UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 - 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NEW GOLD INC. |

| |

|

|

| |

By: |

/s/ Sean Keating |

|

| Date: September 11, 2024 |

|

Sean Keating |

| |

|

Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

NEW GOLD EXPANDS OPEN PIT AND UNDERGROUND MINERALIZATION

AT RAINY RIVER, DEMONSTRATES STRONG SUPPORT FOR MINERAL RESOURCES GROWTH

TORONTO, Sept. 11, 2024 /CNW/ - New Gold Inc. ("New

Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) is pleased to provide an update on its ongoing Rainy River

exploration program. Over the first eight months of 2024, exploration drilling at Rainy River has proven successful in advancing the Company's

exploration objectives to expand existing resource envelopes, confirm the continuity of potential new mining zones, and grow the mineralized

footprint through new near-mine discoveries. These results are expected to have a positive impact on Rainy River's mineral resource estimate

at year-end 2024 and provide high-quality targets as the foundation of the Company's exploration strategy in the coming years.

"The strong exploration results support our

ongoing exploration strategy and confirm the upside potential remaining at Rainy River" stated Patrick Godin, President and CEO.

"This is our first major drilling campaign since 2017, and it is delivering positive results, confirming that the deposit remains

open at depth and along strike, highlighting the potential for additional underground reserves close to existing infrastructure, while

shallow drilling of near-surface targets demonstrates the potential for additional open pit reserves."

Underground Zones Extended Along Strike and at

Depth, New Gold Mineralization Intersected between Intrepid and Underground Main

Diamond drilling conducted from surface and from underground

confirmed the extension of gold mineralization along strike at Intrepid and down-plunge at the ODM East and 17-East zones of Underground

Main ("UG Main"). In addition, diamond drilling from the connection ramp between Intrepid and UG Main led to the intersection

of sulphide-bearing gold mineralization above current underground mining cut-off grade (1.74 g/t AuEq) and minimum mining width (2.4 metres)

at the Gap Area target.

Underground Highlights1

| • | Intrepid Strike-Extension drilling highlights: |

| • | 3.26 g/t gold and 7.22 g/t silver (3.32 AuEq) over 7.5 metres

core length (6 metres estimated true width) in Borehole RR24-2011 including: |

| • | 6.09 g/t gold and 9.60 g/t silver (6.17 AuEq) over 1.5 metres

core length (1 metre estimated true width) |

| • | 4.44 g/t gold and 38.05 g/t silver (4.78 AuEq) over 4.3 metres

core length (4 metres estimated true width) in Borehole RR24-2005 including: |

| • | 8.83 g/t gold and 46.90 g/t silver (9.24 AuEq) over 1.5 metres

core length (1 metre estimated true width) |

| • | ODM East down-plunge drilling highlights: |

| • | 2.59 g/t gold and 3.10 g/t silver (2.62 AuEq) over 13.50

metres core length (11 metres estimated true width) in Borehole RR24-2001 including: |

| • | 5.47 g/t gold and 5.13 g/t silver (5.52 AuEq) over 4.50

metres core length (4 metres estimated true width) |

| • | 17 East drilling highlights: |

| • | 4.09 g/t gold and 31.42 g/t silver (4.37 AuEq) over 7.6 metres

core length (6 metres estimated true width) in Borehole RR24-2003B including: |

| • | 8.19 g/t gold and 74.76 g/t silver (8.85 AuEq) over

2.20 metres core length (2 metres estimated true width) |

| • | New gold mineralization intersection at Gap Area Target: |

| • | 3.59 g/t gold over 4.50 metres core length (3 metres estimated

true width) in Borehole RRUG24-0007 including: |

| • | 7.65 g/t gold over 1.50 metres core length (1 metres

estimated true width) |

| 1All gold and silver grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

Continuity of Near-Surface Zones Confirmed, Supporting

the Potential for Additional Open Pit Mineral Resources

Completion of the reverse circulation ("RC")

drilling program confirmed the continuity of near-surface gold mineralization at NW-Trend and 280 Zone, including high-grade gold mineralization

intersections at NW-Trend, providing potential opportunities for additional open pit mining.

