TIDMTLY

RNS Number : 8312U

Totally PLC

28 November 2023

28 November 2023

Totally plc

("Totally", "the Company" or "the Group")

Interim results for the six months ended 30 September 2023

Responding to an evolving market - supporting the NHS during

their challenging times

Totally plc (AIM: TLY), a leading provider of frontline

healthcare services, corporate fitness and wellbeing services

across the UK and Ireland , is pleased to announce its unaudited

interim results for the six months ended 30 September 2023.

Financial highlights

-- Group turnover down 20.6% to GBP55.8 million (H1 2023: GBP70.3 million).

-- Gross profit down 18.5% to GBP9.7 million (H1 2023: GBP11.9 million).

-- EBITDA excluding exceptional items GBP1.1 million (H1 2023: GBP3.4 million).

-- Exceptional items of GBP0.5 million relating to restructuring costs (H1 2023: nil).

-- Loss before tax of GBP1.9 million (H1 2023: GBP1.0 million profit before tax ).

-- Adjusted loss before tax of GBP1.0 million (H1 2023: GBP2.0 million profit before tax).

-- Cash position of GBP1.7 million at 30 September 2023 (31 March 2023: GBP6.5 million).

-- No interim dividend proposed at this time (H1 2023: 0.125p).

-- New contracts secured in the period contributing GBP14.8 million of annualised revenue.

Operational highlights

-- Totally continues to support the NHS and healthcare providers

across the UK and in the Republic of Ireland with the delivery of

urgent and elective care services across multiple locations,

ensuring that patients can access the appropriate care, when they

need it.

-- Totally has responded robustly to challenging market

conditions by taking responsible action to reduce overhead and

rationalise operational infrastructure.

-- Group is well positioned to return to profitability following

rationalisation of contracts, careful management of increasing

costs and reduced support costs.

-- New contracts worth c.GBP2.3 million in the current financial

year awarded to support the reduction of elective care waiting

lists in the Republic of Ireland.

-- Fully mobilised GBP10 million contract announced in January

2023 for NHS England 111 Resilience support. Post period additional

capacity mobilised to ensure resilience during winter months.

-- Successful pilots with multiple ambulance trusts to broaden

access to care for all types of patient.

-- All Care Quality Commission (CQC) registerable services

continue to be rated as GOOD reflecting Totally's commitment to

excellent patient care during continued pressure across the

healthcare industry.

Chairman's statement

I am pleased to announce trading results for the six months

ended 30 September 2023. My AGM announcement in early September

highlighted the challenging operating environment that the Group

was facing, with increasing costs and difficulties in hiring

suitably qualified teams of people.

The NHS continues to be in crisis, and this impacts all

organisations that are there to support them. The loss of North

West London contracts resulted in a downturn in our revenues in the

period being reported. As the contracts came to the end of their

contracted period, and despite previous assertions that we would

retain the contracts, the ICB allowed the contracts to end. We were

unable to terminate all costs immediately at that point but have

since undertaken a significant cost review to remove costs related

to those contracts as well as other costs which are not critical to

the day to day running of the business.

Totally prides itself on being able to support the NHS by

looking after those patients who do not have life critical

conditions, meaning that the NHS can focus on those patients that

only it can treat. We remain ready to provide support where it is

needed and we are confident that we will return to growth. This

approach reflects the professionalism and commitment to patient

care with which the Company delivers all its services.

During the first half of the year, we have participated in a

number of pilots with ambulance trusts to identify ways to increase

access to care for all types of patients. We are very positive

about the outcomes of these pilots and the potential to support

trusts on a longer-term basis. We also continue to tender for

opportunities to run urgent care services on behalf of the NHS and

to reduce elective care waiting lists through both insourcing and

outsourcing. We are continuing to see delays in the conclusion of

procurement processes, but we are confident in the quality of our

tenders, our services and the future prospects for the Group.

The scale of the opportunity for the Company remains significant

and we remain confident that the NHS will rebound, survive and

thrive once more, with the support of organisations such as

Totally.

In line with corporate governance requirements, having spent

nine years as a Director of Totally, I will step down from the

Board at the end of 2023. I am pleased to confirm that Simon

Stilwell will be joining our Board as a non-executive director

effective today and taking over as Chairman of Totally plc from 1

January 2024. The Company intends to make further Board changes

over the coming months in line with best corporate governance

standards.

