Thanks to the immense popularity of ETFs in recent years, there

has been a race to the bottom in the exchange-traded

fund business on the cost front for gaining market share. Many

ETF sponsors have reduced costs to make their funds the cheapest in

a particular category, heating up the competition in the space.

Cost is an important element in selecting funds in the

portfolio, especially when two funds track similar, or even

identical, indexes. Generally, the low-cost product overtakes the

high-cost product and leads in AUM when cost is really the only big

difference between the two funds.

This trend has been especially important for iShares, despite

their solid performance this year as the company has pulled in

about $50 billion in AUM in the first nine months of the year.

Though the firm has among the most in asset inflows, it is

losing share in large liquid funds to low cost ETFs managed by

Vanguard and other low cost providers like Schwab. Still, iShares

occupies about 41% of the U.S. market share with 276 funds in its

total lineup, a figure that is down from 48% reported in 2009.

As a result, iShares recently announced plans to cut the expense

ratio on six core ETFs, making them some of the cheapest offerings

in each of their respective categories. The cut follows the latest

fee reductions by Vanguard and Charles Schwab to boost its assets

inflows amid stiff competition (read: Charles Schwab Slashes Fees

on Entire ETF Lineup).

The products that iShares announced the cuts on are not

unimportant funds either, as iShares has slashed costs on two

important ETFs, Core S&P 500 ETF (IVV) and

Core S&P Total U.S. Stock Market ETF (ISI),

funds that now have expense ratios of just 0.07% per year, making

them some of the cheapest ETFs in any category (ISI’s ticker will

change to ITOT as well).

Though IVV fails in comparison to VOO in terms of expense ratio

by two basis points, the product so far attracted $33.2 billion of

assets compared to $5.7 billion for VOO, suggesting that it could

have a much easier time keeping assets after this

cut.

The other three ETFs – Core S&P Mid-Cap ETF

(IJH), Core S&P Small-Cap ETF (IJR) and

Core Total U.S. Bond Market ETF (AGG) – will now

have expense ratios of 0.15%, 0.16% and 0.08%, respectively. IJH is

the low-cost choice in tracking the S&P MidCap 400 Index,

outstripping IVOO, a Vanguard product, which has an expense ratio

of 0.17%.

Among the three funds tracking the S&P SmallCap 600 Index,

IJR and VIOO will be the cheapest funds in the category. On the

other hand, AGG is the cheapest fund after Charles Schwab’s SCHZ

that tracks the Barclays Capital U.S. Aggregate Bond Index. AGG has

so far managed assets of about $15.9 billion while SCHZ has only

$336.6 million in AUM (read: Ten Biggest U.S. Equity Market

ETFs).

iShares also cut the expense ratio on Core Long-Term

U.S. Bond ETF (GLJ) to 0.12% from 0.20% and decided to

change the tracking index to Barclays US Long Government/Credit

Bond. Furthermore, the new ticker name will be ILTB instead of

GLJ.

The Vanguard product, Long-Term Bond ETF (BLV), tracks the same

index and charges 11 bps in fees per year to investors. We have

seen that the Vanguard product has attracted around $587 million

more assets than iShares’ product owing to lower fees of 1

bps.

While these fee reductions are expected to take a toll on

iShares’ revenue by $35–$40 million, it would boost more cash

inflows for the products. Further, the firm introduced four new

low-fee ETFs to its lineup in order to attract long-term investors

instead of cutting fees on the old funds (read: Who Says iShares

ETFs Aren’t Cheap?).

The new funds - Core MSCI Total International Stock

ETF (IXUS), Core MSCI Emerging Markets

ETF (IEMG), Core MSCI EAFE ETF (IEFA) and

Core Short-Term U.S. Bond ETF (ISTB) – will have

expense ratios of 0.16%, 0.18%, 0.14% and 0.12%, respectively.

These funds are similar to iShares’ four existing ETFs - MSCI

ACWI ex US Index Fund (ACWX), MSCI Emerging Markets Index Fund

(EEM), MSCI EAFE Index Fund (EFA) and Barclays 1-3 Year Treasury

Bond Fund (SHY) that have expense ratios of 0.34%, 0.67%, 0.34% and

0.15%, respectively.

Since these funds have a huge asset base and relatively higher

expense ratios, iShares might have lost $259 million in annual

revenue had it simply cut fees on them instead of introducing the

new products, suggesting that the San Francisco-based firm is

testing a novel strategy of new launches instead of cuts on at

least some of its funds.

This low-cost strategy may also bolster the firm’s competitive

position against its rivals such as Vanguard, Charles Schwab and

State Street in a number of important ETF categories across a

number of asset classes.

This is an interesting plan that has immense ramifications for

the broader ETF world. It suggests that the fight for low-cost

products is intensifying and a number of issuers are coming up with

low fees as cheap funds attract more inflows. The approach helps

investors to build a diversified portfolio with lower cost and

higher returns.

For investors looking for a list of iShares fees changes, we

have highlighted the company’s products below, by AUM, along with

their old and new expense ratios (see more on ETFs in the Zacks ETF

Center):

|

ETF

|

AUM (in millions) as of October

17

|

New Expense Ratio

|

Old Expense Ratio

|

|

IVV

|

$33,237

|

0.07%

|

0.09%

|

|

ISI/ITOT

|

$365

|

0.07%

|

0.20%

|

|

IJH

|

$11,421

|

0.15%

|

0.21%

|

|

IJR

|

$7,925

|

0.16%

|

0.22%

|

|

AGG

|

$15,893

|

0.08%

|

0.20%

|

|

GLJ/ILTB

|

$200

|

0.12%

|

0.20%

|

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

(GLJ): ETF Research Reports

ISHARS-SP MID (IJH): ETF Research Reports

ISHARS-SP SC600 (IJR): ETF Research Reports

ISHARS-10+Y GCB (ILTB): ETF Research Reports

(ISI): ETF Research Reports

ISHARS-1500 IDX (ITOT): ETF Research Reports

ISHARS-SP500 (IVV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

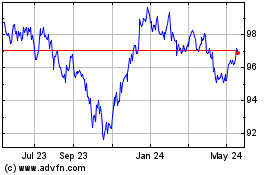

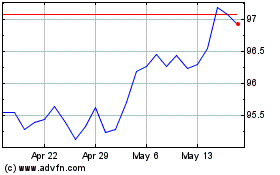

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Jan 2025 to Feb 2025

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Feb 2024 to Feb 2025