Open Pit Highlights1

| • | NW-Trend near-surface drilling highlights: |

| • | 4.15 g/t gold and 5.13 g/t silver (4.20 AuEq) over 18.0 metres

core length (17 metres estimated true width) in Borehole RC24-0020 including: |

| • | 8.47 g/t gold and 10.28 g/t silver (8.57 AuEq) over 8 metres

core length (8 metres estimated true width) |

| • | 2.34 g/t gold and 11.03 g/t silver (2.44 AuEq) over 12.0

metres core length (12 metres estimated true width) in Borehole RC24-0022 including: |

| • | 3.47 g/t gold 20.40 g/t silver (3.66 AuEq) over 6 metres

core length (6 metres estimated true width) |

| • | 280 Zone near-surface drilling highlights: |

| • | 1.20 g/t gold and 0.72 g/t silver (1.21 AuEq) over 32 metres

core length (21 metres estimated true width) in Borehole RC24-0050 including: |

| • | 3.35 g/t gold and 0.90 g/t silver (3.36 AuEq) over 6 metres

core length (4 metres estimated true width) |

| 1All gold and silver grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

Rainy River Exploration Budget Increased by Another

$3 Million to the End of 2024, to Follow Up on the Positive Results

Following the highly encouraging results to date,

the Company intends to allocate an additional $3 million to the 2024 Rainy River exploration program. Following early success in the first

quarter, the Rainy River 2024 exploration budget was increased from $5 million to $9 million, as previously reported. The total budget

for Rainy River exploration will be increased by an additional $3 million for a total of $12 million for 2024. The increased budget at

Rainy River is expected to provide an additional 13,000 metres of drilling by year-end, targeting high priority targets including UG Main

(ODM Main, ODM East, 17 East, and 114-Deep), Gap Area, and Intrepid (Figure 1).

"The exploration successes support the Company's

approach at optimizing net asset value with modest investment, leveraging existing infrastructure," added Mr. Godin. "Over the

past two years, our focus at New Gold has been on operational excellence, project execution, and financial discipline. Both operations

are now consistently delivering while we continue to execute on the above priorities, 2024 marks a renewed focus on adding value through

exploration and these results are a strong step in the right direction."

Rainy River Exploration Drilling Results

This year marks the first major exploration campaign

carried out at Rainy River since mine opening in 2017. As such, several promising targets remain untested. The Rainy River 2024 exploration

program is divided into three main components of equal priority:

| 1. | Test the potential extension of underground ore zones at depth and along strike. |

| 2. | Explore the previously undrilled gap between Intrepid and UG Main. |

| 3. | Follow up on previously drilled near-surface priority targets surrounding the existing Rainy River open pit. |

On the first exploration component, diamond drilling

conducted from surface and from underground confirmed the extension of gold mineralization along strike at Intrepid and down-plunge at

the ODM East and 17 East zones at UG Main. At Intrepid, new drill intersections locally extend the mineralized envelope by approximately

100 metres towards the east, which has the potential to add underground reserves and increase the gold ounces per level. At UG Main, five

boreholes intersected gold mineralization at a depth of up to 850 metres below surface, extending the resource envelopes down-plunge and

confirming continuity of existing ore zones. All zones remain open at depth. The new diamond drilling results are expected to have a positive

impact on underground resources at year-end.

Additionally, diamond drilling conducted from the

underground ramp between Intrepid and UG Main intersected new gold mineralization. UG Main and Intrepid deposits are interpreted to occur

along the same stratigraphic units. However, the 1,000-metre strike length between the two deposits remained mostly undrilled prior to

this year. Borehole RRUG24-0007 intersected gold-bearing sulphide mineralization grading 3.59 g/t gold over 4.50 metres core length (3

metre estimated true width), above current underground cut-off grade and minimum mining width (Figure 3). Additional underground drilling

will focus on exploring the extents of this new mineralized area. All new notable diamond drilling intercepts from Intrepid, ODM East,

17 East, and Gap Area exploration programs are summarized in Tables 1 and 3, and Figure 1 below.

The third exploration component is to define near-surface

mineral resources with the potential to be mined by open pit methods. On review of historical exploration data and following the successful

addition of Phase 5 open pit mineral reserves at year-end 2023, high-quality targets were identified, of which the NW-Trend, or Western

Zone, and 280 Zone were prioritized for RC drilling in 2024. The recently completed RC drilling program proved successful in demonstrating

the near-surface continuity of the targeted gold-mineralized zones. High-grade gold intersections at NW-Trend confirms the continuity

of high-grade gold zones intersected in historical diamond boreholes. At 280 Zone, several gold-mineralized intersections over 10 metres

wide within the first 100 metres below surface confirmed the up-dip continuity of deeper gold zones intersected in historical diamond

boreholes. While the economic viability of these targets is currently under evaluation, further extension of open pit mining has the potential

to defer reclaim of the low-grade stockpile and improve the long-term gold production profile. All notable results from the RC drilling

campaign are summarized in Tables 2 and 4, and Figure 2 below.

