Mutual Fund Summary Prospectus (497k)

24 December 2020 - 8:49AM

Edgar (US Regulatory)

Filed pursuant to 497(k)

File Nos. 811-22310; 333-182274

Supplement to the

Summary Prospectus dated January 31, 2020 as previously supplemented, of the

Wedbush ETFMG Global Cloud Technology ETF (IVES)

December 23, 2020

The fourth paragraph of the section of the Prospectus titled “SUMMARY – Principal Investment Strategies – Dan Ives Global Cloud Technology Prime Index” is hereby deleted.

The following is added after the fifth paragraph of the section of the Prospectus titled “SUMMARY – Principal Investment Strategies – Dan Ives Global Cloud Technology Prime Index”:

At the time of each reconstitution, the value of Index components with headquarters in any single country (including the United States) will not comprise more than 50% of the value of the Index. The Index is expected to be composed of securities of issuers with headquarters in at least three countries (including the United States).

The following is added to the section of the Prospectus titled “SUMMARY – Principal Risks.”

Risks of Investing in China and Hong Kong: Investments in the securities of Chinese issuers that trade on an exchange in Hong Kong subject the Fund to risks specific to China and Hong Kong. China and Hong Kong may be subject to considerable degrees of economic, political and social instability. China and Hong Kong are developing markets and demonstrate significantly higher volatility from time to time in comparison to developed markets. Over the past 25 years, the Chinese government has undertaken reform of economic and market practices and is expanding the sphere of private ownership of property in China. However, Chinese markets generally continue to experience inefficiency, volatility and pricing anomalies resulting from governmental influence, a lack of publicly available information and/or political and social instability. Internal social unrest or confrontations with other neighboring countries, including military conflicts in response to such events, may also disrupt economic development in China and result in a greater risk of currency fluctuations, currency convertibility, interest rate fluctuations and higher rates of inflation. Export growth continues to be a major driver of China’s rapid economic growth. Reduction in spending on Chinese products and services, institution of tariffs or other trade barriers, or a downturn in any of the economies of China’s key trading partners may have an adverse impact on the Chinese economy. Further, any attempt by China to tighten its control over Hong Kong’s political, economic, legal or social policies may result in an adverse effect on Hong Kong’s markets.

Please retain this Supplement with your Summary Prospectus for future reference.

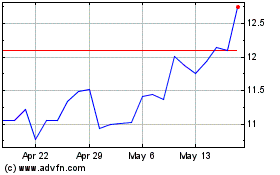

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

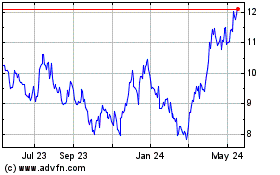

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Jul 2023 to Jul 2024