Secure Trust Bank PLC Issue of Equity and purchase of shares by EBT (2292S)

03 November 2023 - 1:22AM

UK Regulatory

TIDMSTB

RNS Number : 2292S

Secure Trust Bank PLC

02 November 2023

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

SECURE TRUST BANK PLC

('Secure Trust Bank' or the 'Company')

Issue of Shares and p urchase of shares by Employee Benefit

Trust

On 1 November 2023, the Company issued from its block listing

authority 204,075 new Ordinary shares of 40p each to satisfy the

exercise of options under the 2017 Sharesave Plan 2020 grant. These

shares rank pari passu with the existing Ordinary shares in

issue.

As a result of this issuance, the total number of Ordinary

shares in issue is 18,920,621 and the total number of voting rights

in the Company is 18,920,621. There are no shares held in

treasury.

18,920,621 should be used by shareholders as the denominator for

the calculation of notifiable interests in, or change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Also on 1 November 2023, Ocorian Trustees (Jersey) Limited (the

'Trustee'), which administers the Company's Employee Benefit Trust

(the 'Trust'), has made market purchases of ordinary shares in the

Company for the benefit of the Trust of GBP860,263 or 142,428

shares (the 'Market Purchases').

The Market Purchases will be used to help meet future

obligations arising under the Company's various share schemes and

share plans, some of which will include share awards that Executive

Directors and PDMRs are the recipients of. The Market Purchases

were subject to the Trustee's absolute discretion as to the

purchase price paid but within pre-agreed parameters set by the

Company.

The Market Purchases have been funded by the Company by way of a

loan.

Enquiries:

Secure Trust Bank

David McCreadie, Chief Executive Officer

Mark Stevens, Company Secretary

Phil Clark, Investor Relations

Tel: 0121 693 9100

About the Company:

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 71--year trading track record.

Secure Trust Bank operates principally from its head office in

Solihull, West Midlands, and had 873 employees (full--time

equivalent) as at 30 June 2023. The Group's diversified lending

portfolio currently focuses on two sectors:

(i) Business finance through its Real Estate Finance and

Commercial Finance divisions, and

(ii) Consumer finance through its Vehicle Finance and Retail Finance divisions.

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

Secure Trust Bank PLC, Yorke House, Arleston Way, Solihull, B90

4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEZLLFBXFLLFBB

(END) Dow Jones Newswires

November 02, 2023 10:22 ET (14:22 GMT)

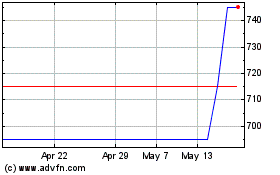

SECURE TRUST BANK (AQSE:STB.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

SECURE TRUST BANK (AQSE:STB.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024