Table 1: Notable Exploration Drilling Results

at Rainy River Underground1, 2

| Zone |

Drill Hole |

|

From (m) |

To (m) |

Interval (m) |

Estimated

True Width

(m) |

Au (g/t) |

Ag (g/t) |

AuEq |

| Intrepid |

RR24-2005 |

|

512.9 |

517.2 |

4.3 |

4 |

4.44 |

38.05 |

4.78 |

| Including |

515.7 |

517.2 |

1.5 |

1 |

8.83 |

46.90 |

9.24 |

| RR24-2007 |

|

518.1 |

521.1 |

3.0 |

3 |

1.95 |

17.85 |

2.11 |

| Including |

520.6 |

521.1 |

0.5 |

0.5 |

7.22 |

72.60 |

7.86 |

| RR24-2008 |

|

530.0 |

533.0 |

3.0 |

2 |

2.15 |

6.35 |

2.21 |

| |

546.5 |

551.0 |

4.5 |

4 |

2.81 |

7.50 |

2.88 |

| RR24-2010 |

|

519.5 |

524.5 |

5.0 |

4 |

1.88 |

13.49 |

2.00 |

| RR24-2011 |

|

548.0 |

555.5 |

7.5 |

6 |

3.26 |

7.22 |

3.32 |

| Including |

548.0 |

549.5 |

1.5 |

1 |

6.09 |

9.60 |

6.17 |

| RR24-2012 |

|

536.0 |

539.0 |

3.0 |

2 |

2.29 |

10.95 |

2.39 |

| RR24-2013 |

|

566.0 |

570.5 |

4.5 |

4 |

2.96 |

56.50 |

3.46 |

| RRUI24-029 |

|

72 |

79 |

6.5 |

4 |

1.92 |

13.99 |

2.04 |

| RRUI24-031 |

|

100 |

105 |

4.5 |

3 |

2.32 |

92.43 |

3.14 |

| RRUI24-032 |

|

99 |

111 |

12.0 |

6 |

2.17 |

16.22 |

2.31 |

| ODM East |

RR24-2001 |

|

809.0 |

822.5 |

13.5 |

11 |

2.59 |

3.10 |

2.62 |

| Including |

815.0 |

819.5 |

4.5 |

4 |

5.47 |

5.13 |

5.52 |

| RR24-2001 |

|

827.0 |

831.5 |

4.5 |

4 |

1.84 |

2.33 |

1.86 |

| 17 East |

RR24-2003B |

|

914.0 |

921.6 |

7.6 |

6 |

4.09 |

31.42 |

4.37 |

| Including |

914.0 |

916.2 |

2.2 |

2 |

8.19 |

74.76 |

8.85 |

| RR24-2009-W1 |

|

807.0 |

819.0 |

12.0 |

11 |

1.94 |

21.55 |

2.13 |

| RR24-2009-W2B |

|

803.0 |

807.5 |

4.5 |

4 |

1.92 |

8.00 |

1.99 |

| RR24-2014-W2 |

|

846.5 |

849.5 |

3.0 |

2 |

4.34 |

2.95 |

4.37 |

| Including |

846.5 |

848.0 |

1.5 |

1 |

6.07 |

4.20 |

6.11 |

| Gap |

RRUG24-0007 |

|

126.0 |

130.5 |

4.5 |

3 |

3.59 |

NA |

NA |

| Including |

127.5 |

129.0 |

1.5 |

1 |

7.65 |

NA |

NA |

| 1Notable drilling intervals are defined by 3-metre-long composites with average grade above 1.75 g/t gold. Rainy River underground Mineral Reserves cut-off grade is 1.74 g/t AuEq, minimum mining width is 2.4 metres. |

| 2Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

Figure 1: Notable Drill Intercepts at Rainy River

Underground (CNW Group/New Gold Inc.)

