Battalion Oil Corporation (NYSE American: BATL) (“Battalion” or the

“Company”) announced today that it has entered into an amendment to

the previously disclosed Agreement and Plan of Merger (as amended,

the “Merger Agreement”) with Fury Resources, Inc. (“Buyer” or

“Parent”), pursuant to which Parent has agreed to acquire all of

the outstanding shares of Common Stock of the Company

(the “Common Stock”) for $7.00 per share in cash, without

interest (the “Merger Consideration”). The holders of all of the

outstanding shares of the Preferred Stock of the Company, Luminus

Management, LLC (“Luminus”), Gen IV Investment Opportunities, LLC,

and funds and accounts managed by Oaktree Capital Management, L.P.

(“Oaktree”), or their respective affiliates (collectively,

the “Rollover Stockholders”), have agreed to contribute to Buyer

all of their shares of Preferred Stock of the Company in exchange

for new preferred shares of Buyer at a valuation based on the

redemption value of such Company Preferred Stock.

The transaction is expected to close in the

fourth quarter of 2024, subject to various closing conditions as

set forth in the Merger Agreement, including the approval of

Battalion’s stockholders.

Parent has confirmed to the Company that it has

received the following capital commitments to complete the

transactions contemplated by the Merger Agreement:

-

$200 million in debt commitments from Fortress Credit Corp.

and AI Partners Asset Management Co., Ltd;

-

$188 million in total Preferred Stock commitments from a

combination of the Rollover Stockholders listed above ($173

million) and AI Partners Asset Management Co., Ltd.

($15 million);

-

$160 million in equity commitments to acquire new shares of

common stock of Parent.

Post-transaction, net of acquisition

consideration and fees, Parent is expected to have approximately

$100 million in cash on the balance sheet.

As previously disclosed, in connection with the

transactions contemplated by the Merger Agreement, Luminus and

Oaktree, who collectively own 61.61% of the Common Stock of the

Company, had entered into a Voting Agreement with Buyer pursuant to

which they have agreed, among other things, to vote 6,254,652 of

their shares of Common Stock, which in the aggregate represents 38%

of the total voting power of the shares of capital stock of the

Company, in favor of adopting the Merger Agreement.

For Battalion, Houlihan Lokey Capital, Inc.

acted as financial advisor and Mayer Brown LLP is acting as legal

counsel. Jefferies LLC acted as financial advisor and K&L Gates

LLP is acting as legal counsel to Buyer.

Avi Mirman, Co-Founder and Chairman of Fury

Resources stated “With this acquisition, Fury has secured a

foothold in one of the world’s most prolific basins. Our team has

significant experience in the region, and we believe these assets

present a compelling value proposition for our investors. With a

deep inventory of high return locations and consolidation

opportunities in the area, we believe this asset can be scaled

quickly and provide a meaningful return to our investors. We have

strong institutional support for this transaction, including the

Rollover Stockholders. We view their decision to stay in the

investment opportunity as a strong vote of confidence in our

ability to deliver results and are excited for us to get to

work.

I’m excited to have Richard Little, the former

CEO of Battalion, back to unlock the potential of these assets by

accelerating development, tapping into new reserves and advancing

the gas processing capabilities in the area” added Mr. Mirman.

“Finally, I especially want to thank both the Fury and Battalion

teams for their tenacity in reaching this objective, both for the

benefit of BATL common stockholders and Fury Resources

post-transaction. This is a win-win.”

Matt Steele, Battalion CEO, commented, “I echo

Mr. Mirman’s comments. This transaction has taken longer than

anyone at the table intended. Despite that, the teams persevered to

achieve the best outcome for BATL stockholders. The company and

Fury will work diligently in the coming months to close this

transaction and position Fury for a successful transition.”

About Battalion

Battalion Oil Corporation is an independent

energy company engaged in the acquisition, production, exploration

and development of onshore oil and natural gas properties in the

United States.

About Fury

Fury Resources, Inc. (“Fury Resources”) is a

privately held exploration and production company focused on value

creation through the acquisition and exploitation of assets in the

Permian Basin. The team is comprised of core individuals who are

long-term oil and gas veterans, and have in the past successfully

grown Lilis Energy, Inc., a struggling $3MM market cap exploration

and production company to well over $550MM, by the acquisition,

organic growth, and development of Permian Basin properties. With

expertise and talent in the team, Fury Resources is positioned and

capitalized to grow in the area organically and through future

acquisitions. To learn more, visit Fury Resource’s website at

www.furyresources.com.

