TIDMVIS

RNS Number : 8316U

Visum Technologies PLC

30 March 2023

30 March 2023

Visum Technologies PLC

("Visum," the "Company," or the "Group")

Half-Year Results

Visum Technologies PLC (AQUIS: VIS), a video technology company

focussed on the global leisure market, announces its unaudited

Half-Year Results for the period ended 31 December 2022. A copy of

the Half-Year Results is available on the Company's website at:

https://visumtechnologies.net/.

Financial Overview

-- Loss of GBP457,088 in the period under review with revenues of GBP119,930

-- Total net asset position GBP2,741,141 (2021: GBP2,998,214).

Operational overview

-- In November 2022, the company opened its first US location in

partnership with DEI at the TILT 360 Chicago.

Post period end

-- In March 2023, the Company completed a Fee Share Agreement

with Terra Nova Capital Partners to provide debt financing for

rides & attractions.

-- In April 2023, the Company will reopen its existing sites in Europa Park and Linnanmaki.

-- The company intends to open a second location at Europa Park in mid-summer 2023.

Marc Dixon, Chief Executive Officer of Visum, said:

Given the challenging trading conditions and market uncertainty,

the Company has been prudent with our resources and focused on

securing contract wins.

Visum's recent contract with Terra Nova Capital will allow us to

help current and potential clients secure financing for their rides

or attractions and provide the company with another revenue

stream.

The company continues to look at mergers and acquisitions to

strengthen further our value proposition in the travel and leisure

sector.

We will continue to update the market as these, and other

developments are available.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged for the

release of this announcement on behalf of the Company was Marc

Dixon, Chief Executive Officer of the Company, and the Directors of

the Company are responsible for releasing this announcement.

Andy Edge, Chairman of Visum, said:

Having successfully listed the company in June 2022, the

business worked hard to secure new installations for its video

capture technology. However, given the relatively late listing in

the calendar year, most of the 2022 season had passed, and new

revenue stream opportunities were limited. Computer chip shortages

exacerbated the short-term challenges for the business to grow its

income via the core technology last season.

Over the last few months, the CEO has focused on finding new

opportunities for video imaging technology, prudently managing the

monthly cash run rate, and exploring new revenue streams to broaden

potential income opportunities. The opportunity to offer

complimentary but mutually supportive products and services offers

much more scope for revenue growth in 2023 and beyond.

The IPO listing fees clearly significantly impact the net loss

position in the half-year results. The board remains confident that

given new opportunities that we believe exist, both within the core

business and outside of it, with adequate funding, the business can

grow in 2023 and beyond. Given that a large proportion of the

listing costs have now been covered, we expect the financial

position to improve in the next 6 months.

For further information, please contact:

Visum Technologies PLC +011 (1)804 640 3003

Marc Dixon, Chief Executive Officer

Visum Technologies PLC +353 (87)108 8646

Andy Edge, Chairman

First Sentinel (AQSE Corporate Adviser) +44 (0)20 3989 2222

Brian Stockbridge / Jenny Liu

About Visum Technologies PLC

Visum Technologies is an AQUIS-quoted provider of video capture

technology services. The Company specialises in video solutions for

the travel and leisure market. The Company has an experienced

management team who have deployed systems across this sector for

over 50 years of combined experience.

