Admission to AIM

01 November 2006 - 7:05PM

UK Regulatory

RNS Number:3395L

Somero Enterprises Inc.

01 November 2006

Embargoed for 08.05 hrs

1 November 2006

This announcement is not a prospectus. Investors should not subscribe for or

purchase any securities referred to in this announcement except on the basis of

information published in the admission document dated 27 October 2006 relating

to Somero Enterprises, Inc.

THIS DOCUMENT MAY NOT BE RELEASED, PUBLISHED OR DISTRIBUTED IN OR INTO THE

UNITED STATES, CANADA, JAPAN OR AUSTRALIA OR TO US PERSONS OR TO RESIDENTS,

NATIONALS OR CITIZENS OF CANADA, JAPAN OR AUSTRALIA.

Somero Enterprises, Inc.

Somero Enterprises, Inc. (R) ("Somero" or "the Company"), a U.S.-based designer

and manufacturer of concrete construction equipment, announces that the

Company's Common Shares have today been admitted to trading on the AIM market of

the London Stock Exchange ("AIM"). The Company's trading symbol is SOM.

Admission details

* On Friday 27 October 2006 it was announced that the Common Shares being

offered to institutional and professional investors (the "Placing") would be

priced at 125p per share.

* Based on this Placing Price, the market capitalisation of the Company

following the Placing was #42.85m.

* The number of Common Shares in issue at listing was 34,281,968.

* The Company raised approximately $10.03 million (#5.35m) in gross proceeds

from the Placing before expenses. Approximately $40.13 million (#21.41m) in

gross proceeds was received by Somero Holdings, LLC, the Company's existing

sole shareholder, which is controlled by The Gores Group, LLC ("Gores"), a

private equity firm based in Los Angeles, California.

* Somero Holdings, LLC remains a significant shareholder in Somero,

retaining 37.55% of the issued share capital of the Company following its

Admission today to the AIM market.

* The Company intends to use the net proceeds received from the Placing,

together with cash on hand, to repay a portion of its outstanding

indebtedness.

Jefferies International Limited acted as Lead Manager and Nominated Advisor and

Collins Stewart Europe Limited acted as Co-Lead Manager for the Placing.

Enquiries:

Financial Dynamics +44 (0)20 7831 3113

Edward Bridges, Managing Director

Harriet Keen, Senior Vice President

Matt Dixon, Consultant

U.S. Dollar amounts or Pounds Sterling amounts included in this document that

have been translated from Pounds Sterling or U.S. Dollars, respectively, have

been calculated using an exchange rate of #1.00 equals $1.8745 (being the noon

buying rate as certified for customs purposes by the Federal Reserve Bank of New

York on 24 October 2006).

"Somero", "Somero Enterprises" and "Laser Screed" are registered trademarks of

the Company in the United States. "Laser Screed" is a registered trademark of

the Company in Switzerland and the European Community. This document also

includes other registered and unregistered trademarks of the Company and other

persons.

The contents of this announcement, which have been prepared by and are the sole

responsibility of the Company, have been approved by Jefferies International

Limited solely for the purposes of section 21(2)(b) of the Financial Services

and Markets Act 2000.

Jefferies International Limited and Collins Stewart Europe Limited, each of

which is authorised and regulated in the United Kingdom by the Financial

Services Authority, is each advising the Company in relation to the Placing.

Jefferies International Limited and Collins Stewart Europe Limited is each

acting exclusively for the Company and no one else and will not be responsible

to anyone other than the Company for providing the protections afforded to the

customers of Jefferies International Limited or Collins Stewart Europe Limited

nor for providing any advice in relation to the Placing or any other matter

referred to herein.

This announcement does not constitute or form part of any offer or invitation to

sell, or any solicitation of any offer to purchase any securities and any

purchase, shares of the Company. Any purchase of shares of the Company pursuant

to the Placing should only be made on the basis of the information contained in

the formal AIM admission document which was issued by the Company on 27 October

2007 in connection with the Placing (the "Admission Document") and any

supplement or amendment thereto. The Admission Document contains detailed

information about the Company and its management, as well as financial data.

The Placing will be made in the United Kingdom to institutional investors and

certain limited others. Neither this announcement nor any copy of it may be

taken or transmitted into the United States, Australia, Canada or Japan or to a

resident, national or citizen of the United States, Australia, Canada or Japan.

The Placing and the distribution of this announcement and other information in

connection with the placing in certain jurisdictions may be restricted by law

and persons into whose possession any document or other information referred to

herein comes should inform themselves about and observe any such restriction.

Any failure to comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

No shares or stock in the Company have been nor will they be registered under

the applicable securities laws of Australia, Canada or Japan and may not be

offered or sold within Australia, Canada or Japan or to, or for the account or

benefit of citizens or residents of Australia, Canada or Japan.

This announcement is not for distribution, directly or indirectly, in or into

the United States or to any U.S. person (as defined in Regulation S under the

U.S. Securities Act of 1933, as amended (the "Securities Act")). The shares of

the Company have not been and will not be registered under the Securities Act

and may not be offered or sold in the United States or to, or for the account or

benefit of, U.S. persons except pursuant to (i) a transaction meeting the

requirements of Rules 901 through 905 (including Preliminary Notes) of

Regulation S, (ii) an effective registration statement under the Securities Act,

or (iii) an exemption from the registration requirements of the Securities Act.

Hedging transactions involving shares of the Company may not be conducted unless

in compliance with the Securities Act.

This announcement does not constitute a recommendation concerning the shares of

the Company. The price and value of securities may go down as well as up. Past

performance is not necessarily a guide to future performance. Persons needing

advice should contact a professional adviser.

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be identified

by the use of forward-looking terminology, including the terms "believes",

"estimates", "plans", "projects", "anticipates", "expects", "intends", "may",

"will", or "should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include matters that

are not historical facts and include statements regarding the Company's

intentions, beliefs or targets.

By their nature, forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. A number of factors could cause

actual results and developments to differ materially from those expressed or

implied by the forward-looking statements.

Forward-looking statements may and often do differ materially from actual

results. Any forward-looking statements in this announcement reflect the

Company's view with respect to future events as at the date of this announcement

and are subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Save as required by law or by the

AIM Rules of the London Stock Exchange, the Company undertakes no obligation

publicly to release the results of any revisions to any forward-looking

statements in this announcement that may occur due to any change in its

expectations or to reflect events or circumstances after the date of this

announcement.

Information in this document or any of the documents relating to the placing

cannot be relied upon as a guide to future performance.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCILFLAIVLLVIR

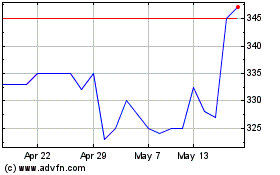

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

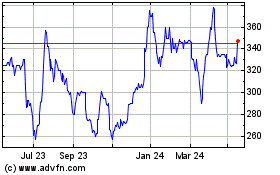

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jul 2023 to Jul 2024