Vanguard Slashes Fees for 5 ETFs Including VWO - ETF News And Commentary

08 March 2014 - 2:00AM

Zacks

Thanks to the growing competition in the ETF business in recent

years, there has been a race to the bottom with regard to costs in

order to gain market share. While many issuers have joined

this bandwagon, the low cost corner of the market is dominated by

Charles Schwab and Vanguard.

Initially, Vanguard was the ruler of low cost products. But, lately

Schwab seems to have surpassed Vanguard by cutting its fees to rock

bottom levels. Probably, in a bid to regain its lost ground,

Vanguard also resorted to a price cut strategy lately.

Recently, this mega ETF issuer announced that expense ratios have

fallen for five of its international stock ETFs, including

FTSE Emerging Markets (VWO) – the most popular

emerging market ETF. This is not the first time that Vanguard

slashed its already low expense ratio to a new level. In December

2012, the issuer reduced fees on almost two dozen ETFs (read:

Vanguard Ends 2012 with a Bang, Cuts Fees on 22 ETFs).

The following are the ETFs that saw a cut in fees:

| ETF |

Symbol |

AUM |

Old Expense Ratio |

New Expense Ratio |

How Cheaper? |

| FTSE All-World ex-US Small-Cap |

VSS |

$1.81 billion |

0.25% |

0.20% |

87% lower than the average fees charged by

peers with similar holdings. |

| FTSE Emerging Markets |

VWO |

$41.1 billion |

0.18% |

0.15% |

91% lower than the average fees charged by

peers with similar holdings. |

| Global ex-U.S. Real Estate |

VNQI |

$1.26 billion |

0.32% |

0.27% |

80% lower than the average fees charged by

peers with similar holdings. |

| Total International Stock |

VXUS |

$2.54 billion |

0.16% |

0.14% |

89% lower than the average fees charged by

peers with similar holdings. |

| Total World Stock |

VT |

$3.29 billion |

0.19% |

0.18% |

87% lower than the average fees charged by

peers with similar holdings. |

VWO's Fee Cut in Detail

Among the set of five funds, the most-talked about is VWO. It is

the largest emerging market ETF followed by

iShares MSCI

Emerging Markets Index Fund (EEM) that charges 67 bps in

fees. Such a huge expense ratio differential is deemed to be the

reason behind iShares EEM’s failure to keep the top spot in the

space.

So far, VWO used to face tough competition, on the expense front,

from

Core MSCI Emerging Markets ETF

(

IEMG) charging 18 bps in fees and most

importantly arch rival Schwab’s

Emerging Markets Equity ETF

(SCHE) charging 15 bps

annually. But with the latest cut to 15 bps, Vanguard left iShares’

IEMG behind and matched Schwab’s SCHE.

VSS’s Fee Cut in Detail

With a 5 bps cut in fees to 20 bps annually, VSS also matches the

lowest expense ratio along with Charles Schwab’s

International Small-Cap Equity ETF (SCHC) in the

foreign small & mid cap equities ETF space. In terms of

AUM, VSS ranks second in the space following iShares MSCI EAFE

Small Cap Index Fund (SCZ) which charges 40 bps. This latest cut

might help VSS compete for some more investors’ assets.

VNQI’s Fee Cut in Detail

VNQI has also seen a 5 bps cut in fees. Previously, VNQI was the

cheapest ETF option in the global real estate ETF space, though the

recent cut makes VNQI an even cheaper option. VNQI comes second in

terms of AUM in the space trailing

SPDR Dow Jones

International Real Estate ETF

(RWX) that charges about

59 bps.

VT & VXUS’s Fee Cuts in Detail

The duo operates in the global equities space securing third and

fourth places in terms of AUM. Either way, the space is dominated

by Vanguard in terms of AUM as well as having the cheap choices

too. Vanguard’s fund

FTSE All World Ex US ETF

(VEU) tops the list

(read: 3 Ultra Cheap ETFs for Value Investors).

Bottom Line

Cost is a crucial factor in choosing funds for a portfolio, in

particular when two funds track similar, or even identical,

indexes. Generally, the low-cost product goes past the high-cost

product and leads in AUM making cost essentially the only big

difference between the two funds (read: Inside Fidelity's New Low

Cost Sector ETF Lineup).

We think Vanguard is striving to gain some market share by

promoting its core strength – ‘low cost’ tag – in some highly

crowded categories. In fact, Vanguard started to lose its title of

the cheapest ETF provider to Charles Schwab in recent times.

Meanwhile, iShares – not even known as a low cost provider – jumped

on this low cost trend and took part in this price war (read:

iShares Cuts Fees on Six ETFs, Debuts Four Low Cost Funds).

In such a scenario, how could Vanguard sit still? Whatever the

cause, investors would like to see an effect on the AUMs of the

aforementioned Vanguard funds with lower costs and closely follow

the asset flow following these fee cuts.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

VANGD-GL XUS RE (VNQI): ETF Research Reports

VANGD-FA -US SC (VSS): ETF Research Reports

VANGD-TOT W STK (VT): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

VANGD-TOT ISIF (VXUS): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

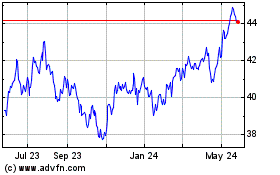

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

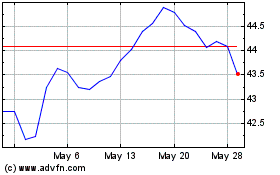

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Feb 2024 to Feb 2025