Buy These Bond ETFs for Income and Diversification - ETF News And Commentary

04 April 2013 - 11:30PM

Zacks

Investors now have a plethora of choices for fixed income in the

ETF world. There are options that focus in on various subsectors of

the U.S. bond market, while international products have also seen

big inflows as well.

One especially intriguing segment that many have overlooked is

in the emerging market space, specifically for sovereign debt.

Funds in this segment are usually tiny (or non-existent) portions

of broad bond ETFs like AGG or

BND, and thus are probably not in many investor

portfolios (see 3 Excellent ETFs for Income Investors).

This is unfortunate, as emerging market sovereign debt ETFs

generally are sporting impressive yields (above 3.8%), have great

diversification benefits, and the underlying nations generally are

in a solid fiscal position. Furthermore, due to relatively high

rates in emerging markets, their central banks have greater policy

flexibility to either tame inflation or reduce rates and boost bond

prices in the process.

Best of all, there are even several options that provide

investors exposure to dollar-denominated securities, a great choice

when the dollar is seeing strength. This situation helps to prevent

currency risk, and could lead to outperformance over local

denominated debt when emerging market currencies are slumping.

Emerging Market Bond Picks

Two great options in this space are the JP Morgan USD

Emerging Markets Bond Fund (EMB) and the

PowerShares Emerging Markets Sovereign Debt Portfolio

(PCY). These two are somewhat similar, but there are few

key differences that investors should be aware of before choosing

between the two for exposure.

First, PCY is a bit cheaper and a better yielder, with fees of

just 50 basis points and a yield of 4.25% in 30 Day SEC terms. This

compares favorably to EMB’s 59 basis point cost, and its slightly

less robust 30-Day SEC payout of 3.8%.

However, it is also worth noting that EMB is a bit more focused

on intermediate term securities, and that its interest rate risk is

a bit less. This could make EMB a bit safer than PCY, although this

obviously reduces the overall payout (also read Zacks Top Ranked

Bond ETF in Focus).

For more information on emerging market bonds, and these two

ETFs, watch this short video on the subject below:

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

ISHARS-JPM EM B (EMB): ETF Research Reports

PWRSH-EM SVN DP (PCY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

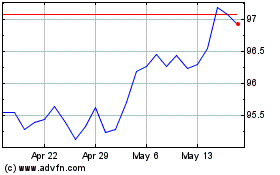

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Oct 2024 to Nov 2024

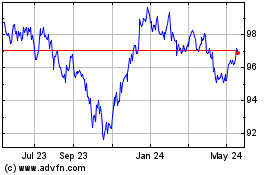

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Nov 2023 to Nov 2024