www.visumtechnologies.net

Visum Technologies PLC

Profit and Loss

July - December, 2022

Total

-------------------------------------------------------------------------------

Income

Other Operating Income 66 269,85

Services 53 660,11

Total Income GBP119 , 929,96

Cost of Sales

Cost of sales

Hosting 3 763,79

Storage 2 023,21

Total Cost of sales GBP5,787,00

Purchases 3 740,07

GBP9 ,

Total Cost of Sales 527,07

Gross Profit GBP110 , 402,89

Expenses

Accountancy & Audit 4 550,00

Advertising 6 358,00

Bank charges 42,00

Consultancy Fees 6 000,00

Consultancy Fees - Operational 29 392,48

Consultancy Fees - Technical 60 507,37

Directors Fees 24 008,19

Directors Fees - Other 1 366,74

Total Directors Fees GBP25 , 374,93

Total Consultancy Fees GBP121 , 274,78

Directors' remuneration 64 442,75

Insurance 4 223,93

Interest Payable 20 575,52

Legal and professional

fees 850,00

Co. Secretarial Fees 21 771,11

Corporate Finance Fees 30 750,00

IPO Listing Fees 74 241,79

Total Legal and professional

fees GBP127 , 612,90

Marketing Support 4 526,20

Rent 270,00

Subscriptions 1 236,29

Telephone 342,18

Travelling expenses 17 576,64

Total Expenses 373 , 031,19

Net Operating Income - GBP262 , 628,30

Other Expenses

Unrealised Gain or Loss 0,00

Depreciation 186 000,00

Exchange Gain or Loss 8 460,20

Total Other Expenses GBP194 , 460,20

Net Other Income -GBP194 , 460,20

Net Income -GBP457 , 088,50

Visum Technologies PLC

Balance Sheet

As of December 31, 2022

Total

-----------------------------------------

Fixed Asset

Tangible assets

Goodwill 3 720 000,00

Goodwill Amortisation -244 083,00

GBP3 , 475

Total Goodwill , 917,00

GBP3 , 475

Total Tangible assets , 917,00

GBP3 , 475

Total Fixed Asset , 917,00

Cash at bank and in hand

CORPAY Cross Borders 1 154,75

CORPAY Cross Borders EURO -0,01

CORPAY Cross Borders USD -0,01

Lloyds Account 5660 101 770,41

Ridercam Bank 0,00

Ridercam EURO 0,00

Ridercam USD 0,00

Total Cash at bank and in

hand GBP102 , 925,14

Debtors

Debtors 0,00

Debtors - EUR 0,00

Debtors - USD 0,00

Total Debtors GBP 0,00

Current Assets

Other debtors -0,43

Prepayments 23 533,33

Total Current Assets GBP23 , 532,90

Net current assets GBP126,458,04

Creditors: amounts falling

due within one year

Trade Creditors

Creditors 306 460,14

Creditors - EUR -84 073,55

Creditors - USD 40 410,15

Total Trade Creditors GBP262 , 796,74

Current Liabilities

Accruals 80 038,69

Convertible Loan Note 0,00

Loan - Ridercam Deferred Consideration 538 207,43

Other loans 6 000,00

VAT Control -20 982,48

VAT Suspense -4 826,22

Total Current Liabilities GBP598 , 437,42

Total Creditors: amounts falling

due within one year GBP861 , 234,16

-GBP734 ,

Net current assets (liabilities) 776,12

Total assets less current GBP2,741 ,

liabilities 140,88

GBP2 , 741

Total net assets (liabilities) , 140,88

Capital and Reserves

Ordinary share capital 521 498,58

Retained Earnings -858 760,18

Share premium 3 535 490,98

Profit for the year -457 088,50

GBP2 , 741

Total Capital and Reserves , 140,88

Visum Technologies PLC

Statement of Cash Flows

July - December, 2022

Total

------------------------------------------------------------------------------------

OPERATING ACTIVITIES

Net Income -457 088,50

Adjustments to reconcile

Net Income to Net Cash

provided

by operations:

Debtors - EUR 0,00

Debtors - USD 0,00

Other debtors 348 339,43

Prepayments -13 533,33

Goodwill:Goodwill

Amortisation 186 000,00

Creditors 19 192,83

Creditors - EUR -58 724,51

Creditors - USD -52 417,64

Accruals -18 897,31

Convertible Loan Note -200 000,00

Loan - Ridercam Deferred

Consideration -138 730,54

Other loans 6 000,00

VAT Control 16 243,72

VAT Suspense -4 826,22

Total Adjustments to

reconcile

Net Income to Net Cash GBP88

provided ,

by operations: 646,43

Net cash provided by operating

activities -GBP368 , 442,07

FINANCING ACTIVITIES

Ordinary share capital 14 285,71

Share premium 185 714,29

Net cash provided by financing GBP200 ,

activities 000,00

Net cash increase /decrease

for period -GBP168,442,07

Cash at beginning of period 271 367,21

GBP102 ,

Cash at end of period 925,14

Caution regarding forward-looking statements

Certain statements in this announcement are or may be considered

forward-looking. Forward-looking statements are identi ed by their

use of terms and phrases such as "believe", "could", "should,"

"envisage", "estimate", "intend", "may", "plan", "potentially",

"expect," "will" or the negative of those, variations, or

comparable expressions, including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the Company's future growth, results of operations,

performance, future capital, and other expenditures (including the

amount, nature, and sources of funding thereof), competitive

advantages, business prospects, and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBUGDXRDXDGXG

(END) Dow Jones Newswires

March 30, 2023 11:27 ET (15:27 GMT)

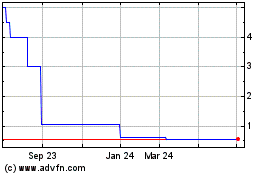

VISUM Technologies (AQSE:VIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

VISUM Technologies (AQSE:VIS)

Historical Stock Chart

From Nov 2023 to Nov 2024