Thalassa Holdings Ltd (THAL)

Thalassa Holdings Ltd: Interim Results (30 June 2023)

29-Sep-2023 / 09:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Thalassa Holdings Limited

Thalassa Holdings Ltd

(Reuters: THAL.L, Bloomberg: THAL:LN)

("Thalassa", "THAL" or the "Company")

Interim Results for the period ended 30 June 2023

The Company is pleased to announce its results for the six months ended 30 June 2023. The interim results have been

submitted to the FCA and will shortly be available on the Company's website: www.thalassaholdingsltd.com

Highlights for the 6 months ended 30 June 2023

GROUP RESULTS 1H 2023 versus 1H 2022, unless otherwise stated (Unaudited)

. Profit /(loss) after tax for the H1 period under review (GBP0.53) vs. GBP0.20m

. Group Earnings Per Share (basic and diluted)*1 (GBP0.07) vs. GBP0.03

. Book value per share*2 30 June 2023 vs. 31 December 2022 GBP1.21 vs. GBP1.30

. Holdings*3 30 June 2023 vs. 31 December 2022 GBP11.8m vs GBP12.5m

. Cash 30 June 2023 vs. 31 December 2022 GBP0.6m vs. GBP0.6m

*1 based on weighted average number of shares in issue of 7,945,838 (2022: 7,945,838)

*2 based on actual number of shares in issue as at 30 June 2023 of 7,945,838 (2022: 7,945,838)

*3 includes all holdings ex cash

2023 Observations

-- Short Term US Interest rates have climbed from just above 0%

and now stand at 5.28% for one month T-Billsand 5.42% for

three-month T-Bills.

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_bill_rates&

field_tdr_date_value=2023

-- Through 7 September 2023, the tech-heavy NASDAQ Composite

(CCMP) has risen 32% whilst the NASDAQ 100(NDX) has risen 39% led

by AAPL, NVDA, TSLA et al., which have accounted for 60% of this

year's performance.

-- As an example of the madness of crowds, we have chosen TSLA.

TSLA, and the 51 Wall Street Analysts (onBloomberg) who cover TSLA,

would, apparently, like investors to believe that TSLA is a tech

company, not a carcompany; in the end analysis, if logic prevails,

it doesn't actually make any difference because if TSLA is a

techcompany, then so are all the other new EV car manufacturers.

Logically, therefore, as with every industry, it willcome down to

who survives and how much money they make.the answer, in our view

is that margins will shrink ascompetition intensifies, and many

will go bust before there is a clear winner. Ultimately, however,

thetransportation industry has never yielded above average long

term returns.and we don't think this time is anydifferent.even if

Mr Musk and his groupies believe we are no longer driving cars but

tech-platforms on wheels.callthem what you want, but at some point

it will invariably come down to 'Free Cash Flow', not a new

paradigm todescribe an old industry.

-- For those who don't agree, they may want to cast an eye over

the graphic and price chart below whichhighlights the insanity of

TSLA's recent USD777 billion market value.

The left-hand column shows the Market Cap of 12 international

'car' manufacturers vs. TSLA, whilst the right-hand column shows

the combined number of cars sold by the twelve vs. TSLA. Go

figure?!

TSLA 5 Year Share Price Chart

Chairman's Statement

Macro

H1 2023 was all about Big Tech, the magnificent seven as they

are now referred to, META, GOOG(L), MSFT, AMZN, NVDA, AAPL, TSLA,

which now represent more than 40% of US Large Cap Active Managers'

Assets, compared with 12% last year. (Source: Bank of America).

There is always a problem in the making when stock market

leadership narrows to the point of stupidity.just as with the

timeless children's game of musical chairs.at some point there will

be nowhere to sit, and when investors decide that NVDA may not be

worth 41x Revenues or that Apple, Amazon Meta, Alphabet and

Microsoft are in fact mature companies, valuations will compress

and the price of these shares will fall dramatically (read

plummet).

