- Shareholders to receive $32.00 in cash per share,

representing a premium of 33% over the last closing price and 58%

over the 60-day volume-weighted average trading price

- Offer values CI’s equity at approximately $4.7 billion and

implies an enterprise value of approximately $12.1 billion

- Transaction provides CI with long-term, stable capital,

supporting the continued execution of its strategy of building a

best-in-class wealth and asset manager that will operate with the

highest standards for clients and employees

- CI will continue with its current Canadian operations,

structure and management team, maintain Canadian headquarters, and

remain independent of Mubadala Capital’s other portfolio

businesses

- Chief Executive Officer Kurt MacAlpine will continue to lead

CI

- Transaction was unanimously approved by a special committee

of independent members of CI’s Board of Directors

All financial amounts are in Canadian

dollars unless stated otherwise.

CI Financial Corp. (“CI”) (TSX: CIX) today

announced that it has entered into a definitive agreement with an

affiliate of Mubadala Capital, the alternative asset management arm

of Mubadala Investment Company, to take CI private in a transaction

that values CI’s equity at approximately $4.7 billion and implies

an enterprise value of approximately $12.1 billion. Following the

closing of the transaction, CI will continue to operate with its

current structure and management team and will be independent of

Mubadala Capital’s other portfolio businesses.

All issued and outstanding shares of CI will be acquired for

cash consideration equal to $32.00 per share, other than shares

held by members of senior management who enter into equity rollover

agreements as further detailed below. The cash purchase price

represents a 33% premium to the last closing price prior to the

announcement of the transaction and a premium of 58% to the 60-day

volume-weighted average trading price on the Toronto Stock

Exchange.

CI’s Board of Directors, with interested directors abstaining,

is unanimously recommending that CI shareholders vote in favor of

the transaction. The recommendation follows the unanimous

recommendation of a special committee of the Board, comprised

solely of independent directors, that was formed in connection with

the transaction (the “Special Committee”).

“This transaction, with its significant cash premium, represents

an exceptional outcome for CI shareholders and provides certainty

to shareholders while CI pursues its ongoing transformation,” said

William E. Butt, CI’s Lead Director and Chair of the Special

Committee. “It also provides significant benefits to Canada, by

providing long-term capital to underpin the building of a Canadian

champion in the wealth and asset management industries.”

“Mubadala Capital invests with a long-term outlook and

represents long-term capital – providing stability and certainty

for CIʼs clients and employees,” said Kurt MacAlpine, CI’s Chief

Executive Officer. “With this transaction, CI has never been better

positioned to fulfil our mission of delivering outstanding services

and solutions to our clients.”

“We are fully aligned with the strategy and direction of the

firm and look forward to working with the CI management team to

continue to build this outstanding business and ensure that CI

continues to deliver superior services to its clients,” said Hani

Barhoush, Managing Director and CEO of Mubadala Capital.

“We look forward to partnering with CI’s talented team to

capitalize on new opportunities in the asset and wealth management

sectors and build on the company’s successes,” said Oscar Fahlgren,

Chief Investment Officer of Mubadala Capital.

The transaction also supports CI’s expansion in the U.S., where

it operates as Corient and will continue to operate independently

under the Corient brand.

“We’re excited to continue to execute our U.S. strategy with our

incredibly talented team,” said Mr. MacAlpine. “Notably, the

transaction preserves Corient’s structure and its unique Private

Partnership model, under which 250 of our colleagues are equity

Partners in Corient. Our partnership model is highly differentiated

in our industry – it allows us to deliver the best of the firm to

all clients and creates a culture of collaboration and unified

purpose.”

Benefits to Canada

- This transaction will maintain CI’s existing leadership and

will result in CI retaining its talented team across CI’s multiple

offices in Canada, and will create the opportunity for new hiring

in Canada to support growth.

- CI will remain headquartered in Canada and existing operations

and structure in Canada will stay in place. This includes

maintaining CI’s existing technology and data protection practices,

including maintaining all personal data in Canada for Canadian

operations.