Once again, I want to pass my ongoing thanks to our exceptional

teams who continue to deliver essential services alongside NHS

colleagues under incredible pressure. Totally is able to provide

excellent and compassionate services to thousands of individuals

across the UK and Ireland every day due to the commitment,

expertise and passion of our teams.

Bob Holt OBE

Chairman

28 November 2023

Operational review

It has been a challenging first six months of the year as we

continue to respond to multiple external factors such as high

inflation, an NHS in crisis and workforce shortages. We have

continued to work with NHS colleagues to maintain effective

services and seek new innovative ways to support demand. Demand for

healthcare remains high and will increase as winter months

bite.

External pressures have impacted the Group in the first half of

the period, to which we have responded accordingly, quickly

reorganising our operating and corporate structure to reflect the

changing shape of the business, whilst ensuring we retain capacity

to grow. We delivered GBP0.5 million of cost savings in the first

half of the year with increased savings to be delivered in the

second half, as further efficiencies from structural changes are

realised. In total, c.GBP3.0 million of annual costs have been

removed from our overheads and we continue to ensure our

infrastructure is fit for purpose.

As with most businesses we manage our cash facilities on a daily

basis. The cash balance at the end of September was adversely

affected by a GBP2.9m NHS debtor which was paid shortly after

period end. The Board expects the Company to be cash positive in

H2.

As we enter what is traditionally the busiest period of the year

for healthcare, there are opportunities to further expand support

for resilience services and we are working to ensure that we retain

the capacity within the organisation to meet demand. We have

recently mobilised additional capacity for NHS England 111

Resilience work, in addition to our continuing 111 contract as NHS

England's Resilience partner (mobilised in April and valued at

GBP10 million). During October 2023 we delivered considerable

additional capacity demonstrating our ability to respond rapidly to

increased demand. The additional capacity agreed for the period 1

October and 2023 to 31 March 2023 has the potential to double the

revenue originally confirmed for the original NHS 111 resilience

contract.

All of the services we deliver on behalf of NHS England and NHS

trusts continue to perform well.

Urgent Care

Totally's Urgent Care continues to deliver core services on

behalf of the NHS across the UK, including Urgent treatment

centres, GP out-of-hours, clinical assessment services, and online

and telephonic 111 services. We expect to support thousands of

people with access to the healthcare they need during over the

forthcoming winter.

Our focus on delivering excellent, quality care continues and a

s a result, all of Totally's CQC registerable services continue to

be rated as GOOD.

During the period our work on adapting services, innovating

current and new services as well as taking forward our thoughts on

increasing the use of digital services continued at pace. We have

also worked closely with a number of ambulance trusts to identify

and test new ways to broaden access and support for all types of

patients. Ongoing pilots have been extremely successful and we are

positive about the potential to work more extensively with these

trusts as we move forward.

Elective Care

Demand for elective care remains high, with the number of

patients waiting for care at all-time highs, as reported widely in

the media. Totally continues to be registered as an approved

provider on frameworks targeting waiting reduction across the UK

and Ireland.

Energy Fitness Professionals

During the period, Energy Fitness Professional has been

responding to increased tender opportunities, including

opportunities to deliver services in partnerships with Totally

healthcare operations.

During November 2023 the deferred consideration of GBP0.3

million, in relation to the acquisition Energy Fitness

Professionals on 16 December 2021, was paid.

Outlook

It is a difficult time for all healthcare provider organisations

however, managing demand and controlling costs is not a new

challenge for Totally and is one that we have faced and responded

to for many years. We have taken significant action to reduce costs

as we respond to the current market conditions and will continue to

seek out and identify new opportunities to drive efficiencies as

part of our business-as-usual cost management processes.

We are confident that our strong cost management culture will

enable us to return to previous levels of profit in future years,

whilst recognising the potential for lower revenues. Due to the

ongoing challenges however, the Board of Totally believe it is

prudent at the present time to withdraw market forecasts until such

time as normal market conditions return. As previously stated, the

Board is confident in the medium to long term prospects of the

business but views the current financial year as a period of

re-structuring and working alongside the NHS to manage current

issues. The Board will seek to provide forward looking growth

targets at the appropriate time.