For those die-hard believers that the above 'Famous Five' are

still growth stock, the chart below courtesy of StoneX Financial

graphically shows what Momentum and Quant investors simply ignore,

namely the fact that Revenues of the above 5 companies barely keep

up with US nominal gross domestic product and their collective net

income fell to USD263 billion in the past four quarters, down 9%

from USD289 billion the year before.

As Vincent Deluard of StoneX points out "If stock prices are the

net present value of their future cash flows, higher rates should

penalize growth stocks, (or perceived growth stocks), which derive

most of their profits from distant profits."

These 'mega' companies should clearly weather an economic

slowdown or recession better than more cyclical companies.but they

are not immune!

Where next?

The US Govt. is famous (in old Westerns!) for speaking with a

forked tongue.on the one hand the FED is raising interest rates,

and reversing quantative easing, whilst on the other, the Federal

Government continues to spend, like money grows on trees, which if

you oversee the printing press, it clearly does. Exactly one year

ago, President Biden signed the Inflation Reduction Act, meant in

large part to deliver on the administration's climate goals. The

law provides for USD369 billion in new spending to help accelerate

renewable energy projects in the US, increase EV auto manufacturing

and spur electric everything adoption. This latest 'give away'

follows the USD1.9 trillion January 2021 Economic Rescue Plan,

which augmented the USD3 trillion coronavirus relief bill from

March 2020, and the USD900 billion legislation from December 2020,

which was scaled back to garner support from Senate

Republicans.

Clearly, some (read a lot) of this money has flowed into the

stock market and consequently ramped-up prices.

Stock markets are driven by sentiment, by a feeling of

well-being and, lest we forget, by greed.

For the past nine months, experienced commentators, including

Jeremy Grantham, founder of GMO, have warned of the dangers of a 3

Sigma Bubble and the devastating impact that a massive correction

in stocks, bonds and real estate will have on personal and

corporate wealth. Few, very few have listened and the 'smart money'

managers that shared Jeremy's point of view and took on large short

positions have been flattened by the magnitude of the increase in

share prices in 2023.led by the Magnificent 7.

Like it or not, the Board of THAL believe that sentiment and by

consequence, money flows, have already changed direction and the

combination of higher interest rates, spiking energy prices and

Apple's Black Swan(?) moment following the Chinese Govt. ban on the

use of Apple's I-Phones has finally forced even the most ardent

believers of 'to infinity and beyond' valuations, to the need for

earnings and free cash flow.

We believe that the S&P 500 (SPX), the NASDAQ Composite

(CCMP) and the NASDAQ 100 (NDX) have already begun a correction

which coupled with declining economic activity and reduced earnings

could evolve into a perfect storm which could in turn result in a

decline in the S&P well below fair value (estimated at about

-20% below current levels) as a correction overshoots. To this end,

a small portion of the Company's assets have again been invested in

various SPX, QQQ,VIX and TSLA hedges.

Holdings -

-- There was little or no movement in our positions in H1

2023.

Real Estate -

-- The Real Estate owned by the Chairman, but pledged to the

Company, is currently let until September 2024.Planning permission

has and is being sought for certain developments, which it is hoped

will increase the value ofthe property. It is anticipated that the

sales process will begin in Q4 2023.and that a sale can be

completed in Q42023/Q1 2024.

Janzz - https://janzz.technology/

-- Janzz recently closed a strategic investment by subsidiary of

major Japanese industry market-leader

ALNA - https://www.alina-holdings.com/

-- Please refer to Alina website

AMOI - https://anemoi-international.com/

-- Please refer to Anemoi website

NWT - https://newmarksecurity.com/

-- Share price performance of NWT continued to recover slowly

through H1 2023. We still believe that, giventhe age of its

chairman and the fact that he has three children, two of whom are

not involved in the company, thatNWT will, in due course, be sold.

We are patient investors and will continue to hold our

position.

