Clean Invest Africa Plc Placing to raise £210,000, CLN Conversion and Total Voting Rights

30 November 2023 - 9:51PM

UK Regulatory

TIDMCIA

30 November 2023

Clean Invest Africa Plc

("CIA", the "Company" or the "Group")

Placing to raise £210,000, CLN Conversion and Total Voting Rights

Clean Invest Africa Plc, the mineral fines waste processing company quoted on

the Aquis Growth Market, is pleased to announce the successful completion of a

placing (the "Placing"), to raise £210,000 to support the continuing growth of

its wholly owned subsidiaries, CoalTech Limited ("CoalTech") and Coal

Agglomeration South Africa (Pty) Ltd ("CASA"), and to provide working capital to

the Group.

Placing

A total of 60,000,000 ordinary shares of 0.25p nominal value each ("Placing

Shares") have been placed with one investor at 0.35p per share. For each one

Placing Share issued, one warrant will be granted, exercisable at 0.7p, valid

for a period of three years from the date of admission of the Placing Shares to

the Aquis Growth Market. Application has been made for the Placing Shares to be

admitted to trading on the Aquis Growth Market and this is expected to occur on

or around 5 December 2023.

Following the Placing, Clear Water Holding WLL will own 60,000,000 ordinary

shares, representing approximately 3.10% of the issued share capital of the

Company. Clear Water Holding WLL is 90% owned by the adult children (Shaikh

Abdulla Alkhalifa, Shaikh Fai Alkhalifa and Shaikha Reem Alkhalifa) of the

Company's Non-Executive Chairman, Shaikh Mohamed Abdulla Khalifa Alkhalifa.

CLN Conversion

Filippo Fantechi, Chief Executive Officer of the Company has converted £20,000

of principal plus £1,593.42 of interest of an outstanding convertible loan note

("CLN"), plus director's fees, into 24,237,368 ordinary shares of the Company.

Following the CLN conversion and issue of the director's fees, Filippo is

interested in 542,035,789 Ordinary Shares in the Company, representing

approximately 28.01% of the issued share capital.

The Company has also issued 19,298,400 ordinary shares to a consultant of the

Company to settle outstanding professional fees.

Total Voting Rights

Following the issue of the Placing Shares, the issued share capital of the

Company will consist of 1,935,399,170 ordinary shares. No shares were held in

treasury at the date of this announcement. The total current voting rights in

the Company are therefore 1,935,399,170. The above figure of 1,935,399,170 may

be used by shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their interest in,

or a change in their interest in, the share capital of the Company under the

FCA's Disclosure and Transparency Rules.

About CoalTech technology ("CoalTech")

In the context of the global policy of environmental improvement, reconditioning

of polluted areas and development of sustainable solutions for those industries

(such as, but not limited to, coal) which have an impact in terms of

environmental pollution, but which, at least for the next two to three decades,

will have to continue to produce in order to sustain the demand for

energy, CoalTech believes that the application of its technology, in addition to

meeting the Global Environmental Improvement Policy, also effectively addresses

the following problems:

(i) how to clean up/dispose of the more than 30 billion tonnes of coal

dust now found worldwide as an unavoidable residue of coal mining processes, and

(ii) how to minimize the accumulation of further coal dust in those

areas where coal mining ponds are still active and/or at the loading/unloading

hubs of the coal trade routes such as ports and/or stations and/or in those

industries that still use coal.

In other words, even if the ecological transition is making great strides, coal

dusts will continue to damage the environment if they are not removed or

minimised in cases where industries use coal (e.g. power plants, steel mills,

etc.) and these last will takes years to complete the ecological transition with

less polluting technologies, if available.

CoalTech uses the agglomeration process (pelletizing) to transform coal dust

into spherical agglomerates (pellets) through the rotational and inclination

forces generated in a Pelletizer and the amalgamation action of an organic, non

-polluting agent developed in-house. The transformation process is then

finalised by drying treatments to make the pellets transportable and reusable in

various industrial applications.

CoalTech technology is the right balance for merging energy demand with

governments' commitment to a clean world. In particular, it is a valuable

vehicle for achieving goals #8, #9 and #15 of the UN 2030 Agenda combining the

useful with the enjoyable. Useful because it is certainly effective in carrying

out the initial reclamation of the land and/or the hubs of the trade routes

and/or the coal storage areas of the power stations where tonnes of unused and

environmentally harmful coal dust are still being deposited. Enjoyable because

it is a business with a potential of millions of dollars as the process used

does not alter the original characteristics of the coal (e.g. the calorific

value and the chemical composition) and therefore the pellets produced, becoming

transportable, can be sold on the market and have multiple uses, such as for

example:

- be introduced into the coal market by blending with the original raw

material, thus solving at the root the problem of coal dust accumulation and, in

time, reducing the existing accumulation at the washing and/or storage plants

- be introduced into the circuit of those industries that use coal to

produce other products such as: the steel industry to produce coke and the

chemical industry for the production of ammonia, hydrogen, synthetic products

such as solvents, dyes, pesticides, synthetic rubbers, explosives, plastics,

medicines, and others

- originate a circular economy system as from the distillation of

coal, it is also possible to obtain tar, benzol, phosphates, nitrates, sulfates,

naphthalene, celluloid

- to become a raw material in the coal gasification process for the

production of syngas; and

- to support, during the transition period, the less affluent

populations that still live-in rural areas where the energy distribution network

is not yet in place and will require years of work to make it available, so

becoming a source of energy and house heating through the use of domestic

stoves, already existing on the market, which, in addition to heating, can also

produce a few kW useful to turn on a few light bulbs.

The directors of the Company accept responsibility for the contents of this

announcement.

ENQUIRIES:

Clean Invest Africa plc

Filippo Fantechi - Chief Executive Officer: +973 3 9696273

Peterhouse Capital Limited

Guy Miller +44 20 7469 0930

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 30, 2023 05:51 ET (10:51 GMT)

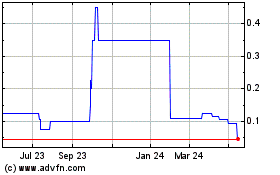

Clean Invest Africa (AQSE:CIA)

Historical Stock Chart

From Nov 2024 to Dec 2024

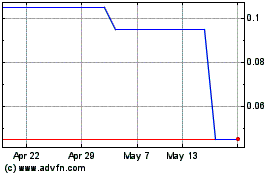

Clean Invest Africa (AQSE:CIA)

Historical Stock Chart

From Dec 2023 to Dec 2024