Table 2: Notable Near-Surface RC Drilling Results

at Rainy River1,2

| Zone |

Drill Hole |

|

From (m) |

To (m) |

Interval (m) |

Estimated

True Width

(m) |

Au (g/t) |

Ag (g/t) |

AuEq |

| NW Trend |

RC24-0020 |

|

93.0 |

111.0 |

18.0 |

17 |

4.15 |

5.13 |

4.20 |

| Including |

101.0 |

109.0 |

8.0 |

8 |

8.47 |

10.28 |

8.57 |

| RC24-0022 |

|

89.0 |

101.0 |

12.0 |

12 |

2.34 |

11.03 |

2.44 |

| Including |

93.0 |

99.0 |

6.0 |

6 |

3.47 |

20.40 |

3.66 |

| RC24-0025 |

|

75.0 |

87.0 |

12.0 |

11 |

1.12 |

1.42 |

1.13 |

| RC24-0030 |

|

53.0 |

69.0 |

16.0 |

15 |

0.63 |

1.05 |

0.64 |

| |

99.0 |

111.0 |

12.0 |

11 |

1.26 |

7.45 |

1.33 |

| RC24-0033 |

|

117.0 |

129.0 |

12.0 |

9 |

0.46 |

10.80 |

0.56 |

| RC24-0035 |

|

61.0 |

81.0 |

20.0 |

19 |

0.67 |

0.38 |

0.67 |

| RC24-0036 |

|

115.0 |

129.0 |

14.0 |

14 |

1.50 |

0.59 |

1.51 |

| RC24-0037 |

|

133.0 |

145.0 |

12.0 |

12 |

0.46 |

0.35 |

0.46 |

| RC24-0038 |

|

51.0 |

69.0 |

18.0 |

16 |

0.57 |

0.39 |

0.57 |

| RC24-0040 |

|

71.0 |

95.0 |

24.0 |

22 |

0.41 |

0.50 |

0.41 |

| |

153.0 |

165.0 |

12.0 |

11 |

0.80 |

1.30 |

0.81 |

| Zone 280 |

RC24-0045 |

|

115.0 |

127.0 |

12.0 |

8 |

0.76 |

0.75 |

0.77 |

| RC24-0047 |

|

89.0 |

101.0 |

12.0 |

7 |

0.73 |

0.53 |

0.73 |

| RC24-0048 |

|

65.0 |

77.0 |

12.0 |

8 |

0.52 |

1.92 |

0.54 |

| RC24-0050 |

|

73.0 |

105.0 |

32.0 |

21 |

1.20 |

0.72 |

1.21 |

| Including |

99.0 |

105.0 |

6.0 |

4 |

3.35 |

0.90 |

3.36 |

| RC24-0001 |

|

43.0 |

65.0 |

22.0 |

16 |

0.86 |

1.07 |

0.87 |

| RC24-0002 |

|

73.0 |

89.0 |

16.0 |

11 |

0.42 |

0.38 |

0.42 |

| RC24-0006 |

|

55.0 |

69.0 |

14.0 |

7 |

0.64 |

1.86 |

0.66 |

| RC24-0007 |

|

95.0 |

117.0 |

22.0 |

11 |

0.53 |

0.73 |

0.54 |

| RC24-0008 |

|

111.0 |

145.0 |

34.0 |

25 |

0.55 |

0.74 |

0.56 |

| RC24-0009 |

|

97.0 |

113.0 |

16.0 |

13 |

0.66 |

0.68 |

0.67 |

| RC24-0012 |

|

91.0 |

103.0 |

12.0 |

9 |

1.07 |

1.90 |

1.09 |

| 1Notable drilling intervals are defined by 10-metre-long composites with average grade above 0.3 g/t gold. Rainy River Open Pit Mineral Reserves cut-off grade is 0.3 g/t AuEq. |

| 2Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

Figure 2: Notable RC Drilling Intercepts at 280 Zone

and NW-Trend (CNW Group/New Gold Inc.)