Conclusion

We anticipate a further correction to US and European Stock

Markets, and remain cautious on the macro-economic outlook, which

we believe could deteriorate significantly this winter.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

28 September 2023

Responsibility Statement

We confirm that to the best of our knowledge: a. the condensed

set of financial statements has been prepared in accordance with

IAS 34 'Interim FinancialReporting' and gives a true and fair view

of the assets, liabilities, financial position and profit or loss

of theCompany and the undertakings included in the consolidation as

a whole as required by DTR 4.2.4 R; b. the interim management

report includes a fair review of the information required by DTR

4.2.7R(indication of important events during the first six months

and description of principal risks and uncertaintiesfor the

remaining six months of the year); and c. the interim management

report includes a fair review of the information required by DTR

4.2.8R(disclosure of related parties' transactions and changes

therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

28 September 2023

Financial Review

Continuing Operations

Total revenue from operations for the period to 30 June 2023 was

GBP0.1m (1H22: GBP0.1m).

Net financial loss from investment operations was GBP0.04m

(1H22: income GBP0.56m),

Cost of Sales was of GBP0.007m (1H22: nil) comprising

development costs (net of capitalised costs) at ARL, resulting in a

Gross Profit of GBP0.07m (1H22: gross profit GBP0.68m).

Administration expenses were GBP0.43m (1H22: GBP0.33m).

Depreciation costs were GBP0.16m (1H22: GBP0.15m).

Operating Loss was therefore GBP0.36m (1H22 Profit:

GBP0.35m).

Loss before tax was GBP0.5m (1H22 profit: GBP0.2m).

Net assets at 30 June 2023 amounted to GBP9.6m (1H22:

GBP11.9m).

Net cash (being cash balances less borrowings) was GBP0.6m as at

30 June 2023 (1H22: GBP0.8m).

Net cash outflow from operating activities amounted to GBP0.1m

compared to an inflow of GBP0.18m in 1H22.

Net cash inflow from investing activities amounted to GBP0.39m,

compared to 1H22 outflow of GBP0.26m.

Net cash outflow from financing activities amounted to GBP0.14m

(1H22: outflow GBP3.89m).

Interim Condensed Consolidated Statement of Income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

Note GBP GBP GBP

Continuing Operations

Revenue 118,673 119,498 295,968

Net financial income/(expense) 105,371 553,522 249,535

Other gains/(losses) - 101,691 (881,118)

Share of losses of associated entities (143,962) (93,758) (235,658)

Cost of sales (7,096) - (95,925)

Gross Profit 72,986 680,953 (667,198)

Administrative expenses excluding exceptional costs (434,654) (330,190) (531,024)

Profit/(loss) before depreciation (361,668) 350,763 (1,198,222)

Depreciation and Amortisation 4&5 (164,488) (147,083) (305,848)

Profit/(loss) before taxation (526,156) 203,680 (1,504,070)

Taxation (528) (431) 54,167

Profit/(loss) for the year (526,684) 203,249 (1,449,903)

Attributable to:

Equity shareholders of the parent (526,684) 203,249 (1,449,903)

Non-controlling interest - - -

(526,684) 203,249 (1,449,903)

Earnings per share - GBP (using weighted average number of shares)

Basic and Diluted 3 (0.07) 0.03 (0.18)

The notes on pages 14 to 19 form an integral part of this

consolidated interim financial information. Interim Condensed

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Profit/(loss) for the financial year (526,684) 203,249 (1,449,903)

Other comprehensive income:

Exchange differences on re-translating foreign operations (83,113) 586,430 594,684

Total comprehensive income (609,797) 789,679 (855,219)

Attributable to:

Equity shareholders of the parent (609,797) 789,679 (855,219)

Non-Controlling interest - - -

Total Comprehensive income (609,797) 789,679 (855,219)

The notes on pages 14 to 19 form an integral part of this

consolidated interim financial information.

