New CEO at Ben & Jerry's Plans to Whip Up Activism, 'Whirled Peace'

15 August 2018 - 10:59PM

Dow Jones News

By Vanessa Fuhrmans

Ben & Jerry's, the ice-cream maker known for its social

advocacy as much as its chunk-filled flavors, has a new chief

executive who is promising to ramp up the brand's corporate

activism.

Matthew McCarthy, a food-business veteran of Unilever PLC, which

bought Ben & Jerry's in 2000, succeeds Jostein Solheim as

CEO.

Mr. Solheim, another longtime Unilever executive, led Ben &

Jerry's for eight years and is moving into a broader role

overseeing all of the Anglo-Dutch company's food and refreshment

businesses in North America.

Mr. McCarthy has a track record in the kind of sustainable food

production Ben & Jerry's has long promoted. At Unilever, he led

an initiative to transition Hellmann's mayonnaise to 100% cage-free

eggs and more recently launched Unilever's first organic snack

brand in the U.S., Growing Roots, which gives 50% of its profits to

U.S. urban farmers. He also led the company's 2017 acquisition of

Sir Kensington's, an upstart maker of high-end condiments.

The CEO change comes as Vermont-based Ben & Jerry's has been

diversifying into new ice-cream products and boosting its political

activism. During the 2016 election season, it launched an "Empower

Mint" ice-cream flavor in support of a voting-rights campaign. More

recently, it has advocated for the passage of Amendment 4 in a

Florida referendum in November, which would restore voting rights

to former felons.

The 49-year-old Mr. McCarthy calls "Phish Food," named after the

Vermont band Phish, his favorite Ben & Jerry's ice cream. It

and "Imagine Whirled Peace," a tribute to John Lennon's "Imagine,"

are among the Ben & Jerry's ice creams with musical or other

pop-culture references.

Mr. McCarthy said he plans to amplify the brand's tradition of

promoting environmental sustainability and advocating for social

causes while promoting its ice cream flavors. Over the next few

months, he said, the company will unveil new initiatives.

"Many people are feeling a tremendous lack of trust in [public]

institutions around them," he said. "We need organizations,

including businesses, to step forward more than ever."

Mr. McCarthy said Ben & Jerry's also has new product plans

in the works. Competition among premium ice creams has intensified

as relative newcomers such as Halo Top have won market share with

low-calorie and nondairy products. To compete, Ben & Jerry's

launched its first nondairy vegan ice-cream flavors in 2016 and,

earlier this year, introduced a line of "Moo-phoria" ice cream with

640 calories a pint or less. (Many of its traditional ice creams

top 1,000 calories a pint.)

Though Ben & Jerry's doesn't disclose sales, its share of

the U.S. ice-cream market in the 12 months ended July 14 was the

third-largest at 6.9%, slightly higher than the prior-year period,

according to market-research firm Nielsen Co. The company sells ice

cream in more than 30 countries.

Write to Vanessa Fuhrmans at vanessa.fuhrmans@wsj.com

(END) Dow Jones Newswires

August 15, 2018 08:44 ET (12:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

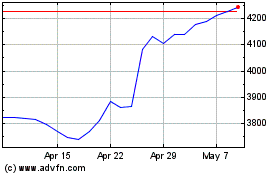

Unilever (LSE:ULVR)

Historical Stock Chart

From Apr 2024 to May 2024

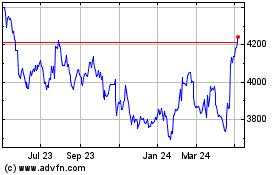

Unilever (LSE:ULVR)

Historical Stock Chart

From May 2023 to May 2024