Despite the recognised uncertainties that once again come with

the winter period, we remain confident that the business is

well-positioned. The NHS is in crisis and issues with their

workforce still need addressing. This inevitably results in

uncertainty for commissioners and delays important decisions

required for them to meet ongoing demand. Nevertheless, we are

confident that the financial challenges being currently experienced

by the NHS and those associated with it will be resolved. By

working together, continuing to seek new ways of working, such as

the recent pilots undertaken with ambulance trusts and the

development of new models of care, which reflect the needs of

today's population, we can help ensure the delivery of excellent

patient care and return to growth.

I would like to thank our team for their continued hard work and

commitment. All colleagues across Totally are committed to ensure

that patients receive the very best care they can and are

delivering this under exceptional circumstances. Similarly, we

thank our shareholders for their continued support, and look

forward to updating the market on new opportunities in due

course.

Wendy Lawrence

Chief Executive Officer

28 November 2023

Investor presentation

Wendy Lawrence, Chief Executive Officer, Lisa Barter, Chief

Financial Officer, and John McMullan, Medical Director will provide

a live presentation relating to the Company's interim results via

the Investor Meet Company at 11:00 a.m. (UK) on Thursday, 30

November 2023. The online presentation is open to all existing and

potential shareholders and will consist of a presentation followed

by a Q&A session. Questions can be submitted pre-event via the

Investor Meet Company dashboard or at any time during the live

presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Totally plc via:

https://www.investormeetcompany.com/totally-plc/register-investor

Investors who already follow Totally plc on the Investor Meet

Company platform will automatically be invited.

For further information please contact:

Totally plc

Wendy Lawrence, Chief Executive

Bob Holt, Chairman

Holly Smart, Director of Communications

& Marketing 020 3866 3330

Canaccord Genuity Limited (Nominated Adviser

& Corporate Broker)

Bobbie Hilliam

Harry Rees 020 7523 8000

Notes to editors

About Totally

Totally is a leading provider of healthcare and wellbeing

services across the UK and Ireland, working in partnership with the

NHS, other healthcare providers and corporate customers to help

address the challenges of increased demand for healthcare

services.

The Company is committed to pursuing a progressive buy-and-build

consolidation strategy within the fragmented healthcare market and

looks to capitalise on the attractive opportunities that its

disruptive service model offers to generate value to

shareholders.

Totally helps healthcare commissioners and hospitals ensure

patients can access the most appropriate care quickly and

efficiently by delivering quality urgent care services, such as NHS

111 and urgent treatment centres, elective care services including

insourcing, outsourcing and elective care delivered via 'Any

Qualified provider', as well as community dermatology clinics; and

therapy servicing including first contact practitioner and a full

physiotherapy and podiatry offering. Our corporate customer

services also play a role in reducing reliance on healthcare by

promoting healthy lifestyles and physical and mental health.

Healthcare services

Urgent Care: Totally's urgent care services are delivered under

the Totally Urgent Care brand, by Vocare and Greenbrook Healthcare.

Both businesses have a strong heritage and have been delivering

quality urgent care services including NHS 111, GP Out of Hours and

Urgent Treatment centres on behalf of the NHS for more than 25

years and 15 years respectively.

Elective care: Totally's elective care services are delivered by

Pioneer Healthcare, About Health and Premier Physical

Healthcare.

-- Pioneer Healthcare was established in 2007 and delivers a

wide range of acute services to NHS patients, in partnership with

independent healthcare sector private hospitals across England, to

help the NHS reduce waiting lists whilst maintaining patient care

and quality. Pioneer offer services through insourcing and

outsourcing agreements and through its Any Qualified Provider

status.

-- About Health has been delivering community-based specialist

care with a focus on delivering prompt assessment and treatment

across the country since 2008.

-- Premier Physical Healthcare was established in 2007 and

provides physiotherapy and podiatry services to NHS patients, often

within a community GP practice, and to the prison service.

Corporate Wellbeing Services

Energy Fitness Professionals ("EFP"): EFP is a corporate fitness

provider established in 1990 to address a gap in the market for

workplace fitness, which has grown to offer a range of services

covering workplace wellbeing. EFP manages 58 gyms on behalf of its

corporate customers, with more than 11,500 members.