Interim Condensed Consolidated Statement of Financial

Position

As at 30 June 2023

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Note Unaudited Unaudited Audited

Assets GBP GBP GBP

Non-current assets

Intangible assets 4 1,514,815 1,073,047 1,319,695

Property, plant and equipment 5 1,838,423 1,608,478 2,030,733

Loans 7 4,776,479 6,056,810 5,571,412

Investments in associated entities 8 2,199,253 2,494,091 2,356,526

Total non-current assets 10,328,970 11,232,426 11,278,366

Current assets

Trade and other receivables 714,821 897,740 765,302

Portfolio investments 6 726,371 1,536,883 504,877

Cash and cash equivalents 614,365 1,297,876 629,215

Total current assets 2,055,557 3,732,499 1,899,394

Liabilities

Current liabilities

Trade and other payables 1,221,922 1,156,112 1,210,810

Short term debt 9 159,783 163,262 158,473

Borrowings 9 - 459,280 -

Total current liabilities 1,381,705 1,778,654 1,369,283

Net current assets 673,852 1,953,845 530,111

Non-current liabilities

Long term debt 9 1,404,237 1,243,273 1,510,377

Total non-current liabilities 1,404,237 1,243,273 1,510,377

Net assets 9,598,585 11,942,998 10,298,100

Shareholders' Equity

Share capital 11 128,977 128,977 128,977

Share premium 21,717,786 21,717,786 21,717,786

Treasury shares (8,558,935) (8,558,935) (8,558,935)

Other reserves (1,696,320) (1,696,320) (1,696,320)

Foreign exchange reserve 4,258,024 3,836,171 4,430,855

Retained earnings (6,250,947) (3,484,681) (5,724,263)

Total shareholders' equity 9,598,585 11,942,998 10,298,100

Total equity 9,598,585 11,942,998 10,298,100

The notes on pages 14 to 19 form an integral part of this

consolidated interim financial information.

These financial statements were approved by the board on 28

September 2023.

Signed on behalf of the board by:

Duncan Soukup Interim Condensed Consolidated Statement of Cash

Flows

For the six months ended 30 June 2023

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

Notes GBP GBP GBP

Profit/(Loss) before income tax from:

Continuing operations (526,156) 203,680 (636,829)

Add back Portfolio Holdings 38,591 (561,455) -

Profit/(Loss) before income tax (487,565) (357,775) (636,829)

Adjustments for:

Other income - - 25,486

(Increase)/decrease in trade and other receivables 50,481 (88,133) 44,305

(Decrease)/increase in trade and other payables 11,112 42,823 97,521

Accrued interest income 22,635 180,132 -

Gain/(loss) on disposal of portfolio investments 60,404 (294,986) 471,589

Net exchange differences 285,642 (26,161) (19,253)

Depreciation/Amortisation 4&5 164,488 147,083 306,497

Share of losses of associate (143,962) (93,758) (234,828)

Fair value movement on portfolio investments (62,226) 672,217 64,817

Cash generated by operations (98,991) 181,442 119,305

Taxation (528) (431) 54,167

Net cash flow from operating activities (99,519) 181,011 173,472

Sale/(purchase) of property, plant and equipment (2,320) - (517,376)

Sale/(purchase) of intangible assets 4 (184,244) (167,576) (418,408)

Net (purchase)/sale of portfolio investments 6 648,613 (89,465) (245,899)

Investments in associated entities (68,642) - (31,071)

Net cash flow in investing activities 393,407 (257,041) (1,212,754)

Cash flows from financing activities

Interest Expense (1,522) (25,132) -

Leasing Liabilities (145,128) (45,051) -

Proceeds from borrowings 7,731 32,116 33,133

Repayment of borrowings 9 - (3,853,018) (4,357,529)

Net cash flow from financing activities (138,919) (3,891,085) (4,324,396)

Net increase in cash and cash equivalents 154,969 (3,967,115) (5,363,677)

Cash and cash equivalents at the start of the year 629,215 5,398,208 5,398,208

Effects of exchange rate changes on cash and cash equivalents (169,819) (133,217) 594,684

Cash and cash equivalents at the end of the year 614,365 1,297,876 629,215

The notes on pages 14 to 19 form an integral part of this

consolidated interim financial information.

