TIDMSN.

RNS Number : 1436F

Smith & Nephew Plc

03 November 2022

Smith+Nephew Third Quarter 2022 Trading Report

3 November 2022

Q3 Highlights(1,2)

-- Q3 revenue of $1,250 million (2021: $1,266 million),

representing underlying revenue growth of 4.8% (600bps FX headwind

resulted in reported decline of -1.2%)

-- Orthopaedics revenue up 2.1%. Excluding China, Orthopaedics grew 5.6%

-- Sports Medicine & ENT up 7.1%, with recent product launches performing well

-- Advanced Wound Management up 6.0%, maintaining recent strong performance

2022 Full Year Outlook(1,2)

-- Full-year underlying revenue growth currently expected in

middle of previously guided range of 4.0% to 5.0%

-- Unchanged trading profit margin guidance of around 17.5%

Strategic and Operational Update

-- 12-point plan to improve execution and drive Strategy for

Growth underway, focused on fixing Orthopaedics, improving

productivity, and accelerating growth in Advanced Wound Management

and Sports Medicine

o Teams and structures embedded and KPIs established

o In Orthopaedics, improved logistics contributed to a reduction

in overdue orders and improved instrument set utilisation during

the quarter

-- Continuing cadence of new product launches and publication of clinical evidence

Deepak Nath, Chief Executive Officer, said:

"We delivered 4.8% underlying revenue growth in the third

quarter, with all franchises and geographies contributing, and are

on track to deliver our full year guidance.

"Last quarter we set out our 12-point plan to improve business

performance. We are executing at pace and have recorded a number of

early successes, including reducing backorders and improving

instrument set deployment in Orthopaedics.

"We also continue to deliver innovative new products and build

on the value of our technology. During the quarter we became the

first company to receive FDA approval for robotics-assisted

revision knee surgery, launched a superabsorbent wound dressing,

and published compelling new rotator-cuff repair data for REGENETEN

.

"While we are still near the start of the journey, and there is

much more work to be done, I am pleased with our early progress,

and confident that we are on the right track to transform

performance."

Enquiries

Investors

Andrew Swift +44 (0) 1923 477433

Smith+Nephew

Media

Charles Reynolds +44 (0) 1923 477314

Smith+Nephew

Susan Gilchrist / Ayesha Bharmal +44 (0) 20 7404 5959

Brunswick

Analyst conference call

A conference call to discuss Smith+Nephew's third quarter

results will be held today at 8.30am GMT / 4.30am EDT, details of

which can be found on the Smith+Nephew website at

https://www.smith-nephew.com/results/ .

Forward calendar

The full year results will be released on 21 February 2023.

Notes

1. All numbers given are for the quarter or nine months ended 1

October 2022 unless stated otherwise.

2. Unless otherwise specified as 'reported' all revenue growth

throughout this document is 'underlying' after adjusting for the

effects of currency translation and including the comparative

impact of acquisitions and excluding disposals. All percentages

compare to the equivalent 2021 period.

'Underlying revenue growth' reconciles to reported revenue

growth, the most directly comparable financial measure calculated

in accordance with IFRS, by making two adjustments, the 'constant

currency exchange effect' and the 'acquisitions and disposals

effect', described below.

The 'constant currency exchange effect' is a measure of the

increase/decrease in revenue resulting from currency movements on

non-US Dollar sales and is measured as the difference between: 1)

the increase/decrease in the current year revenue translated into

US Dollars at the current year average exchange rate and the prior

year revenue translated at the prior year rate; and 2) the

increase/decrease being measured by translating current and prior

year revenues into US Dollars using the prior year closing

rate.

The 'acquisitions and disposals effect' is the measure of the

impact on revenue from newly acquired material business

combinations and recent material business disposals. This is

calculated by comparing the current year, constant currency actual

revenue (which includes acquisitions and excludes disposals from

the relevant date of completion) with prior year, constant currency

actual revenue, adjusted to include the results of acquisitions and

exclude disposals for the commensurate period in the prior year.

These sales are separately tracked in the Group's internal

reporting systems and are readily identifiable.

Third quarter 2022 trading update

Our third quarter revenue was $1,250 million (2021: $1,266

million), representing underlying revenue growth of 4.8%. A 600bps

foreign exchange headwind, primarily due to the strength of the US

Dollar, resulted in a reported revenue decline of -1.2%. Q3 2022

comprised 63 trading days, in line with the comparable Q3 period in

2021.

All franchises and geographies contributed to the underlying

revenue growth in the quarter.

Orthopaedics revenue was up 2.1% (-3.0% reported), Sports

Medicine & ENT up 7.1% (0.8% reported), and Advanced Wound

Management up 6.0% (-1.0% reported) .