For more information visit www.totallyplc.com

Interim Consolidated Income Statement

For the six months ended 30 September 2023

Six Months Six Months Year ended

ended 30 September ended 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------ ------------------- ------------------- -----------

Revenue 55,802 70,300 135,696

Cost of sales (46,114) (58,376) (110,695)

------------------- ------------------- -----------

Gross profit 9,688 11,924 25,001

Administrative expenses (8,569) (8,516) (18,113)

Other income - - 2

Exceptional items (475) - (562)

EBITDA 644 3,408 6,328

Depreciation and amortisation (2,254) (2,249) (4,249)

------------------- ------------------- -----------

Operating profit (1,610) 1,159 2,079

Finance costs (257) (119) (295)

------------------- ------------------- -----------

Profit before tax (1,867) 1,040 1,784

Income tax - (150) -

------------------- ------------------- -----------

Profit after tax (1,867) 890 1,784

------------------- ------------------- -----------

Earnings per share

Basic: Pence (0.95) 0.48 0.94

Diluted: Pence (0.95) 0.47 0.93

Adjusted Earnings per share

Basic: Pence (0.50) 1.06 1.99

Diluted: Pence (0.50) 1.05 1.96

All activities relate to continuing operations.

Interim Consolidated Statement of Changes in Equity

For the six months ended 30 September 2023

Share capital Share premium Retained Equity Shareholders'

earnings funds

GBP000 GBP000 GBP000

GBP000

------------------------------------ ------------- ------------- --------- --------------------

At 1 April 2023 (Audited) 19,610 1,945 15,510 37,065

Comprehensive loss for the period

(Unaudited) - - (1,867) (1,867)

Issue of share capital (Unaudited) 45 - - 45

At 30 September 2023 (Unaudited) 19,655 1,945 13,643 35,243

------------- ------------- --------- --------------------

At 1 April 2022 (Audited) 18,723 1,053 15,634 35,410

Comprehensive profit for the period

(Audited) - - 1,784 1,784

Issue of share capital (Audited) 887 892 - 1,779

Dividend payment (Audited) - - (1,908) (1,908)

At 31 March 2023 (Audited) 19,610 1,945 15,510 37,065

------------- ------------- --------- --------------------

At 1 April 2022 (Audited) 18,723 1,053 15,634 35,410

Comprehensive profit for the period

(Unaudited) - - 890 890

Credit on issue of warrants and

options (Unaudited) - - 61 61

------------- ------------- --------- --------------------

At 30 September 2022 (Unaudited) 18,723 1,053 16,585 36,361

------------- ------------- --------- --------------------

Interim Consolidated Statement of Financial Position

As at 30 September 2023

Six Months Six Months Year ended

ended 30 ended 30 31 March

September September 2023

2023 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

----------------------------------- ------------ ------------ ----------

Non-current assets

Intangible fixed assets 46,641 48,492 48,210

Property, plant and equipment 1,107 1,295 1,218

Right-of-use assets 2,689 1,526 1,362

Deferred tax 242 363 242

------------ ------------ ----------

Total non-current assets 50,679 51,676 51,032

Current assets

Inventories 72 72 75

Trade and other receivables 16,609 17,547 13,680

Cash and cash equivalents 1,704 7,441 6,451

------------ ------------ ----------

Total current assets 18,385 25,060 20,206

------------ ------------ ----------

Total assets 69,064 76,736 71,238

------------ ------------ ----------

Current liabilities

Trade and other payables (26,753) (31,093) (28,057)

Borrowings (2,500) - (2,500)

Lease liabilities (508) (275) (275)

Deferred acquisition consideration (528) (6,636) (528)

------------ ------------ ----------

Total current liabilities (30,289) (38,004) (31,360)

Non-current liabilities

Lease liabilities (2,311) (1,778) (1,661)

Other payables (209) (47) (140)

Deferred tax (1,012) (546) (1,012)

------------ ------------ ----------

Total non-current liabilities (3,532) (2,371) (2,813)

------------ ------------ ----------

Total liabilities (33,821) (40,375) (34,173)

