India ETFs Slump on Weak GDP Forecast - ETF News And Commentary

08 February 2013 - 10:21PM

Zacks

Only a few days back, India ETFs prospered when the RBI, or the

Reserve Bank of India, embarked on another rate cutting campaign,

slashing the rate in order to infuse liquidity in the economy. This

step was seen as a solid attempt to reinvigorate growth in an

economy that was seeing the slowest growth rate in a decade India

ETFs after Central Bank Rate Cut).

However, the GDP growth rate forecast for the economy paints a

different picture for the economy. The Indian government’s outlook

for the country could be a sign that the economy is just not on a

good growth track.

On Thursday, the Indian government made an announcement that the

economy will possibly register annual GDP growth of just 5% in the

fiscal year ending in March. The rate is much lower than the growth

of 6.2% recorded in the preceding fiscal year (India ETFs: Trouble

On The Horizon?).

This implies that the once booming economy that was accustomed

to record growth rates in the vicinity of 9% is on the verge of

delivering the slowest growth rate in a decade this fiscal

year.

The GDP growth rate forecast also comes in worse than India's

finance ministry’s previous projection. The ministry had perceived

that the economy would expand at the rate of 5.7–5.9% for the

current fiscal year. While the Reserve Bank of India anticipated

that the economy would grow at the rate 5.5% this fiscal year.

It should also be noted that India’s service sector output

accounts for 60% of India’s GDP. So this possibly adds to the

apprehension of the economy as the service sector output growth is

expected to fall to the level of 6.6% this fiscal year compared

with an 8.2% increase last year (Can India ETFs Continue Their

Solid Run?).

The disappointing growth forecast does not seem to end here as

manufacturing output for the economy is also expected to follow the

decelerating path. Manufacturing output growth is expected to turn

up at 1.9% as against 2.7% growth reported last year.

So with these sluggish numbers from the Congress-led coalition

government, India ETFs had no choice but to react negatively on the

growth expectation for the economy. All India equity based ETFs

tracking the economy tumbled following the news, including the

following funds:

One of the Zacks Top Ranked ETFs for the region,

WisdomTree India Earnings Fund (EPI), lost 1.46%

in the last trading session. EPI is by far the largest ETF in terms

of asset base and also the most liquid fund tracking Indian

equities (Zacks Top Ranked India ETF: EPI).

The fund offers a broader play in Indian equities as it holds a

portfolio of 196 securities and appears to be moderately

diversified in the top 10 stocks where it has invested 37.93% of

its assets.

Among individual holdings, Reliance Industries, Oil and Natural

Gas Corporation and Infosys form the top line of the fund and

together account for almost 21.7% of the allocation. The fund

charges an expense ratio of 83 basis points on an annual basis.

Another Zacks top ranked ETF, iShares S&P India

Nifty 50 ETF (INDY), suffered 1.29% on news. The product

has amassed a net asset base of $427.3 million. The fund’s asset

base is spread across 51 Indian securities which does little to

reduce company-specific risk as more than 55% of the asset base go

towards the top ten (Zacks Top Ranked India ETF in Focus:

INDY).

ITC Limited (8.83%), Reliance Industries Limited (7.68%) and

ICICI Bank Limited (7.12%) are the three top elements in the

basket.

Among sector allocations, banks take the first spot in the fund

and make up a substantial portion of the basket with a share of

20.9%. The ETF is extremely pricey with an expense ratio of 92

basis points a year.

Yet another ETF that dwindled on the tepid growth expectation of

the economy is PowerShares India Portfolio (PIN).

The fall in the PIN ETF price was comparatively less than the other

two ETFs discussed above. The fund closed the day after falling

0.83%.

The fund has built an asset base of $399.3 million since its

inception and provides exposure to 51 Indian securities. These 51

securities are mainly from energy, financials and information

technology sectors in which the fund assigns more than 60% of the

asset base in total (Does Your Portfolio Need An India ETF?).

Among individual holdings, Infosys (10.23%), Reliance Industries

(9.92%) and Oil & Natural Gas Corp (8.86%) occupy the top line

of the fund. The fund appears to be a bit reasonable than INDY,

charging a fee of 79 basis points from investors.

Indian Economy in 2013

Despite the gloomy projection, the Indian economy seems to be

poised for positive growth in 2013 as the government engages in

several reform measures to revitalize the economy (India ETFs:

Getting Back On Track?).

It seems that the effect of the measure will only be visible in

the second half of the year thereby leading the economy to end the

year on a better-than-expected note.

Notwithstanding the restrained economies of the other BRIC

nations, there are global factors at play that would likely boost

the Indian economy against all odds. Government actions in the form

of implementation of the goods and services tax in addition to

power sector improvement would be a catalyst for the Indian economy

this year.

If these end up having their desired impact, it could help India

to get out of its current slump and return to high growth rates

once again in the near future.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

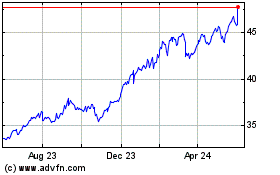

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

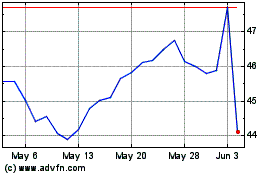

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Jan 2024 to Jan 2025