TIDMRGO

RNS Number : 8105N

RiverFort Global Opportunities PLC

27 September 2023

RiverFort Global Opportunities plc

("RGO" or the "Company")

Unaudited interim results for the 6 months ended 30 June

2023

RiverFort Global Opportunities plc is pleased to announce its

unaudited interim results for the six months to 30 June 2023.

Highlights

-- Total NAV of GBP 10.2 million as at 30 June 2023

-- NAV per share of 1.30 pence compared to the current share price of 0.59 pence

-- Smarttech247 is progressing well as a listed company

-- Around GBP2.4 million of net cash available for further investment

Philip Haydn-Slater, Non-Executive Chairman, commented:

"Given the difficult market conditions of 2022 continuing into

2023, RGO has continued to accumulate and preserve cash during the

period such that at the period end the Company had a cash balance

of GBP2.4 million. This strategy has, however, resulted in a

reduction in investment income, although at the same time, the

Company has broadly maintained its NAV against this background of

difficult markets. In particular, Smarttech247 is progressing well

as a listed company which has been reflected in an increase in its

share price during the period. However, notwithstanding this and

the maintenance of its NAV, disappointingly, the Company's current

shares are trading at a 55% discount to its underlying NAV.

Post period end both in response to attractive investment

opportunities and significant demand for the Company's capital, a

number of new investments have been made which, going forward, we

believe will generate attractive returns whilst offering downside

protection. We believe that this combination continues to be an

attractive investment strategy in current markets."

Chairman's statement

The analysis of income for the period is set out below:

Half year Year to

to 30 June 31 December

2023 2022

GBP000 GBP000

------------ -------------

Investment income 215 1,167

Net income from financial instruments

at FVTPL (141) (1,450)

Net foreign exchange gains/(losses)

on financial instruments (106) 90

Total investment income (32) (193)

------------ -------------

During the period, the Company generated total investment income

of GBP215,000 from its investment portfolio. The Company

principally invests by way of debt and/or equity-linked instruments

which provides equity upside with downside protection. Investment

income is therefore principally generated from interest, fees, with

additional income from equity conversion and warrants. Net income

from financial instruments at FVTPL is derived from changes in the

value of the Company's investment portfolio.

The Company's principal investment portfolio categories are

summarised below:

Category Cost or valuation Cost or valuation

at at

30 June 2023 31 December

2022

(GBP000) (GBP000)

Debt and equity- linked debt

investments 2,482 3,612

Pre IPO investments 1,067 3,427

Equity and other investments 3,277 1,067

Cash resources 2,420 958

Total 9,246 9,064

------------------- -------------------

During the period, the Company has focused on recovering cash

from its debt and equity linked portfolio. This portfolio currently

includes over 20 companies, with principal investments in companies

such as Jubilee Metals plc, Gaussin SA, Kibo Energy plc and Valoe

Corp Oyj. Since the period end, investments have been made in

companies including Gaussin SA, UK Oil and Gas plc, Cadence

Minerals plc and Sareum Holdings plc.

The pre-IPO investment category now principally comprises the

Company's holding in Emergent Entertainment ("Emergent") as

Smarttech247 Group plc ("Smarttech247") was successfully listed on

AIM in December 2022 and is now included in the equity and other

investments category.

During the period, Emergent signed an LOI to secure development

funding to develop a new game and is also in discussions on other

projects. The launch of the VR game, Peaky Blinders, was positively

received and further work is underway to increase sales. The

company has agreed terms with a massive multiplayer roleplaying

game developer to fast track the development of its Web3 game,

Resurgence, which is expected to reduce development times by 12

months. The management team is also working on various initiatives

to reduce the company's cost base and it expects 2023 revenues to

be significantly ahead of the previous year.

The equity and other investments category principally comprises

the Company's holdings in Smarttech247, Pires and its warrant

portfolio.

Smarttech247 (AIM: S247) is an established global artificial

intelligence-based cybersecurity business, specialising in

automated managed detection and response. It has a successful track

record of revenue growth and profitability and is positioned at the

intersection of three major cyber security growth markets: security

threat incidents, growth of cloud adoption and proliferation of

cyber security data generation that needs to be integrated.

Recent full year and interim results of Smarttech247, along with

some significant new contract wins have reinforced the company's

growth trajectory. In May 2021, the Company invested EUR1.4 million

in Smarttech247 to help fund its expansion and development. As at

the period end, this holding was worth GBP2.4 million representing

a significant uplift on investment.

Pires, is a company listed on AIM that invests in next

generation technology companies with a focus on AI. Pires is

continuing to build an attractive investment portfolio and,

notwithstanding difficult markets for technology companies, has

managed to maintain the value of its portfolio during the period.

