Supply @ME Capital PLC Appointment of new independent Non-Executive Chair (7706N)

06 June 2022 - 4:02PM

UK Regulatory

TIDMSYME

RNS Number : 7706N

Supply @ME Capital PLC

06 June 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION NO 596/2014 WHICH IS

PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS

CONSIDERED TO BE IN THE PUBLIC DOMAIN

6 June 2022

Supply@ME Capital plc

(The "Company" or "SYME")

Appointment of new Chair:

Supply@ME appoints Albert Ganyushin as new independent

non-executive chairman

Supply@ME Capital plc, the fintech business which provides an

innovative Platform for use by manufacturing and trading companies

to access Inventory Monetisation(c) solutions enabling their

businesses to generate cashflow, is pleased to announce that the

Board of Directors proposes to appoint Albert Ganyushin as a

director and new independent non-executive chairman with effect

from the conclusion of its Annual General Meeting envisaged by the

end of June 2022. He will succeed James Coyle, who stepped down

from the role in March of this year.

Mr Ganyushin was appointed as an independent adviser (the

"Adviser") to the Company, as stated in the RNS of 4 March 2022

when SYME announced the appointment of the Adviser to complete,

inter alia, its strategic review. He has subsequently conducted an

assessment of the business focussing on the long-term business

objectives and its governance requirements. Mr Ganyushin's

knowledge, skills and experience identify him as an excellent

candidate to lead the business through its next stage of growth. He

will provide leadership, support, and strategic guidance during a

period of significant change for the business.

His two-decade career comprises a range of increasingly senior

investment and capital markets roles across the US, UK, continental

Europe and emerging markets. Mr Ganyushin has a wealth of public

markets experience including as Head of International Listings at

the New York Stock Exchange and Euronext and Investment Banking at

Deutsche Bank. Most recently, Mr Ganyushin has worked as Head of

Capital Markets at Dr. Peters Group, an alternative investment and

asset manager with a track record of investing and managing over

US$8bn in real assets across the transportation infrastructure

(shipping and aviation) and specialist real estate. Mr Ganyushin

holds an MBA from the London Business School.

SYME Chief Executive, Alessandro Zamboni said:

"I am very pleased to welcome Albert to Supply@ME. He will bring

a wealth of capital markets and investment experience and will be a

valuable asset when it comes to guiding the Company through its

next stage. I look forward to working with him."

SYME Chair, Albert Ganyushin said:

"I am delighted to be joining Supply@ME as its new chair. The

opportunity that lies ahead of Supply@ME is clear. I'm looking

forward to bringing my experience to help shape the next stage of

the development of Supply@ME's unique offering."

The following information is disclosed in respect of Mr

Ganvushin pursuant to the Financial Conduct Authority's Listing

Rules:

Albert Ganyushin holds or has held the following directorships

or partnerships in the past five years:

Current Directorships or Partnerships

Austen Grove Capital Limited

Westcott Hill Capital Limited

Wotton Hill Capital LLP

Past Directorships or Partnerships

Dr. Peters Asset Invest Ltd

Ross Wisconsin AS

Mr Ganyushin does not hold any interests in any shares in the

Company.

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the "Group") provide an innovative fintech platform (the

"Platform") for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/export

transaction. SYME announced in August 2021 the launch of a global

Inventory Monetisation programme which will be focused on both

inventory in transit monetisation and warehouse goods monetisation.

This program will be focused on creditworthy companies and not

those in distress or otherwise seeking to monetise illiquid

inventories.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Brian Norris, Cicero/AMO, +44 (0)20 7947 5317;

brian.norris@cicero-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOAUPUGGQUPPUAQ

(END) Dow Jones Newswires

June 06, 2022 02:02 ET (06:02 GMT)

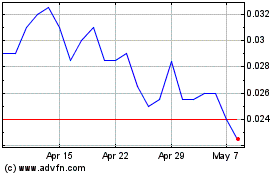

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024