the time spent on projects

in their development stage. When a percentage allocation has been

agreed, per the estimate below, this is then applied to other,

non--employee--related development costs to ensure costs are

consistently and appropriately capitalised (related estimate

disclosure in iii. below). The net book value of internally

generated capitalised assets at 30 June 2023 is GBP29.9 million (31

December 2022: GBP29.7 million).

Estimates

i. Non-standard customer contracts

As noted in the revenue recognition accounting policy set out in

our Annual Report and Financial Statements for the year ended 31

December 2022, revenue contracts for the sale of bundled goods and

services require the allocation of the total contract price to

individual performance obligations based on their stand-alone

selling prices. The Group occasionally enters into larger bespoke

contracts which might include a clause linked to the performance of

the products and provision of consumables to fulfil the contract.

This requires Management to estimate the number of items likely to

be delivered under the contract. If additional consumables were

required to fulfil the contract for a further 6 months, revenue

recognised to the reporting date would decrease by GBP3.4 million.

If additional consumables were required to fulfil the contract for

the entirety of its term, revenue recognised to the reporting date

would decrease by GBP5.6 million.

Critical accounting judgements and sources of estimation uncertainty

(continued)

ii. Share-based payments

Details of the share-based payment schemes operated by the Group

are disclosed in note 16. In 2021, awards were granted to the

Executive Directors of the Company under the Oxford Nanopore

Technologies Limited Long Term Incentive Plan 2021 (Founder LTIP).

Half of the awards are subject to a non-market revenue performance