Table 3: All New Exploration Diamond Drilling Location

and Orientation at Rainy River

| Drill Hole |

Azimuth |

Dip |

Length (m) |

UTM Easting (m) |

UTM Northing (m) |

Elevation (m) |

| RR24-2001 |

5 |

-74 |

935 |

425,566 |

5,408,959 |

348 |

| RR24-2002 |

7 |

-71 |

938 |

425,996 |

5,408,891 |

348 |

| RR24-2003B |

350 |

-77 |

949 |

425,996 |

5,408,891 |

348 |

| RR24-2004B |

0 |

-73 |

641 |

425,053 |

5,408,840 |

347 |

| RR24-2005 |

3 |

-71 |

587 |

427,251 |

5,409,427 |

376 |

| RR24-2006 |

28 |

-65 |

950 |

425,996 |

5,408,890 |

348 |

| RR24-2007 |

19 |

-64 |

574 |

427,251 |

5,409,427 |

376 |

| RR24-2008 |

358 |

-75 |

590 |

427,251 |

5,409,427 |

375 |

| RR24-2009 |

20 |

-57 |

909 |

425,996 |

5,408,890 |

348 |

| RR24-2009-W1 |

20 |

-57 |

930 |

425,996 |

5,408,890 |

348 |

| RR24-2009-W2 |

20 |

-57 |

500 |

425,996 |

5,408,890 |

348 |

| RR24-2009-W2B |

20 |

-57 |

926 |

425,996 |

5,408,890 |

348 |

| RR24-2010 |

14 |

-70 |

575 |

427,251 |

5,409,426 |

376 |

| RR24-2011 |

11 |

-72 |

626 |

427,251 |

5,409,426 |

376 |

| RR24-2012 |

18 |

-71 |

643 |

427,251 |

5,409,427 |

376 |

| RR24-2013 |

13 |

-76 |

669 |

427,251 |

5,409,427 |

376 |

| RR24-2014C |

349 |

-73 |

482 |

425,996 |

5,408,892 |

348 |

| RR24-2014-W1 |

349 |

-73 |

480 |

425,996 |

5,408,892 |

348 |

| RR24-2014-W2 |

349 |

-73 |

971 |

425,996 |

5,408,892 |

348 |

| RR24-2015 |

358 |

-77 |

689 |

427,250 |

5,409,426 |

375 |

| RR24-2016 |

19 |

-68 |

614 |

427,252 |

5,409,426 |

376 |

| RRUG24-0001 |

180 |

-5 |

400 |

426,763 |

5,409,579 |

-6 |

| RRUG24-0002 |

180 |

-43 |

180 |

426,763 |

5,409,579 |

-8 |

| RRUG24-0003 |

164 |

+73 |

231 |

426,852 |

5,409,669 |

8 |

| RRUG24-0004 |

189 |

+38 |

176 |

426,850 |

5,409,668 |

7 |

| RRUG24-0005 |

152 |

-12 |

195 |

426,963 |

5,409,723 |

23 |

| RRUG24-0006 |

176 |

-27 |

251 |

426,962 |

5,409,723 |

22 |

| RRUG24-0007 |

164 |

-24 |

195 |

426,851 |

5,409,668 |

5 |

| RRUG24-0008 |

144 |

+10 |

176 |

426,852 |

5,409,668 |

6 |

| RRUG24-0009 |

236 |

+70 |

146 |

426,764 |

5,409,580 |

-3 |

| RRUG24-0011 |

136 |

+25 |

176 |

426,964 |

5,409,723 |

24 |

| RRUI24-029 |

119 |

-6 |

105 |

427,300 |

5,409,766 |

28 |

| RRUI24-030 |

127 |

+16 |

131 |

427,300 |

5,409,766 |

28 |

| RRUI24-031 |

127 |

+9 |

116 |

427,299 |

5,409,766 |

28 |

| RRUI24-032 |

139 |

+19 |

111 |

427,299 |

5,409,765 |

28 |

Table 4: Drilling Location and Orientation of Rainy

River RC Drilling

| Drill Hole |

Azimuth |

Dip |

Length (m) |

UTM Easting (m) |

UTM Northing (m) |

Elevation (m) |

| RC24-0001 |

15 |

-61 |

111 |

426,601 |

5,410,086 |

378 |

| RC24-0002 |

20 |

-59 |

131 |

426,618 |

5,410,084 |

378 |

| RC24-0003 |

10 |

-62 |

121 |

426,574 |

5,410,067 |

378 |

| RC24-0004 |

10 |

-60 |

135 |

426,601 |

5,410,059 |

378 |

| RC24-0005 |

29 |

-63 |

161 |

426,614 |

5,410,058 |

378 |

| RC24-0006 |

56 |

-49 |

151 |

426,619 |