Revenue growth in our Established Markets was 3.9% (-1.8%

reported). Within this, in the US, our largest market, we delivered

strong 6.0% revenue growth (6.0% reported). Other Established

Markets revenue was up 0.4% (-14.3% reported). Emerging Markets

revenue was up 8.6% (1.4% reported), as the expected decline in

China Orthopaedics discussed below continued to be offset by strong

growth elsewhere including in India and Latin America.

Macro factors including shortages of some input materials, such

as semiconductors and resin, and staff shortages in healthcare

systems, remained constraining factors on growth across a number of

segments during the quarter.

Strategic update

In July 2022 we announced a comprehensive 12-point plan to drive

better execution at pace, in order to take the business forward and

deliver on our Strategy for Growth pillars to Strengthen and

Accelerate. This plan is focused on:

-- Fixing Orthopaedics

-- Improving productivity

-- Accelerating growth in Advanced Wound Management and Sports Medicine & ENT

During the quarter we embedded the teams and structures to drive

this work and established the internal KPIs to monitor progress and

drive accountability.

While we expect the work to deliver the full plan to take two

years, we are making meaningful early progress, including:

-- Improving logistics and updating our demand and supply

planning process to bring a deeper level of specificity and

collaboration between our operations and commercial teams;

-- Reducing the value of overdue orders in US Orthopaedics by

more than 15% since the peak in the first half of the year; and

-- Moving Orthopaedics instrument sets to more active customer

accounts, with 80% of the first phase completed in the US by

quarter end.

Further work is proceeding across the 12-point plan, and we will

continue to update on progress in future trading updates.

Delivering innovation

During the quarter we continued to introduce innovative new

products and clinical evidence to drive future growth.

In Orthopaedics, we became the first company to receive FDA

510(k) clearance for a revision knee indication using a

robotics-assisted platform and completed the first cases on our

CORI Surgical System. Revisions account for around 10% of all knee

procedures in the US. We also continued the roll-out of our OR3O

Dual Mobility System for use in primary and revision hip

arthroplasty, launching in Japan.

In Sports Medicine, we announced encouraging evidence supporting

our REGENETEN Bioinductive Implant, which delivered an 86%

reduction in rotator cuff re-tear rates at 12 months in interim

results from a randomised controlled trial.

In Advanced Wound Management, we also introduced our DURAMAX S

Silicon Super Absorbent Dressing for high exuding wounds, launching

in Europe where superabsorbers are one of the fastest growing

categories of dressings.

Consolidated revenue analysis for the third quarter

1 2

October October Reported Underlying Acquisitions Currency

2022 2021 growth growth(i) /disposals impact

Consolidated revenue by

franchise $m $m % % % %

------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

Orthopaedics 492 508 -3.0 2.1 - -5.1

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

Knee Implants 210 207 1.9 7.4 - -5.5

Hip Implants 136 145 -6.5 -1.0 - -5.5

Other Reconstruction(ii) 18 20 -10.5 -6.0 - -4.5

Trauma & Extremities 128 136 -5.5 -1.2 - -4.3

Sports Medicine & ENT 382 379 0.8 7.1 - -6.3

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

Sports Medicine Joint

Repair 209 207 0.9 7.5 - -6.6

Arthroscopic Enabling

Technologies 131 139 -5.6 0.5 - -6.1

ENT (Ear, Nose and Throat) 42 33 27.8 32.1 - -4.3

Advanced Wound Management 376 379 -1.0 6.0 - -7.0

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

Advanced Wound Care 173 189 -8.3 1.6 - -9.9

Advanced Wound Bioactives 136 121 12.0 12.7 - -0.7

Advanced Wound Devices 67 69 -3.4 5.8 - -9.2

Total 1,250 1,266 -1.2 4.8 - -6.0

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

Consolidated revenue by

geography

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

US 671 633 6.0 6.0 - -

Other Established

Markets(iii) 341 398 -14.3 0.4 - -14.7

Total Established Markets 1,012 1,031 -1.8 3.9 - -5.7

Emerging Markets 238 235 1.4 8.6 - -7.2

Total 1,250 1,266 -1.2 4.8 - -6.0

----------------------------- ------- ---- ------- ---- -------- ---- ---------- ---- ------------ ---- --------

(i) Underlying growth is defined in Note 2 on page 2

(ii) Other Reconstruction includes robotics capital sales, our

joint reconstruction business and cement

(iii) Other Established Markets are Europe, Canada, Japan,

Australia and New Zealand

Orthopaedics

In Orthopaedics revenue was up 2.1% (-3.0% reported). Excluding

China, where performance continued to be impacted by the

implementation of the previously disclosed hip and knee

volume-based-procurement (VBP) programme, Orthopaedics grew by 5.6%

underlying.