Important Information for Investors and

Stockholders

This communication is being made in respect of

the proposed transaction involving the Company and Parent. In

connection with the proposed transaction, the Company intends to

file the relevant materials with the SEC, including a proxy

statement on Schedule 14A and a transaction statement on

Schedule 13e-3 (the “Schedule 13e-3”). Promptly

after filing its definitive proxy statement with the SEC, the

Company will mail the definitive proxy statement and a proxy card

to each stockholder of the Company entitled to vote at the special

meeting relating to the proposed transaction. This communication is

not a substitute for the proxy statement, the Schedule 13e-3

or any other document that the Company may file with the SEC or

send to its stockholders in connection with the proposed

transaction. The materials to be filed by the Company will be made

available to the Company’s investors and stockholders at no expense

to them and copies may be obtained free of charge on the Company’s

website at www.battalionoil.com. In addition, all of those

materials will be available at no charge on the SEC’s website at

www.sec.gov. Investors and stockholders of the Company are urged to

read the proxy statement, the Schedule 13e-3 and the other

relevant materials when they become available before making any

voting or investment decision with respect to the proposed

transaction because they contain important information about the

Company and the proposed transaction. The Company and its

directors, executive officers, other members of its management and

employees may be deemed to be participants in the solicitation of

proxies of the Company stockholders in connection with the proposed

transaction under SEC rules. Investors and stockholders may obtain

more detailed information regarding the names, affiliations and

interests of the Company’s executive officers and directors in the

solicitation by reading the Company’s Annual Report on

Form 10-K, as amended on Form 10-K/A, for the fiscal year

ended December 31, 2023, and the proxy statement, the

Schedule 13e-3 and other relevant materials that will be filed

with the SEC in connection with the proposed transaction when they

become available. Information concerning the interests of the

Company’s participants in the solicitation, which may, in some

cases, be different than those of the Company’s stockholders

generally, will be set forth in the proxy statement relating to the

proposed transaction and the Schedule 13e-3 when they become

available.

Cautionary Information Regarding

Forward-Looking Statements

All statements and assumptions in this

communication that do not directly and exclusively relate to

historical facts could be deemed “forward-looking statements.”

Forward-looking statements are often identified by the use of words

such as “anticipates,” “believes,” “estimates,” “expects,” “may,”

“could,” “should,” “forecast,” “goal,” “intends,” “objective,”

“plans,” “projects,” “strategy,” “target” and “will” and similar

words and terms or variations of such. These statements represent

current intentions, expectations, beliefs or projections, and no

assurance can be given that the results described in such

statements will be achieved. Forward-looking statements include,

among other things, statements about the potential benefits of the

proposed transaction; the prospective performance and outlook of

the Company’s business, performance and opportunities; the ability

of the parties to complete the proposed transaction and the

expected timing of completion of the proposed transaction; as well

as any assumptions underlying any of the foregoing. Such statements

are subject to numerous assumptions, risks, uncertainties and other

factors that could cause actual results to differ materially from

those described in such statements, many of which are outside of

the Company’s control. Important factors that could cause actual

results to differ materially from those described in

forward-looking statements include, but are not limited to,

(i) the risk that the proposed transaction may not be

completed in a timely manner or at all; (ii) the failure to

receive, on a timely basis or otherwise, the required approvals of

the proposed transaction by the Company’s stockholders;

(iii) the possibility that any or all of the various

conditions to the consummation of the proposed transaction may not

be satisfied or waived, including the failure to receive any

required regulatory approvals from any applicable governmental

entities (or any conditions, limitations or restrictions placed on

such approvals); (iv) the possibility that competing offers or

acquisition proposals for the Company will be made; (v) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the definitive transaction

agreement relating to the proposed transaction, including in

circumstances, which would require the Company to pay a termination

fee; (vi) the effect of the announcement or pendency of the

proposed transaction on the Company’s ability to attract, motivate

or retain key executives and employees, its ability to maintain

relationships with its customers, suppliers and other business

counterparties, or its operating results and business generally;

(vii) risks related to the proposed transaction diverting

management’s attention from the Company’s ongoing business

operations; (viii) the amount of costs, fees and expenses

related to the proposed transaction; (ix) the risk that the

Company’s stock price may decline significantly if the Merger is

not consummated; (x) the risk of stockholder litigation in

connection with the proposed transaction, including resulting

expense or delay; and (xi) other factors as set forth from

time to time in the Company’s filings with the SEC, including its

Annual Report on Form 10-K, as amended, for the fiscal year

ended December 31, 2023, as may be updated or supplemented by

any subsequent Quarterly Reports on Form 10-Q or other filings

with the SEC. Readers are cautioned not to place undue reliance on

such statements which speak only as of the date they are made. The

Company does not undertake any obligation to update or release any

revisions to any forward-looking statement or to report any events

or circumstances after the date of this communication or to reflect

the occurrence of unanticipated events except as required by

law.

Matthew B. Steele

Chief Executive Officer

832-538-0300

www.battalionoil.com

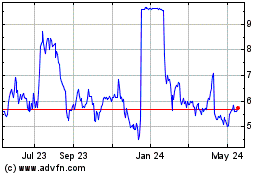

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Oct 2024 to Nov 2024

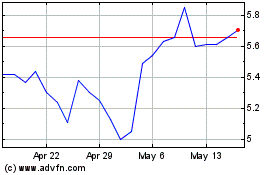

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Nov 2023 to Nov 2024