------------ ------------ ----------

Net current liabilities (15,436) (15,315) (11,154)

------------ ------------ ----------

Net assets 35,243 36,361 37,065

------------ ------------ ----------

Shareholders' Equity

Share capital 19,655 18,723 19,610

Share premium account 1,945 1,053 1,945

Retained earnings 13,643 16,585 15,510

------------ ------------ ----------

Equity shareholders' funds 35,243 36,361 37,065

------------ ------------ ----------

Interim Consolidated Cash Flow Statement

For the six months ended 30 September 2023

Six Months Six Months Year ended

ended 30 September 31 March

2023 2023

(unaudited) ended 30 September (audited)

2022

GBP000 (unaudited) GBP000

GBP000

------------------------------------- ------------------- -------------------- -----------

Cash flow from operating activities:

(Loss)/profit before tax (1,867) 1,040 1,784

Adjustments for:

Options and warrants charge - 61 -

Amortisation and depreciation 2,254 2,249 4,249

Loss on disposal of non-current

assets - - 33

Finance Income - - (26)

Finance costs 257 119 321

Movements in working capital:

Movement in inventory 3 2 (1)

Movement in trade and other

receivables (2,929) (4,512) 419

Movement in trade and other

payables (1,554) (5,186) (8,106)

------------------- -------------------- -----------

Cash (used in)/generated from

operations (3,836) (6,227) (1,327)

Income tax received/(paid) - - (280)

------------------- -------------------- -----------

Net cash flows from operating

activities (3,836) (6,227) (1,607)

------------------- -------------------- -----------

Cash flow from investing activities:

Purchase of property, plant

and equipment (224) (400) (730)

Additions of intangible assets (114) (305) (665)

Contingent consideration - - (4,896)

Acquisition of subsidiary, net

of cash acquired - - (735)

------------------- -------------------- -----------

Net cash flows from investing

activities (338) (705) (7,026)

------------------- -------------------- -----------

Cash (outflow)/inflow before

financing (4,174) (6,932) (8,633)

Cash flow from financing activities:

Issue of share capital 45 - 567

Dividends paid - - (1,908)

Borrowings - - 2,500

Interest paid (188) (119) (295)

Finance lease payments (430) (819) (1,091)

------------------- -------------------- -----------

Net cash flow from financing

activities (573) (938) (227)

------------------- -------------------- -----------

Net decrease in cash and cash

equivalents (4,747) (7,870) (8,860)

Cash and cash equivalents at

beginning of the period 6,451 15,311 15,311

------------------- -------------------- -----------

Cash and cash equivalents at

end of the period 1,704 7,441 6,451

------------------- -------------------- -----------

Notes to the Interim Results

1. Basis of preparation

Totally plc is a public limited company incorporated in the

United Kingdom under the Companies Act 2006 (registration number:

3870101). The Company's ordinary shares are admitted to trading on

the AIM market of the London Stock Exchange ("AIM").

The Group's principal activities in the period under review have

been the provision of innovative and consolidatory solutions to the

healthcare sector, which are provided by the Group's wholly owned

subsidiaries, Totally Health Limited, Premier Physical Healthcare

Limited, About Health Limited, Optimum Sports Performance Centre

Limited, Vocare Limited, Greenbrook Healthcare (Hounslow) Limited,

Greenbrook Healthcare (Earl's Court) Limited, Totally Healthcare

Limited, Pioneer Health Care Limited and Energy Fitness

Professionals Limited.

The Group's interim report and accounts for the six months ended

30 September 2023 have been prepared using the recognition and

measurement principles of International Accounting Standards in

conformity with the requirements of the Companies Act 2006 as per

the annual report.

These interim financial statements for the six months ended 30

September 2023 have been prepared in accordance with the AIM Rules

for Companies and should be read in conjunction with the financial

statements for the year ended 31 March 2023, which have been

prepared in accordance with International Accounting Standards in

conformity with the requirements of the Companies Act 2006 as per

the annual report. The interim report and the condensed financial

statements do not include all the information and disclosures

required in the annual financial statements.

The interim report and condensed financial statements have been

prepared on the basis of the accounting policies, presentation and

methods of computation as set out in the Group's March 2023 Annual

Report and Accounts and on the basis of the principal accounting

policies that the Group expects to apply in its financial

statements for the year ending 31 March 2024.

