Nucor Warns of Challenge in Steel Mills Business in 3Q

18 July 2019 - 11:11PM

Dow Jones News

By Micah Maidenberg

Nucor Corp. said it expects performance in its raw materials

business to decline in the third quarter compared with the second

quarter, due to weaker profit margins for a metal product called

direct-reduced iron.

Profitability in the company's steel-products business is

expected to improve during the third quarter versus the second

quarter, the company also said. The nonresidential construction

market remains strong, according to Nucor, which should support the

steel-product business.

However, Nucor also warned it believes its steel mills

business's performance in the third quarter will be weaker than the

last period due to lower prices for flat-rolled steel and plate

steel.

"Prices for several key product lines have only recently

reversed the downward trajectory that prevailed during the first

half of the year due to weather conditions and service center

destocking," Nucor said about the mills business. "We expect

service center customers will resume more normal market

demand-driven buying patterns during the third quarter of

2019."

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

July 18, 2019 08:56 ET (12:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

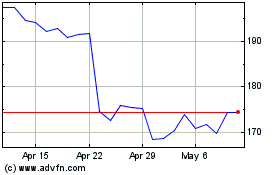

Nucor (NYSE:NUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

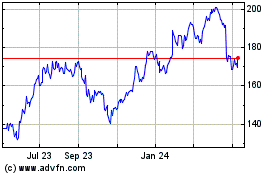

Nucor (NYSE:NUE)

Historical Stock Chart

From Apr 2023 to Apr 2024