AMP Dividend Cut After Slump in Profit

25 January 2019 - 9:53AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australian wealth manager AMP Ltd.

(AMP.AU) plans to slash its final dividend by more than 70% after

detailing a sharp contraction in earnings as it absorbs further

costs to cover customer compensation.

The company on Friday said it expects to pay a dividend of 4

Australian cents (US$0.03) for the second half of the year, a steep

cut from the 14.5 cents paid a year earlier.

The drop, which AMP said recognizes the performance of the

business, capital impacts and uncertainties in the operating

environment, comes against an anticipated 96% fall in its full-year

net profit to about A$30 million from A$848 million recorded for

2017.

AMP has been under pressure since it apologized in April for

misconduct and failings in its regulatory disclosures that were

revealed in a royal-commission inquiry into misconduct across the

wider financial industry, including allegation the company misled a

regulator over fees charged to customers for advice it failed to

deliver. In the wake of that, AMP's CEO, chairman and several board

members stepped down.

In late October, the company agreed to sell a portfolio of

wealth-protection insurance and mature businesses and decided to

sell its New Zealand wealth-management and advice businesses via an

initial public offering. The company had been reviewing its assets

since last February but stepped up its efforts the wake of the

damaging revelations that emerged during in the probe, which is

expected to hand its final report and recommendations to the

government at the end of the month.

On Friday, AMP said it would book a further A$200 million

provision for customer remediation efforts, covering the cost of

the ongoing program and lost earnings. That adds to a range of

items it had previously disclosed, including hundreds of millions

of dollars in customer remediation costs for mischarged fees and

inappropriate advice.

The company also will be hit by an about A$105 million operating

loss for the Australian and New Zealand businesses it agreed to

sell in the second half of the year. It said the deal remained on

track to be completed by the end of 2019.

AMP further warned that earnings from its retained businesses

were expected to be impacted by external market conditions this

year and the regulatory environment, but added it retained a strong

capital position that included a surplus of about A$1.6 billion

above the minimum regulatory requirement. It affirmed plans to

return the majority of the net cash from the agreed sale of its

businesses to its shareholders, though said that was subject to

unforeseen circumstances.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

January 24, 2019 17:38 ET (22:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

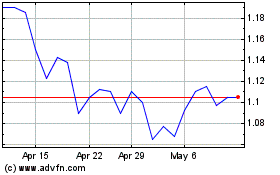

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

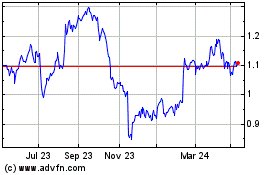

AMP (ASX:AMP)

Historical Stock Chart

From Mar 2024 to Mar 2025