RC2 increases its shareholding in EPH

29 April 2010 - 4:00PM

UK Regulatory

TIDMRC2

RNS Number : 9978K

Reconstruction Capital II Ltd

29 April 2010

Reconstruction Capital II Limited

("RC2" or the "Company")

29 April 2010

RC2 increases its shareholding in East Point Holdings Limited ("EPH" or the

"Group") by exchanging claims against EPH's founding shareholders for additional

shares

RC2 is pleased to announce that it has increased its shareholding in EPH from

21.33% to 42.00% as a result of exchanging claims against EPH's founding

shareholders for an additional shareholding in the Group.

Under RC2's original investment agreement, RC2 had the right to put its shares

in EPH back to EPH and its founding shareholders (the "Put Option") if a

reorganisation of the Group into its various business lines (the

"Reorganisation") had not taken place by 8 December 2009.

Because EPH was unable to complete the required Reorganisation in due time, RC2

was able to exercise the Put Option and did so as a protective measure in early

2010. Following this exercise, RC2 commenced negotiations with the Group and,

after examining all options and with particular regard to the difficulties in

monetising the claim derived from the Put Option, RC2 determined that the most

beneficial solution for its shareholders was to exchange its claim for

additional shares in EPH.

At the same time, Darby Converging Europe Mezzanine Finance Limited ("Darby"), a

principal investment fund, has agreed to swap a mezzanine facility provided to

another affiliate of the Group for a 24.67% shareholding in EPH. Darby is the

private equity arm of the Franklin Templeton Investments Group of the USA.

Following the above transactions the new shareholding structure of EPH is:

RC2: 42.00%

Darby: 24.67%

Founders: 33.33%

RC2's original investment in EPH amounted to EUR 30 million and, based on an

independent valuation last year, this was written down to EUR 18m to reflect

changed market conditions. RC2 has now commissioned a new valuation of EPH to

reflect the current business environment and the Group's latest financial

results, as well as Darby's conversion of its mezzanine debt into equity. It is

expected that the new valuation of this investment will be included in the May

monthly NAV statement, which will also reflect RC2's higher shareholding in EPH.

Ion Florescu, a director of RC2, commented: "We are pleased to continue our

partnership with the founders of EPH and welcome Darby as a new shareholder.

This move will more closely align the interests of the two funds. Since the

entry of RC2 into the Group, substantial progress has been made to reorganize

EPH along its business lines, improve corporate governance and prepare its

various businesses for exits. RC2 and its partners in this investment intend to

build up shareholder value by continuing to work on these objectives."

Robert D. Graffam, Senior Managing Director of Darby, commented "We are pleased

to be joining RC2 and the Founding Shareholders as a major stakeholder in EPH, a

prominent Group operating many attractive businesses throughout Central and

Southeast Europe."

For further information, please contact:

Reconstruction Capital II Limited

Ion Florescu

Tel: +44 (0) 207 244 0088

Grant Thornton Corporate Finance (Nominated Adviser)

Philip Secrett / Robert Beenstock

Tel: +44 (0) 20 7383 5100

LCF Edmond de Rothschild Securities (Broker)

Hiroshi Funaki / Claire Heathfield

Tel: +44 (0) 20 7845 5960

About EPH

Founded in 1990, EPH is a Cyprus-based holding company with significant business

interests across South East Europe, primarily Serbia and Romania. Based on the

audited consolidated accounts, in 2008 the Group recorded sales of EUR 426.1m

and an operating profit of EUR 9.9m. EPH operates along the following main

business lines:

· Agribusiness: the Group is a specialist trader in agricultural products

across South East Europe, and has built up a network of agricultural storage

facilities along or near the Danube, including a flagship silo in the port of

Constanta.

· Milling: the Group owns two wheat and one corn flower mill all of which

are based in Serbia and include cereal storage facilities.

· Bakeries: the Group owns a controlling stake in Klas DOO, the largest

industrial bakery group in Serbia including a network of retail shops and

several production sites across the country.

· Copper Processing: EPH owns a controlling stake in Valjaonica Bakra

Sevojno AD, Serbia's biggest copper processor.

· Cable Production: EPH acquired a 93% stake in Novkabel AD, Serbia's second

largest cable producer in early 2009.

· River Shipping: In 2007, EPH acquired DDSG-Cargo (now renamed Erste

Donau-Dampfschiffahrts-Gesellschaft m.b.H.), an Austrian river shipping company

which dates back to 1829 with 265 vessels operating along the Danube.

· Real Estate: The Group owns a number of properties in various countries

and plans to redevelop some of its operating industrial assets as residential

and commercial projects.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCKMGZDVRGGGZM

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jun 2024 to Jul 2024

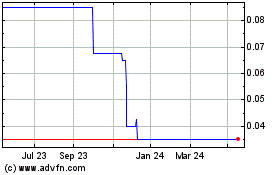

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jul 2023 to Jul 2024