5,410,087 |

378 |

| RC24-0007 |

56 |

-51 |

171 |

426,613 |

5,410,060 |

378 |

| RC24-0008 |

10 |

-61 |

171 |

426,602 |

5,410,027 |

378 |

| RC24-0009 |

348 |

-63 |

161 |

426,594 |

5,410,026 |

378 |

| RC24-0010 |

335 |

-61 |

101 |

426,574 |

5,410,076 |

378 |

| RC24-0011 |

335 |

-68 |

121 |

426,577 |

5,410,060 |

378 |

| RC24-0012 |

320 |

-61 |

151 |

426,603 |

5,410,018 |

378 |

| RC24-0013 |

335 |

-53 |

151 |

426,289 |

5,409,569 |

363 |

| RC24-0014 |

345 |

-60 |

151 |

426,289 |

5,409,568 |

363 |

| RC24-0015 |

16 |

-60 |

131 |

426,290 |

5,409,566 |

363 |

| RC24-0016 |

16 |

-49 |

131 |

426,290 |

5,409,567 |

363 |

| RC24-0017 |

30 |

-53 |

151 |

426,291 |

5,409,566 |

363 |

| RC24-0018 |

318 |

-64 |

181 |

426,290 |

5,409,567 |

363 |

| RC24-0019 |

36 |

-70 |

171 |

426,292 |

5,409,567 |

363 |

| RC24-0020 |

73 |

-70 |

115 |

424,217 |

5,410,127 |

366 |

| RC24-0022 |

70 |

-69 |

101 |

424,236 |

5,410,146 |

366 |

| RC24-0023 |

62 |

-72 |

171 |

424,186 |

5,410,156 |

366 |

| RC24-0024 |

70 |

-65 |

141 |

424,191 |

5,410,166 |

366 |

| RC24-0025 |

64 |

-49 |

101 |

424,216 |

5,410,183 |

366 |

| RC24-0026 |

75 |

-61 |

121 |

424,205 |

5,410,188 |

366 |

| RC24-0027 |

75 |

-72 |

111 |

424,186 |

5,410,186 |

366 |

| RC24-0028 |

55 |

-70 |

141 |

424,188 |

5,410,191 |

366 |

| RC24-0029 |

70 |

-49 |

101 |

424,193 |

5,410,207 |

366 |

| RC24-0030 |

70 |

-58 |

111 |

424,191 |

5,410,200 |

366 |

| RC24-0031 |

57 |

-64 |

122 |

424,193 |

5,410,206 |

366 |

| RC24-0032 |

46 |

-47 |

125 |

424,192 |

5,410,207 |

366 |

| RC24-0033 |

37 |

-58 |

131 |

424,194 |

5,410,204 |

366 |

| RC24-0035 |

40 |

-56 |

115 |

424,328 |

5,409,952 |

357 |

| RC24-0036 |

35 |

-74 |

171 |

424,314 |

5,409,922 |

357 |

| RC24-0037 |

40 |

-68 |

171 |

424,310 |

5,409,879 |

357 |

| RC24-0038 |

50 |

-64 |

101 |

424,365 |

5,409,937 |

358 |

| RC24-0039 |

48 |

-56 |

131 |

424,282 |

5,409,972 |

356 |

| RC24-0040 |

70 |

-55 |

191 |

424,305 |

5,409,862 |

357 |

| RC24-0041 |

35 |

-50 |

135 |

424,372 |

5,409,775 |

350 |

| RC24-0044 |

330 |

-62 |

125 |

426,583 |

5,410,032 |

378 |

| RC24-0045 |

306 |

-62 |

155 |

426,597 |

5,410,014 |

378 |

| RC24-0046 |

316 |

-49 |

109 |

426,582 |

5,410,041 |

378 |

| RC24-0047 |

358 |

-64 |

105 |

426,593 |

5,410,051 |

378 |

| RC24-0048 |

14 |

-74 |

151 |

426,600 |

5,410,030 |

378 |

| RC24-0049 |

28 |

-61 |

141 |

426,602 |

5,410,031 |

378 |

| RC24-0050 |

5 |

-73 |

105 |

426,612 |

5,410,063 |

378 |

| RC24-0051 |

318 |

-55 |

165 |

426,287 |

5,409,568 |

363 |

| RC24-0052 |

28 |

-72 |

185 |

426,292 |

5,409,567 |

363 |

About New Gold

New Gold is a Canadian-focused intermediate mining

company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold mine. The Company

also holds other Canadian-focused investments. New Gold's vision is to build a leading diversified intermediate gold company based in