- Mubadala Capital’s long-term approach will create a stable,

well-funded platform for CI to continue to grow, allowing

management greater ability to reinvest into the overall business

and strategy.

- Mubadala Capital is committed to continuing CI’s philanthropic

support of charitable organizations across Canada.

Transaction Details

The transaction will proceed via a plan of arrangement under the

Business Corporations Act (Ontario) and will require approval of at

least (i) 66⅔ per cent of the votes cast by shareholders, and (ii)

a simple majority of the votes cast excluding votes as required

under Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI 61-101”), at a

special meeting of CI shareholders to be held to consider the

transaction. The meeting is expected to be held in January

2025.

The transaction is also subject to court approval, regulatory

clearances and other customary closing conditions. The transaction

is not subject to any financing condition and, assuming the timely

receipt of all required regulatory approvals, is expected to close

in the second quarter of 2025.

The definitive agreement includes customary terms and

conditions, including a non-solicitation covenant on the part of

CI, which is subject to “fiduciary out” provisions that enable CI

to terminate the agreement in customary circumstances, subject to

Mubadala Capital having a right to match any third party superior

proposal. A termination fee of $150 million is payable by CI to

Mubadala Capital in certain circumstances, including termination of

the agreement by CI pursuant to the “fiduciary out” provisions. A

reverse termination fee of $225 million is payable by Mubadala

Capital to CI if the transaction is not completed in certain

circumstances, including where certain of the required regulatory

approvals are not received.

Chief Executive Officer Kurt MacAlpine expects to roll all his

equity in the transaction and other members of CI’s senior

management holding an aggregate of up to 1.5% of CI’s shares are

also expected to have the opportunity to enter into equity rollover

agreements to exchange their CI shares into a new holding vehicle.

In addition, Chairman William Holland may roll 25% of his total CI

holdings in the transaction. All rollovers will occur at a value

equal to the cash purchase price.

Each of CI’s directors and executive officers or entities

controlled by them, which own or control an aggregate of

approximately 16.88% of CI’s outstanding shares, have entered into

a voting and support agreement with Mubadala Capital agreeing to

vote their shares in favor of the transaction. All voting and

support agreements terminate automatically upon termination of the

definitive agreement or a change of recommendation by CI’s Board of

Directors made in accordance with the terms of the definitive

agreement. Any equity rollover agreements will terminate

automatically upon termination of the definitive agreement.

CI’s debentures and notes are expected to remain outstanding

following closing of the transaction and the financing for the

transaction has been structured to maintain CI’s long-term issuer

and senior unsecured debt ratings of Baa3 (Stable) by Moody’s. CI’s

shares will be delisted from the Toronto Stock Exchange following

closing of the transaction; however, CI is expected to remain a

reporting issuer under applicable Canadian securities laws as a

result of its debentures and notes remaining outstanding. Holders

of outstanding shares of preferred equity in CI’s subsidiary,

Corient Holdings Inc., have agreed to waive and amend certain

liquidity and other rights in connection with the transaction

through the closing of the transaction. Mubadala Capital intends to

fund up to $750 million of additional cash at closing to reduce the

preferred equity outstanding. Following the closing, the parties

will continue prioritizing the maintenance of CI’s investment grade

senior unsecured debt ratings.

CI will pay its previously declared regular quarterly dividends

on January 15, 2025 and April 15, 2025 to shareholders of record as

of December 31, 2024 and March 31, 2025, respectively, but under

the terms of the definitive agreement, has agreed to suspend any

additional dividends.

Board and Special Committee Recommendation

In arriving at its unanimous recommendation in favor of the

transaction, the Special Committee considered several factors,

including the opinion of INFOR Financial Inc. (“INFOR Financial”)

to the effect that, as of the date thereof and subject to the

assumptions, limitations and qualifications therein, the

consideration to be received by CI shareholders (other than

shareholders eligible to enter into an equity rollover agreement)

pursuant to the transaction is fair, from a financial point of

view, to such shareholders.