At the same time, a number its portfolio companies have been able

to successfully raise new funds during the period demonstrating the

quality of its portfolio. Further details can be found on the

company's website which is www.piresinvestmentsplc.com.

As previously announced, as part of the Company's overall

strategy when making investments, warrants or their equivalent are

negotiated which can significantly increase the level of investment

return . However, due to the inherent volatility associated with

this form of instrument, the potential value of this warrant

portfolio is not fully reflected in the Company's net asset value

and a return is only crystallised when the respective warrants are

exercised and resulting shares sold.

The key unaudited performance indicators are set out below:

Performance indicator 30 June 31 December Change

2023 2022

------------------------------------ ------------------ ------------- ----------

Investment income GBP215,035 GBP1,167,379

------------------------------------ ------------------ ------------- ----------

Net asset value GBP 10,164,956 GBP10,587,738 -4.0%

Net asset value - fully diluted per

share 1.30p 1.35p -3.7%

Closing share price 0.63p 0.75p -16.7%

Market capitalisation GBP4,846,000 GBP5,816,000 -16.7%

------------------------------------ ------------------ ------------- ----------

The Company's overall net asset position has reduced slightly

during the period. The decrease in the value of the Pires

investment partially offset by the increase in the value of the

Company's holding in Smarttech247 and the lower level of investment

income was offset by administration and advisory costs. As referred

to above, the Company has continued to grow its cash balance during

the period and is now well positioned to focus on making new

investments as attractive opportunities arise .

Philip Haydn-Slater

Non-Executive Chairman

27 September 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For more information, please contact:

RiverFort Global Opportunities plc: +44 (0) 20 3368 8978

Philip Haydn-Slater, Non-Executive Chairman

Nicholas Lee, Investment Director

Nominated Adviser:

Beaumont Cornish +44 (0) 20 7628 3396

Roland Cornish/Felicity Geidt

Joint Broker: +44 (0) 20 7601 6100

Shard Partners LLP

Damon Heath/Erik Woolgar

Joint Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Lucy Williams

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

-------------------------------------------- -------------- -------------- ----------------

Investment income 215,035 417,476 1,167,379

Net loss from financial instruments

at FVTPL (140,753) (440,460) (1,449,703)

Foreign exchange (losses)/gains on

financial

instruments (106,529) 103,689 89,703

Total income (32,247) 80,705 (192,621)

Administration expenses (173,245) (170,371) (318,933)

Investment advisory fees (151,565) (214,879) (413,746)

Exchange translation (losses)/gains (65,725) 22,249 58,870

Loss before taxation (422,782) (282,296) (866,430)

Taxation - - -

-------------------------------------------- -------------- -------------- ----------------

Loss for the period and total comprehensive

expense (422,782) (282,296) (866,430)

Basic loss per share

Continuing and total operations (0.05p) (0.04p) (0.11p)

-------------------------------------------- -------------- -------------- ----------------

Fully diluted loss per share

Continuing and total operations (0.05p) (0.04p) (0.11p)

-------------------------------------------- -------------- -------------- ----------------

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

---------------------------- ---------- ---------- ---------------

ASSETS

Non-current investments

Financial asset investments 5,545,225 7,434,772 5,962,814

---------------------------- ---------- ---------- ---------------

Total non-current assets 5,545,225 7,434,772 5,962,814

---------------------------- ---------- ---------- ---------------

Current assets

Financial asset investments 1,280,498 2,456,686 2,152,879

Trade and other receivables 1,444,766 299,102 1,854,870

Cash and cash equivalents 2,419,917 1,718,844 958,135

---------------------------- ---------- ---------- ---------------

Total current assets 5,145,181 4,474,632 4,965,884

---------------------------- ---------- ---------- ---------------

Total assets 10,690,406 11,909,404 10,918,698

---------------------------- ---------- ---------- ---------------

LIABILITIES

Current liabilities

Trade and other payables 525,450 442,879 330,960

Total current liabilities 525,450 442,879 330,960

---------------------------- ---------- ---------- ---------------

Net assets 10,164,956 11,466,525 10,587,738

---------------------------- ---------- ---------- ---------------

EQUITY

Share capital 77,540 77,540 77,540

Share premium account 1,568,353 1,568,353 1,568,353

Share options reserve 201,034 201,034 201,034

Retained earnings 8,318,029 9,619,598 8,740,811

---------------------------- ---------- ---------- ---------------

Total equity 10,164,956 11,466,525 10,587,738

---------------------------- ---------- ---------- ---------------

UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Called

up Share Share

share premium options Retained Total

capital account reserve earnings equity

GBP GBP GBP GBP GBP

-------------------------- --------- ---------- --------- ----------- -----------