Interim Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 June 2023

Share Share Treasury Other Foreign Exchange Retained

Capital Premium Shares Reserves Reserve Earnings Total

GBP GBP GBP GBP GBP GBP GBP

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 3,836,171 (4,274,360) 11,153,319

31 December 2021

Total comprehensive income - - - - - 789,679 789,679

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 3,836,171 (3,484,681) 11,942,998

30 June 2022

Exchange on conversion to GBP - - - - - - -

Total comprehensive income - - - - 594,684 (2,239,582) (1,644,898)

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 4,430,855 (5,724,263) 10,298,100

31 December 2022

Foreign exchange on translation - - - - (89,718) - (89,718)

Total comprehensive income - - - - (83,113) (526,684) (609,797)

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 4,258,024 (6,250,947) 9,598,585

30 June 2023

The notes on pages 14 to 19 form an integral part of this

consolidated interim financial information. Notes to the Interim

Condensed Consolidated Financial Information

1. General information

Thalassa Holdings Ltd (the "Company") is a British Virgin Island

("BVI") International business company ("IBC"), incorporated and

registered in the BVI on 26 September 2007. The Company is a

holding company with various interests across a number of

industries.

Autonomous Robotics Limited ("ARL" - formerly GO Science 2013

Ltd) is a wholly owned subsidiary of Thalassa and is an Autonomous

Underwater Vehicle ("AUV") research and development company.

Apeiron Holdings (BVI) Ltd is a BVI registered company and is

wholly owned by Thalassa. It owns 100% of Alfalfa Holdings AG which

is a company registered in Switzerland.

WGP Geosolutions Limited is a wholly owned subsidiary of

Thalassa currently non-operational.

2. Significant Accounting policies

The Company prepares its accounts in accordance with applicable

UK Adopted International Accounting Standards.

The accounting policies applied by the Company in this unaudited

consolidated interim financial information are the same as those

applied by the Company in its consolidated financial statements as

at and for the period ended 31 December 2022 except as detailed

below.

The financial information has been prepared under the historical

cost convention, as modified by the accounting standard for

financial instruments at fair value.

2.1. Basis of preparation

The condensed consolidated interim financial information for the

six months ended 30 June 2023 has been prepared in accordance with

International Accounting Standard No. 34, 'Interim Financial

Reporting'. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Company as at and

for the year ended 31 December 2022.

These condensed interim financial statements for the six months

ended 30 June 2023 and 30 June 2022 are unaudited and do not

constitute full accounts. The comparative figures for the period

ended 31 December 2022 are extracted from the 2022 audited

financial statements. The independent auditor's report on the 2022

financial statements was not qualified.

All intra-company transactions, balances, income and expenses

are eliminated in full on consolidation.

2.2. Going concern

The financial information has been prepared on the going concern

basis as management consider that the Company has sufficient cash

to fund its current commitments for the foreseeable future.

Notes to the Interim Condensed Consolidated Financial

Information Continued

3. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

The calculation of earnings per share is based on

the following loss and number of shares:

Profit/(loss) for the period (526,684) 203,249 (1,449,903)

Weighted average number of shares of the Company 7,945,838 7,945,838 7,945,838

Earnings per share:

Basic and Diluted (GBP) (0.07) 0.03 (0.18)

Number of shares outstanding at the period end: 7,945,838 7,945,838 7,945,838

4. Intangible assets

Development

costs Patents Software Total

GBP GBP GBP GBP

At 31 December 2022

Cost 1,153,647 153,501 25,096 1,332,243

Accumulated amortisation - - (12,548) (12,548)