CI’s Board of Directors also received INFOR Financial’s fairness

opinion and, after receiving the unanimous recommendation of the

Special Committee, unanimously determined (with interested

directors abstaining) that the transaction is in the best interests

of CI and unanimously recommends that shareholders vote in favor of

the transaction.

A copy of the written fairness opinion, as well as additional

details regarding the terms and conditions of the definitive

agreement and transaction and the rationale for the recommendations

made by the Special Committee and the Board of Directors, will be

included in the management proxy circular and other materials to be

mailed to shareholders in connection with the shareholder meeting

to approve the transaction. The summaries of the definitive

agreement and voting and support agreements in this press release

are qualified in their entirety by the provisions of those

agreements. Copies of the definitive agreement and voting and

support agreements and, when finalized, the meeting materials will

be filed under CI’s profile on SEDAR+ at www.sedarplus.ca.

Advisors

INFOR Financial is acting as exclusive financial advisor to the

Special Committee. INFOR Financial was paid a fixed fee for its

services and is not entitled to any fee that is contingent on the

successful completion of the transaction. Wildeboer Dellelce LLP is

serving as legal advisor to the Special Committee.

Stikeman Elliott LLP and Skadden, Arps, Slate, Meagher &

Flom LLP are serving as legal advisors to CI. RBC Capital Markets

is also an advisor to CI.

Jefferies Securities Inc. is acting as lead financial advisor to

Mubadala Capital and Blake, Cassels & Graydon LLP and Latham

& Watkins LLP are serving as legal advisors to Mubadala

Capital. FGS Longview is acting as strategic communications and

public affairs advisor to Mubadala Capital. BMO Capital Markets is

also an advisor to Mubadala Capital.

About CI Financial

CI Financial Corp. is a diversified global asset and wealth

management company operating primarily in Canada, the United States

and Australia. Founded in 1965, CI has developed world-class

portfolio management talent, extensive capabilities in all aspects

of wealth planning, and a comprehensive product suite. CI manages,

advises on and administers approximately $518.1 billion in client

assets (as at September 30, 2024). CI operates in three

segments:

- Asset Management, which includes CI Global Asset Management,

which operates in Canada, and GSFM, which operates in

Australia.

- Canadian Wealth Management, operating as CI Wealth, which

includes CI Assante Wealth Management, Aligned Capital Partners, CI

Assante Private Client, CI Private Wealth, Northwood Family Office,

CI Coriel Capital, CI Direct Investing, CI Direct Trading and CI

Investment Services.

- U.S. Wealth Management, which includes Corient Private Wealth,

an integrated wealth management firm providing comprehensive

solutions to ultra-high-net-worth and high-net-worth clients across

the United States.

CI is headquartered in Toronto and listed on the TSX (TSX: CIX).

To learn more, visit CI’s website or LinkedIn page.

CI Global Asset Management is a registered business name of CI

Investments Inc., a wholly owned subsidiary of CI Financial

Corp.

About Mubadala Capital

Mubadala Capital is a global alternative asset manager that

oversees $24 billion USD of assets under management. The firm is an

independent subsidiary of Mubadala Investment Company, a c. $302

billion USD global sovereign investor headquartered in Abu Dhabi,

UAE. Mubadala Capital manages assets through its four investment

businesses spanning various private market strategies, including

private equity, special situations, solutions, and venture capital.

Mubadala Capital has a team of over 200 spanning 5 offices,

including in Abu Dhabi, New York, London, San Francisco, and Rio De

Janeiro. Mubadala Capital aims to be the partner of choice for

investors looking for attractive and differentiated risk-adjusted

returns across various private markets and alternative asset

classes.

Note Regarding Forward-Looking Statements

This press release contains “forward-looking information” within

the meaning of applicable Canadian securities laws. Forward-looking

information may relate to our future outlook and anticipated events

or results and may include information regarding our financial

position, business strategy, growth strategy, budgets, operations,

financial results, taxes, dividend policy, plans and objectives.