Knee Implants grew 7.4% (1.9% reported) and Hip Implants

declined -1.0% (-6.5% reported). Knee Implants grew by 11.1% and

Hip Implants by 3.6% in the US. Our JOURNEY II and LEGION REVISION

knee systems both delivered double-digit growth and we are starting

to see the early benefit of our cementless total knee LEGION

CONCELOC . We remain focused on improving overall performance in

Hip Implants, nevertheless our POLAR3 Total Hip Solution, with its

class-leading survivorship data , and the OR3O Dual Mobility Hip

System both delivered good growth in the quarter.

Other Reconstruction revenue declined -6.0% (-10.5% reported),

as raw material supply constraints continued to impact this

segment. Our installed base in robotics has now passed 500 units

globally .

Trauma & Extremities declined -1.2% (-5.5% reported)

continuing to reflect our decision not to participate in the

broader roll-out of provincial trauma tenders in China.

Sports Medicine & ENT

Our Sports Medicine & ENT franchise delivered revenue growth

of 7.1% (0.8% reported) in the quarter.

Within this, Sports Medicine Joint Repair delivered 7.5% (0.9%

reported) revenue growth and A rthroscopic Enabling Technologies

revenue was up 0.5% (-5.6% reported). We continue to benefit from

our excellent shoulder repair portfolio, including double-digit

growth for REGENETEN. Recent product launches also performed well,

including the FAST-FIX FLEX Meniscal Repair System and WEREWOLF

FASTSEAL 6.0 Hemostasis Wand.

Revenue from ENT was up 32.1% (27.8% reported) as procedure

volumes recover from the impact of COVID.

Advanced Wound Management

Our Advanced Wound Management franchise delivered revenue growth

of 6.0% (-1.0% reported), maintaining recent strong performance

with growth coming across all regions and product categories.

Advanced Wound Care revenue was up 1.6% (-8.3% reported),

including good growth from our infection management and films

portfolios and in Asia-Pacific.

Advanced Wound Bioactives revenue was up 12.7% (12.0% reported),

driven by both our enzymatic debrider SANTYL and our skin

substitute portfolio.

Advanced Wound Devices revenue was up 5.8% (-3.4% reported),

with double-digit growth from our PICO Single Use Negative Pressure

Wound Therapy System being offset by a slower quarter from the

traditional negative pressure system RENASYS due to

on-going input material shortages.

2022 Full Year Outlook

With one quarter remaining of 2022, we currently expect our

underlying revenue growth for the full year to be around the middle

of our guided range of 4.0% to 5.0% (around -0.8% to +0.2% o n a

reported basis, including a foreign exchange headwind of 480bps

based on exchange rates prevailing on 28 October 2022).

We also continue to expect trading profit margin to be around

17.5%.

We expect the tax rate on trading results for 2022 to be around

18%, subject to any material changes to tax law, or other one-off

items.

Consolidated revenue analysis for nine months to 1 October

2022

1 October 2 October Reported Underlying Acquisitions Currency

2022 2021 growth Growth(i) /disposals impact

Consolidated revenue by franchise $m $m % % % %

----------------------------------- --------- --------- -------- ---------- ------------ --------

Orthopaedics 1,564 1,605 -2.5 1.2 - -3.7

------------------------------------ --------- --------- -------- ---------- ------------ --------

Knee Implants 665 644 3.2 7.3 - -4.1

Hip Implants 434 461 -5.8 -1.9 - -3.9

Other Reconstruction(ii) 61 67 -9.0 -5.5 - -3.5

Trauma & Extremities 404 433 -6.6 -3.7 - -2.9

Sports Medicine & ENT 1,159 1,143 1.5 5.8 - -4.3

------------------------------------ --------- --------- -------- ---------- ------------ --------

Sports Medicine Joint Repair 634 616 3.0 7.6 - -4.6

Arthroscopic Enabling Technologies 412 432 -4.6 -0.3 - -4.3

ENT (Ear, Nose and Throat) 113 95 18.9 21.7 - -2.8

Advanced Wound Management 1,127 1,117 0.8 5.9 - -5.1

------------------------------------ --------- --------- -------- ---------- ------------ --------

Advanced Wound Care 533 550 -3.1 4.3 - -7.4

Advanced Wound Bioactives 388 368 5.2 5.8 - -0.6

Advanced Wound Devices 206 199 3.5 10.4 - -6.9

Total 3,850 3,865 -0.4 3.9 - -4.3

------------------------------------ --------- --------- -------- ---------- ------------ --------