Canada that is committed to the environment and social responsibility. For further information on the Company, visit www.newgold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release,

including any information relating to New Gold's future financial or operating performance are "forward-looking". All statements

in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New Gold

expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical facts and

are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is

expected", "budget", "scheduled", "targeted", "estimates", "forecasts", "intends",

"anticipates", "projects", "potential", "believes" or variations of such words and phrases or

statements that certain actions, events or results "may", "could", "would", "should", "might"

or "will be taken", "occur" or "be achieved" or the negative connotation of such terms. Forward-looking

statements in this news release include, among others, statements with respect to: expectations regarding exploration results having a

positive impact on the mineral resource estimate at year-end, successfully providing high-quality targets for the coming years and confirming

the upside potential remaining at the Rainy River operations; successfully finding additional underground reserves close to existing infrastructure,

increased gold ounces per level and additional open pit reserves at Rainy River; the potential for finding and taking advantage of additional

open pit and underground mining opportunities at Rainy River; intentions to allocate additional funds to the 2024 Rainy River exploration

program and expected use of and benefit of funds; anticipated future success of the Company, including adding value through exploration

and successfully generating sustained free cash flow moving forward; anticipated focus areas and priorities for the Company's exploration

program and planned exploration activities; successfully accessing a newly discovered mineralized zone from existing underground development

at Rainy River; successfully extending open pit mining, deferring reclaim of the low-grade stockpile and improving the long-term gold

production profile at Rainy River; and successfully advancing the Company's strategic opportunities for mine life extension.

All forward-looking statements in this news release

are based on the opinions and estimates of management that, while considered reasonable as at the date of this press release in light

of management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors

and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this news release, New Gold's latest annual MD&A, its most recent annual information form and technical

reports on the Rainy River Mine and New Afton Mine filed on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. In addition to, and

subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this news release are also subject

to the following assumptions: (1) there being no significant disruptions affecting New Gold's operations, including material disruptions

to the Company's supply chain, workforce or otherwise; (2) political and legal developments in jurisdictions where New Gold operates,

or may in the future operate, being consistent with New Gold's current expectations; (3) the accuracy of New Gold's current Mineral Reserve

and Mineral Resource estimates and the grade of gold, silver and copper expected to be mined and the grade of gold, copper and silver

expected to be mined; (4) the exchange rate between the Canadian dollar and U.S. dollar, and commodity prices being approximately consistent

with current levels and expectations for the purposes of 2024 guidance and otherwise; (5) prices for diesel, natural gas, fuel oil, electricity

and other key supplies being approximately consistent with current levels; (6) equipment, labour and materials costs increasing on a basis

consistent with New Gold's current expectations; (7) arrangements with First Nations and other Indigenous groups in respect of the Rainy

River Mine being consistent with New Gold's current expectations; (8) all required permits, licenses and authorizations being obtained

from the relevant governments and other relevant stakeholders within the expected timelines and the absence of material negative comments

or obstacles during any applicable regulatory processes; and (9) the results of the life of mine plan for the Rainy River Mine described

herein being realized.

Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual

results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities;

discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves

and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents;

risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes

to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and

maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each

jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining

and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; changes in project parameters

as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being

able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility

in the market price of the Company's securities; changes in national and local government legislation in the countries in which New Gold

does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political

or economic developments in the countries in which New Gold does or may in the future carry on business; the Company's dependence on the

Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline

or at all; inadequate water management and stewardship; tailings storage facilities and structure failures; failing to complete stabilization

projects according to plan; geotechnical instability and conditions; disruptions to the Company's workforce at either the Rainy River

Mine or the New Afton Mine, or both; significant capital requirements and the availability and management of capital resources; additional

funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration

or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine

and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other

Indigenous groups; climate change, environmental risks and hazards and the Company's response thereto; ability to obtain and maintain

sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets

and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; global economic and financial

conditions and any global or local natural events that may impede the economy or New Gold's ability to carry on business in the normal

course; inflation; compliance with debt obligations and maintaining sufficient liquidity; the responses of the relevant governments to

any disease, epidemic or pandemic outbreak not being sufficient to contain the impact of such outbreak; disruptions to the Company's supply

chain and workforce due to any disease, epidemic or pandemic outbreak; an economic recession or downturn as a result of any disease, epidemic

or pandemic outbreak that materially adversely affects the Company's operations or liquidity position; taxation; fluctuation in treatment