The interim report and condensed financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. These interim financial statements were

approved by the Board of Directors on 14 November 2023. The results

for the six months to 30 September 2023 and the comparative results

for the six months to 30 September 2022 are unaudited. The amounts

for the period ended 31 March 2023 are extracted from the audited

statutory financial statements of the Group for that period.

The Directors believe that a combination of the Group's current

cash and credit facilities, projected revenues from existing and

future contracts will enable the Group to meet its obligations and

to implement its business plan in full. Inherently, there can be no

certainty in these matters, but the Directors believe that the

Group's internal trading forecasts are realistic and that the going

concern basis of preparation continues to be appropriate.

2. Earnings per share

Basic earnings per share is calculated by dividing the

(loss)/profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the

period. Diluted earnings per share takes into account the effects

of share options in issue.

Adjusted earnings per share is calculated by dividing the

pre-exceptional (loss)/profit before amortisation of intangible

customer contracts & relationships and tax by the weighted

average number of ordinary shares in issue during the period.

Statutory Earnings per 6 months ended 6 months ended Year ended

share 31 March 2023

30 September 30 September GBP000

2023 2022

GBP000 GBP000 (Audited)

(Unaudited) (Unaudited)

Profit (GBP000) (1,867) 890 1,784

Weighted average number

of shares used in basic

earnings per share calculations

('000) 196,547 187,268 190,836

Potentially dilutive share

options and contingent share

consideration ('000) 144 2,070 3,238

---------------- ---------------- -----------------

Weighted average number

of shares used in diluted

earnings per share calculations

('000) 196,691 189,338 194,074

---------------- ---------------- -----------------

Basic earnings per share

(Pence) (0.95) 0.48 0.94

Diluted earnings per share

(Pence) (0.95) 0.47 0.93

---------------- ---------------- -----------------

Adjusted Earnings per 6 months ended 6 months ended Year ended

share 31 March

2023

30 September 30 September GBP000

2023 2022

GBP000 GBP000 (Audited)

(Unaudited) (Unaudited)

Pre-exceptional profit

before tax (GBP000) (1,867) 1,040 2,346

Amortisation of intangible

customer contracts & relationships 880 950 1,459

---------------- ---------------- -----------------

Adjusted profit (GBP000) (987) 1,990 3,805

---------------- ---------------- -----------------

Weighted average number

of shares used in diluted

earnings per share calculations

('000) 196,547 189,268 190,836

Potentially dilutive share

options and contingent

share consideration ('000) 144 2,070 3,238

---------------- ---------------- -----------------

Weighted average number

of shares used in diluted

earnings per share calculations

('000) 196,691 189,338 194,074

---------------- ---------------- -----------------

Adjusted basic earnings

per share (Pence) (0.50) 1.06 1.99

Adjusted diluted earnings

per share (Pence) (0.50) 1.05 1.96

---------------- ---------------- -----------------

3. Dividends

The below dividends are recorded in the financial

information

6 months 6 months Year ended

ended 30 September ended 30 September 31 March 2023

2023 2022

GBP000 (Unaudited) GBP000 (Unaudited) GBP000 (Audited)

Interim dividend (FY23)

- 0.50p per share - - 937

Final dividend (FY22) -

0.50p per share - - 971

- - 1,908

In addition to the above, a final dividend (FY23) of 0.125p per

share or GBP246,000 was paid in October 2023. The Board are not

proposing to pay an interim dividend in respect of FY24.

4. Distribution of Interim Report

A copy of the interim report will be available shortly on the

Company's website ( www.totallyplc.com ) in accordance with Rule 26

of the AIM Rules for Companies.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBBDBUUDDGXR

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

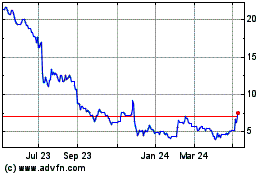

Totally (LSE:TLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

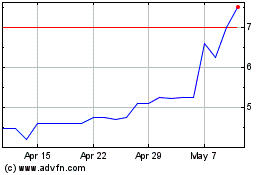

Totally (LSE:TLY)

Historical Stock Chart

From Apr 2023 to Apr 2024