Consolidated revenue by geography

----------------------------------- --------- --------- -------- ---------- ------------ --------

US 2,022 1,950 3.7 3.7 - -

Other Established Markets(iii) 1,119 1,229 -8.9 1.9 - -10.8

Total Established Markets 3,141 3,179 -1.2 3.0 - -4.2

Emerging Markets 709 686 3.5 8.1 - -4.6

Total 3,850 3,865 -0.4 3.9 - -4.3

------------------------------------ --------- --------- -------- ---------- ------------ --------

(i) Underlying growth is defined in Note 2 on page 2

(ii) Other Reconstruction includes robotics capital sales, our

joint reconstruction business and cement

(iii) Other Established Markets are Europe, Canada, Japan,

Australia and New Zealand

About Smith+Nephew

Smith+Nephew is a portfolio medical technology company that

exists to restore people's bodies and their self-belief by using

technology to take the limits off living. We call this purpose

'Life Unlimited'. Our 18,000 employees deliver this mission every

day, making a difference to patients' lives through the excellence

of our product portfolio, and the invention and application of new

technologies across our three global franchises of Orthopaedics,

Sports Medicine & ENT and Advanced Wound Management.

Founded in Hull, UK, in 1856, we now operate in more than 100

countries, and generated annual sales of $5.2 billion in 2021.

Smith+Nephew is a constituent of the FTSE100 (LSE:SN, NYSE:SNN).

The terms 'Group' and 'Smith+Nephew' are used to refer to Smith

& Nephew plc and its consolidated subsidiaries, unless the

context requires otherwise.

For more information about Smith+Nephew, please visit

www.smith-nephew.com and follow us on Twitter , LinkedIn ,

Instagram or Facebook .

Forward-looking Statements

This document may contain forward-looking statements that may or

may not prove accurate. For example, statements regarding expected

revenue growth and trading margins, market trends and our product

pipeline are forward-looking statements. Phrases such as "aim",

"plan", "intend", "anticipate", "well-placed", "believe",

"estimate", "expect", "target", "consider" and similar expressions

are generally intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause actual

results to differ materially from what is expressed or implied by

the statements. For Smith+Nephew, these factors include: risks

related to the impact of COVID, such as the depth and longevity of

its impact, government actions and other restrictive measures taken

in response, material delays and cancellations of elective

procedures, reduced procedure capacity at medical facilities,

restricted access for sales representatives to medical facilities,

or our ability to execute business continuity plans as a result of

COVID; economic and financial conditions in the markets we serve,

especially those affecting health care providers, payers and

customers (including, without limitation, as a result of COVID);

price levels for established and innovative medical devices;

developments in medical technology; regulatory approvals,

reimbursement decisions or other government actions; product

defects or recalls or other problems with quality management

systems or failure to comply with related regulations; litigation

relating to patent or other claims; legal compliance risks and

related investigative, remedial or enforcement actions; disruption

to our supply chain or operations or those of our suppliers

(including, without limitation, as a result of COVID); competition

for qualified personnel; strategic actions, including acquisitions

and dispositions, our success in performing due diligence, valuing

and integrating acquired businesses; disruption that may result

from transactions or other changes we make in our business plans or

organisation to adapt to market developments; and numerous other

matters that affect us or our markets, including those of a

political, economic, business, competitive or reputational nature.

Please refer to the documents that Smith+Nephew has filed with the

U.S. Securities and Exchange Commission under the U.S. Securities

Exchange Act of 1934, as amended, including Smith+Nephew's most

recent annual report on Form 20-F, for a discussion of certain of

these factors. Any forward-looking statement is based on

information available to Smith+Nephew as of the date of the

statement. All written or oral forward-looking statements

attributable to Smith+Nephew are qualified by this caution.

Smith+Nephew does not undertake any obligation to update or revise

any forward-looking statement to reflect any change in

circumstances or in Smith+Nephew's expectations

(.) Trademark of Smith+Nephew. Certain marks registered US

Patent and Trademark Office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAFFAEFFAFAA

(END) Dow Jones Newswires

November 03, 2022 03:00 ET (07:00 GMT)

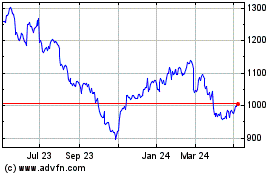

Smith & Nephew (LSE:SN.)

Historical Stock Chart

From Mar 2024 to Apr 2024

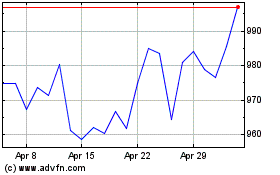

Smith & Nephew (LSE:SN.)

Historical Stock Chart

From Apr 2023 to Apr 2024