and refining charges; transportation and processing of unrefined products; rising costs or availability of labour, supplies, fuel and

equipment; adequate infrastructure; relationships with communities, governments and other stakeholders; labour disputes; effectiveness

of supply chain due diligence; the uncertainties inherent in current and future legal challenges to which New Gold is or may become a

party; defective title to mineral claims or property or contests over claims to mineral properties; competition; loss of, or inability

to attract, key employees; use of derivative products and hedging transactions; reliance on third-party contractors; counterparty risk

and the performance of third party service providers; investment risks and uncertainty relating to the value of equity investments in

public companies held by the Company from time to time; the adequacy of internal and disclosure controls; conflicts of interest; the lack

of certainty with respect to foreign operations and legal systems, which may not be immune from the influence of political pressure, corruption

or other factors that are inconsistent with the rule of law; the successful acquisitions and integration of business arrangements and

realizing the intended benefits therefrom; and information systems security threats. In addition, there are risks and hazards associated

with the business of mineral exploration, development, construction, operation and mining, including environmental events and hazards,

industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate

insurance or inability to obtain insurance to cover these risks) as well as "Risk Factors" included in New Gold's Annual Information

Form and other disclosure documents filed on and available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Forward-looking

statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated

in such statements. All of the forward-looking statements contained in this news release are qualified by these cautionary statements.

New Gold expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new

information, events or otherwise, except in accordance with applicable securities laws.

QA/QC Procedure

New Gold maintains a Quality Assurance / Quality Control

("QA/QC") program at its Rainy River Mine operation using industry best practices and is consistent with the QA/QC protocols

in use at all of the Company's exploration and development projects. Key elements of New Gold's QA/QC program include chain of custody

of samples, regular insertion of certified reference standards and blanks, and duplicate check assays. Drill core is sampled at lengths

varying from 0.5 to 1.5 m, halved and shipped in sealed bags to Activation Laboratories Ltd. in Thunder Bay, Ontario. Reverse Circulation

("RC") drill rock chips are sampled at the drill at regular two metre intervals and shipped in sealed bags to Activation Laboratories

Ltd. in Thunder Bay, Ontario. Additional information regarding the Company's data verification and quality assurance processes is set

out in the March 28, 2022 Rainy River National Instrument 43-101 Technical Report titled "NI 43-101 Technical Report for the

Rainy River Mine, Ontario, Canada" available on SEDAR+ at www.sedarplus.ca.

Technical Information

The scientific and technical information relating

to the exploration results at Rainy River has been reviewed and approved by Dr. Jean-François Ravenelle, Vice President, Geology

for the Company. Dr. Ravenelle is a Professional Geologist and a member of the Association of Professional Geoscientists of Ontario and

the Ordre des Géologues du Québec. Dr. Ravenelle is a "Qualified Person" for the purposes of National Instrument

43-101 - Standards of Disclosure for Mineral Projects.

For additional technical information on New Gold's

material properties, including a detailed breakdown of Mineral Reserves and Mineral Resources by category, as well as key assumptions,

parameters, and risks, refer to New Gold's Annual Information Form for the year ended December 31, 2023 dated February 21, 2024 filed

and available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-gold-expands-open-pit-and-underground-mineralization-at-rainy-river-demonstrates-strong-support-for-mineral-resources-growth-302244446.html

SOURCE New Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/11/c1798.html

%CIK: 0000800166

For further information: For further information, please contact:

Ankit Shah, Executive Vice President, Strategy & Business Development, Director, Investor Relations, Direct: +1 (416) 324-6027, Email:

ankit.shah@newgold.com; Brandon Throop, Direct: +1 (647) 264-5027, Email: brandon.throop@newgold.com

CO: New Gold Inc.

CNW 06:30e 11-SEP-24

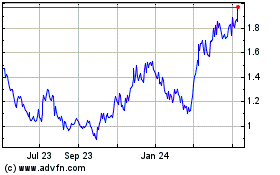

New Gold (AMEX:NGD)

Historical Stock Chart

From Nov 2024 to Dec 2024

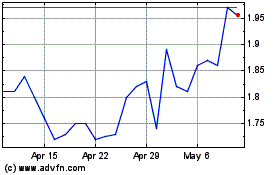

New Gold (AMEX:NGD)

Historical Stock Chart

From Dec 2023 to Dec 2024