Particularly, information regarding our expectations of future

results, performance, achievements, prospects or opportunities is

forward-looking information. In some cases, forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “targets”, “expects” or “does not

expect”, “is expected”, “an opportunity exists”, “budget”,

“scheduled”, “estimates”, “outlook”, “forecasts”, “projection”,

“prospects”, “strategy”, “intends”, “anticipates”, “does not

anticipate”, “believes”, or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“would”, “might”, “will”, “will be taken”, “occur” or “be

achieved”. In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but

instead represent management’s expectations, estimates and

projections regarding future events or circumstances. These

statements include, without limitation, statements regarding the

receipt, in a timely manner, of shareholder, court and regulatory

approvals in respect of the transaction, the timing for the special

meeting of CI shareholders to consider the transaction, expected

participation in equity rollover arrangements, expectations

regarding remaining a reporting issuer under applicable Canadian

securities laws, the expected closing date for the transaction and

CI’s business prospects, debt ratings and securities outstanding

following closing of the transaction.

Undue reliance should not be placed on forward-looking

information. The forward-looking information in this press release

is based on our opinions, estimates and assumptions in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that we

currently believe are appropriate and reasonable in the

circumstances. Despite a careful process to prepare and review the

forward-looking information, there can be no assurance that the

underlying opinions, estimates and assumptions will prove to be

correct. Further, forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information, including but not limited to, those

described in this press release. The belief that the investment

fund industry and wealth management industry will remain stable and

that interest rates will remain relatively stable are material

factors made in preparing the forward-looking information and

management’s expectations contained in this press release and that

may cause actual results to differ materially from the

forward-looking information disclosed in this press release. In

addition, factors that could cause actual results to differ

materially from expectations include, among other things, the

possibility that the transaction will not be completed on the terms

and conditions, or on the timing, currently contemplated, and that

it may not be completed at all, due to a failure to obtain or

satisfy, in a timely manner or otherwise, required regulatory,

shareholder and court approvals and other conditions to the closing

of the transaction or for other reasons, the risk that competing

offers or acquisition proposals will be made, the negative impact

that the failure to complete the transaction for any reason could

have on the price of the shares or on the business of the

Corporation, general economic and market conditions, including

interest and foreign exchange rates, global financial markets, the

impact of pandemics or epidemics, changes in government regulations

or in tax laws, industry competition, technological developments

and other factors described or discussed in CI’s disclosure

materials filed with applicable securities regulatory authorities

from time to time. Additional information about the risks and

uncertainties of the Corporation’s business and material risk

factors or assumptions on which information contained in

forward‐looking information is based is provided in the

Corporation’s disclosure materials, including the Corporation’s

most recently filed annual information form and any

subsequently-filed interim management’s discussion and analysis,

which are available under our profile on SEDAR+ at

www.sedarplus.ca.

There can be no assurance that such information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward looking

information, which speaks only as of the date made. The

forward-looking information contained in this press release

represents our expectations as of the date of this news release and

is subject to change after such date. CI Financial disclaims any

intention or obligation or undertaking to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125704743/en/

CI Financial Investor Relations Jason Weyeneth,

CFA Vice-President, Investor Relations & Strategy 416-681-8779

jweyeneth@ci.com

Media Relations Canada Murray Oxby Vice-President,

Corporate Communications 416-681-3254 moxby@ci.com

United States Jimmy Moock Managing Partner, StreetCred

610-304-4570 jimmy@streetcredpr.com ci@streetcredpr.com

Mubadala Capital Boyd Erman Partner, FGS Longview

416-523-5885 boyd.erman@fgslongview.com

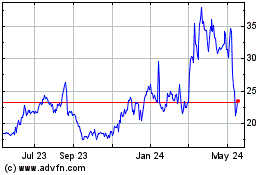

CompX (AMEX:CIX)

Historical Stock Chart

From Dec 2024 to Jan 2025

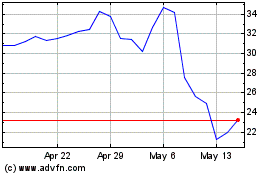

CompX (AMEX:CIX)

Historical Stock Chart

From Jan 2024 to Jan 2025