Net book amount 1,153,647 153,501 12,548 1,319,695

Half-year ended 30 June 2023

Opening net book amount 1,153,647 153,501 12,548 1,319,695

FX movement - - - -

1,153,647 153,501 12,548 1,319,695

Additions 184,244 15,058 - 199,302

Amortisation charge - - (4,183) (4,183)

FX movement - - - -

Closing net book amount 1,337,891 168,559 8,365 1,514,814

At 30 June 2023

Cost 1,337,891 168,559 25,096 1,531,546

Accumulated amortisation - - (16,731) (16,731)

Net book amount 1,337,891 168,559 8,365 1,514,815

The intangible assets held by the Company increased as a result

of capitalising the development costs of Autonomous Robotics Ltd

("ARL").

Notes to the Interim Condensed Consolidated Financial

Information Continued

5. Property, plant and equipment

Plant

Land and and Motor

Total buildings Equipment Vehicles

Cost GBP GBP GBP GBP

Cost at 1 January 2023 2,736,687 2,066,128 130,483 540,076

FX movement (43,204) (30,795) 0 (12,409)

2,693,483 2,035,333 130,483 527,667

Additions 2,320 0 2,320 0

Cost at 30 June 2023 2,695,803 2,035,333 132,803 527,667

Depreciation

Depreciation at 1 January 2023 705,955 235,540 127,934 342,481

FX movement (7,503) (264) 0 (7,239)

698,452 235,276 127,934 335,242

Charge for the year on continuing operations 160,305 107,741 1,284 51,280

Foreign exchange effect on year end translation (1,377) (714) 0 (663)

Depreciation at 30 June 2023 857,380 342,303 129,218 385,859

Closing net book value at 30 June 2023 1,838,423 1,693,030 3,585 141,808

6. Securities

The Company classifies the following financial assets at fair

value through profit or loss (FVPL):-

Equity investments that are held for trading

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Securities

At the beginning of the period 504,877 1,187,346 1,187,345

Additions 521,167 2,078,047 3,554,617

Unrealised gain/(losses) 179,051 (168,131) 87,635

Disposals (475,713) (1,693,596) (4,461,505)

Forex on opening balance (3,011) 133,217 136,785

At period close 726,371 1,536,883 504,877

Investment Holdings

Securities held 726,371 1,536,883 504,877

Portfolio Holdings - - -

726,371 1,536,883 504,877

Investments have been valued incorporating Level 1 inputs in

accordance with IFRS7.

For period ending 30 Jun 23, portfolio holdings cash balances

have been reclassified to cash and cash equivalents.

Notes to the Interim Condensed Consolidated Financial

Information Continued

7. Loans and holdings

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Loans at period open 1,532,469 1,333,599 1,333,599

Accrued interest - to be waived 22,186 22,403 45,235

Forex on opening balance (62,647) 150,599 153,635

Loans at period close 1,492,008 1,506,601 1,532,469

Portfolio Holdings at 1 January 4,038,944 4,371,674 4,371,674

Issued - - 746,009

Interest - 158,225 325,237

Repaid - - (92)

Forex - 20,310 28,157

Reclassification under portfolio holdings (754,473) - -

Written off - Tappit Loan Interest & Option Value - - (1,432,041)

Portfolio holdings at period close 3,284,471 4,550,209 4,038,944

Total of loans and holdings 4,776,479 6,056,810 5,571,412

The Loan is to the THAL Discretionary Trust, the terms of the

loan are set with a 0% interest rate however interest has been

accrued at 3% as per IFRS requirements, it is the intention of the

Company to waive this interest upon repayment of the capital.

8. Investments in associated entities

On 17 December 2021, the acquisition of id4 was complete by

Anemoi International Ltd with consideration in the form of shares

issued to Thalassa and its subsidiary Aperion BVI totaling 36.92%

of the voting rights. The investment is recognised using the equity

method as described in the financial statements for December 2022.

During the period further shares were purchased to equal a total of

40.77% of the voting rights.

Athenium Consultancy Ltd in which the Company owns 35% shares

was incorporated on 12 October 2021.

