Has the Euro ETF Bottomed Out? - ETF News And Commentary

27 March 2013 - 12:45AM

Zacks

The recent drama arising out of Cyprus was an ugly reminder to

the world that the euro zone worries are not over by any means.

However, it virtually proved to be a non-event in the domestic

U.S. market with no major consequences in the capital markets.

Still, the issue had certainly weighed on the common European

currency after the euro started the year on a positive note. The

Currency Shares Euro ETF (FXE) which tracks the

performance of euro versus U.S. Dollars (USD), had a good first

month gaining around 3%. However, since then, certain issues within

the euro zone had caused the euro to slide versus the USD (read Is

the Dollar ETF About to Surge?).

The political scenario in Spain and the election outcome in

Italy had caused huge sell offs in European equities (read Italy

ETF Plunges on Election Chaos). This coupled with the Cyprus

bailout uncertainty had caused massive downward pressure on the

euro. Also, despite some sort of clarity on the Cyprus front as

well as the situation in Italy and Spain being comparatively

stable, the euro continues to slide.

Beyond these short-term issues, it can be argued that the slump

for the Euro for these region specific factors might be over. This

is especially true considering that the European Central Bank (ECB)

and its measures have for long been successful in restoring some

sort of stability in the region after quite a disastrous 2011.

In fact, a technical look at the Euro ETF FXE, suggests that the

ETF is on the verge of bottoming out. As we can see from the above

chart, the ETF has witnessed a fair amount of consolidation near

its 200 DMA line (blue). This crucial level was breached marginally

on yesterday’s (Monday) trading session when the ETF slumped a tad

more than 1% to close at $127.46.

Still, this should not be mistaken for signs of a further slump,

at least not yet. In fact, the past few days were pretty eventful

considering the Cyprus situation and a decent level of volatility

was expected on the ETF (see Is It Time for the Spain ETF?).

Given this, it is very important to have an unbiased view on the

movement of the ETF going forward which is independent of any major

catalyst. This is the reason why the next few trading sessions will

prove to be vital for the ETF, at least in this holiday shortened

week.

On an analytical front, a more concrete assertion arises out of

the fact that FXE has an extremely strong support in the 200 DMA

line which has developed in a strong consolidation point for FXE.

Also, it will be interesting to see if Monday’s breakout of this

support carries it further down. The odds of a further slide and a

consolidation are quite evenly poised at the moment (read Bet on

the Euro with These 3 ETFs).

A look at the RSI chart reveals that the sell off in the ETF has

been extremely vicious since its February 2013 highs. The RSI shows

that the ETF has been on and near the oversold territory for quite

some time now and an up-move is long overdue.

Also, the Bollinger Bands have been seen contracting of late

suggesting relatively lesser variation than before. However, the

strong selling pressure on the ETF is surely a matter of

concern.

Bottom Line

Investors having long positions in the ETF should not liquidate

the positions just yet. The next few trading sessions will pave the

way for the future course for the ETF at least for the near

term.

In this regard, the 200 DMA line should be closely monitored. A

gradual dip below this line would indicate weakness (see more in

the Zacks ETF Rank Guide).

However, for investors seeking to initiate long positions in

FXE, current levels provide good entry points as most of the recent

negative news arising out of Cyprus, Italy and Spain seems to be

factored in the current level. The ETF also has a Zacks ETF Rank of

2 or ‘buy’ so we are relatively optimistic on the medium term for

this fund, suggesting this could be an interesting time to dive

into this currency product.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

CRYSHS-EURO TR (FXE): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

Invesco DB US Dollar Ind... (AMEX:UUP)

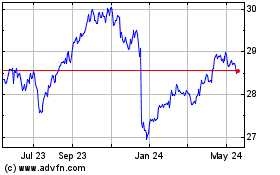

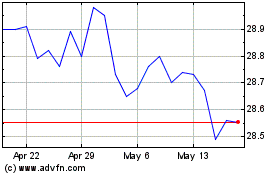

Historical Stock Chart

From Jun 2024 to Jul 2024

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Jul 2023 to Jul 2024