Balance at

1 January 2022 77,540 1,568,353 201,034 9,901,894 11,748,821

Loss for the year and

total comprehensive

expense - - - (866,430) (866,430)

-------------------------- --------- ---------- --------- ----------- -----------

Dividend payment - - - (294,653) (294,653)

Balance at

31 December 2022 77,540 1,568,353 201,034 8,740,811 10,587,738

Loss for the period

and total comprehensive

expense - - - (422,782) (422,782)

-------------------------- --------- ---------- --------- ----------- -----------

Balance at

30 June 2023 77,540 1,568,353 201,034 8,318,029 10,164,956

-------------------------- --------- ---------- --------- ----------- -----------

UNAUDITED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

--------------------------------------- -------------- ---------------- ----------------

Cash flows from operating activities

Investment income received 401,514 43,938 500,099

Operating expenses paid (146,885) (244,386) (1,026,445)

--------------------------------------- -------------- ---------------- ----------------

Net cash inflow/(outflow) from

operating activities 254,629 (200,448) (526,346)

--------------------------------------- -------------- ---------------- ----------------

Cash flows from investing activities

Purchase of investments (808,089) (2,807,144) (5,384,144)

Proceeds from disposal of investments - 27,316 27,316

Debt instrument repayments 2,059,394 2,582,948 5,033,776

Net cash from/(used in) investing

activities 1,251,305 (196,880) (323,052)

--------------------------------------- -------------- ---------------- ----------------

FINANCING ACTIVITIES

Dividend payment - - (294,653)

--------------------------------------- -------------- ---------------- ----------------

Net cash used in financing activities - - (294,653)

--------------------------------------- -------------- ---------------- ----------------

Net increase/(decrease) in cash

and cash equivalents 1,505,934 (397,328) (1,144,051)

Cash and cash equivalents at beginning

of period 958,135 2,012,483 2,012,483

Effect of foreign currency exchange

on cash (44,152) 103,689 89,703

--------------------------------------- -------------- ---------------- ----------------

Cash and cash equivalents at end

of period 2,419,917 1,718,844 958,135

--------------------------------------- -------------- ---------------- ----------------

NOTES TO THE INTERIM REPORT

1. The financial information set out in this interim report does

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The group's statutory financial statements for

the period ended 31 December 2022, prepared under International

Financial Reporting Standards (IFRS), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The interim financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 31 December 2022. The

interim financial statements have not been audited or reviewed in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

The financial statements have been prepared on a going concern

basis under the historical cost convention.

The Directors believe that the going concern basis is

appropriate for the preparation of the financial statements as the

Company is in a position to meet all its liabilities as they fall

due.

2. Earnings per share

Earnings per share is calculated by dividing the profit/(loss)

attributable to equity shareholders by the weighted average number

of shares in issue.

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

------------------------------------------- -------------- -------------- --------------

(Loss)/profit from continuing

and total operations (GBP422,782) (GBP282,296) (GBP866,430)

------------------------------------------- -------------- -------------- --------------

Weighted average number of shares

in the period for basic earnings 775,404,187 775,404,187 775,404,187

Weighted average number of shares

in the period for fully diluted

earnings 775,404,187 775,404,187 775,404,187

------------------------------------------- -------------- -------------- --------------

Basic and fully diluted (loss)/earnings

per share:

Basic (loss)/earnings per share

from continuing and total operations (0.05p) (0.04p) 0.11p

Fully diluted (loss)/earnings

per share from continuing and

total operations (0.05p) (0.04p) 0.11p

For the current period exercise of the outstanding warrants

would be anti-dilutive for earnings per share, so the weighted

average number of shares in issue is the same for both basic

and fully diluted earnings per share calculations.

3. Copies of the interim report can be obtained from: The

Company Secretary, RiverFort Global Opportunities plc, Suite 39, 18

High Street, High Wycombe, Buckinghamshire, HP10 8NJ and are

available to view and download from the Company's website :

www.riverfortglobalopportunities.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GUGDCDSDDGXR

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

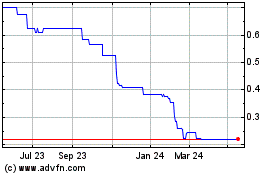

Riverfort Global Opportu... (LSE:RGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

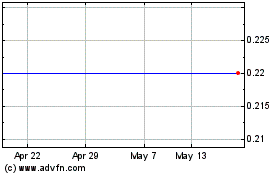

Riverfort Global Opportu... (LSE:RGO)

Historical Stock Chart

From Dec 2023 to Dec 2024