Movement on interests in associates can be summarised as

follows:

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

GBP GBP GBP

Fair value of investment at beginning of period 2,356,526 2,325,457 2,325,457

Share of losses for the period (143,803) (93,758) (235,659)

Additions 68,642 - -

Exchange Variance (82,112) 262,392 266,728

2,199,253 2,494,091 2,356,526

There are no other entities in which the Company holds 20% or

more of the equity, or otherwise exercises significant influence

over the affairs of the entity.

Notes to the Interim Condensed Consolidated Financial

Information Continued

9. Borrowings

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

Non-current liabilities GBP GBP GBP

Lease liabilities 1,404,237 1,243,273 1,510,377

1,404,237 1,243,273 1,510,377

Current liabilities

Credit facility - 459,280 -

Lease liabilities 159,783 163,262 158,473

159,783 622,542 158,473

The credit facilities outstanding as at 30 Jun 2022 consist of

fixed term advances opened on in May 2022 for GBP461k, this advance

was settled in July 2022. The settling of the facility outstanding

at Dec '21 was completed on the 9th April 2022. The credit facility

was cancelled in December 2022.

The lease liabilities comprise of amounts owed in relation to

office leases held by ARL and Aperion AG. The lease held by Aperion

Holdings AG was entered in to in Feb 2021.

10. Related party balances and transactions

Under the consultancy and administrative services agreement

initially entered into on 3 January 2011 and most recently updated

1 February 2018 with a company in which the Chairman has a

beneficial interest, the Company accrued GBP130,362 (1H22:

GBP225,145) for consultancy and administrative services provided to

the Company. As at 30 June 2023 the amount owed to this company was

GBP524,868 (1H22: GBP268,055).

Athenium Consultancy Ltd, a company in which the Company owns

shares invoiced the Company for financial and corporate

administration services totalling GBP90,750 for the period (June

2022: GBP82,500).

The Company was due GBP9,372 (June 2022: GBP25,988) from Anemoi

International Ltd, a company in which through its subsidiary

Apeiron Holdings BVI holds shares and is related by common control

through the Chairman, Duncan Soukup.

As at the period end the Company was due GBP49,887 (June 2022:

GBP24,790) from Alina Holdings Limited, a company under common

directorship.

ARL owed rent of GBP5,000 during the period for trading premises

from Eastleigh Court Limited. The beneficiaries of Eastleigh Court

Ltd include D Soukup, a director during the period.

Notes to the Interim Condensed Consolidated Financial

Information Continued

11. Share capital

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Authorised share capital:

100,000,000 ordinary shares of USD0.01 each 1,000,000 1,000,000 1,000,000

Exchange Rate for Conversion 1.61674 1.61674 1.61674

100,000,000 ordinary shares of USD0.01 each in GBP 618,529 618,529 618,529

Allotted, issued and fully paid:

20,852,359 ordinary shares of USD0.01 each 208,522 208,522 208,522

Average Exchange Rate for Conversion 1.61674 1.61674 1.61674

20,852,359 ordinary shares of USD0.01 each in GBP 128,977 128,977 128,977

The exchange rate used for conversion is the aggregate rate for

the transactions as they occurred.

12. Subsequent events

There were no reportable subsequent events

13. Copies of the Interim Report

The interim report is available on the Company's website:

www.thalassaholdingsltd.com.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG878801114

Category Code: IR

TIDM: THAL

LEI Code: 2138002739WFQPLBEQ42

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 274671

EQS News ID: 1737045

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1737045&application_name=news

(END) Dow Jones Newswires

September 29, 2023 04:00 ET (08:00 GMT)

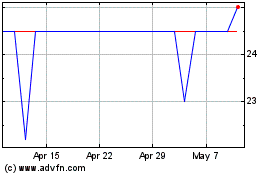

Thalassa (LSE:THAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Thalassa (LSE:THAL)

Historical Stock Chart

From Apr 2023 to Apr 2024